Summary

Omicron uncertainty; inflation certainty

The resurgence of the virus cycle, central banks’ reactions to high inflation figures, and Evergrande’s unavoidable default have led to some volatility in the market, but these issues have not caused any major disruption. In the battle between growth and inflation narratives, the mantra that bad news is good news for markets continues to prevail. At this point, it is definitely too early to make a judgement on the Omicron variant and its impacts. Investors should be aware that the virus cycle will be in focus once again. The new variant may affect the fragile parts of the supply chain, further adding to inflationary pressures. Importantly, there is a psychological element in the inflation situation currently offering a self-fulfilling narrative. This is definitely a risk to take note of moving into 2022.

Nonetheless, the level of concern is not in the red zone yet, but the Fed’s tone turned more hawkish, with Chair Powell speeding-up the tapering process. Despite the Fed’s shift to reducing accommodation, policy will remain easy in 2022, with the Fed Funds rate well below the “neutral” rate, a level where monetary policy neither stimulates nor restrains economic growth. In fact, the reaction of equities is an illustration of the market’s belief that the Fed will master inflation while not hurting economic growth, and that this episode will only be temporary. However, we think the situation will not be so straight-forward.

Amid tight labour markets (wage pressures) and strong consumer demand, we could potentially see demand-side pressures on inflation. So, the Fed is walking on thin ice: on the one hand, inflation is barely sustainable from a political standpoint; on the other, excessive tightening of financial conditions, causing market turbulence, would be equally unsustainable. The Fed will do something, but will likely remain behind the curve with tapering and rate hikes in 2022 and it will likely keep rates at very low levels.

The third item on the news front is China: the Evergrande and Kaisa groups have officially defaulted. So far, we see no signs of contagion. China’s government had also been active in recent weeks in supporting the real estate sector and taking a major role in the Evergrande’s restructuring. The policy stance looks much more constructive in 2022 vs 2021 and we believe that will be an important element. Against this backdrop, we see some key considerations for investors:

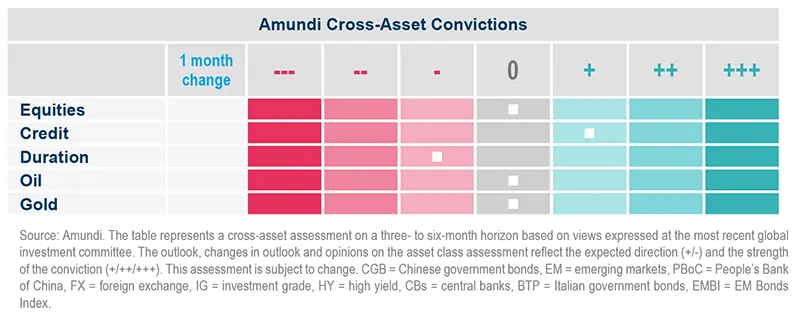

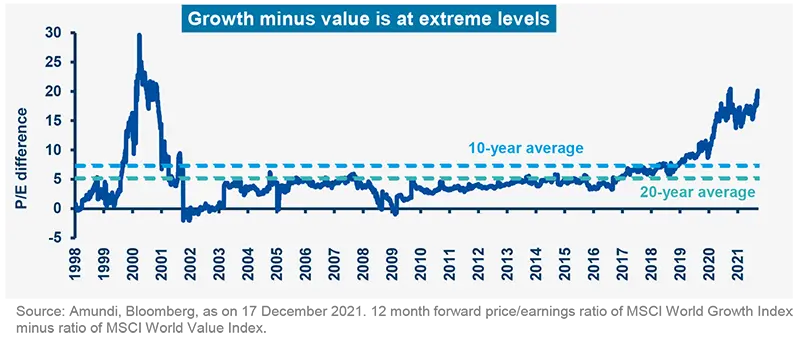

- Rising uncertainty and the risk of policy mistakes point towards a neutral stance for risk assets. Equities will continue to be favoured based on a TINA (there is no alternative) argument as long as real rates remain deeply depressed and inflation expectations are well anchored. The recent buy the dip move signals that market sentiment is still upbeat, despite high valuations and falling real earnings yields. Hence, once again, investors should selectively favour sectors and businesses that can better navigate an inflationary environment and should prever value given the wide valuation gap vs growth.

