Summary

Worries about extreme valuations in US mega caps call for a diversified approach into areas and sectors which are supported indirectly by AI, but more reasonably priced.

We believe China’s tech sector offers attractive valuations and strong growth, making it a compelling diversification option.

Europe offers opportunities in AI-related capital goods, and small- to mid-cap companies focused on domestic markets.

A potential bottleneck in the tech transformation is energy, as AI and data-centre growth could increase electricity demand sharply.

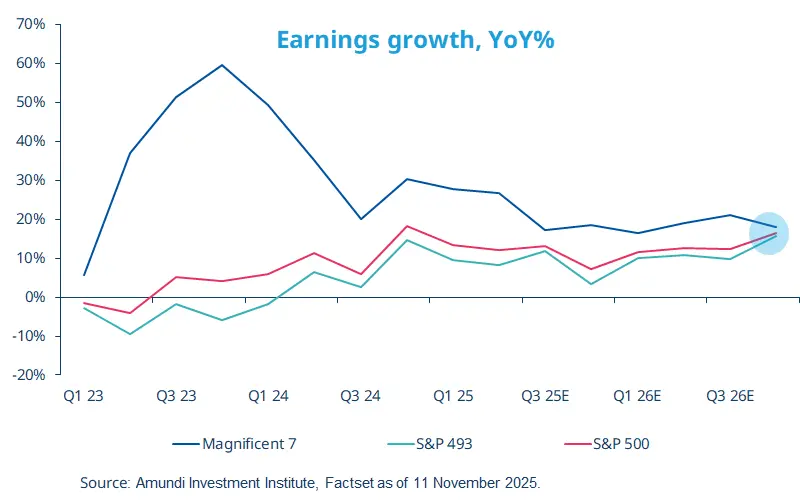

After reaching fresh all-time highs in October, global equity markets sold off early last week, particularly the US ‘Magnificent Seven’ group of stocks, driven by concerns about AI valuations. Good US earnings results have helped soothe market worries, but questions around the AI run remain. Over the past couple of years, earnings growth for the ‘Magnificent Seven’ stocks outpaced that of the remaining 493 stocks in the S&P 500 index by a wide margin, but this gap has narrowed recently and is expected to narrow further. As a result, earnings growth may converge across the US equity market. This, together with concentration risk in US mega-caps, argues for geographic and sector diversification away from the most expensive market segments and for exploration of other areas that are supported indirectly by AI capex, as we address in our just-released 2026 Investment outlook.

This week at a glance

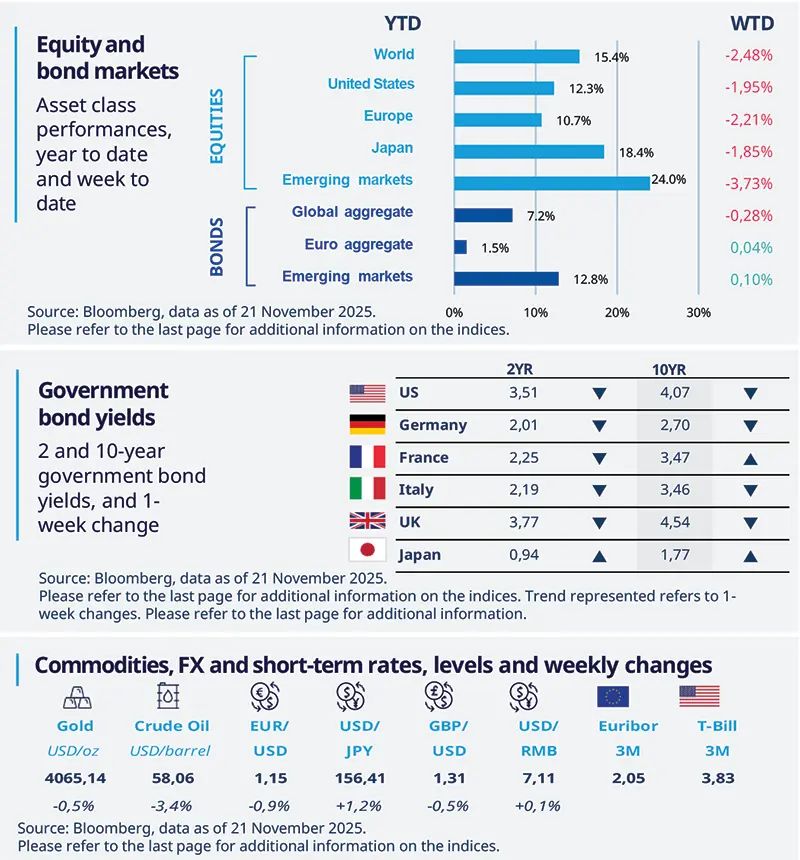

Global stocks declined due to concerns over the artificial-intelligence (AI) euphoria in the US and the Fed’s policy actions. Most bond yields fell after US labour data raised worries about unemployment. In commodities, oil prices were lower on hopes that an end to the Russia-Ukraine war would increase the commodity’s supply. European allies remain skeptical of the US peace proposal.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 21 November 2025. The chart shows earnings growth for the S&P 500 stocks, the Magnificent 7 group, and the remaining S&P 493 stocks.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US labour market show weakness

September labour market data shows rising unemployment, which signals weakening labour demand that’s not only impacting jobs creation but is also increasing layoffs. Wage growth remains somewhat more elevated, but some leading indicators of wage dynamics point to moderation looking ahead. We believe this supports the case for rate cuts by the Fed, in line with our expectations.

Europe

Consumer confidence in EZ remains weak

A preliminary reading of the consumer confidence index in November came in at -14.2 for the euro area. While the number is in line with the October reading, it is still below the long-term average. This data remains in line with our reading of a still cautious consumer in the winter period, possibly becoming progressively more confident to spend later in 2026 as inflation comes down and the impact of uncertainty recedes.

Asia

Bank Indonesia kept rates unchanged

Despite maintaining its dovish stance, Bank Indonesia (BI) stayed on hold at its Monetary Policy meeting (Policy Rates at 4.75%). The currency weakness appears to have driven this decision. The bank highlighted that economic growth is still robust thanks to exports and public expenditure. Credit to stimulate domestic activity is also picking up.

Key dates

Germany IFO business climate, Chicago Fed National Activity Index |

US GDP growth, US personal income and spending |

India GDP growth, France and Italy inflation rate |