Summary

CIOs’ letter

As the global economy recovers from its pandemic scars and inflation makes its first comeback in decades, the world is preparing to face its greatest ever challenges: the energy transition to fight the inexorable climate crisis and the development of an inclusive growth model. We believe that 2022 will be a pivotal year in this respect, encompassing a huge mobilisation of resources to succeed in both of these challenges. Meanwhile, some of the paradigms that have characterised the previous decade will appear outdated.

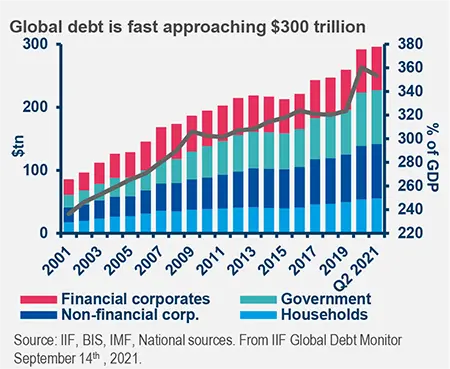

The paradigm of austerity at all costs is a thing of the past, and not only as a response to the Covid-crisis disruptions. Huge fiscal stimulus, along with private capital, is crucial for the ambitious investment needed to reach Net Zero emission targets by 2050 and to manage the transition. The energy crisis we are living in today is adding more fragility to an already unequal society, and governments need to act. Central Banks’ independence will come into question, while dealing with multiple targets (inflation, growth, unemployment, green, inequality). The mantra of «too much of everything» (overcapacity) is also debunked as scarcity is all around: commodities (food and energy), a skilled workforce and alternative supply chains to mention a few. This comes alongside the end to the old wave of globalisation and the emergence of China as global power (in terms of consumer demand, climate action, geopolitical equilibria), rather than being a mere low cost manufacturer.

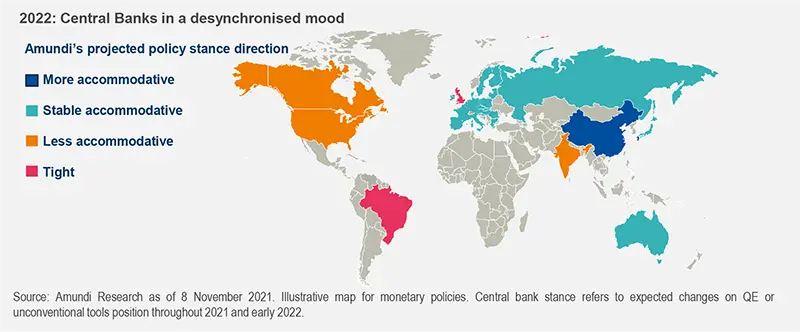

All this translates into three major themes for investors in 2022: first, inflation, at a time when economic growth starts to slowdown; second, the de-synchronisation of fiscal and monetary policies across the world, along with the impacts of the slowdown in China; third an acceleration of ESG integration into portfolios. We will help you rethink your portfolios through these lenses, and to explore the opportunities that will arise in this new investment regime.

10 Key messages from the 2022 Investment Outlook

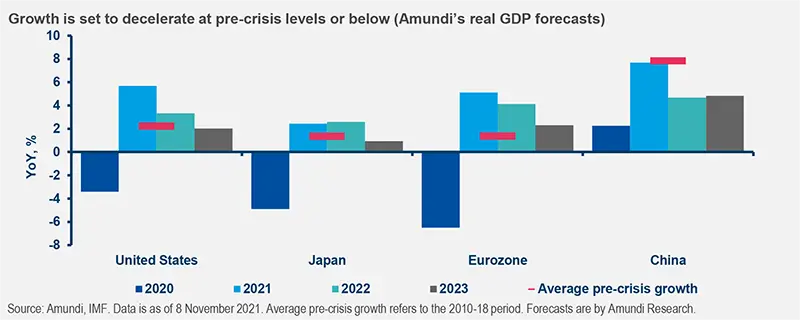

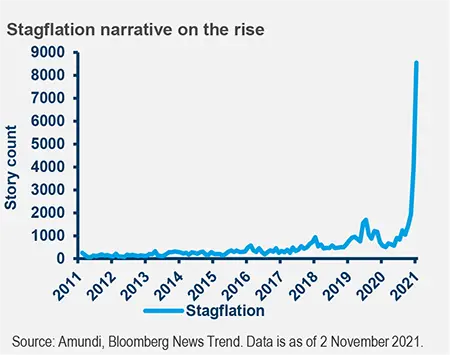

1. The road back to 70s narrative gains traction. Secular stagnation is a thing of the past, the “roaring 20s” – a new economic miracle – a dream. Global growth will return to potential after the peak, as cyclical stimuli fade. Inflation will prove to be permanent and uncertain, fuelled by supply shortages and scarcity all around. De-synchronisation among growth and inflation trends are back with vengeance, globalisation will take a hit.

2. Central Banks (CB) hold the key to the cycle. A stagflationary direction is on the horizon, with a risk that Central Banks may lose control, while trying to balance the growth and inflation trade off. In DM, CBs will accept falling behind the curve, given their benign neglect of the inflation narrative.

3. After an initial tiptoe into tapering, expect more, not less, monetary accommodation down the road (moving into 2023) amid decelerating growth and the rising fiscal needs required to finance the green and just transition. Central Banks and governments will work in harmony: higher debt will need to be monetised and financial repression will continue.

