Summary

Markets between love and fear

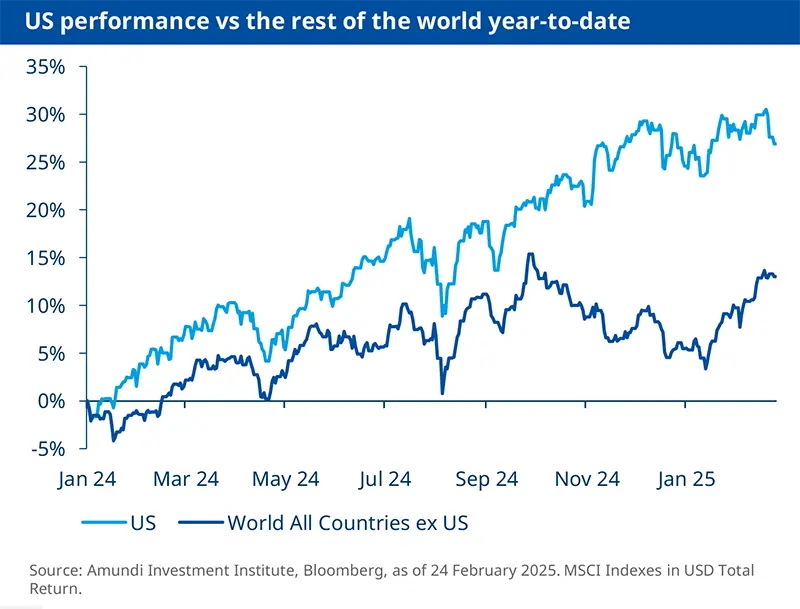

In February, the markets have shown that love is in the air: despite new tariff announcements, inflation risks, and the DeepSeek shakeup, positive market sentiment continues to prevail. In Europe, equities reached new all-time highs, and in the US, there is evidence of a broadening equity rally, as the dominance of the Magnificent Seven may be starting to fade. However, uncertainty remains at extreme levels, with renewed fears emerging following the higher-than-expected January CPI, which recorded its fastest increase in a year and a half, and some weak US economic data. To assess whether the current environment of positive market sentiment can continue, we focus on the following themes:

First, inflation is the dominant concern, as the market remains highly sensitive to it, which could pose a significant challenge for Trump. Recent consumer surveys highlight growing uncertainty, with long-term consumer inflation expectations surging to 3.3%, the highest since 2008, with the highest dispersion since the 80s.

Second, global growth is set to stabilise as inflation gradually declines, but policy uncertainty under Trump adds risks.

Third, the Eurozone is supported by a clearer ECB policy path. Fiscal support in Germany following the elections and a possible increase in defence spending are key themes to monitor.

Finally, China remains focused on avoiding a disruptive trade war, as evident in its measured response to Trump's tariffs.

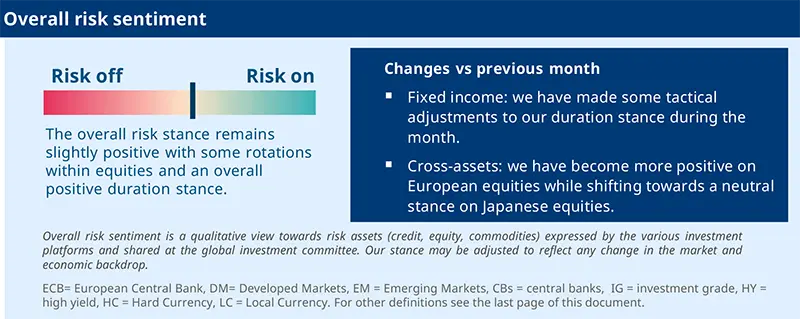

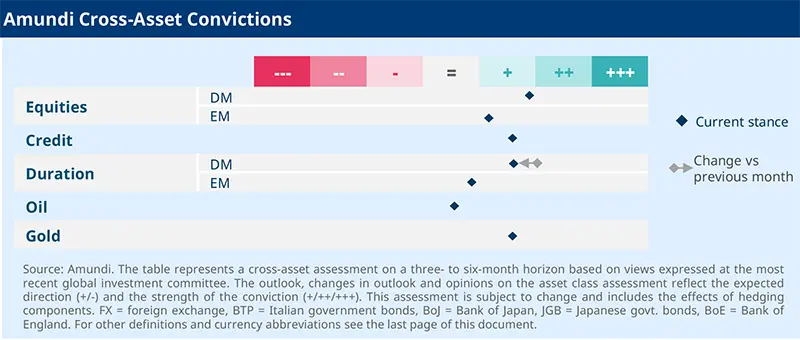

All this translates into a still supportive backdrop for risky assets, but areas of complacency call for rotating into segments that offer more compelling opportunities and keeping a strong focus on diversification.

