Summary

Acknowledgements

This report was developed as part of the technical assistance delivered under the MOBILIST Programme, a flagship initiative of the UK Foreign, Commonwealth & Development Office (FCDO) aimed at mobilising institutional capital through listed product structures to achieve the Sustainable Development Goals (SDGs). In this context, Amundi received targeted support to further develop a gender-lens investing framework, with the goal of deepening market standards and fostering innovation in gender-focused fixed income investments. To inform and ground this work in current market dynamics, Amundi convened a workshop in June 2025 with a diverse group of ecosystem actors including issuers, investors, regulators, second-party opinion providers, development finance institutions, and technical assistance providers. The discussion offered valuable practitioner insights into the data challenges and infrastructure gaps constraining the growth of the gender-lens investing market, particularly within emerging markets. This dialogue provided the foundation for the reflections and recommendations captured in this report. The report was co-authored by Amundi and Access Alliance, Inc., a women-led consulting firm specializing in gender-smart finance and inclusive investment strategies. Deena M. Burjorjee and Lynée M. Bradley of Access Alliance served as thought partners and coauthors, supporting Amundi in designing and facilitating the workshop, synthesizing market feedback, and shaping this paper’s strategic guidance. We also extend our appreciation to all those who contributed their insights to this work, including over 70 participants from Asia-Pacific, Europe, Latin America and Africa, representing the private sector, development institutions, governments and the civil society, and especially to our peer reviewers – Jessica Schnabel (IFC Banking on Women), Valérie Guillaumin (ICMA), Robyn Oates and Alexandra Lockyer (UN Women) – whose thoughtful comments helped strengthen the final product. Their collective input reflects the growing community of practice committed to advancing gender equality through capital markets. |

Key Takeaways

|

Introduction

"Gender-focused issuances must be anchored in national action plans or embedded within a holistic corporate strategy. When issuers take a thoughtful, organization-wide approach to gender, they create lasting value - demonstrating that gender equality is not just a moral imperative, but a material driver of economic and financial performance."

| Robyn Oates Head of Sustainable Finance, UN Women |

Persistent gender disparities in economic opportunity and access to finance continue to constrain global growth and resilience – particularly in emerging markets, where institutional barriers remain deeply entrenched. According to the World Bank's 2024 “Women, Business and the Law” report, eliminating discriminatory laws and practices that hinder women's participation in the workforce could increase global GDP by over 20%, effectively doubling the global growth rate over the next decade.2 Reducing gender employment gaps could raise GDP per capita by an average of 35%, with productivity gains from workplace diversity contributing over half that value.3

As emerging economies navigate a convergence of structural challenges – including demographic ageing, productivity slowdowns, and financial system fragmentation – the economic inclusion and progression of women stands out as a critical yet underleveraged solution. Women remain vastly underrepresented in formal labor markets and leadership roles across much of the Global South, despite constituting a majority of the informal economy and unpaid care work.4 This exclusion is not merely a matter of inequity but one of a macroeconomic inefficiency. Closing gender gaps in employment, education, and financial access could unlock transformative growth and resilience for developing markets.

According to ILO and World Bank data, countries such as Egypt, India, and Pakistan continue to record female labor force participation rates under 25% – well below global and even regional averages.5 In Sub-Saharan Africa and South Asia, women are significantly less likely to access formal financial services or credit. The International Finance Corporation (IFC) estimates that the credit gap for women-owned small and medium enterprises in developing markets exceeds $1.9 trillion.6 These constraints reduce not only individual agency, but also collective economic output.7

Compounding the urgency is the demographic trajectory of many emerging economies. Countries such as China, Thailand, and Vietnam are ageing rapidly, with old-age dependency ratios rising and working-age populations beginning to decline. Without an expanded labor force, these economies face shrinking tax bases and mounting social security burdens.8 The OECD and UN project that increasing female labor force participation is one of the few available strategies to counteract the economic drag of ageing. In this context, women’s inclusion is a demographic and an economic necessity.9

In this report, we share the insights from the work to strengthen gender-lens investing through feedback from market participants, a proposed innovative gender-smart investing framework and case studies from Amundi’s engagement with companies and sovereigns to promote women’s inclusion and workforce participation.