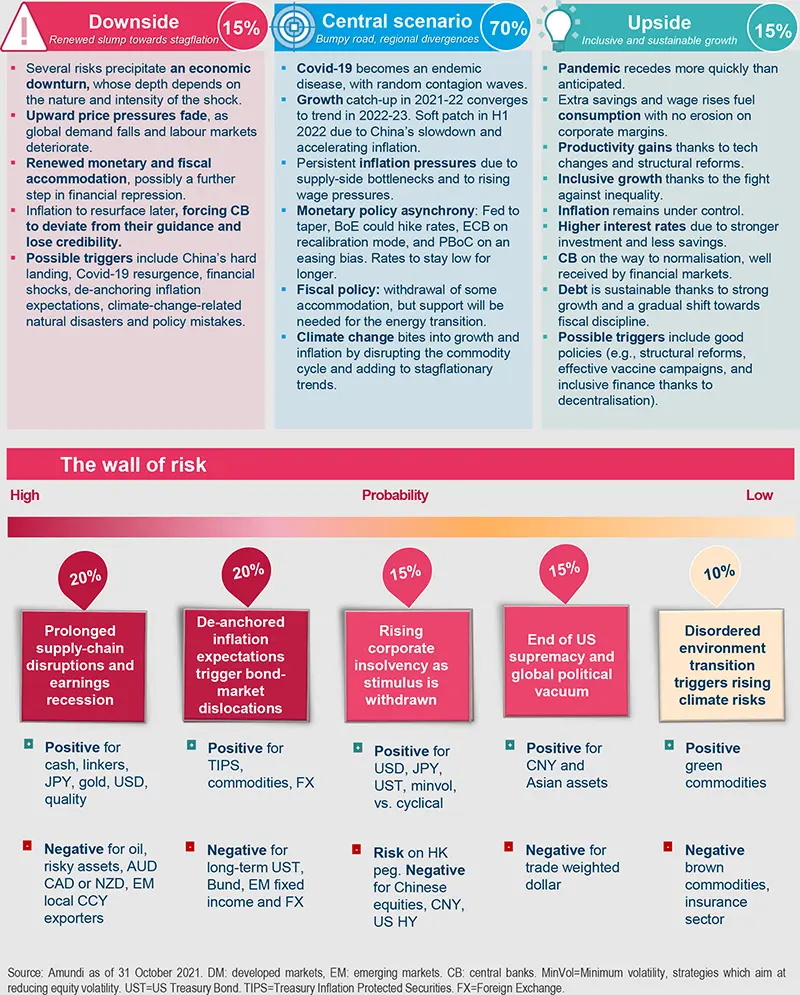

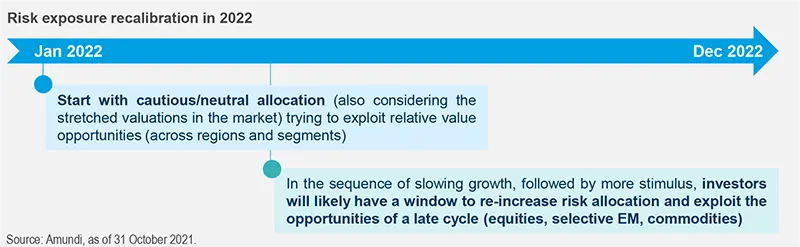

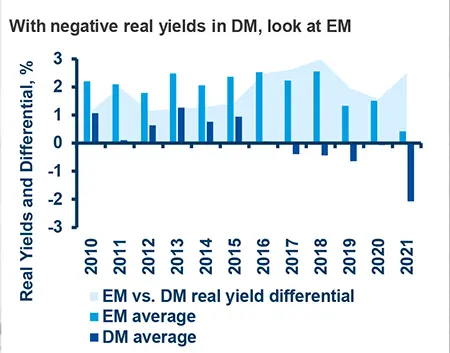

4. The cycle will extend further, but frenzied markets are no longer in sight. In the sequence of tapering and deceleration, followed by more stimuli and re-acceleration, investors should be cautious first (neutral on risk assets) and search for entry points to complement their strategic positioning in equities, commodities and EM. The latter, should be back in focus after a lost decade, in which global positioning has fallen below strategic targets.

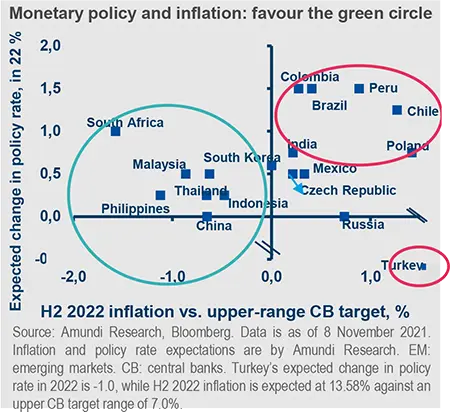

5. The concept of EM as a block is definitely over. The great divide will be across three worlds: 1) countries with inflation and Central Banks acting to control it; 2) countries with Central Banks remaining inactive (out of control); and 3) China. Investors should favour 1 and 3, where currencies should also appreciate versus the US dollar, bearing the burden of hyper-Keynesian policies.

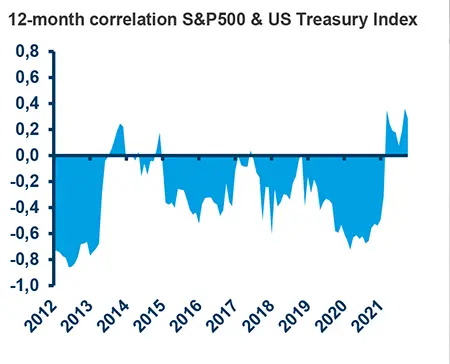

6. Targeting real returns is the new horizon, beware of the nominal illusion. Challenges will increase for a 60/40 portfolio. Positive equity/bond correlation calls for more dynamic allocation. Relative value plays and additional sources of diversification that can potentially mitigate inflation risk, such as real assets, will be paramount.

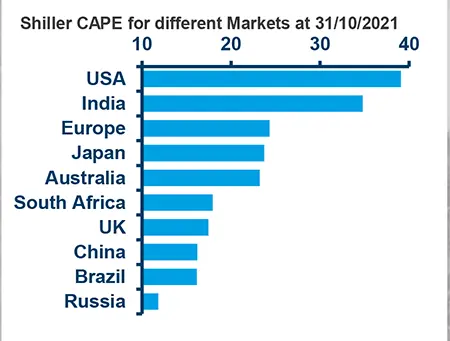

7. Real rates will determine the fate of excessive equity valuations. They will eventually pick up, challenging the bubble areas in the growth space. Selection should focus on earnings and pricing power, quality and value, amid higher costs and rising rates.

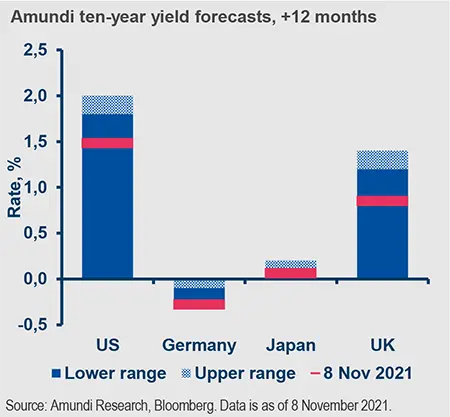

8. Resist the temptation to go long duration after the first leg of rising nominal yields. Curve movements, currencies and cross-regional opportunities will flourish in a world of divergent monetary policies. Unconstrained fixed income will remain the name of the game.

9. We will likely see some cracks relating to leverage issues come to the surface. This will trigger the first round of the great discrimination between unsound and expensive credit, at risk during a time of tighter liquidity conditions and default rates bottoming out, versus sound and expensive credit.

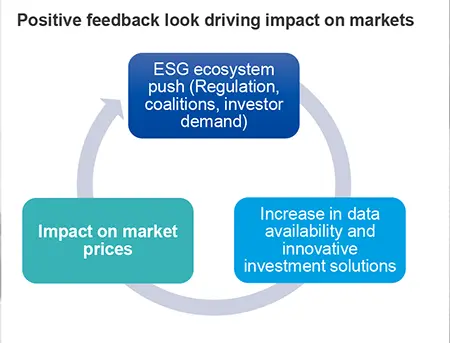

10. The green and social recovery will push towards ESG mainstreamisation, but the transition will not be linear. The ESG ecosystem (regulation, coalitions, investor preferences) will drive demand and data quality and affect the price discovery process, with positive feedback loops between some ESG factor adoption and their increasing impact on prices.

DM = Developed Markets, EM = Emerging Markets.

Setting the scene

MULTIPLE TRANSITIONS LEADING DIVERGING PATHS

Central banks hold the key to the cycle in a desynchronised world

2022 will mark a critical juncture on the road to a new economic and financial regime. Multiple coexisting transitions will drive the shift from the old to a new regime, that has already started in economic, social and geopolitical spheres, that will accelerate and have profound implications for investors. The end of the ultra easy monetary era, as well as the growing momentum for policies to avoid a climate catastrophe and social threats will be themes to watch.

The strong growth rebound in 2021 means that some of the excess accommodation introduced to fight the economic damage from the pandemic is no longer needed. It is time for Central Banks to start gradually removing it, as overheating in some areas will start to emerge and inflation is making its first major comeback in decades. At the same time, the impact of the energy transition will determine winners and losers across economies and markets and fiscal policy will have to mitigate the cost of this. Tapering is the buzzword at the end of 2021 but Central Banks may only tiptoe into it.

The shift away from a world of ultra-easy money will not be straight forward, as multiple transitions will affect Central Banks’ reaction functions.

Transition 1: From euphoria to normality

In a broadly good environment for global growth, we are moving away from the re-opening euphoria seen earlier in the year and global economic momentum is slowing down to potential, from its peak as cyclical stimuli fade.

The illusion of a global economic miracle will wane.

In the US, ongoing supportive fiscal policy, positive wealth effects from financial markets and rising demand from millennials may support further years of above potential growth, but expansion will remain below 2021’s record level. Chinese growth will be critical. It will cool down, but not be derailed in our view. The Chinese government will have to manage China’s transition towards a more balanced and equal society, avert a hard landing and curb investors’ moral hazard in over-indebted areas such as the housing market. While such deleveraging goes ahead, fiscal and monetary policy should become moderately supportive.

The impact of a Chinese slowdown should remain contained overall, although spill overs on select metal/commodity exporters and trade partners may occur. Discrimination regarding emerging markets (EM) will be key.

The Eurozone outlook should remain benign, with peripheral countries benefitting from resources from the Next Generation EU (NGEU) recovery package and regained confidence in service sectors, which have not been fully exploited this year. Yet, there is also the possibility that growth will disappoint on the downside as supply shortages threaten the recovery to different degrees across regions. This is a key area of risk.

Transition 2: From liberalism to government intervention in addressing green and social issues

The Covid-19 crisis has further exacerbated the need to fight inequalities and put health and environmental issues at the top of the political agenda. Addressing these issues means fighting monopolies, accelerating the energy transition, rebuilding the social pact and rebalancing the dynamic between profits and wages.