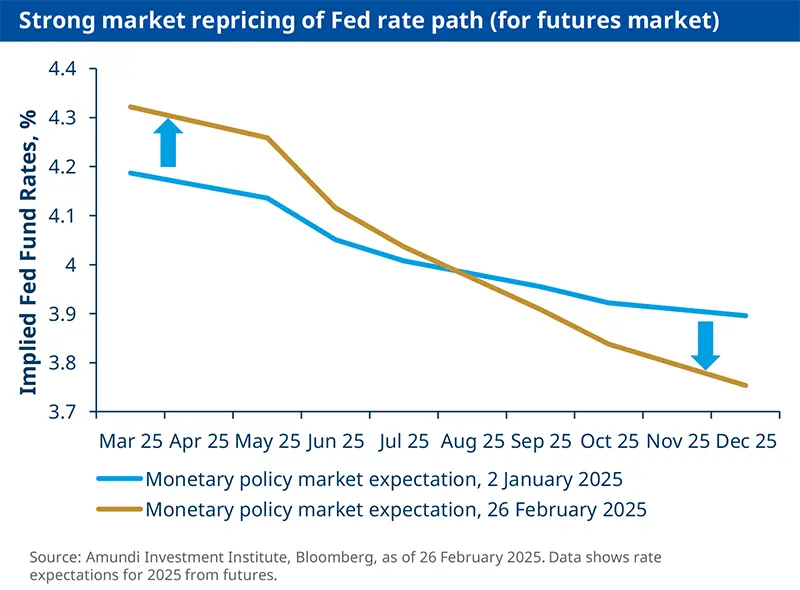

In fixed income, we have strengthened our positive duration stance for the Eurozone, as growth is lagging and we expect the ECB to continue to cut rates. In the US, repricing of Fed rates has been fast: we continue to expect rate cuts in 2025 and we believe the possibility of a Fed rate hike is very low for now amid an already restrictive policy stance and a relatively quiet fiscal landscape. In global credit, the outlook is positive and supported by a combination of resilient economic activity, inflation moderation, and less restrictive monetary policy in both the United States and the Eurozone. We favour European IG credit while remaining cautious on US HY due to stretched valuations.

Leveraging the broadening rally in equities. We are increasingly positive on the Eurozone, both relative to the US, due to its more compelling valuation, and compared to the UK, where the economic outlook is weaker. Within Europe, we look for companies with strong balance sheets and pricing power. In the US, our focus is beyond the mega caps. We favour banks and materials and look for domestic-oriented companies that are well-positioned to benefit from anticipated tax cuts and reduced regulation.

On Emerging Markets, we maintain an overall neutral stance, due to the ongoing macroeconomic and geopolitical developments. We have become more optimistic about India after the recent sell-off which led to less stretched valuations and signs of bottoming out in earnings revisions.

Cross-Asset: We maintain a positive view on risky assets, with a constructive stance on equities and credit while making internal rotations to seize opportunities. In particular, we have become more positive on European equities, while we turn from positive to neutral on Japanese equities, as we see no immediate catalysts for growth amid a stronger yen and potential volatility. To enhance overall allocation resilience against potential adverse scenarios, we maintain some hedges in equities and duration, while continuing to have a positive stance on gold.

Despite high uncertainty, the investment environment remains supportive for equities. Here we favour opportunities in Europe which could benefit from a

possible ceasefire in Ukraine and better valuation compared to the US.

Three hot questions

1| What is your view on Trump’s reciprocal tariffs?

On 13 February, Trump announced the Fair and Reciprocal Trade Plan, aimed at addressing imbalances in US trade relationships and countering non-reciprocal trading arrangements. However, the execution of these measures is by no means a done deal, partly because up-to-date, accurate, and consistent bilateral tariff data is difficult to obtain. Considering the repercussions of higher tariffs, we have recently moderately revised down US growth forecasts and upgraded inflation projections. While this doesn’t change the soft-landing path, it does return the US economy to trend faster, making it less ‘exceptional’ relative to others.

Investment consequences :

Mantain a diversified global equity stance

Positive on gold

2| How do you view the latest developments in US inflation?

