Summary

Heading into 2026, we believe that a long-term and diversified investment approach into Europe could help overcome short-term volatility and boost returns in the long run.

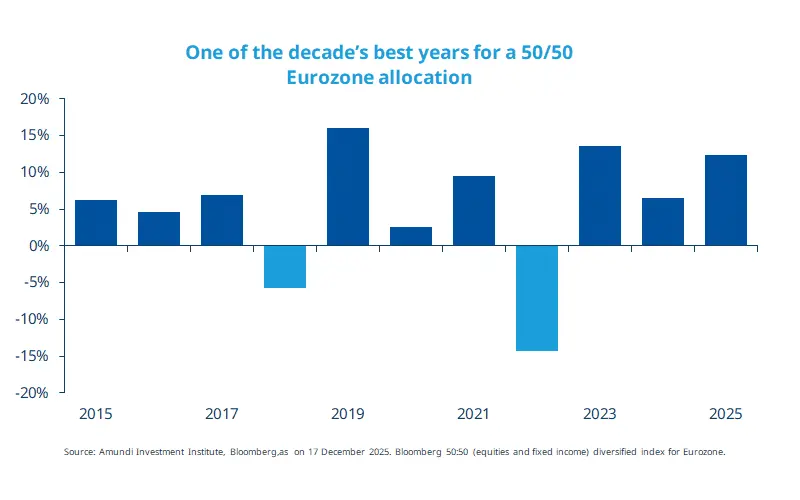

Double-digit returns on a 50-50 Eurozone allocation make 2025 one of the best years of the last decade.

European industrial stocks are well-positioned to take advantage of public spending programmes, while European banks can engage in higher lending linked to public investment.

European equities and bonds offer attractive opportunities for global investors seeking to diversify beyond US assets.

A 50-50 Eurozone equity and fixed‑income index has delivered only two negative annual returns since 2015, showing how diversification across asset classes and a long-term investment horizon can help overcome volatility. The 2022 exception – when both equities and bonds delivered negative returns – was followed by three years of above-average returns. Europe as an investment theme offers many opportunities, with European equities among the top performers in 2025, benefitting from policy support, earnings growth, and capital inflows.

Growth prospects are supported by Germany’s multi‑year defence and infrastructure plan. In addition, earnings in domestic cyclical sectors such as industrials and financials have surprised to the upside this year.

To sum up, we think a diversified* and long-term investment approach to Europe could help sustain returns over the long run.

*Diversification does not guarantee a profit or protect against a loss.

This week at a glance

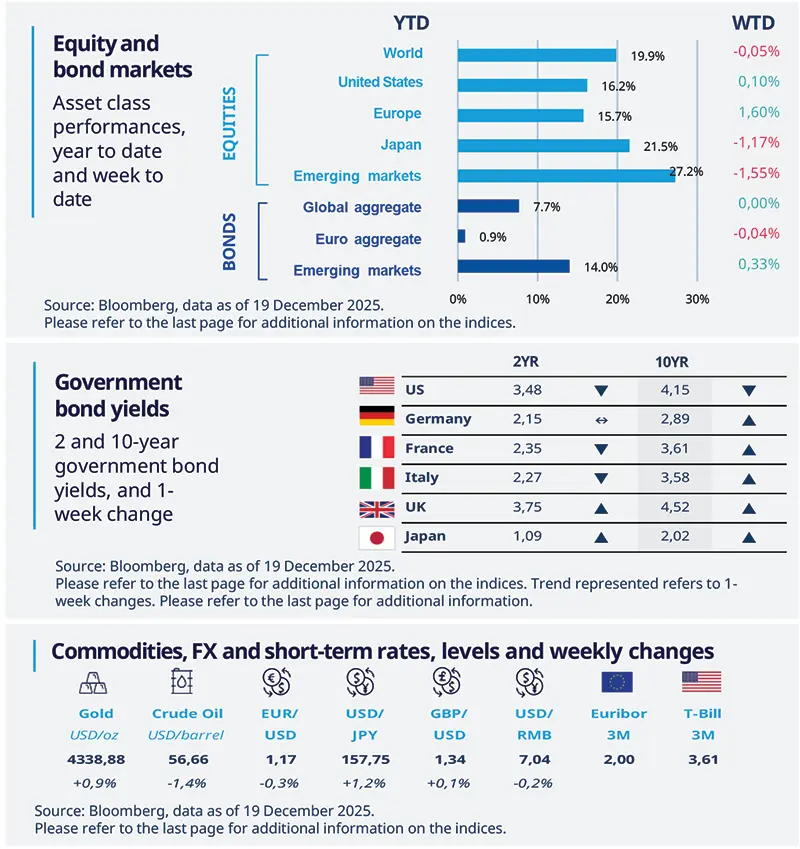

Equity markets were mixed last week, driven by doubts over AI valuations on one hand and a soft US CPI report on the other. 10y German bond yields hit their highest level since the fiscal stimulus announcement in March; Japan’s bond yields were supported by the BoJ rate hike, with 10y yields hitting the highest level since 1999. Crude oil prices were down on a bearish oversupply outlook.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 19 December 2025. The chart shows the yearly performance of the Bloomberg Eurozone 50:50 equity/fixed-income index.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Benign US inflation report despite shutdown noise

US CPI was up 2.7% YoY in November, down from 3.0%, the slowest pace since early 2021. October’s data was not collected because of the government shutdown, so it is not possible to gauge the usual monthly price change. Core CPI index – which excludes food and energy – rose 2.6% YoY, down from 3.0% in September. Despite several caveats, the report offers hope that inflationary pressures are on a declining path.

Europe

Germany’s IFO index down in December

The German IFO index fell in December, underlining that the expected recovery has yet to materialise. The fall was driven by worsening expectations, while assessments of current conditions remained stable. Activity indicators point to a weak economy, with little impact so far from fiscal stimulus. Although we expect fiscal measures to lift growth from mid-2026, gradual implementation and rising ageing-related costs mean the stimulus effect may may provide upside that is not yet fully visible in 2026

Asia

BoJ hikes rates as expected

As expected, the BoJ members voted unanimously to hike the policy rate by 25bp to 0.75% in December. The decision -- well telegraphed by Governor Ueda in early December -- followed through as anticipated. The government’s growth ambitions, supported by continued fiscal stimulus, pave the way for further rate hikes in 2026, as policymakers remain focused on sustaining economic momentum and managing inflation dynamics.

Key dates

China lending rates, Italy PPI, UK GDP and current account balance |

US GDP and consumer confidence, Brazil inflation |

Japan industrial production, India FX reserves |