I. Catalyzing demand for gender bonds

Financial instruments with a gender focus – such as social bonds, sustainability bonds, sustainability-linked bonds, and the emerging Orange Bond framework (collectively “Sustainable Bonds”) – are increasingly recognized as viable tools to mobilize private capital in support of Sustainable Development Goal 5 (SDG 5): Gender Equality.10

Due to the growing issuer and investor activity in gender-inclusive bonds, we believe it is an opportune time to provide direction, standards, and clarity to the market. Indeed, structural challenges persist and there is a need to build on existing guidance and standards on what qualifies as a gender and gender use- of-proceeds bond. Many gender-themed bonds bundle SDG 5 alongside other goals, resulting in minimal clarity about the allocation of proceeds to gender-focused outcomes. Despite the proliferation of frameworks, investors and issuers alike report difficulty applying them in practice, with limited consensus on a core set of gender KPIs or pathways for verification. This contributes to persistent uncertainty about what constitutes a credible gender-aligned instrument. In addition, there is a perception that gender bonds are the domain of development finance institutions or mission- driven investors. Broader investor engagement – especially from mainstream institutional investors – will be key to deepening the market and moving from niche innovation to market norms.

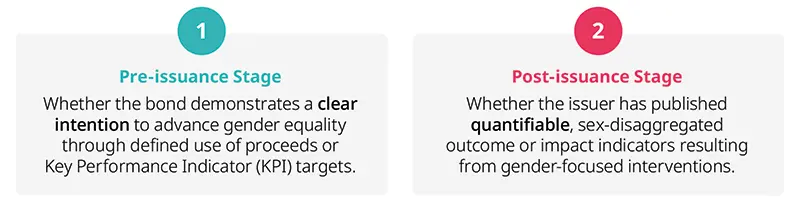

Clarifying the market: What is a gender-focused bond and how big is the market? Capital market instruments have the potential to play a transformative role in channeling financing towards women’s economic empowerment. However, the absence of globally recognized principles makes it challenging to identify debt securities specifically designed to support this critical agenda. In 2025, IFC’s Banking on Women (BOW) business team conducted an in-depth Assessment of the bond market for women’s economic empowerment, which reviewed existing Green, Social, Sustainability, and Sustainability- Linked Bonds (“GSSS”) to assess the size and growth potential of sustainable securities that aim to advance women and women’s economic empowerment.

The findings reveal a substantial and growing market. By 2024, cumulative issuances of bonds with verifiable allocation and/or impact data for women’s empowerment reached approximately US$160 billion, comprising over 440 bonds issued by 170 entities across 55 emerging markets and developed economies. Multilateral development banks are the largest contributors, accounting for over 33% of the total issuance volume, while private sector financial institutions and corporates collectively represent over 36%. Among the emerging markets, the Latin America and Caribbean region leads the way, with issuances exceeding US$21.7 billion. The use of proceeds tied to women’s empowerment typically fall into two categories:

Sustainability-linked bonds, on the other hand, often incorporate key Performance Indicators (KPIs) aimed at advancing women’s leadership within the issuing organizations, with some innovative interventions such as increasing women owned enterprises in the business’s supply chain and procurement. The research also identified key obstacles for investors. For instance, some SDG 5-labeled bonds that failed the screening often include women as part of the targeted population in their bond framework but fail to provide any sex-disaggregated outcome indicators in their result and impact reporting. This lack of transparency creates a significant risk of “pink-washing”, where gender commitments are marketed without credible evidence of achievement or progress. As this credible and maturing bond market for women’s empowerment continues to grow, the need for standardized, simple, and transparent bond guidelines to define the asset class becomes increasingly urgent. Establishing such a framework will add value for both the issuers and investors, enabling them to align capital returns with initiatives that drive women’s leadership, employment, and entrepreneurship. |

II. The data challenge: Gender-focused sustainable bonds to bridge the gap between intent and impact

A persistent challenge in scaling the gender-focused Sustainable Bond market is the disconnect between the stated intent of these instruments and the availability of credible, project-level gender data. While more issuers are incorporating gender-themed language into their Sustainable Bond frameworks, the underlying data often fails to meaningfully track or substantiate gender outcomes.

Much of the current reporting still centers on issuer- level diversity, equity, and inclusion (DEI) metrics, such as workforce diversity, board composition, or internal policies. These indicators are valuable and useful for gender screening to scope in corporate issuers for investment in general-purpose bonds. However, they rarely demonstrate how proceeds are advancing gender equality at the beneficiary or project level – such as improving women’s access to housing, finance, infrastructure, or livelihoods. Broad categorizations or proxy indicators are often used without clear baselines or measurable targets.