Recent CPI data shows that inflation remains sticky, with headline inflation rising to 3.0% YoY and core inflation at 3.3% YoY. This first inflation report of the year may reflect some seasonal effects, along with annual price increases that typically roll out at the start of the year. Despite this seasonal noise, we anticipate headline CPI to remain around 2.6% in H1 and rise to 2.9% in H2, with medium-term upside risks due to strong consumer demand and stalled disinflation in shelter costs. Overall, we believe that the Fed may adopt a ‘no hurry’ approach to rate cuts, pausing this quarter while monitoring the economic impacts of new US administration policies.

Investment consequences :

Tactical duration management, favouring the intermediate part of the US curve

3| What is your take on India’s 2025-26 budget?

As India’s updated budget points to fiscal consolidation. The fiscal deficit for FY26 projects the budget deficit to shrink to 4.4% of GDP from 4.9% currently. The income tax structure has been revised to enhance disposable income for the middle class, while food subsidies are set to increase. Enhanced rural schemes are anticipated to improve economic conditions in rural areas. Following the announcement, the RBI cut its benchmark interest rate by 25bp to 6.25% to support economic growth.

Investment consequences :

Maintain a strategic positive stance on Indian equities

The US Fed faces an uncertain outlook, with a high expected fiscal deficit and possible labour supply shocks, which will weigh on the inflation and growth outlook.

MULTI-ASSET

Navigating inflation uncertainty

| Francesco SANDRINI Head of Multi-Asset Strategies | John O'TOOLE Head of Multi-Asset Investment Solutions |

We remain optimistic about opportunities in Europe, while actively hedging against inflation risks and geopolitical uncertainty.

We expect an overall benign economic outlook, although data from Q4 has revealed diverging trends amongst economies. In the US, growth has been solid, driven by strong personal consumption, while in Europe, growth is exhibiting a weaker momentum. Due to uncertainties surrounding trade wars, global growth faces downside risks, and central banks have begun to act asynchronously. The Fed is temporarily on pause, the ECB is determined to follow a clear trajectory toward neutrality, and the BoJ is expected to hike rates in 2025. Overall, while macro, credit, and liquidity conditions remain reasonably supportive, we remain mindful of inflation risks and potential earnings revisions in the second half of the year and therefore favour a mildly pro-risk allocation with hedges and gold.

We maintain a constructive outlook on equities, as the backdrop remains supportive of risky assets, but with some adjustments. In equities, we have further upgraded our positive stance in the Eurozone, supported by a dovish ECB and relatively attractive valuations, while downgrading Japanese equities to neutral due to expectations of a stronger yen. The growth premium still favours emerging markets, particularly China, where pro-growth and prostimulus policies are expected to mitigate the impact of tariffs.

In fixed income, we remain positive on the US 2-year Treasury and maintain our view of a steepening yield curve for 5-30 year maturities. We also remain positive on EU rates but we have become less positive in UK rates, as we now see the undervaluation as less stretched. We remain cautious on JGBs, while holding our positive stance on Italian BTPs versus German Bunds. We still see European IG credit as the brightest spot in the credit market, while we remain neutral on both EM hard currency debt and local debt.

In order to hedge against geopolitical risks and inflation-driven volatility, we believe investors should consider equity hedges in the US, where valuations appear stretched, and duration hedges to manage inflation risk, while maintaining an allocation to gold.

FIXED-INCOME

Fast-paced changes in rate expectations

| Amaury D'ORSAY Head of Fixed Income | Yerlan SYZDYKOV Global Head of Emerging Markets | Marco PIRONDINI CIO of US Investment Management |

In 2025, the inflationary and growth impact of Trump’s policies is the primary concern when evaluating the Fed’s trajectory. After initial fears of higher inflation, markets have now started to price risks of growth disappointment. This has resulted in a strong and rapid reassessment of market expectations on the Fed’s trajectory. Such strong market movements call for maintaining an active duration stance and looking for opportunities across the board. Overall, we maintain our positive stance on duration and credit with a preference for high quality and shorter maturities. In emerging markets, we remain overall neutral with a preference for hard currency versus local currency debt.

- We are overall positive on duration. We have slightly increased our positive duration stance for the Eurozone and the UK, as we believe that there is room for rates to be lower. We remain cautious on JPY duration, as the BOJ has signaled more hikes to come.

- We are positive on credit. We remain favourable on Euro financials, in particular IG over HY.

- Regarding FX, we favour JPY and USD and have upgraded our stance on GBP to positive. We remain cautious on EUR and CNY.

- On duration, we remain tactical and continue to prefer intermediate maturities seeing that they offer a reasonable riskreward.