- In fixed income, after the Fed’s move, while 2Y Treasury yields fully priced in the FOMC’s projected pace of rate hikes, intermediate- and longer-term yields did not. We see risk of a bearish steepening of the yield curve. This reinforces our negative view on duration. In credit, the recent spread widening, especially in the quality part of the market (IG), may offer some room to add exposure, but very cautiously and in the short duration part. A scenario of decent growth, easy fiscal policies, behind-thecurve CBs, and continued global demand for yield remains supportive for credit, and in particular for the segments that can withstand inflationary pressure and don’t suffer from extreme leverage.

- In EM, investors should look for opportunities to play the asynchrony in policy responses. EM is a divided world between countries and CBs that are taking inflation seriously and those that are not. We have seen a largely credible response from EM CBs to higher inflationary pressures (Brazil, Mexico, Russia, South Africa). The divergence in monetary policy with the Fed will have important implications for 2022, benefitting the debt of EM countries that have already acted in a credible way to cool inflation risks: eg, Brazil and Russia. On the equity side, China may be the positive surprise next year.

- Finally, we reaffirm the need to selectively add real assets exposure for investors able to withstand the liquidity risk, as these assets may offer potential for inflation protection and higher real income.

Regarding 2022, we are entering the third year of the pandemic: it has already moved to an endemic phase in financial markets, as they have been getting used to digesting any news quite quickly amid huge doses of accommodation from central banks. It will be a year of change and a reality check regarding what this new endemic phase will mean once CBs start to readjust their efforts, inflation proves stickier than anticipated, and long-term expectations start to be challenged.

PPI to CPI pass-through: top-down, bottom-up views

The regime shifts along growth and inflation and the sequencing of monetary policies are two key factors included in our 2022 Investment Outlook - Investing in the great transformation. Here, we elaborate on the pass- through of PPI to CPI, the effect on corporate margins, and the significance of pricing power as an investment criterion.

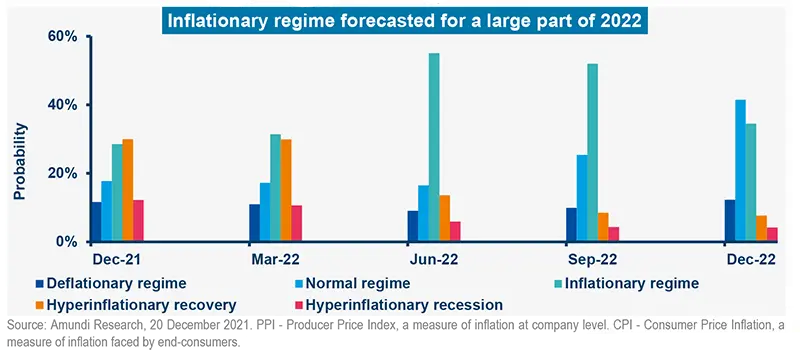

While market participants and CBs have now moved past the ‘temporary/structural’ inflation illusion, we are extending our ‘inflationary regime’ call to Q3 2022 on a combination of factors: higher trajectories for 1) the employment cost index, 2) unit labour costs (ULC), 3) import prices, and 4) PPI. These are the pivots that will frame our inflationary regime’s taxonomy and the associated investment consequences. The PPI-CPI differential deserves specific attention in 2022, as it will affect margins. The gap between input costs along industrial value chains and the real pricing power per sector and/or per company will likely be on display in 2022.

Amid pressures on margins from rising input costs, companies’ pricing power will be a key aspect for us to monitor, and it will also guide our investment decisions in 2022.

