Summary

Look out for growth, but with an eye on inflation

In this environment of restrictive financial conditions, investors should build balanced portfolios, with a focus on quality and sustainability of earnings and dividends.

Markets have remained range-bound in the past few weeks as they try to judge the direction of monetary policies, economic growth, and the inflation trajectory, regarding which the assessment is further complicated by the Israel-Hamas war.

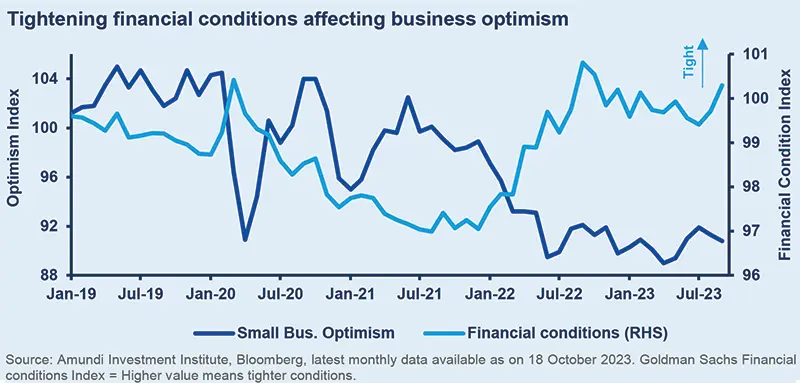

We continue to expect a mild US recession in H1. Higher-for-longer rates and tight financial conditions, along with the following main factors, keep us concerned about the global economic outlook:

- Ambiguity on monetary policy, expectations of a hawkish pause. Rise in yields have led to additional tightening and central banks may pause now. Success on inflation will eventually determine their policy. The Middle East conflict raises inflation uncertainty (oil prices).

- Fiscal capacities are constrained in the US and Europe. Looking ahead, the fiscal side won’t be able to completely offset weakness on the consumer side, which is already coming under pressure.

- Savings and labour markets. Until now, excess savings and tight labour markets supported consumption. But if there are layoffs and wage growth falls, consumption would be affected.

- Corporate weakening. US bankruptcies are rising. Pressures can also be seen on small businesses which are a key component of the economy and rely on banks for their funding requirements.

- China’s structural deleveraging indicates that the growth slowdown will be driven by the decline in capital input. We do not expect a policy bazooka but incremental measures to stablise the economy.

With an overall cautious view, we see opportunities in the following:

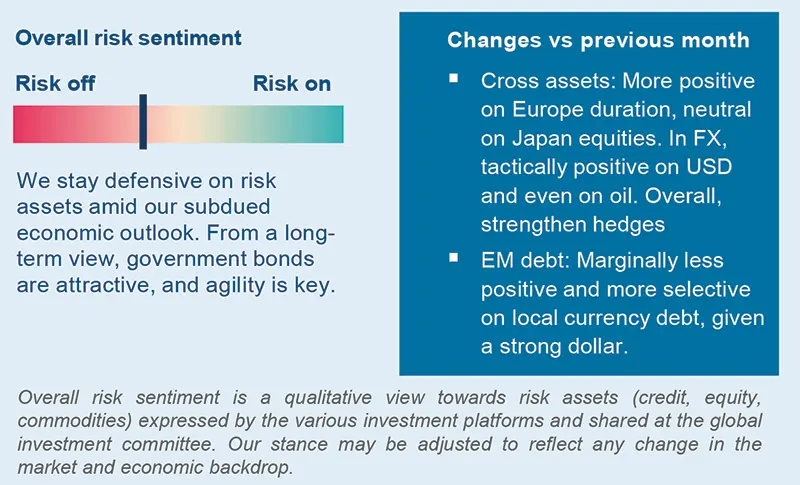

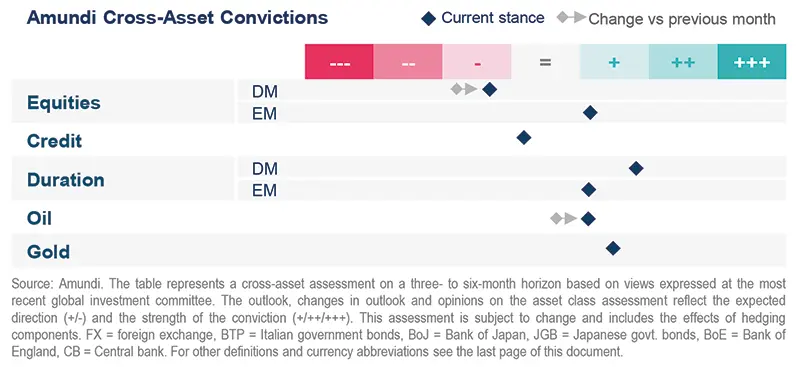

- Cross asset. The economic backdrop and valuations favour a positive stance on duration, with some pressure from inflation. We stay positive on US Treasuries and are becoming more constructive on Europe, including on the short end of the curve. In equities, while we are cautious on DM, we upgraded Japan to neutral in light of a domestic recovery. In FX, concerns on US inflation and higher-forlonger US rates could provide some short-term fillip to the dollar. Thus, we turned tactically positive vs select Asian FX and the lowyielding CHF. But we maintain that a Fed pivot would cause dollar weakness in the medium term. We also became constructive on oil for diversification and think investors should enhance portfolio hedges.

- Government bonds offer strong long-term prospects after a sharp upward move in yields. Amid risks of an economic slowdown, we think bonds will act as a diversifier. But short term, the situation is tricky, depending on incoming data, leading us to be agile. We are positive on the US, neutral on core Europe, and cautious on Japan. In corporate credit, we maintain our slightly positive view tilted to high quality, such as IG, where we see no or limited scope for a deterioration in fundamentals. Overall, the need to differentiate is high.

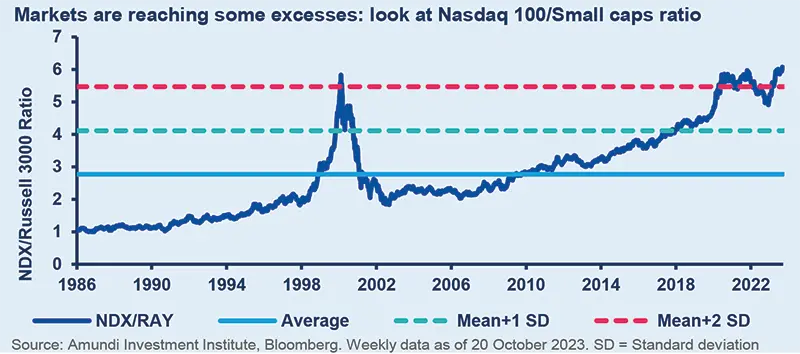

- We are cautious on the US, particularly megacaps, and European equities; neutral on Japan. Markets are moving from corporate rhetoric to concrete impacts on bottom lines. While a growth slowdown makes us cautious on cyclicality, there is a need to distinguish within cyclicality: businesses that would benefit from secular themes (electrification, near shoring) present opportunities. Value vs Growth outperformance is a long-term phenomenon, but we like names with pricing power, intellectual property, low cyclicality.

- EM offer attractive returns, but there is a need to show selectivity in favour of best-in-class companies and countries that can deliver productivity growth. HC and corporate debt offer good carry and within these we like HY but focus on quality. On LC debt, a strong USD makes us selective. In equities, we are neutral on China and believe government actions are meant to soften the slowdown. We see value in India and Brazil, and other Latin American countries.

Three hot questions

|

Monica DEFEND |

The latest US inflation figures showed some stickiness – especially for services – and this means slight upside risks to our forecasts. But, we believe the disinflationary trend is likely to continue, with the Fed keeping a close eye on price increases.

1| How do your growth and inflation expectations for next year compare with those of the IMF?

The IMF’s US growth outlook for 2024 is stronger than ours, assuming higher resilience regarding consumption. We expect a recession in H1 next year, taking our 2024 GDP forecasts to 0.3% (real GDP, year on year) vs the IMF’s 1.5%. Unsurprisingly, on the inflation front, we expect a benign 2.5% rate (CPI, YoY) next year, whereas the IMF projects 2.8%. In the eurozone, we forecast growth divergences next year, and the region’s growth at 0.5% is below IMF projections. Finally, regarding China, the IMF projects growth to be on a downtrend in next few years, as we do.