All this will come with greater regulations, possible changes in taxation, investment in infrastructure and green projects, and fiscal measures targeted towards social issues. Hence, the fiscal push will continue, but at a slower pace compared with 2020-2021.

The already high debt pile could rise further, at a time when growth is slowing, and challenging its sustainability.

Transition 3: From a global value chain setup to independence in strategic sectors.

The geopolitical context will become more complex amid the battle for self sufficiency, energy and technology supremacy. The Pacific area is getting hot, while China and US tensions are escalating again. These trends are taking place at a time when the pandemic has already triggered many businesses and governments to rethink global value chains in order to make them more resilient to future shocks, including natural disasters which are increasingly likely to occur on a warmer planet. This means reshoring elements of production and increasing supply chain diversification by nearshoring it. The focus on self-sufficiency will be particularly high in Europe, where part of the NGEU has been allocated to strategic sectors (semiconductors, defence and security, clean energy) on the road towards greater economic autonomy.

Regionalisation versus globalisation will be a key theme as well as a focus on strategic sectors.

Transition 4: From temporary to stickier inflation.

All the aforementioned transitions will determine the path of inflation. Their combined effects are changing the dominant inflation narrative from low and temporary, to higher for longer. Inflation will not likely return to precrisis levels, as supply chain bottlenecks, surging energy prices, the rebalancing towards higher wages and rising tax rates will push it higher compared to the past decade. What initially has been a US story is spreading globally through rising food and energy prices, with the notable exception of China, where consumer prices (CPI) are under control but producer prices (PPI) are being squeezed, putting pressure on corporate margins.

Transition 5: From old to new Central Bank mandates.

Central Banks’ actions will depend on how growth, inflation and debt adjust. The new regime we are facing will likely see financial repression continue in 2022, with Central Banks remaining behind the curve and acting in an asynchronous way. Not only will the road towards the withdrawal of extreme policies be long, but a further fiscal push to finance the energy transition and fight inequality will also likely require Central Bank support.

In this transition from old (fighting inflation) to new (supporting a more equal and sustainable growth path) mandates, Central Banks will face the dilemma of when and how fast to switch on/off the accommodation button in a world of higher/permanent inflation and slower growth (a stagflationary path). The narrative of a trade-off between growth and inflation (on top of the stagflationary one) will drive Central Banks’ actions.

Central Banks will determine how long the current cycle can be extended further. In our view, the music will continue to play softly.

The Federal Reserve (Fed) will move very gradually, with benign neglect supported by its mantra of transitory inflation. The European Central Bank (ECB) will face more challenges, as the tolerance for higher inflation is limited in the Eurozone and the energy dependence is higher. EM Central Banks will likely start to pause and eventually reverse some of the tightening implemented this year. After an initial hawkish phase in 2022, we expect to see more accommodation down the road, which will reaccelerate growth at some point in 2022 and extend the cycle further.

Central Banks’ actions will also be critical in relation to debt dynamics and the management of possible bubbles.

The case of struggling property developers in China is an example of the need to address excessive leverage before it becomes a systemic risk. Hence, this situation should be seen as a positive move for long-term stability even though it may prove painful in the short term. Globally, other areas of excess could also be a source of risk for investors. As extra liquidity is lifted, and real yields start to drift higher, ultra-high growth stocks at extreme valuations and highly leveraged corporate bonds will find themselves under pressure. We will likely see cracks regarding leverage issues coming to the surface, which will require additional focus on credit selection across the board, at a time of tighter liquidity conditions.

TRANSITIONS LEADING TO THE GREAT DESYNCHRONISATION

|

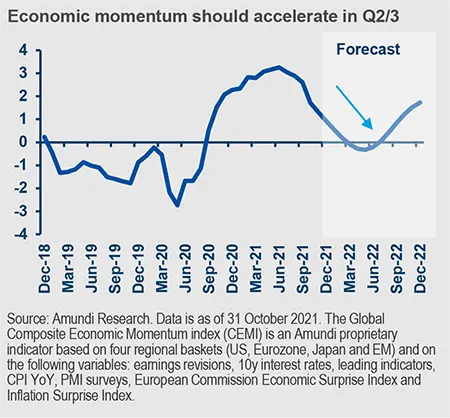

From post pandemic euphoria to slowing economic momentum 2022 will likely start with a deceleration from the 2021 peak, amid a China slowdown, followed later in the year by a pick-up in economic activity when China stabilises and an additional fiscal push reboots the growth engine. |

|

From liberalism to government interventions, with a focus on ESG themes The Covid-19 crisis has further exacerbated the need to fight inequalities and also put health and environmental issues at the top of the political agenda. |

|

From global value chain to self-independence A more complex geopolitical context amid the battle for energy and tech supremacy and the need to make supply chains resilient to the pandemic and to possible natural disasters is driving reshoring and nearshoring trends globally. |

|

From low/temporary inflation, to stickier inflation Supply chain bottlenecks, energy prices, rebalancing towards higher wages and rising tax rates will push inflation higher compared to the last decade. With slowing growth and higher inflation the risk of stagflation is on the rise. |

|

Central Banks, from old to new mandates Central Banks will be forced to stay behind the curve and maintain a financial repression environment (zero to negative real rates) to support the rising debt needed to finance environmental and social projects. |

Central Banks’ focus

WHEN THE GOING GETS TOUGH, THE TOUGH GETS GOING

Central Banks deal with slowing growth and rising inflation

After more than a decade, the financial community is used to reactive and influential Central Banks.

2022 will not be an exception: while fiscal levers remain significant and tied to monetary policy, Central Banks will stay vigilant and keen to manage the growth/inflation twist that, we are convinced, will be the dominant market narrative throughout 2022 and will further increase the asynchrony of monetary policies across the globe.

A regime shift is underway: enduring inflation on some structural forces and a slower global growth path not necessarily driven by the pandemic.

Key assumptions to our 2022 outlook

- Global supply chain fragilities and bottlenecks to be put together by H2 2022. The pandemic exacerbated an already existing imbalance related to a concentration of global supply chains aimed at tackling short-term efficiency rather than maximising their resilience;

- Labour shortages to be solved as soon as policy support schemes end, wage growth to remain mild on average;

- Energy prices remain at high levels without creating a power crunch in China and Europe, with WTI (West Texas Intermediate) staying in the 75/80 USD range; and

- China’s economic recovery in the shadow of its political agenda with growth still on a slow path in Q4 21 and gaining some mild traction in 2022.

We expect Chinese growth to drive the two speed recovery path that will lead global financial markets into a late cycle only in the second half of 2022.

When we consider the global picture at a regional level, we continue to see a multi-speed, uneven, unbalanced economic and transformational restart.

The policy mix challenge is to transform the economic rebound we have seen into a recovery with a more equitable income distribution aimed at tackling the inequality and social tensions that the pandemic exacerbated. A real and tangible transformation is what we need.

On the price dynamics front, we see inflation abating from 2021 levels, but remaining high when compared to prepandemic levels. The same path will take place in the Emerging Markets where inflation increased even faster than in developed ones, largely moving on soaring food and energy prices.

In 2021, the ECB and the Fed introduced new formulations of their mandates which sometimes remain obscure such as their new “average inflation targeting” where the time horizon of reference has not been specified. However, when the temporary/permanent debate exhausts its appeal, monetary authorities will wrestle with what to do in the face of inflation materially rising amid supply side shocks, which dominate demand side shocks.

While Central Banks have been trained on demand driven inflation management, it is less the case on soaring supply side prices (labour market shortages, energy and food, clogged shipping lanes). In any case, we shouldn’t worry about a lack of demand side price pressures! Soon we will see them building up in the US on demographic trends: Gen Z (a population cluster much larger than GEN X) will be soon ready to spend more (likely to buy houses and form families).

Central Banks face the big challenge of tapering at a time when global growth is quickly going back to potential.

Walking on a tightrope

Moving to the short term, the going is definitely getting tougher especially for two Central Banks with very different constraints and concerns: the Bank of England and the People Bank of China.

- The BoE has to fight rising inflation and will likely hike rates at its December meetings amid the uncertainty coming from the Brexit spillover.

- The PBoC is refraining to broadly adjust its tightening policy, notwithstanding the persistent weakening induced in the economy.