From a top-down perspective, the pass-through from PPI to CPI was not evident in the figures reported over the recent earnings season, if only marginally. Typically, the ‘pass-through’ comes with lower revenues, USD appreciation, lower rates, tighter margins, and, therefore, lower expectations on profits and earnings formation. If in the past, the passthrough effect from PPI to CPI had been mitigated by productivity increases related to technological progress, globalisation and offshoring, trade weighted (TW) USD depreciation1, this is unlikely to be the case in 2022. CBs’ asynchrony will lead to a stronger USD while we expect single-digit EPS growth2, assuming financial conditions remain benign amid contained TW USD appreciation3 and negative real rates. Looking at the bottom line, we see some pressures from mildly higher ULC and higher PPI. The Omicron variant will not only procrastinate opening of supply chain bottlenecks, it may also obstruct structural decisions (ie, reshoring), given the still uncertain outlook. Top-line deceleration, lower margins, and less supportive liquidity conditions are all risks to the downside, challenging our ‘benign neglect of inflation’ scenario in H1 20224 . Moreover, relative to international peers, the US is showing greater flexibility in passing higher input costs on to consumers. In particular, if we use CPI/PPI ratios productivity’s proxies (using the BalassaSamuelson framework), we can explain part of the USD’s strength seen in 2021.

From a bottom-up perspective, we believe, there is a time lag between market participants — who adapt fast and believe production adjusts almost immediately to new input prices — accepting inflation and the actual adjustments to the real industrial value chain. The latter takes longer to adjust and possibly integrate the new dynamics. After 15 years of deflationary forces, CEO/CFOs now have to adapt to this environment of bargaining and renegotiating price increases for 2022 in their budget processes (change of mind-set). So far, our anecdotal evidence shows that re-shoring and short-term adjustments of supply chains (eg, relocating sneaker production from Vietnam, Indonesia) is elusive. At a sector level, we noticed that in Europe, consumer, materials and industrial (especially transportation) saw minimal passthrough. Retailers (food and non-food) are at risk of a margin squeeze. On the other hand, consumer, luxury media, packaging and some parts of tech are showing strong pricing power. Pharma is a different ballgame: given mostly regulated prices, the sector has little pricing power but is not yet facing higher input prices.

To conclude, the inflationary regime will dominate most of 2022. The pass-through of PPI to CPI will likely dampen earnings formation, and thus pricing power will be key. We see tangible downside for risk assets in H1 2022, justifying why we enter the year having reduced the equity exposure to neutral.

___________________

1 Including in the basket, a larger exposure to EM currencies than DXY;

2 We forecast operating EPS for S&P500 growth at 7%, 12M forward earnings;

3 3% appreciation over the next 6M;

4 When we recommend staying cautious.

Look for entry points in quality credit and equities

Global expansion continues in the midst of growth challenges posed by the new variant, a hawkish Fed, and inflation pressures, confirming our stagflation views. This, coupled with some tactical weakening of equity momentum, prevents us from taking an aggressive risk-on stance. However, CBs remaining behind the curve does not warrant any structural de-risking either. Thus, investors should rotate out of areas that could be affected by weak risk sentiment and look for tactical as well long-term opportunities presented by market dislocations (eg, in credit). This should be done with an overall risk-neutral mindset and based on an active and well-diversified approach. Investors must maintain sufficient hedges to protect equity/credit exposure.

High conviction ideas

On DM and EM equities, although we stick to our neutral stance, we maintain a buy-the-dip view, without increasing our risks level. We are also debating about and investigating what should be a good entry point for investors to selectively take advantage of the recent correction in some markets, such as Japan, that have lagged the recovery and are attractively valued. In the US, with an aim to minimise asymmetrical risks, we think derivatives may offer efficient ways to gain from any upward movement in US equities. Elsewhere, we are mindful of near-term weakness in China and some other EM that could be affected by the Fed’s policy turning more hawkish. Instead, we focus on areas that offer robust long-term opportunities.