Investment consequences:

- Cautious on equity and HY credit.

- Favour government bonds and cash.

2| How do you see the war between Israel and Hamas evolving in the Middle East?

Our base case is for the conflict to remain local, as all the major parties involved (Israel, US, Iran) have much to lose from any escalation. Iran has already achieved its goal of preventing any alliance between Saudi Arabia and Israel. However, there are risks of a tit-for-tat response (Iran’s active role) in Gaza and even through Lebanon or Syria. Historically, the impact of geopolitics on prices has been gradually declining. In most cases, the effect of a crisis on prices waned in three months. So, we think any upside now would be temporary.

Investment consequences:

- Brent: $95/bbl. in short term, eventually moving to $85-$90/bbl. in 2024.

- Equities: positive for energy and defense sectors, negative for airlines.

3| What are your views on Italian BTPs in light of the budget deficit and fragmentation risks in the EU?

The recent re-pricing of BTP-Bund spreads pared this year’s gains partially and was a result of systemic drivers, eg, the risk-off mood and higher risk free yields (spillover from the US). To a lower extent, it was caused by concerns around a challenging supply outlook next year, a higher deficit, and ECB quantitative tightening. However, in Q4, we see support from negative net issuance and Next Gen EU payments. In addition, demand from the domestic retail segment should continue. But, overall, Italy’s commitment to EU fiscal rules and the NRRP* is important, along with reviews from credit rating agencies.

Investment consequences:

- Peripheral spreads: Neutral.

Play 3 Ds: Duration, diversification, divergences

|

Francesco SANDRINI |

John O'TOOLE |

While keeping a cautious stance on DM equities, we have upgraded Japan to neutral, based on a recovery in the services sector and stronger corporate governance.

Economic deceleration and ambiguity over monetary policy are collectively increasing complexity across markets. This is not a time to take bold risks; instead, investors should stick to their long-term convictions around duration in the US and Europe. In addition, the current uncertainty on US inflation opens the door for some tactical trends around the USD and strengthens the case for enhancing safeguards. At the same time, we now think oil offers additional protection and diversification from the recent increase in geopolitical risks.

High conviction ideas

While we remain cautious on DM equities (US, Europe), we upgraded Japan to neutral owing to the ongoing recovery in the services sector and better corporate governance. But we are monitoring risks around a global slowdown. In EM, where we are constructive, valuations look fair and earnings revisions seem to be bottoming. The region presents abundant divergences, with strong growth in LatAm, India, Indonesia, among others.

We are constructive on USTs as higher supply announcements appeared to be already priced in and valuations look more attractive amid a weaker growth scenario. We also believe in curve steepening in the US and Canada. In Europe, sluggish growth prospects now support a more constructive view on duration, particularly on the short end of the curve. But we are no longer positive on Swedish and UK bonds, instead focusing on Europe. Our mildly positive view on BTPs is maintained. Most of the recent increase in yields was driven by a sell-off in global bonds, but supply/demand dynamics for BTPs are supportive. We are vigilant on fiscal deficit and Italy’s growth. But, we are cautious on JGBs.

In EM, while we agree that DM yield movements could have adverse effects, we stay constructive selectively long term. Inflation dynamics are supportive and CBs are at the end of tightening.

Corporate credit in DM offers good carry, but some potential deterioration in fundamentals is leading us to stay selective in favour of EU IG, where technicals and lower supply are positive. However, we are cautious on US HY, where valuations are expensive, and which is likely to suffer from rising default rates.

The USD is showing some upside potential near term, owing to resilient demand, cost push inflation and higher-for-longer Fed rates. Thus, we turned positive vs CNH, TWD. In DM, we are now cautious on CHF/USD but are no longer negative on the GBP/CHF. In commodities, escalating geopolitical risks led us to become positive on oil.

Risks & hedging

Persisting risks around economic growth call for strong hedges around equities. On Treasuries, there is ample uncertainty around monetary policy and inflation, supporting the need to enhance safeguards. Precious metals such as gold offer diversification and protection in case of a strong recession or an escalation in geopolitical crises.

Inflation headwinds, but govies offer strong value

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

As soon as there is some weakness in economic data, we should see markets rooting for bonds, favouring govies and quality assets.