Notably, IFC’s recent review of gender-focused bonds found that 77% of SDG 5-labelled GSSS bonds allocate less than half of their proceeds to gender-focused projects. Among bonds with an SDG 5 tag, less than a third has a clearly articulated intention for specific activities focused on women’s empowerment or report on gender-specific KPIs.

"We are seeing hundreds of billions of dollars in bonds tagged to SDG 5, but the real question is – how can we influence standards to improve measurement, transparency, and accountability for women’s empowerment bonds?"

| Jessica Schnabel Global Head of Banking on Women, IFC |

Despite the presence ofwell-regarded frameworks – such as the ICMA-UN Women-IFC Gender Bond Guidelines11 – issuers face practical challenges in implementation. The challenge does not lie in the absence of KPIs, but in the lack of convergence on a usable, core set of indicators. There is also limited capacity, particularly in emerging markets, to consistently measure and report results, and a lack of consensus on what constitutes good practice. Workshop participants noted that frameworks such as the ICMA registry offer extensive KPIs, but are often underutilized or applied inconsistently across bond structures and by investors.

"There is no shortage of guidance – but what’s missing is agreement on what constitutes good practice."

| Valérie Guillaumin Director, Sustainable Finance, ICMA |

The broader market also lacks a robust verification infrastructure. Whereas green bonds benefit from second-party opinions and established certification mechanisms, gender-focused bonds still lack standardized systems for assurance, labeling, and validation. Emerging efforts such as the Orange Bond framework and gender tagging by exchanges show promise, but application remains uneven. Many gender-focused or gender-tagged bonds still do not provide consistent gender outcome data.

The growing trend of bundling gender within broader social bond themes – while sometimes necessary to raise sufficient capital – introduces additional complexity. Gender’s cross-cutting nature creates this complexity. Having blended use of proceeds is natural, and even crucial, as many of the investments needed to advance gender equality sit at heart of multiple social priorities, such as health, education, and access to essential services. However, having sex- disaggregated targets and reporting is key, as that constitutes the only way to ensure the gender interventions are visible, measurable, and credible. As one participant noted, unless gender is explicitly integrated into bond objectives and performance targets, “it risks being everyone’s responsibility – and no one’s focus.”

"The risk isn’t just greenwashing anymore - it’s impact-washing, especially when there’s no data from the end-users themselves."

| Valérie Guillaumin Director, Sustainable Finance, ICMA |

Another critical constraint is the fragmentation of internal data systems across corporates. Some issuers may be able to track sex-disaggregated data in retail operations, but not across corporate portfolios or bond-financed activities. Even when gender-relevant data is collected internally, it is not always structured in a way that aligns with gender frameworks. This often leads to “impact silos” – where gender equality is addressed within institutional policies but not linked to investment projects. In addition, while many corporates – especially in emerging markets – do report on gender-related issues in their annual or sustainability reports, this data is often not available in a form that institutional investors can use. Without third-party verification or alignment with investor-grade ESG standards, these disclosures do not support capital allocation decisions. As a result, many companies that are advancing gender goals are effectively locked out of access to gender-focused capital, simply because their data isn’t being captured, structured, or validated in the right way.

"We’ve seen that where Technical Assistance has helped issuers build internal data architecture, reporting on gender outcomes becomes not only possible, but powerful."

| Esther Law EM Debt Senior Portfolio Manager and Responsible Investing Lead, Amundi |

III. Aligning investment strategies: Developing a gender-lens framework

A key evolution is the recognition that gender impact doesn’t need to be limited to use-of-proceeds bonds. As one workshop participant noted, "the real opportunity is in using the bond as a hook, but looking at the issuer holistically." With this in mind, Amundi is considering an investment framework that would reflect this shift, enabling gender analysis at the issuer level – whether or not a labeled bond is issued. This approach would open space for sovereign and corporate issuers who are making strategic commitments to gender equality but may not yet have discrete funding opportunities for gender-focused projects.