In fixed income, we maintain a short duration stance in the US and Europe, but remain flexible. We are now cautious specifically on 5Y German government bonds. The recent fall in yields due to concerns about the Omicron variant was an overreaction and was particularly extreme for the core European yield curve. Thus, the 5Y and the more front-ended curves were hit the most by this sudden repricing of yields because these segments had earlier priced in a more rapid normalisation of monetary policy by central banks.

Second, while we think long-term fundamentals for Italian economic growth are strong, there are some near-term uncertainties relating to possible effects of the new virus variant. As a result, we have become slightly more cautious on BTPs. Instead, investors should look for tactical opportunities in EUR IG credit with an aim to keep the overall risk budget constant. ECB support and favourable technicals (limited supply in H1 2022) continue to support credit (IG, HY) which remains a source of income, but we are selective. In addition, the recent market de-risking in EUR IG is not justified.

Third, we are less constructive on Chinese government debt due to downside risks related to local FX, primarily vs the dollar, and turmoil in the country’s credit markets. However, we maintain that Chinese debt offers diversification benefits for global portfolios in the long term. On EM bonds, we remain neutral. In FX, the evolving global economic environment continues to support a relative value approach. While we are monitoring events such as evolution of the Covid situation in the UK, we keep our slightly positive view on the GBP vs CHF as the franc remains the most overvalued currency in the G10 universe. Our conviction is not strong due to the UK’s deteriorating economic backdrop, perennial shortages, and Brexit-related issues. These factors, coupled with high energy prices and inflation, allow us to keep our defensive view on the GBP vs the EUR and the USD.

In EM, we keep our constructive view on the RUB/EUR as the currency is resilient in light of attractive valuations, low external vulnerability, and the hawkish stance of the Russian CB, although we remain vigilant regarding geopolitical tensions with Europe and the US. In Asia, we maintain our constructive view on the CNH/EUR, given China’s growing importance in Asian trade and its increasing role in the global economy.

Given our overall neutral stance, we prefer rotating risk (as opposed to increasing it) to benefit from recent market movement — for example, in IG credit.

Risks and hedging

A higher inflation regime and policy mistakes remain high probability risks. We recommend that investors maintain hedges on DM equities and on US HY to protect from any tail risks.

