Summary

President Trump’s approach to trade and global alliances may be a wake up call for Europe. The region is signalling a clear and a historical shift, which will require target measures to boost growth efficiently.

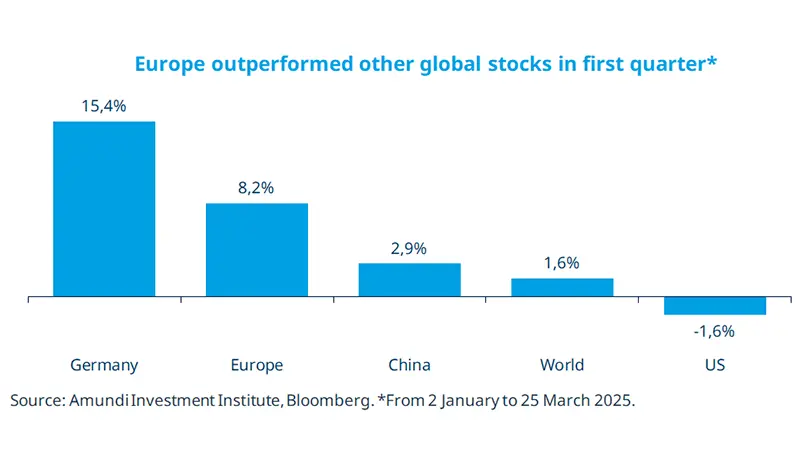

- Optimism around fiscal spending plans in Germany and in Europe has boosted the region’s stocks.

- If implemented well to boost productivity and improve efficiencies across Europe, the plans may be positive for long-term growth. .

- Overall, short-term volatility could rise amid new tariffs in particular on the auto sector.

German equities, and more broadly European indices, have outperformed the main global benchmarks so far this year on the back of changing attitudes towards fiscal austerity in the region. The reform of the ‘constitutional debt brake’ in Germany is paving way for hundred of billions of euros worth of spending on defence and infrastructure. In addition, the European commission has proposed to give additional room to EU countries to spend more on defence and also gave suggestions for joint debt for this purpose. While markets have rightly welcomed this, the most important factors are how these proposals/plans are implemented to improve productivity so that the benefits percolate down to the real economy.

Actionable ideas

- European equities

In a backdrop of attractive valuations, European businesses with strong models offer good long term value, but some business sectors may be challenged by upcoming tariffs.

- European fixed income

Corporate fundamentals in high grade credit look robust and companies with strong cash flows should do well, particularly at a time when ECB continues to reduce policy rates.

This week at a glance

Global stocks fell amid concerns that US’ trade policies would hurt economic growth and consumer sentiment in the country. Bond yields were mixed. In commodities, oil prices rose on US attempts to limit oil supply from major oil exporters, and gold was also up due to high uncertainty.

Amundi Investment Institute Macro Focus

Americas

US PMI survey shows some strength

The March data for US purchasing managers’ index (PMI) rose to 53.5, a three-month high driven by the service sector as companies report signs of strengthening consumer demand. That said, the sentiment in the manufacturing sector has deteriorated further. Looking ahead, we believe the uncertainty on tariffs and the resulting impact on consumption could weigh on growth. However, we do not expect a recession this year.

Europe

Improving business climate in Germany

The IFO business climate index rose from 85.3 points in February to 86.7 points in March. Firms were more satisfied with their current business situation and their future expectations also improved noticeably. German companies are hoping for a recovery on the back of the fiscal expansion expected in the coming years.

Asia

Markets prepare for tariff shock

Asian automakers are among the leading exporters to the U.S. With the latest 25% tariff on automobiles from 2 April, South Korean and Japanese carmakers are particularly vulnerable due to their significant market shares in the U.S. auto import market and their relatively higher exposure to these tariffs. South Korean auto exports to the U.S. account for approximately 1.5% of its GDP, while the number for Japan stands at around 1% of its GDP.

Key dates

1 Apr EZ CPI, US ISM, Australia policy rate | 3 Apr EZ PMI, China PMI | 4 Apr US labour markets, India PMI |