- The ECB postponed its tight spot to December, when it releases its economic projections and possibly adjusts its forward guidance. Then, it will be time to allow the transition from PEPP (Pandemic Emergency Purchase Programme) to APP (Asset purchase programme (APP) that might create some headaches with the ECB avoiding market distortions and more fragmentation.

- The Fed engaged on its well communicated tapering but will likely be challenged on its ability to manage the unwinding of extremely hawkish markets expectations. The risk of market disappointment is high. The first will be the toll paid by the USD and if this is the case we might expect to be challenged on our call for stability with the greenback potentially moving from 1.14 (our present target for Dec22) to 1.20.

Central Banks are all walking on a tightrope: caught in a vice between slower growth and higher inflation.

Their “endowment” is at stake: any deviation from their forward guidance will disturb market participants starting to price in a potential loss of credibility with disruptive consequences for financial markets. For EM Central Banks maintaining high credibility is key to keeping inflation expectations anchored.

Policy attitudes will shape our investment positioning: the combination of balance sheets that need to stay ample to preserve loose financial conditions, persistently rising inflation, slowing growth, overstretched risk asset valuations, is jittery for financial markets (risk assets in particular) and justifies why we are holding our breath now and expect to only start breathing normally later in 2022.

Influencing market narratives

As we mentioned earlier this year, different investment narratives are evolving at this point in time, leading to uncertainty and explaining complacency in the markets. We are convinced that narratives will continue to explain the divergence between market levels and fair values calculated on micro and macro fundamentals (Earnings per share; interest rates, unemployment, oil prices).

We consider markets narratives as “valuation factors”.

When regressing narratives versus S&P500 fair values to explain markets deviation from equilibrium prices.

Results are statistically significant, are sound economically and show that the significance of narratives changes over time.

With this in mind, time for the “secular stagnation” narrative of low growth and forever low inflation is now over. Instead, the “monetary policy” narrative, with the Fed’s policy stance, its balance sheet expansion and Covid-19 related Quantitative Easing, had an outsized impact supporting equity fundamentals up to August 2021. We think this narrative largely explains the disconnection between markets dynamics and fundamentals we have seen since the beginning of the year; it has now lost a bit of traction, but will remain latent in 2022. Since February, narratives have started to revolve around less benign footprints such as “back to 70s”, supporting market highs but looking for confirmations on corporate fundamentals.

For the time being reported earnings are surprising on the upside: we don’t think this upbeat messaging will be repeated into 2022.

As a conclusion, we might expect markets participants to increasingly focus on “stagflation”, “back to 70s” and a sequential move into less favourable valuations and multiple de-ratings. Overall, this emboldens our call for a neutral exposure to equity at the beginning of the year, that can be recalibrated in H2 when we move to a late cycle.

Green transition boosters

We would like to conclude on another field where we see Central Banks playing a prominent role: climate change and the green transition. This will involve a significant evolution in the conduct of monetary policy.

Depending on the speed and the nature of the transition policy, climate risk will affect the traditional transmission channels of monetary policy while the “green swan” risks (i.e., potentially financially disruptive climate related events) might be behind a systemic financial crisis.

While this transformation is definitely on governors’ longterm radar, there are more short-term challenges and opportunities that Central Banks should embrace. In July, the BoJ already announced a Green TLTRO (Targeted longer-term refinancing operations) to offer a favourable rate of bank lending to green activities. Similar proposals are on the ECB’s working list. In light of growing climate risks, having the TLTRO facility calibrated on a taxonomy of sustainable activities could be an immediate step to align lending with the Paris Agreement. Green LTROs could be structured to preserve the objectives and modalities of standard TLTROs, while at the same time including incentives for banks to invest in green activities (if not banks, then banks’ clients).

A proper definition of ‘green lending’ is still missing though as it is difficult to provide a consistent definition of environmental sustainability and a reliable system of verification. Copernican transformations are in place almost everywhere, and it is likely the pandemic provided the needed catalyst to move forward.

We really wish to see Central Banks adopting “green transition boosters” soon.

Base and alternative scenarios and risks

Key investment convictions for 2022

KEY INVESTMENT CONVICTIONS FOR 2022

Moving to a late cycle in H2: equities, EM and commodities favoured

In terms of portfolio construction, 2022 will bring more challenges compared to 2021. Investors cannot expect 2021-level returns for equities, amid an environment of normalising earnings growth and mounting pressure on margins. Pressure on government bonds will continue, while interest rates will start to rise. With real yields globally in the low range, the search for real income will continue.

The key elements to consider in portfolio construction will be: return, liquidity risk and exposure to growth and inflation.

Against this backdrop, investors will have to:

- Start light/neutral in terms of risk exposure and recalibrate risk throughout the year, with a focus on portfolio resilience to rising yields. Investors should start the year with a cautious/neutral allocation (also considering stretched market valuations) and try to exploit relative value opportunities (across regions and segments). In a sequence of slowing growth followed by more stimulus, investors will likely have a window to increase risk allocation again and exploit the opportunities brought by an extended cycle. Risk and liquidity management will be key as rising real yields may bring some market turbulence and challenges for both equity and bonds simultaneously. The 60/40 portfolio will be challenged by potentially positive equity/bond correlation and the duration risk in bonds, calling for additional sources of diversification, such as lowly correlated strategies and real assets.

- Get smart in the search for real income, by enlarging the asset class spectrum in an environment of structurally higher inflation. This will mean going beyond the traditional bond space and looking at equity dividends, real assets, EM bonds with a focus on short duration and more generally at areas offering higher yields with relatively low duration risk (subordinated credit and loans). Credit with longer duration and/or where spreads are too tight, will be challenged. Overall credit selection will be in focus as defaults may start to rise from low levels, with the rising cost of debt.

- Play equity with a focus on the least stretched areas (value, EM, Europe) and sensitivity to higher rates. Earnings growth will decelerate from the record levels seen in 2021, but some businesses are likely to continue to benefit from the ongoing re-opening, while others will suffer from rising costs, taxation and supply chain readjustments. This will lead to an environment of high dispersion of returns among stocks providing a positive backdrop for stock picking. Interest rates will remain reasonably low, but on a rising trajectory, favouring equity value (particularly financials) versus growth. EM equities should be back in focus. Equity exposure has increased to a peak in the cycle, favouring DM equities. The next increase should favour EM, where allocations are far below the strategic target and valuations look relatively attractive. A country-by-country assessment will be key when looking at EM opportunities in the context of China’s policies, price evolution and fiscal and monetary room. Europe should also be favoured thanks to its Next Generation EU, with a focus on the green transition.

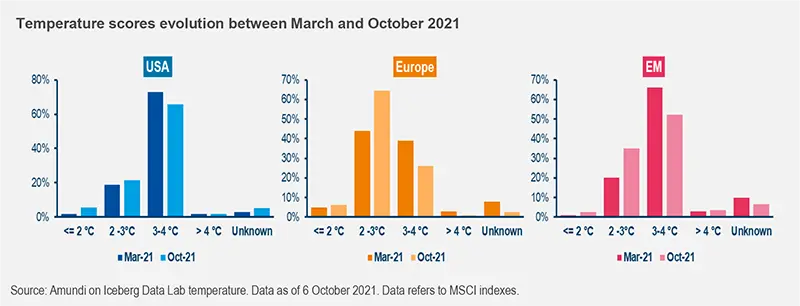

- Add thematic exposure to ESG factors that will likely have a material impact on risk/returns. Environmental, Social and Governance (ESG) themes should be seen as complementary to the classical portfolio metrics of risk and return, particularly when it comes to areas that could have a material impact on asset prices. Changes to regulations and rising demand from institutions and investors are ensuring some factors are becoming increasingly relevant in this respect. The net zero emissions initiative is one of the themes that will have a significant market impact, in our view. The focus on tackling inequality will likely be the next theme, as this is a key focus of governments during the current recovery phase. Some blended themes combining environmental and social aspects could emerge, such as the just transition’s drive to tackle climate change in an equitable way, which is a particular focus of concern for EM.

KEY PORTFOLIO CONSTRUCTION CONVICTIONS

1. FOCUS ON PORTOFLIO RESILIENCE

Balance risk in a world of changing correlations with the addition of uncorrelated sources of returns.