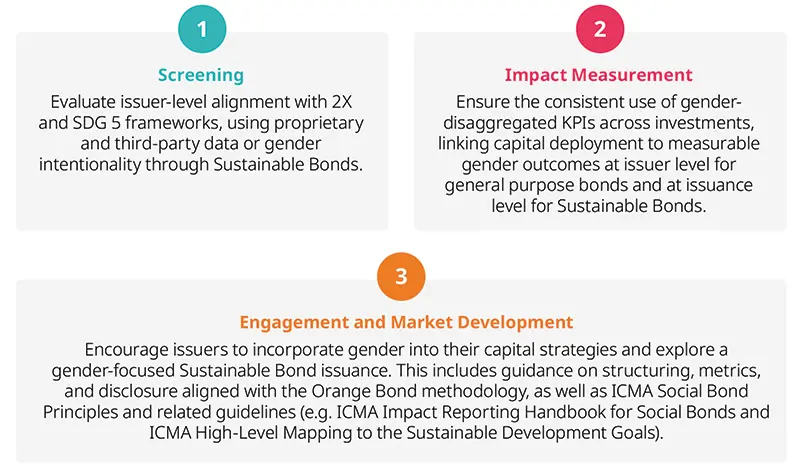

A gender-smart investing approach intentionally integrates gender considerations into the investment process to advance gender equality while maintaining a diverse well-performing investment portfolio. Moving beyond the limitations in the supply of gender focused Sustainable Bonds, Amundi is developing a gender-lens investment strategy grounded in the realities of current capital markets.

This proposed approach facilitates gender-smart investing beyond Sustainable Bonds by evaluating general-purpose issuers through a gender lens. This allows capital to be directed toward entities that demonstrate a strategic commitment to gender diversity and inclusion at the organizational level. In doing so, the framework broadens the investable universe while maintaining a focus on intentionality and accountability.

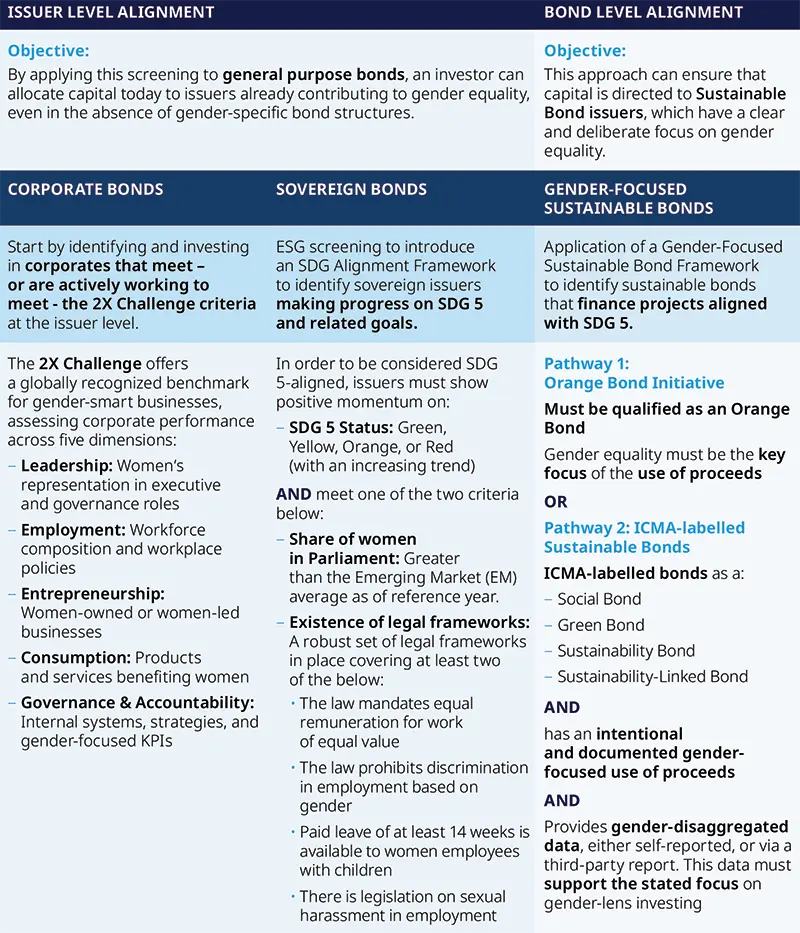

Additionally, this approach is based on three complementary frameworks designed to identify, assess, and advance gender-smart investments. These frameworks guide how issuers are evaluated, capital is allocated, and impact is measured; making gender-smart investments across three distinct pathways, applying recognized frameworks across each dimension:

Corporate Issuers that meet or are on a credible pathway toward meeting the 2X Challenge criteria on women's ownership, leadership, quality employment, and consumption.

Sovereign Issuers that demonstrate alignment with Sustainable Development Goal 5 (Gender Equality), particularly those measuring women’s labor market access, political representation, and rights and demonstrating steady improvement in gender quality legislation, financial sector regulation and other relevant policies.

Gender-Focused Sustainable Bonds with clearly defined use-of-proceeds dedicated to gender equality and supported by robust, sex-disaggregated impact reporting. Here, the ICMA Social and Sustainability Bond Principles guide the structuring and transparency of these use-of-proceeds instruments.