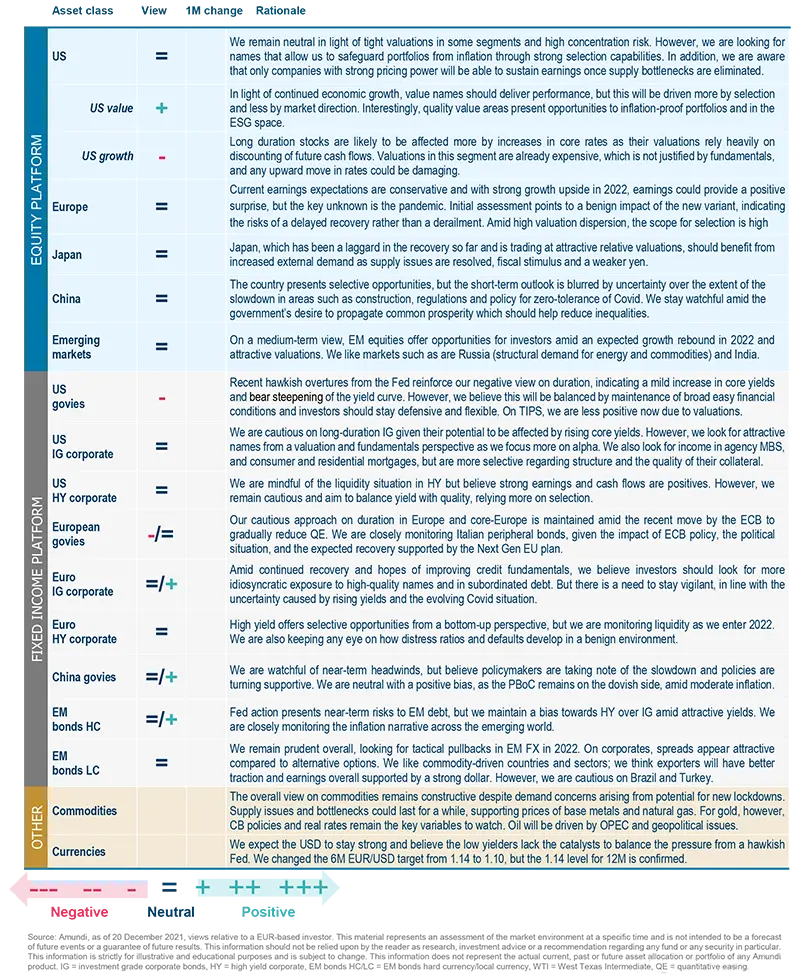

Fed, inflation conundrum and Omicron clouds

The evolution of the virus cycle, a deceleration in economic growth, and inflation (demand side or costpush) will determine CB responses. The last factor has been key for the Fed, together with political pressures and the ‘fiscal dominance’ narrative, as it accelerated its taper plans and raised expectations for rate hikes in 2022. Despite that, we believe the Fed views inflation as transitory — even though it removed the reference — because long-term rate expectations haven’t changed. So, the Fed’s actions will remain within the ‘benign neglect’ narrative of inflation. For investors, this means they should look for income in credit but without increasing portfolio beta, particularly in areas where spreads have widened. Focus should be on alpha generation through a bottom-up approach and valuation bias in EM and peripheral bonds.

Global and European fixed income

We maintain a cautious but flexible stance on duration in the US, and core and semi-core Europe, but remain constructive on peripheral debt in the medium term through Italy (watchful of near-term uncertainties). On breakevens, we are monitoring valuations in the US (less constructive now) and in Europe, where we are no longer positive.

Elsewhere, we look for carry in credit through a mildly constructive view, even though we believe investors should rely more on idiosyncratic exposure to medium-term maturities, centred on convictions such as subordinate debt (in IG and HY) and in financial, industrial and cyclical sectors. In HY, there are opportunities to selectively play the compression theme, but liquidity should be monitored (better liquidity in January). However, we avoid long-duration securities and names likely to engage in re-leveraging/LBOs. We also stay clear of consumer, transportation and chemicals sectors. Overall, we look for winners in an environment of rising core rates, wages and raw material prices.

US fixed income

We believe the risks that the economy will materially slow down are low because we see a lot of stimulus and momentum. But inflation and Covid risks persist amid tight labour markets, supply chain bottlenecks, and strong consumer demand. This, coupled with political pressures on the Fed and an acknowledgement that inflation is not transitory, encouraged the CB to accelerate its taper. We expect to see a mild increase in core rates, allowing us to stay defensive on duration.

On TIPS, however, we maintain only a minimal exposure. Instead, we look for alpha generation in corporate credit when valuations and fundamentals at the issuer level are attractive, but liquidity is key. We also believe derivatives offer selective opportunities in managing IG and HY exposure. In addition, strong income growth and high savings rates should continue to support housing markets, which underpins our positive view on securitized investments.

Entering 2022, even though we are seeing a more hawkish Fed, the broader policy stance is likely to stay benign.

EM bonds

EM bonds remain an area of interest where relative valuations are selectively attractive. However, there are some challenges to EM debt and FX from higher rates in the US, the situation in China (corporate restructuring), and its potential to spill over to global markets. We maintain our bias towards HY vs IG, with preference for HC, while we are especially selective in LC. But, we are cautious on Brazil and Turkey (idiosyncratic risks).

FX

We remain positive on the USD, but downgraded the GBP despite the recent rate hike by the BoE, given uncertainty around the Covid situation and potential setbacks from Brexit. In EM, the PBoC indicated its desire to pause RMB appreciation. Elsewhere, we are constructive on the IDR, INR and RUB but are monitoring geopolitical tensions.