2. GET SMART IN THE SEARCH FOR REAL INCOME

This will mean going beyond the traditional bond space to look at equity dividends, real assets, emerging markets bonds with a focus on short duration and subordinated credit.

3. IN EQUITY FOCUS ON LESS STRETCHED AREAS (VALUE, EM & EUROPE) AND SENSITIVITY TO RATES

Interest rates will remain reasonably low but on a rising path, favouring equities with less stretched valuations such as EM equities or Europe that should benefit from NGEU implementation.

4. ADD EXPOSURE TO ESG FACTORS WITH MATERIAL IMPACT ON RISK/RETURNS

Changes in regulation, rising demand from institutions and investors drive impact on markets. The net zero emissions initiative and the focus on tackling inequality are the main themes to watch

Source: Amundi, Barclays, Bloomberg, as of 31 October 2021 . DM = developed markets, EM = emerging markets.

ESG Focus

ESG: RISING ADOPTION IN US AND THE GREEN MOMENTUM

Environmental in focus with net zero investing

The Covid-19 crisis has given an additional boost to the trends in ESG adoption already in place before the crisis. In 2021, inflows into ESG ETFs reached $107bn during the first nine months of 2021, compared to $92bn in 2020 overall and a meagre $32bn in 2019*.

Rising ESG demand comes with increasing initiatives in terms of data reporting standards, regulation and coalitions push (such as the Net Zero Coalition). In our view, these trends will help to unmask the areas of inefficiency by filling the gaps of data availability and leading to adjustments in market prices, as they start to incorporate these new pieces of information, therefore generating a positive feedback loop. Time will tell if the risk factors embedded in ESG are a unique, idiosyncratic set of factors or just superfluous with the traditional ones. So far, according to our previous research, before the crisis, ESG had already proven to be a strong candidate risk-factor in the Eurozone, while this was not the case in the US. Since the Covid-19 crisis and Biden’s election, our most recent analysis points out that ESG is earning a place as part of a traditional factor mix in North America as well.

North America: social and environmental in focus

Before the crisis, the Trump administration’s conflicting approach on ESG issues such as the withdrawal from the Paris Agreement and further delays on ESG integration in the region, marked a strong contrast with Europe where ESG factors were already showing signs of significant market impact. In Q1 2020, amid the Covid-19 pandemic induced market stress, components of the Social pillar in North America performed strongly in the equity market. Indeed, investors discriminated stocks based on the best and worst “working conditions “of employees.

The election of Joe Biden as the 46th President of the US triggered a “green momentum” which saw strong returns for the Environment Pillar on both sides of the Atlantic Ocean.

ESG had a significant impact on the credit market as well. In the months following the Fed’s intervention in March 2020, firms in North America went into a financing frenzy mainly through the credit market.

From April to October 2020, issuers from MSCI North America financed the credit market more than four times their average activity between January 2014 and March 2020.

While our previous research signalled that better ESG credentials translated into lower credit spreads for issuers, the pandemic highlighted that Governance was the most relevant pillar in terms of lowering the cost of debt.

2022 and the focus on the net zero initiative

The journey towards rising ESG adoption and increasing market impact will not be linear.

The speed and deepness of ESG adoption will depend on the push coming from the overall ESG ecosystem which comprises of regulation, coalitions and investor demand.

The net zero emissions initiative is one of the most recent examples of the ESG ecosystem in motion, highlighting this theme for investors and pushing companies to improve their net-zero profile in terms of temperature scores. These scores are emerging as a complementary tool to other existing climate-oriented metrics for investors willing to create net-zero aligned portfolios.

Very few companies worldwide meet the net zero target on a temperature score basis, there are strong data inconsistencies among providers and no unique approach to creating a portfolio with a net zero objective. This provides a fertile ground for alpha generation as investors may leverage all available ESG data and fundamental bottom up assessments to try to determine a forward-looking view on a company’s net-zero trajectory.

*Source: Bloomberg ESG ETF Dashboard.

Asset Class Views

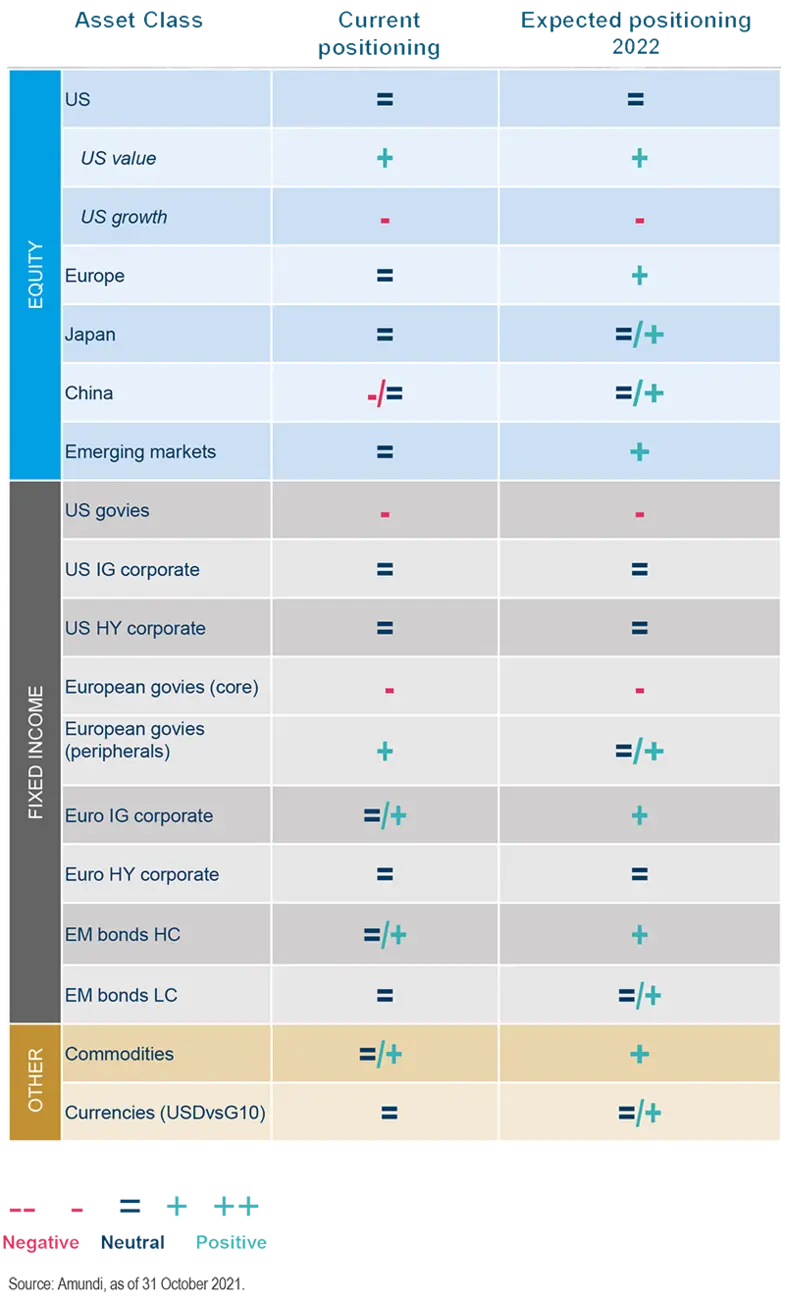

ASSET CLASS VIEWS TABLE

ALLOCATION: START NEUTRAL AND RECALIBRATE RISK

Focus on inflation-sensitive asset classes to build a resilient allocation

We expect equity markets to remain vulnerable to retracements in the near term as higher inflation, decelerating growth and weak data provide less ground for complacency. In a less benign environment for risky assets, markets could overreact to Central Bank actions and challenge the credibility of monetary policies. The inevitable outcome would be for risk asset valuations to reprice. Although expected profit growth prevents a recession, margins squeeze concerns related to increasing production costs and business confidence fragility are likely to last throughout 2022 in line with our “Composite Economic Momentum” indicator projections. An improvement is expected between Q2/Q3. As an investment consequence the asset allocation should be tilted towards inflation: US linkers and EUR IG are the best picks in fixed income. Within equities quality factors in the value segment should benefit most (US value should fit both). Commodity-related currencies in G10 (NOK, SEK and to some extent AUD, NZD) should provide positive carry at a reasonable risk and hedge potential commodity shocks.