- In credit, we prefer highquality names and we are shifting towards shorter issuer maturity curves. We still favour Financials over Industrials, though less so than last month.

- We continue to prefer HY alternatives, such as leveraged loans, as spreads are at multiyear lows and yield valuation is not that compelling.

- We maintain a neutral duration stance with a bias to add to duration on selloffs.

- Regarding hard currency, our outlook continues to be constructive but selective.

- In local rates, we are highly selective, favouring countries that have greater monetary policy room and exploring some tactical opportunities, such as the Mexican Peso.

- We remain constructive on credit, especially the HY segment, as we do not anticipate substantial spread widening.

EQUITIES

Market rotation continues

| Barry GLAVIN Head of Equity Platform | Yerlan SYZDYKOV Global Head of Emerging Markets | Marco PIRONDINI CIO of US Investment Management |

The US’s outperformance has been ongoing for a long time, with a faster rise since 2023 driven by enthusiasm around AI. However, the first months of 2025 have signalled a pause in this trend, with international markets, particularly Europe, outperforming the US, where areas of excessive valuations may see some reassessment. With high uncertainty surrounding tariffs, AI developments, and still high concentration risks, the main market theme remains diversification. Earnings revisions and better risk sentiment continue to support European equities, where valuations remain relatively attractive. EM markets in Asia also offer opportunities, with India more appealing after the recent sell-off.

- The broadening of the market remains highly beneficial for European equities. Markets will continue to watch for the potential impact of Trump’s policies.

- For Europe, we focus on resilience and undisrupted business models with strong balance sheets.

- Sector-wise, we remain cautious on industrials and technology and have grown more cautious on telecom. We maintain a positive stance on consumer staples and healthcare, while seizing opportunities in luxury goods.

- We focus on equities with stable earnings momentum and a strong return on investment capital. As US equities remain expensive across the board, the shift away from mega caps continues to help mitigate against valuation fluctuations driven by reversals in risk sentiment.

- We remain focused on companies that will benefit from Trump’s policies.

- We are cautious on tech and consumer sectors, favouring materials and financials, such as banks that can benefit from the higher yield curve.

- We remain neutral on emerging market equities due to geopolitical uncertainties and tariff risks. However, we note potential rebounds in Mexico and South Korea.

- We have upgraded our positive view in India following the recent sell-off and signs of bottoming out in revisions. We remain positive in Indonesia, while we are cautious on Taiwan amid uncertain growth.

- At sector level, we favour real estate and consumer staples, which offer earnings stability at a reasonable price.

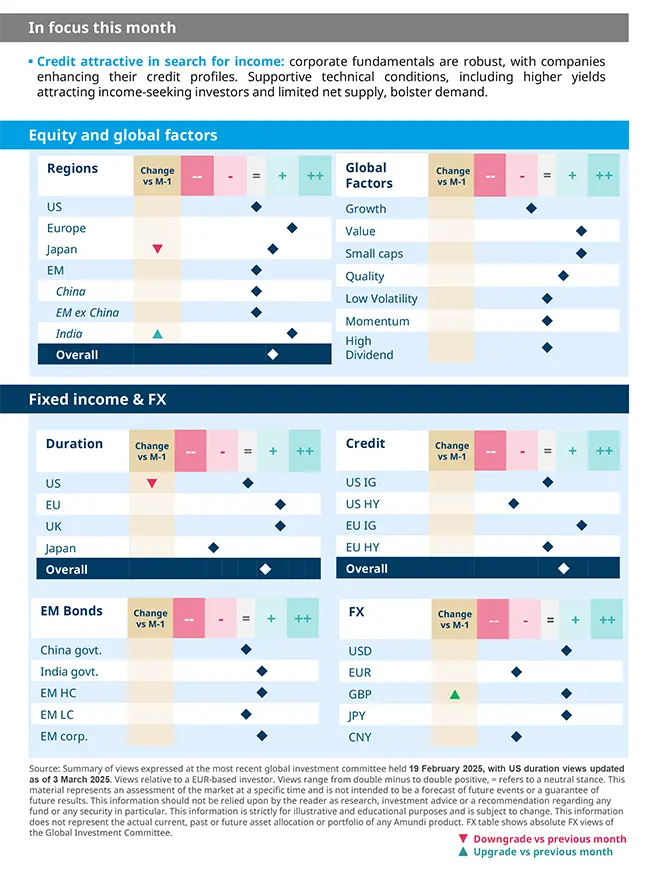

VIEWS

Amundi asset class views

Definitions & Abbreviations

Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint, INR – Indian Rupiah.