Summary

The innovation wave behind the equity rally goes beyond AI: quantum computing and advanced semiconductors are becoming strategic assets, and AI adoption is rising across industries. The shift is global — China’s innovation and supply chains, Taiwan’s chip leadership, India’s IT services role and AI‑related capital goods in Europe. In 2026, leadership should broaden from chips to power and grids, with Europe and Japan re‑rating via capital returns and capex. As US markets are already highly AI‑concentrated, investors should play tech globally and diversify into low‑correlated themes such as global financials, Japan governance trades, European defence and small-mid cap stocks.

The tech capex supercycle is no longer just a US story — China is catching up, and global adoption across industries is turning this into a global opportunity.

AI & tech: redefining the global economic landscape

Artificial intelligence (AI) and related technologies have become core drivers of capex and corporate earnings, reshaping the structure of the economy worldwide. We believe that in the second half of this decade, they will fuel a new capital expenditure cycle aimed at boosting productivity in ageing societies and preserving competitiveness amid geopolitical tensions. Beyond AI, quantum computing and advanced semiconductors are becoming strategic assets.

Although direct AI investment is still modest (around 1% of US GDP), it is triggering significant second‑round effects: higher demand for hardware and software, faster obsolescence, greater energy use and rising infrastructure needs. As AI is integrated across industries, its impact will extend well beyond tech while varying regionally.

The US dominates tech and AI capex, driven by policy support and a strong innovation ecosystem. Firms are investing aggressively — partly for strategic, national‑security reasons amid US‑China rivalry.

US AI supremacy is reflected by the outsized weighting of US stocks in global benchmarks, with the US now representing almost two-thirds of the MSCI ACWI market cap. At the sector level, the picture is similar: Information Technology and Communication Services — which lead the AI charge — together exceed the peak weights seen during the TMT boom. In addition, infrastructure constraints, particularly energy supply, represent an important bottleneck for future growth.

That raises the question of whether this current scenario is a bubble, like the late 90s and early 2000s. US equity valuations may be elevated, but they are underpinned by robust earnings. Indeed, year‑to‑date returns in US equities have not been driven by re-rating but by EPS growth, especially from the Mega Tech names. Current margins are also much higher than they were in the TMT bubble. Lastly, the Fed has resumed its accommodative stance, with more rate cuts to come, which is another key supporting factor for equities.

Of course, risks remain. Beyond market concentration, questions persist over whether massive capex is sustainable and can be monetised. We also note that while much investment to date has been funded from cash, the US tech sector’s debt issuance rose significantly in 2025. Key risks to monitor are a more hawkish Fed, in the case of inflation surprises, and/or weaker than expected profitability.

Asia’s tech role is diverse. China balances supply discipline with strong innovation ambitions. Unlike the US, China is not experiencing a tech super cycle; instead, it is pursuing sustainable growth through policies aimed at curbing subsidies, reducing excess capacity and limiting regional competition.

China continues to invest heavily in AI and related technologies, especially in supply chains and semiconductor manufacturing, with Taiwan playing a pivotal role in global chip production.

Within equities, Chinese tech offers more appealing valuations than US tech and shows stronger growth, making it an attractive diversification for the tech story.

India is gradually carving out its role by leveraging strong product development skills and synergies with IT-enabled services. Alignment between the private sector and government on tech innovation suggests steady progress, positioning India as a key player in Asia’s broader tech ecosystem.

Europe lacks a dominant AI champion and trails the US and China in IT spending, risking a widening competitiveness gap. Energy supply concerns, especially in the UK, and slower fiscal support for tech investments constrain Europe’s AI potential.

Still, Europe holds pockets of opportunity, particularly in electrification, AI-related capital goods, and small- to mid-cap companies focused on domestic markets. These could benefit from a gradual productivity and innovation catch-up, provided Europe addresses infrastructure and skills development challenges. European financials can also benefit from rising financial requirements in a still supportive rate environment.

The AI boom has helped the Japanese market, particularly boosting AI-related data-centres and semiconductor stocks. Japanese equities are further supported by corporate governance reforms that are driving higher returns on equity, reducing excess cash and cross‑holdings, and improving shareholder returns. A still-weak yen makes Japan an appealing play on global manufacturing.

Going global in search for sector opportunities

A wave of AI capex should not only support the tech sector but also related sectors, which are more reasonably priced. As noted above, AI investment requires more power generation and transmission, and higher prices could increase margins more than markets are currently anticipating. In this light, we continue to favour broadening strategies.