- Market triggers: Inflation and margins squeeze

- To watch: PPI and supply chain disruption

- Risks: Monetary policy mistakes, stagflation and virus variants resistant to vaccines

Decelerating economic momentum does not mean structural de/risking but seeking opportunities at reasonable risk. A reacceleration Q2/3 could offer opportunities to re-load risk exposure.

EQUITIES: SELECTION THROUGH INFLATION AND ESG LENSES

Balancing core Value and Momentum with Quality

Toppish margins does not mean negative earnings growth or the end of a bull market, as top lines take the lead for driving earnings per share. Nevertheless, it implies a speed limit to expected returns, as EPS growth (+49% in 2021 for the MSCI World AC) should fade to single digits in 2022 (+8%). Then, the direction of bond yields will become key. Rising bond yields provide some advantage to EMU. Japan should eventually benefit from a delayed recovery and a weak Yen. Also be prepared to take a more positive stance on EM later on once the Chinese authorities accelerate accommodation and if EM FX break out. Moreover, the quality of growth will deteriorate (less growth, more inflation), even if growth remains above potential in 2022. This suggests considering Quality on top of core Value and Momentum. On themes, consider Value (banks), pricing power (luxury, semi-conductors), rising commodities (energy), capex (capital goods) and Quality (pharmaceuticals).

- Market triggers: Maturing expansion phase in the US, diverging with China slowdown, ESG acceleration

- To watch: Fed normalisation process, bond yield direction, China’s response to slowdown, EM FX breakout

- Risks: Policy mistakes, bond yields, profit recession

The wall of worries is rising, but opportunities remain in stocks with pricing power, sensitivity to the commodity cycle and interest rates as well as in the acceleration of the green transition.

BONDS: LOW REAL RATES STILL BENIGN FOR CREDIT

Central Banks will only tiptoe into tapering

The US economy should remain in an expansion phase in 2022 but slow down towards its potential. Inflation should stay higher than the Fed's current forecast. The Fed, given its new reaction function, will keep a cautious approach. US yields should rise moderately driven by (1) above-trend growth (2) the decline in liquidity on the bond market with the Fed's tapering and the end of the Treasury Department's cash drawdown (3) the hiking cycle. The Fed has already announced the tapering. If the economy progresses as expected, it can start a tightening cycle without hurting the economy. In the EU, the rise in yields of core euro bonds will be limited by the continued monetary support from the ECB. Further upward pressure on prices and a significant downward revision of growth would call into question the rise in sovereign core bond yields. This will be limited by the high level of debt in the system. An unexpected rise in prices would create uncertainty for the monetary policy. Credit markets remain supported by the positive cocktail of above-potential growth, negative real rates and accommodative CBs.

- Market triggers: growth/inflation vs policy forward guidance

- To watch: market dislocation due to energy transition amid policies financing

- Risks: FED losing control of the short end of the curve, central banks deviation from forward guidance

Investors should remain short duration and increase scrutiny on credit, as liquidity will be less abundant. CBs’ focus on the energy transition should support demand for green assets.

EM: PLAY REAL YIELDS AND EARNINGS REBOUND

Favour EM with favourable monetary policy/ inflation outlook

Growth and inflation trends, monetary policy cycles and global financial conditions are the themes to watch. While growth momentum is getting stronger, the EM versus DM growth premium will only return to favour EM mildly: China will take its toll with more sustainable growth and lower leverage. Relatively lower cost pressures and moderate growth will allow inflation inflecting. Monetary policy tightening should stabilise moving into H2, in an orderly Fed normalisation phase: late hikers can sail smoothly towards higher rates. Local bonds should benefit from stable/lower rates and a more constructive contribution from widely undervalued commodity related EM FX. Higher US rates and still high debt will widen hard currency spread (through high yield mainly). While the Chinese authorities should avoid a systemic credit event, default rates are getting higher in Asia and decreasing in Latam and CEMEA (Central and Eastern Europe, Middle East and Africa). Attractive valuations, value and quality will favour Latam and CEMEA equity markets in early 2022, followed by Asia later in the year. In China, favour sector selection according to the Common Prosperity agenda (new energy and biotech).

- Market triggers: Growth recovery and inflation peaking

- To watch: China Common Prosperity implications

- Risks: Tighter MP on domestic and/or global conditions

EM still offer attractive risk-adjusted returns. Constructive outlook on widely undervalued FX and commodity-related equity. In China, selective on sectors amid increasing default rates.

COMMODITIES: SUPPLY SHORTAGES IN PLAY FOR OIL & GAS

In the long term, favour commodities needed for the green transition

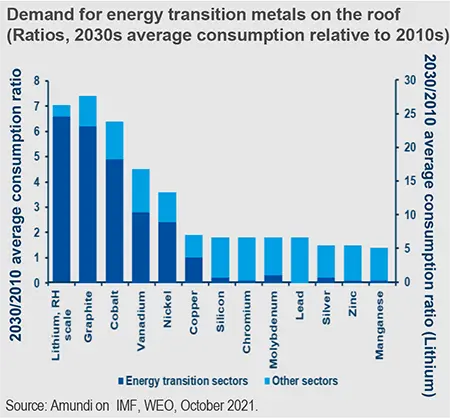

A new phase in the commodities rally occurred in Q321 and is expected to last into 2022. Cyclical components and recovery in H121 helped commodities to catch up closing the undervaluation gap of recent years. Increasing concerns over supply shortages in green commodities and a potential power crunch underpinned several commodities from copper to aluminium, from gas to oil. The rush in Europe and Asia for storage gas and oil inventories approaching winter exacerbated the global shortage caused by coal demand limitations primarily in China. The spill over to oil markets due to substitutions from gas to oil demand has not been mitigated by OPEC so far as it is reluctant to boost production while US shale oil producers are struggling to restore pre-Covid levels. Normalisation in the energy sector is not expected to happen until the end of winter with oil prices above $80 and gas around current levels while base metals are being driven by bottlenecks in production chains. On the other hand, gold is expected to suffer from the higher rates environment and the beginning of tapering.

- Market triggers: Green economy transition

- To watch: Inventories in energy sector in Europe and Asia

- Risks: Geopolitical risk, electric power crunch.

Play the short-term shortage in natural gas and oil and long-term green winners (copper, nickel, aluminium).

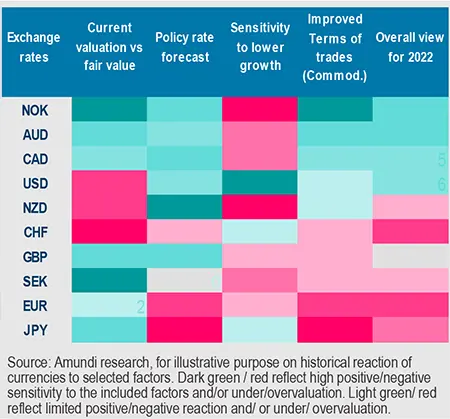

FX: SHORT-TERM POSITIVE USD

Playing the USD status, while hedging a commodity super-cycle

While recognising there is little the Fed can do to surprise market expectations (but disappoint) at this stage, we see the sequence of slowing global growth and the Fed starting its modest policy normalisation remaining, on balance, positive for USD. Inflation expectations led the move in yields in 2021, yet an active Fed and lower growth suggest real rates would need to catch-up, while staying negative, an environment in which the USD tends to strengthen, not to weaken. We see EUR/USD around 1.14 in 2022, with similar dynamics expected for all low yielders in G10. The latter still seems to lack the catalysts to balance the pressure, as dovish monetary policies may still be required to fill the gap with pre-pandemic growth levels. Inflation, on the other hand, is turning out to be more persistent than previously expected and the recent rally in commodity prices is translating into structural changes in G10 in terms of trades.

Slowing growth may prevent the USD from selling-off, while a few cyclical currencies (AUD, NOK, CAD) may still provide good hedges for those emerging macro factors. Yet, that requires the current sweet spot to stay.

- Market triggers: Monetary policy divergence

- To watch: Real rates, global growth

- Risks: Aggressive tightening of the Fed

Different sensitivity to growth, inflation and terms of trade will drive divergences among G10. FX dynamics will, in our view, be key drivers for portfolio returns next year.