Overall assessment

Hard data have been coming in above expectations but weakness on soft data (surveys) and the consumer continues. It is a matter of time before this is reflected in select risk asset valuations. However, with US yields at 16-year highs, there is long-term potential in bonds, and in quality credit in DM and EM.

Global & European fixed income

The potential effects of financial tightening on growth and current yields at high levels (compared to history) mean the long-term scenario of ‘bonds are back’ remains in place. And stagnating investment in Europe could further affect growth. However, inflation is a key variable, and we are vigilant on that. Thus, with a dynamic approach, we are close to neutral on duration in core Europe and peripheral debt but are cautious on Japan. Above-target inflation is likely to encourage the BoJ to drop its yield curve control. In credit, yields are attractive, but it is important to be flexible and tilt towards quality and IG financials (banks). In particular, we think BBB-rated debt offers a good balance of yield, quality and liquidity, but it is important to be selective. However, we are cautious on HY in real estate, technology and electronics and the consumer sectors.

US fixed income

Risk-free rates are fundamentally attractive, but may move higher in the near term if markets think that the US economy could be resilient. For now, the policy is viewed as “sufficiently restrictive”. This, coupled with rising risks to the economy, supports a positive duration view. We are constructive on USTs in both nominal and real forms, particularly longer maturities, but we stay active. Securitised credit is attractive from a long-term view. While the housing market will be affected by rising mortgage rates, we think a demand/supply mismatch and demographics should be supportive. In corporate credit, the huge increase in interest rates will eventually have an impact on corporate balance sheets by year-end or at the beginning of next year. Thus, we are tilted towards quality and favour IG and financials over non-financials. But, we are cautious on HY, as defaults are rising.

EM bonds

EM debt offers good income potential, but we are vigilant on rising US yields, dollar strength and geopolitical risks. We like HC and corporate bonds and focus on HY countries that provide a carry cushion. Selectivity remains key as we see near-term headwinds for LC bonds. At a country level, we are exploring Brazil, Mexico and Indonesia based on growth/inflation dynamics. India, which is the second-largest bond market in the EM space, offers a compelling opportunity.

FX

The USD has seen some strength, but we think this could be short-lived when the Fed likely cuts rates next year and as inflation falls to its target. We are constructive on JPY, AUD, and in EM, we like high-yielding MXN, BRL, IDR, INR.

Differentiate on pricing power, earnings, valuations

| Fabio DI GIANSANTE Head of Large Cap Equity |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Disappointment in earnings/sales would affect expensive and overleveraged businesses more because of their high costs of capital.

Overall assessment

Markets are being driven by changes in narratives relating to rates, a US soft landing or a recession scenario, along with inflation. In this environment, we believe avoiding losers is as important as picking winners because even if a good business is trading at expensive valuations, it offers little protection in times of economic downturn. Hence, we believe in differentiating and are optimistic on attractively priced segments in the US, Europe, Japan and EM.

European equities

We stay balanced and prefer businesses with sustainable pricing power, given their intellectual property, robust brands, etc. Looking ahead, only those companies that have strong power are likely to be able to pass on rising costs. On the other hand, valuations in some segments are expensive, even if their business models are robust: for instance, in cyclicals. In these, we would like to wait for some correction before having a more favourable view. At a sector level, we maintained our stance on staples and financials (banks), and see selection opportunities in industrials. In renewables, we like companies with established business models that can finance their transitions through internal cash flows. In general, there has been underinvestment in some corners of the energy sector (affecting supply), and we think there are opportunities related to this.

US equities

Economic data are not consistent with company reporting, as effects of a slowdown are visible in some sectors, such as industrials. We are becoming cautious on the cyclical parts of industrials, but like businesses linked with long-term secular trends, which will benefit from fiscal boosts in the form of the IRA, electrification, near-shoring/re-shoring and automation themes. Selectively, we like energy names with attractive valuations as they also act as a hedge against geopolitical risks. On the consumer side, we are sceptical of cyclicality and believe this is a time to differentiate within cyclicality. Large cap banks is another area where we are positive. Finally, in Value vs Growth, we like low beta because cyclical parts of Value may come under pressure. Value is also a hedge against higher-for-longer rates, inflation and high commodity prices. Overall, we favour companies that are prudent when it comes to capital allocation.