Introducing a gender-lens investment framework To support a gender-smart investment strategy, we propose a structured gender investment framework

|

The table below delves into the details of the proposed gender-smart investment framework and impact measurement methodology. Please note this framework is conceptual and subject to further evolution as Amundi continues to refine its proprietary methodology in this rather nascent market.

Table 1: Deep dive into a gender-smart investment framework

IV. Stewardship and market development

1. Gender-lens investing: The investor perspective

From an investor perspective, there are various reasons why gender products are compelling:

Closing the gender gap: While global attention often centers on lagging climate targets, gender equality – another core SDG – remains significantly underachieved, especially in emerging markets. Greater awareness of the interconnectedness between SDG 5, economic growth, and other development goals is critical. Directing capital toward gender-focused outcomes is essential to accelerate meaningful progress.

Competitive returns with social impact: Gender-focused bonds allocate capital to businesses, sovereigns and projects that promote women’s leadership, employment, entrepreneurship, and access to essential services. In emerging markets, these instruments deliver returns on par with traditional EM debt while generating tangible, measurable social impact.

"The Equileap Emerging Markets Gender Equality Index has outperformed

its benchmark by 29% since 2019 – demonstrating that investing in women is not just impactful, it’s material.12"

| Desideria Benini Research Manager, Equileap |

Market growth potential: Rising awareness of the economic value of gender diversity – combined with regulatory momentum in regions like Europe and the U.K., and the integration of gender into national sustainable finance taxonomies, as seen in Mexico and Brazil – signals strong growth potential for gender-focused financial products. Gender bonds and equities remain underdeveloped but represent a rapidly expanding segment of the sustainable finance market.

Reputational value: Investing in gender-focused instruments enhances an investor’s sustainability credentials and signals alignment with ESG principles. It reinforces brand credibility among stakeholders seeking demonstrable commitment to inclusive growth and responsible capital allocation.

MDB alignment and support: Gender equality remains a strategic priority for many Multilateral Development Banks (MDBs) and Development Finance Institutions (DFIs), which continue to catalyze investor demand through market-shaping practices, technical assistance, and active engagement with issuers.

Stewardship: Engagement and voting practices can be powerful levers for investors to encourage portfolio companies to enhance their practices on gender diversity and equity.13

2. Issuers: Advancing the integrity, scale & impact of gender-focused investments

While their objectives may differ – corporations aim to embed gender equality into business strategy and stakeholder engagement, and governments seek to align public finance with national gender policy goals – both types of issuers can leverage the bond market to mobilize capital for transformative, gender-equitable outcomes.

a) Corporate issuers: Embedding gender equality into core strategy

For the private sector, gender-focused bonds represent more than a financing tool – they are an extension of a broader commitment to inclusive business practices. When gender equality is integrated into a company’s core business philosophy, it becomes reflected in leadership composition, workplace policies, product development, and supply chain management.

This strategic alignment sends a powerful signal to capital markets that gender inclusion is central to long-term value creation. Issuing gender-focused sustainable bonds allows these companies to access purpose-driven capital, differentiate their brand, and reinforce their market leadership in sustainable finance.

Outside of issuing gender-focused instruments, companies can implement best practices to promote greater gender equality within their policies and governance bodies.

Amundi has, for several years, engaged with companies on the topics of gender equality and on the material benefits of diversity, while taking into account the complexities of the local context.14

In 2024, Amundi engaged 55 companies on gender diversity15 through:

Specific engagement where gender diversity was identified as a material issue of concern through our research and previous dialogue.

A dedicated engagement targeting companies with a high difference between the number of women in the global workforce and in the governance bodies, representing nearly 40 companies.

The 30% Club campaigns in Germany, France and Japan:

In Germany, after launching the 30% Club Germany Investor Group16 in 2023, we focused in 2024 on assessing the state of play and collecting best practices that were shared with engaged companies.

We continued to be an active member of the 30% Club France Investor Group targeting more specifically the SBF120 for the last 3 years.

In Japan, the 30% Club Investor Group conducted interviews and surveys with 12 best practic companies to understand their commonalities and capture the success factors hidden between the lines of integrated reports.

Findings from these local engagement streams, including challenges and best practices, continue to inform our global engagement efforts on gender diversity.

Sector-specific efforts:

Our continued work in Japan where the representation of women in company governance bodies and the workforce has historically been low (see case study 1 below). We have been engaging with companies for several years now and are pleased to see that the Japanese government has proposed to require companies listed on the Prime Market to appoint one female director by 2025 and reach at least 30% of women directors by 2030.