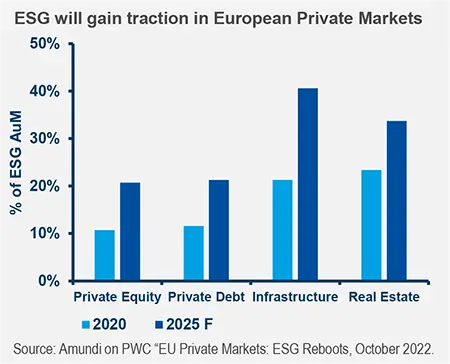

PRIVATE MARKET: FOCUS ON ESG AND TRANSFORMATION

Time to search for sources of diversification and inflation protection

Our base scenario of decelerating growth from the 2021 peak with regional divergences, persistent inflation pressures and asynchronised Central Bank action calls for enhanced portfolio diversification with a focus on inflation protection. Real assets and private markets can help to achieve these goals and, in our view, this explains recent strong demand for them. In Europe, AUM of real and private asset funds grew by almost 19% in 2020 to reach €1.486 billion (excluding hedge funds)* and fundraising in H1 2021 reached 59% of the 2020 total, which is the second highest level on record. Europe now represents 24% of global alternative AUM*.

In our view, real assets will be increasingly relevant:

- Firstly, we expect real assets to offer some of the best return prospects** over the next decade, with private markets returning around 200 to 500bps above listed or publicly traded securities.

- Secondly, while offering a lower liquidity profile compared to traditional asset classes, real assets can help make global portfolios more resilient, through the diversification benefits of these assets, their traditionally low volatility and potential inflation protection characteristics. That is why they will play an increasingly crucial role for investors as they look for solutions to meet their long-term liabilities and secure their retirement plans.

- Finally, real assets provide a direct way to shape our world: the energy transition, digitalisation of economic activity and trade, redesigning supply chains. Real assets provide a direct lever for allocating capital to projects and companies that fulfil a broader social and economic agenda, emphasising ESG.

More than ever, investing in real assets means focusing on a long-term horizon, powerful deal sourcing, asset selectivity, robust operational infrastructure and financial robustness.

Investors should consider ‘core’ strategies which have historically proved to be less volatile and shown more stable income generation, including during times of crisis: core/core+ assets in real estate and infrastructure, senior secured instruments in private debt, primary buyouts and growth capital in private equity.

Private debt supported by rising demand for company financing after the crisis

In the aftermath of the crisis, financing earmarked for the recovery and the needs of corporations will create significant opportunities in the private debt space for 2022 and beyond. We see strong demand from companies, either to aid post-crisis rebounds or to address areas of underinvestment highlighted by the pandemic i.e., in digital infrastructure and supply chains. The need to reduce debt is also driving interesting asset disposal opportunities.

In contrast, bank-financing remains constrained, as banks focus on managing their own portfolios, which will open up some interesting opportunities for private debt managers.

With inflation on the rise, the floating rates available within private debt is a way to mitigate its potential impact upon returns.

Selectivity will be paramount on both a geographical and sector basis in a challenging market where we see pockets of strength and weakness in the asset class. There is a divergence taking place between the best credits, where competition is fiercer than ever – driving preemptive offers and shorter due diligence periods – and more complex situations in areas such as tourism, events, or other sectors where visibility remains poor in the short term. Hence, we are observing a flight to quality as investors wish to protect themselves from a potential deterioration of the situation as government support winds down, which could see a rise in default rates.

This is driving a search for conservative investments with limited risk, such as senior secured debt strategies, which historically show stable income streams and consistent premium returns over liquid and traditional debt, with modest drawdowns over the long term.

Since it emerged as an asset class 10 years ago, private debt has been an important contributor to economic growth, thanks to the support it provides to the real economy as a complement to banking intermediation and we strongly believe that this trend will accelerate in the post-pandemic world, creating appealing investment opportunities for long-term investors. In addition, the asset class is experiencing a strong development of sustainable-linked financings. Consequently, we are confident that in the next 5-10 years, ESG will be fully embedded within financial risks facing companies so that markets value private credit accordingly.

Infrastructure: focus on the energy transition

With governments increasingly relying on infrastructure investment to stimulate economies and deliver climate focused policies, the asset class has been a bright spot throughout the COVID-19 crisis. Private capital is much needed here to complement public funding, which is giving infrastructure investments strong momentum in the year ahead and beyond. In addition, the asset class has proven its ability to thrive during a challenging period, with unlisted infrastructure funds delivering 13.4% one year IRR (internal rate of return) to Q1 2021.

Rising inflation concerns mean infrastructure is likely to gain more traction as investors look to utilise its hedge inflation mechanisms.

Few investors were exposed to infrastructure during the Great Financial Crisis.

The COVID-19 crisis was a real-time test for the asset class and, in the aftermath of the crisis, investors are prizing its now proven ability to resist market turbulence. Such stability confirms a core feature of infrastructure: its long-term time horizon. Prices may be more attractive in some sectors today, but it will not make a big difference in terms of returns in the long run. Buy-and-hold strategies are gaining more traction in this environment.

In terms of sectors, the pandemic has not only brought the need for health and communications infrastructure to light, but also stressed the urgency of the energy transition. A significant share of the EU 2021-27 multi-year budget and of the Next Generation EU plan has been committed to the green transition and to digital infrastructure. In 2021, we have seen a sharp acceleration in the number of transactions, especially for energy transition assets that will likely continue to attract significant private capital flows.

Private equity key to finance post crisis recovery

Private equity continues to hit records numbers as it is experiencing strong post-pandemic growth on the back of a steeper than expected economic recovery. In Q3 2021, buyout deals doubled to 1,042 compared to Q1 2021 and a record 5,284 private equity funds were in the market at the start of Q3, targeting $899bn in total*.

2022 is looking bright for private equity firms. Post-crisis periods are historically the best times to invest in private equity, as the demand for capital from unlisted companies increases significantly. During the COVID-19 crisis, privately owned companies massively used debt and capital expenditure to finance the downturn and sometimes the shutdown in activity, notably with recourse to state-guaranteed loans as well as deferrals of all kinds.

As the crisis unfolds, companies need strong balance sheets to make the most of the economic recovery, be it for refinancing, building-up purposes or corporate activity.

With many companies weakened by the crisis, sector consolidation has been accelerating, creating plentiful investment opportunities for private equity funds. In addition, strong equity markets since Q2 2020 have translated into a buoyant exit market, not just for IPOs, but also for trade sales and refinancing.

Finally, the adoption of existing technological or environmental trends has been accelerated by the pandemic and investors are willing to bid up the valuations of companies on the right side of these changes. The COVID-19 crisis has shone a light on several market disruptions in technology, the environment, demographics, societal changes and globalisation/ relocation. Some companies are well positioned to benefit from such trends that existed before the crisis but have been strengthened over the past two years. The environment megatrend is at the heart of all postpandemic stimulus packages in developed countries and particularly in Europe.

Momentum in the race to net zero in private equity should rise, as environmental issues will be at the core of investment and business opportunities.

Real estate: divergences and ESG in focus

The steeper than expected economic recovery could boost the leasing market and 2022 could be a solid year for real estate activity. There are a record 1,284 private real estate funds targeting an aggregate $365bn*.

With ongoing asset repricing, the flight to quality should benefit core assets and properties whose tenants boast strong balance sheets.

Work on quality and the repositioning of properties to match tenants’ post-pandemic needs in terms of technology, make ESG a key operational component of investment and management procedures: here are our strong convictions in the post-crisis environment. We have a positive view for new and recent prime buildings in major urban centres where it’s easier and less costly to implement technological or high ESG standards.

Offices: As the leader of Europe’s office real estate, we believe that offices will remain an important part of investors’ real estate portfolios, mainly due to the depth of this market. However, the adjustment cycle for office real estate will be a long one, where we expect to see an increase in collaborative installations and services, as well as greater geographical polarisation. Demand for office space is therefore likely to be concentrated on modern buildings in major cities and inter-city centres that are close to both regional transport links and mainline hubs. The best quality assets in the office sector have remained relatively unscathed, proving that offices still drive corporate culture, brand and team building.

Logistics is definitely among the big winners of the crisis. The sector is experiencing strong demand, even in peripheral urban zones, on the back of booming ecommerce and more fragmented supply chains. Strong rental demand in a context of limited supply in the most sought-after locations is pushing rents higher.