EM equities

We are mildly constructive amid the EM macro backdrop, valuations and supportive earnings expectations, but see some geopolitical risks and potential slowdown risks in DM. Our preferences are Brazil and India. The former is showing resilience in the face of global headwinds and has already started its easing cycle; the latter offers a large and fast-growing economy and internal demand. On China, we remain neutral in the short term. Sector-wise, discretionary and real estate offer the best opportunities, but with divergences among countries.

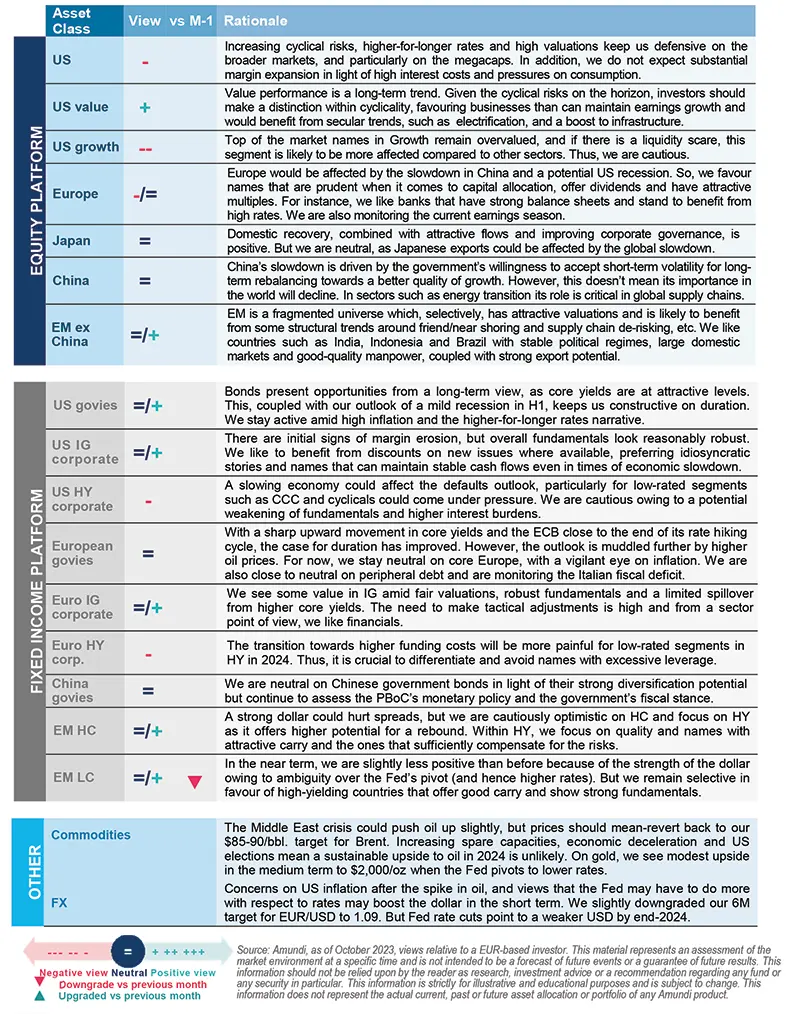

Amundi asset class views

Definitions & Abbreviations

- ABS: Asset-backed securities. These are financial securities such as bonds, which are collateralised by a pool of assets, possibly including loans, leases, credit card debt, royalties or receivables.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS. Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash. Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core strategy is synonymous with ‘income’ in the stock market.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction). Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than shortterm interest rates or short-term rates dropping more than long-term rates.

- Bull steepening: a change in the curve due to short-term rates falling faster than the long-term rates. This leads to a higher spread between the short and long term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market. Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss. P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- Net interest margin: It is a measure that compares a bank’s interest income from lending with its interest expense on its liabilities (such as bank deposits), expressed as a percentage of its assets.

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Non-SIFI: A systemically important financial institution (SIFI) is an institution that the US Fed and regulators believe would pose a serious risk to the financial system and the economy if it collapses. A non-SIFI is an institution that doesn’t fall in this category.

- RMBS: Residential mortgage-backed securities (RMBS) are a debt-based security backed by the interest paid on loans for residences. The risk is mitigated by pooling many such loans to minimise the risk of an individual default.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve control: YCC involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target.