___________________

GFI = global fixed income, GEMs/EM FX = global emerging markets foreign exchange, HY = high yield, IG = investment grade, EUR = euro, UST = US Treasuries, RMBS = residential mortgage-backed securities, ABS = asset-backed securities, HC = hard currency, LC = local currency, CRE = commercial real estate, CEE = Central and Eastern Europe, JBGs = Japanese government bonds, EZ = Eurozone, BoP = balance of payments.

Playing the great divide

Overall assessment

We believe that moving into the new year, the demand backdrop remains robust — strong employment, wage growth, accumulated savings — and is supported by positive fiscal impulses in Europe (green deal) and the US. On the other hand, the Covid situation continues to evolve as the Omicron variant has led to some profit-taking in segments where valuations are excessive. Given that market concentration is also high, a small part of the market is increasingly responsible for huge gains. Thus, selectivity is key to identifying winners at a time when valuation dispersion is high. But in doing this, we acknowledge that the pass through of rising input costs to consumers cannot happen for perpetuity. So, we look for demonstrated pricing power through market positioning, intellectual property, etc, and stay balanced.

European equities

We stay balanced in markets offering opportunities for selective stock-picking in value and defensive segments, such as health care. At the other end, cyclicals (industrials exposed to construction super cycle) and financials (banks) remain our focus. We also like economic reopening-related names that are trading at attractive valuations and offer high dividend yields. However, we are cautious on long duration stocks, tech (slightly less defensive), and discretionary, but are watchful for opportunities presented by market dislocations. Our overall stance is biased towards normalisation, but we continuously assess the impact of inflation and the evolving Covid situation on corporate margins beyond the short term. In doing this, we put special emphasis on balance sheet strength, the potential for improvement in financially significant ESG metrics, and the potential for investing in companies before the ESG premium sets in.

Markets mask the great divides: value vs tech growth; big size concentration and overvaluation vs the rest; companies with pricing power vs the rest. This is fertile ground for bottom-up selection.

US equities

The Fed is accelerating its QE reduction but euphoric sentiment prevails in some market segments, such as tech, where the sector’s relative performance vs the broader S&P index has reached the tech-bubble peak. This is one of the key risks (concentration risk) as performances of some selective large-caps are overshadowing the markets. On the other hand, while companies are delivering record margins, we are focused more on the sustainability of these margins which depends on pricing power. Once supply bottlenecks are removed, companies with limited pricing power could see margin erosion. We remain selective, believing that value should be preferred, as relative valuations vs growth are extreme. In addition, investors should tilt portfolios to areas less exposed to inflation risk, which markets are ignoring. Thus, we prioritise stock-picking over market direction and focus on company-specific drivers. At a sector level, we like high-quality, cyclical value stocks, but are cautious on highmomentum/growth names and long-duration stocks. We are also defensive on traditional riskoff sectors (staples, utilities) as potentially higher real rates could affect sentiment.

EM equities

Attractive relative valuations in the heterogeneous EM world present opportunities from a bottom-up perspective. While China’s short-term outlook is blurred by uncertainty regarding the extent of the slowdown, the government’s stance going into 2022 looks more supportive vs 2021. Our most preferred markets are Russia (structural demand for energy and commodities), India (benefitting a lot from China slowdown, but getting expensive), and Hungary. At a sector level, we favour consumer discretionary and energy, and maintain our preference for value over growth.

Amundi asset class views

Definitions & Abbreviations

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Bear steepening of yield curve: Widening of the yield curve caused by long-term rates increasing at a faster rate than short-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied. Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXP – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Trade-weighted dollar: It is a measurement of the foreign exchange value of the dollar vs certain foreign currencies. It weights to currencies most widely used in international trade, rather than comparing the value of the dollar to all foreign currencies.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.