Most favoured sectors in 2026

| Financials

|

| Communication Services

|

| Industrials

|

| Healthcare (long-term view)

|

Least favoured sectors in 2026

| Energy

|

| Materials

|

Powering sustainable growth

Industrial growth driven by strategic autonomy is reshaping the opportunity set, particularly for responsible investors. Trade tensions, export controls and security policies are encouraging governments and companies to onshore and diversify supply chains as well as energy sources. AI-led digitalisation — from smart grids and data centres to the automation of manufacturing processes — is underpinning this trend. Opportunities include companies benefiting from accelerated spending linked to energy supply (e.g., grid upgrades, nuclear power, water usage), digital infrastructure (AI-linked critical technologies), battery storage and the responsible processing of critical minerals. Specifically, key responsible investment themes for 2026 include:

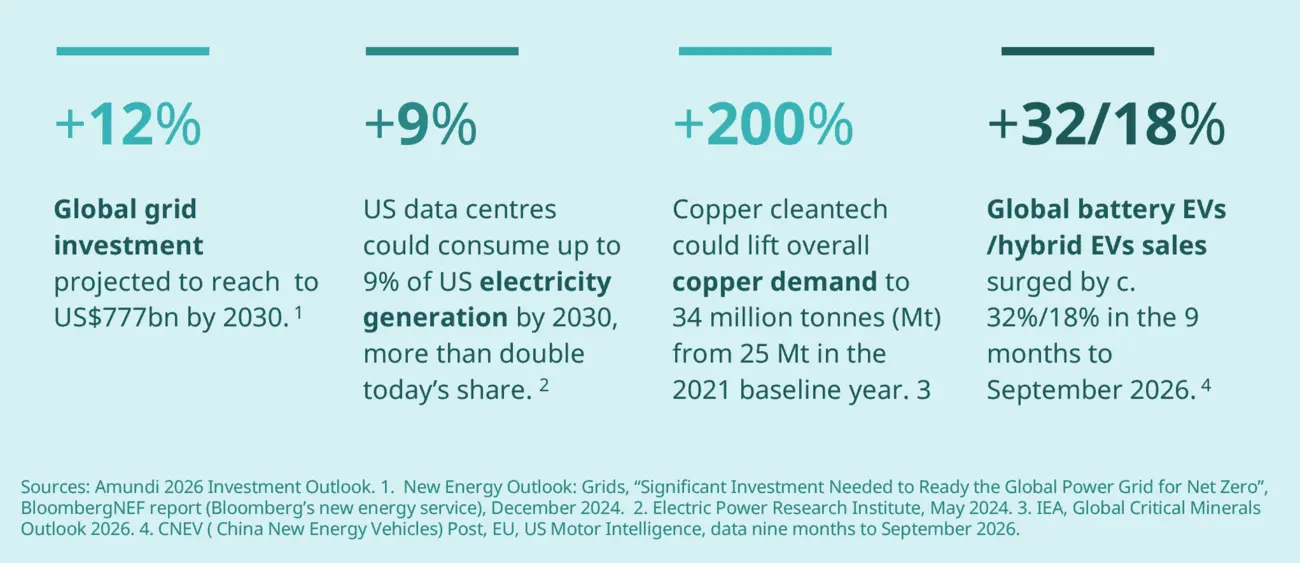

Electricity demand is accelerating as industrial electrification, data-centre expansion and EV adoption rise. Transmission networks must be expanded, grids modernised, and storage scaled up, especially as 40% of grids in advanced economies are over 20 years old. Grid investment should benefit distribution equipment manufacturers and utility companies. For example, US utilities expect 2-3% demand growth driven by electrification, data needs and onshoring. We focus on utilities that address climate challenges, benefit from market stability and pursue strategies aligned with a pathway close to 1.5°C. We see opportunities in the US and among Korean transformer manufacturers supplying the US, Europe and the Middle East.

Industrials are improving factory efficiency, automating processes and expanding data centres. These businesses face structural demand growth, amplified by advances in AI technologies that boost demand for equipment and electricity. Examples of businesses set to benefit include a European capital goods company providing electrical and building-management equipment to data centres and a US equipment rental company exposed to infrastructure, reshoring (construction), power generation and data-centre growth.

Water is a major part of data centres’ energy transition footprint, used mainly for cooling. It circulates through pipes to absorb heat from equipment, moves to cooling towers and is recirculated. Advanced water-based cooling cuts electricity use, enables waste heat reuse and lowers emissions. Operators optimise water-use intensity with monitoring, leak detection and optimisation software. The European capital goods company noted above also benefits from rising demand for water-based cooling in AI systems.

A nuclear revival is supported by policy, regulatory frameworks and capacity targets. AI workloads are a key demand driver. US tech companies are increasingly powering data centres with nuclear energy; thus, we favour Korean nuclear‑equipment companies for their on‑time delivery records and market positions.

Copper cleantech demand is set to at least double by 2040 (to 12 million tonnes versus 6 million tonnes in the 2021 baseline year), as copper is the preferred mineral for electricity networks and is essential for solar panels, wind turbines and EV batteries. Supply is relatively inelastic (new mines have long lead times) thus, medium-term prices should stay strong, benefiting mining companies such as Chilean miners. Finally, EV sales growth is driving robust demand for EV batteries, particularly in China (c. 54% penetration), though US tax changes or/and a subsidy rollback in China could slow growth. However, even a more modest demand trajectory, coupled with tight supply, should support copper prices through 2026.

Get the full picture

| A spirit of endurance has characterized the market rally of the past year. |

Get more insights

|

|

| ||

Fixed income in the new policy order | A new regime calls for a new mindset | ‘Controlled Disorder’ with room for accidents | ||

| Read the article → | Read the article → | Read the article → |