Residential. Demographic changes have accelerated during and post-Covid, which has had a direct impact on the residential market, with many provincial towns with a good level of transportation connectivity to the main cities experiencing a resurgence. However, there is still a mismatch between the supply and rising demand for these second tier urban areas, which is creating some tension and ongoing adjustments in a very competitive residential market.

________

There are risks of liquidity and capital loss.

*Preqin’s 2021 Alternative Assets in Europe Report.

**Expected returns are not necessarily indicative of future performance, which may differ significantly. Past performance is not indicative of future results. Source: Amundi Asset Management CASM Model, Amundi Asset Management Quant Solutions and Research Teams, Bloomberg.

Data as at 20 April 2021, Macro figures per last release. Returns on credit asset are comprehensive of default losses. Forecasts for annualised returns are based on estimates and reflect subjective judgments and assumptions. These results were achieved by means of a mathematical formula and do not reflect the effects of unforeseen economic or market factors on decision-making.

Focus on EU open strategic autonomy

EU OPEN STRATEGIC AUTONOMY IN THE SPOTLIGHT

Investment opportunities for public and private market investors

Europe’s aspiration for strategic autonomy is an investment opportunity with a medium term perspective. Building or re-shoring industrial capabilities to create global players in strategic sectors such as microelectronics, pharma, clean energy, transport, cybersecurity and defence require significant investment, which could provide lucrative investments.

Europe, like the US, came out of the past decade with an investment deficit (capital expenditure and Research and Development) which has to be counterbalanced. Fourteen industrial ecosystems have been identified which account for 50% or Europe’s added value and should be strengthened.1

An important feature is there are synergies between strategic autonomy and the energy transition. Therefore, it should become a key investment theme going forward.

Possible negative effects and risks

The main negative effects of strategic autonomy are:

(1) The cost of non-tariff trade barriers, which leads to permanent loss of value

(2) The retaliation of trading partners while the EU is highly open to global trade.

These two effects combined could reduce EU GDP between 2 and 3%.2 However, the Covid-19 crisis has shown that the cost of supply chain disruption and bottlenecks, as well as the lack of onshore production capabilities for critical goods, can have a far greater impact on growth and lead to chaotic recovery paths.

A more resilient economic model should counterbalance the negative effects on GDP in the long run.

There are risks attached to the search for autonomy too, such as:

(1) Lower quality of onshore production and fewer innovations in a protected EU market versus an open market, and

(2) The transfer of continuity risk inside the Single Market as re-shoring de facto leads to a higher reliance on European infrastructure and supply chains.

Regulation, government support and market forces should mitigate the negative effects and risks.

“A situation of economic strategic autonomy is one where an actor has the power to widen the scope of possibilities”, increase the benefits and reduce the cost of autonomy, which leads to higher equilibrium than economic autonomy itself.3

Therefore, European institutions and national governments’ main priorities should not be to fund projects directly, but to use the power of standards and norms as well as financial incentives to foster private investment.

Trade barriers should be limited in time and levels in order to maintain the main benefits of globalisation. They can avoid imbalances, suboptimal allocation of capital and therefore improve returns for private investors. Hence the need for an “open” strategic autonomy policy for Europe.

Investment opportunities for strategic autonomy

Investors should build portfolios aligned with the strategic autonomy theme. The first step for Europe is to reduce its external dependencies, then become a relevant player and eventually reach the autonomy status it wants to be.

The most obvious example is in electronics and semiconductors, where Europe accounts of 20% of global consumption of chips but has a global production value of only 10% and close to zero in leading edge technologies. To reach strategic autonomy in this space will require several significant investments, renewed value chains that take into account the energy transition and trade barriers.

However, in sectors where Europe already benefits from a leading position, critical dependencies exist as well. European pharmaceutical companies for instance are among the largest global players and EU production accounts for 20% of global revenues while its consumption is only 18%. Yet, regarding the critical topic of antibiotics, the EU imports around €3 billion worth of antibiotics and has a net external deficit of €1.5 billion every year.4

Therefore, this investment theme shouldn’t be built around sector or country allocation but around strategic value chains and industrial ecosystems anchored in the transition to net zero

So far, we have not seen any evidence of changes in supply chains and incremental capex in Europe, just mainly short-term fixes such as increased inventories and diversification of suppliers.

Several hard constraints including intellectual property and industrial knowhow could delay or limit this development. Moreover, Europe has a history of high ambition but subscale solutions.

Post-Covid recovery plans and climate change related policies as well as political decisions, starting with the NGEU, are pointing in the right direction.

These should become tailwinds for the open strategic autonomy investment theme.

________

1. Source European Commission.

2. ITW, 2020.

3. On the path to 'strategic autonomy, European Parliamentary Research Service Sept 2020.

4. Eurostat report Nov 2019.

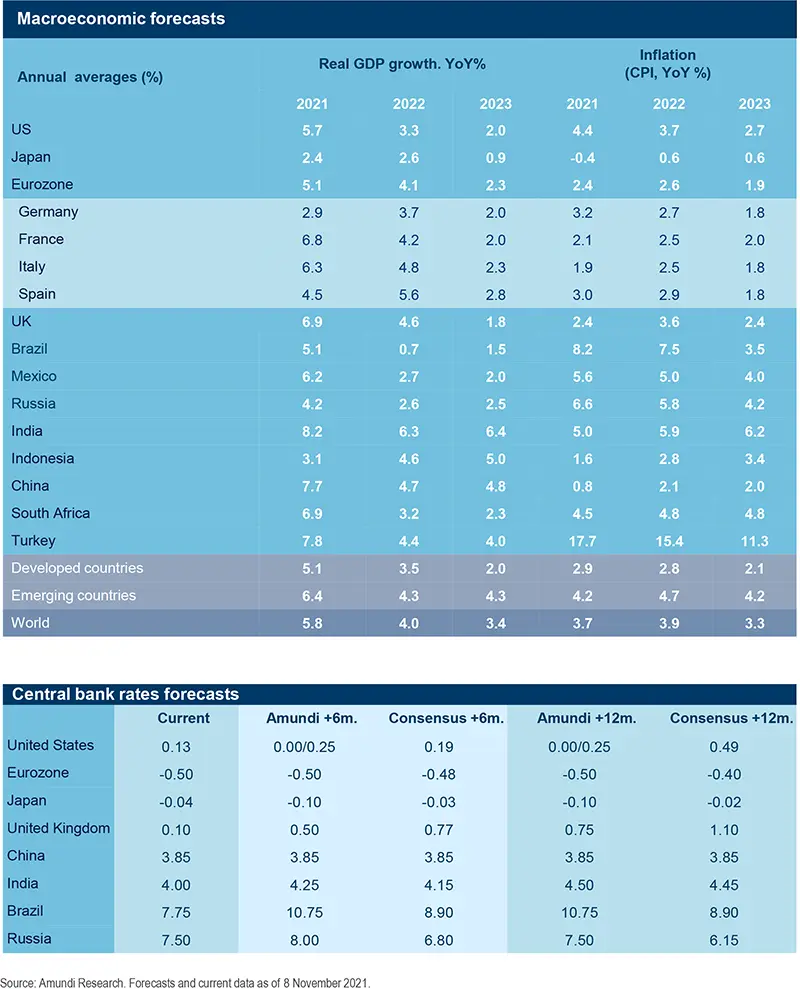

Forecasts

ECONOMIC FORECASTS

GDP growth (YoY%), inflation (CPI, YoY%) and central bank rates

FINANCIAL MARKET FORECASTS

Definitions & abbreviations

- CAPE: Cyclically adjusted price-to-earnings ratio, also known as Shiller PE (named after economist Robert Shiller). It is a ratio used in stock market analysis, generally applied to the S&P 500 market. The CAPE ratio is computed by dividing the market capitalisation by the average net income over ten years, adjusted for inflation.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- FX: FX markets refer to the foreign exchange markets, where participants are able to buy and sell currencies.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- PPI: Producer Price Index, a measure of change in the price of goods as they leave their place of production.

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve steepening: This is the opposite of yield curve flattening. If the yield curve steepens, this means that the spread between long- and short-term interest rates widens. In other words, the yields on long-term bonds are rising faster than the yields on short-term bonds, or short-term bond yields are falling as long-term bond yields rise.