Engagement with the Food Retail sector, where women are over-represented in the global workforce (up to nearly 75% in some companies), but where their numbers drastically decrease at management levels and represent a minority in the governance bodies.

Engagement with the Technology sector, where women’s representation in the workforce and leadership remains low even at the backdrop of continued competition for talent.

Continued engagement on Board diversity to encourage companies to set clear targets for balanced representation and to disclose progress in a transparent way.

b) Sovereign issuers: Linking capital markets to public policy

Amundi started to engage with sovereign issuers in 2024, to ensure that gender objectives are considered a priority in countries’ legal and regulatory frameworks.

At sovereign level, a strong argument to move the topic on the priority list is the positive economic and financial impact of a higher (or better) female inclusion, especially for least-advanced countries. We encourage countries to have a national strategy on gender equality and empowerment of all women and girls, in line with the 2030 UN Sustainable Development Goals.

Additionally, gender-focused sustainable bond issuance is a vehicle for sovereigns to align public finance with national development priorities. Governments can use bond proceeds to fund programs that expand women’s access to healthcare, education, employment, and legal protections – advancing not only SDG 5, but also broader macroeconomic resilience. Iceland’s issuance in 2024 of the first sovereign gender bond, targeting improved parental leave and affordable housing for women, is a good example which can pave the way for other governments to advance women’s living standards through the bond market.

Amundi’s engagements with sovereigns on gender, sought to:

Ensure that countries have ratified international conventions and protocols on women’s rights and converted them into domestic law;

Assess whether countries have laws, policies, action plans and monitoring tools aimed at progressing towards SDG 5’s objectives, notably in the areas of education, work, as well as politics and public affairs;

Encourage countries to report gender disaggregated data and monitor on the topic of gender equality to assess policy outcomes;

Encourage countries to include gender-related projects in their social or sustainable bond frameworks.

Further, Amundi decided to engage EM sovereign issuers in different regions on their progress towards SDG 5, as better inclusion of women would have a signi- ficant positive impact on their economic development on top of improving girls’ and women’s situations.

The outcome of the first year’s engagement effort was mixed. 5 of the 11 countries contacted acknowledged our request for engagement and provided answers, which is quite encouraging given that sovereign engagement, especially on this matter, is not mainstream.

One key conclusion of this engagement so far is that having a legal framework supporting women’s rights is not enough. Even when countries have ratified the main international treaties and conventions related to women’s rights and have domestic laws in line with these, implementation processes and frameworks are often lagging, leading to weak outcomes.

Another conclusion is that while gender equality in education appears achieved or almost achieved in the targeted countries (except Peru), there is large room for improvement in the labour market and in public affairs and politics, where women representation is generally low.

Lastly, an additional observation is that a major hurdle for engaging sovereigns on gender is the lack (or low quality) of data available on some topics. For instance, most of the countries covered do not have reliable statistics on the gender wage gap. There is therefore potential in engaging with sovereign issuers on data disclosures as well.

Case study 1: Engaging with Mexico on gender equality

Mexico has ratified almost all international treaties and conventions related to human rights, including women’s rights, and the national legislative framework is also strong in this area. There are laws and policies to allow progress towards SDG 5’s objectives, notably regarding equal access to education, parity at work and in the political area, and violence against women. However, there are shortcomings in the implementation process of this legislative framework, leading to an insufficient outcome. The main issues are:

On the positive side, there is parity in Mexico’s parliament. Next Steps |

By aligning their capital-raising strategies with clearly defined and transparently reported gender equality objectives, both corporate and sovereign issuers can expand access to global capital markets while advancing inclusive development, and investor engagement could contribute to their ability to do so.17

3. Embedding gender in the regulatory ecosystem

Regulatory and policy frameworks play a catalytic role in mainstreaming gender within sustainable finance. When designed with intentionality, regulatory levers such as taxonomies, mandatory disclosures, and harmonized ESG standards do more than signal market priorities - they drive internal operational shifts, prompting new systems, cross-functional alignment, and institutional accountability.

As one workshop participant noted, “Regulation is often what pushes ESG from reporting into actual business operations. Gender should follow the same trajectory.” This reflects a growing recognition that gender must be treated not as a niche or stand-alone concern, but as a foundational lens across the architecture of sustainable finance, especially as gender focused bonds grow in prevalence within the Sustainable Bond market.

Critically, integration can be powerful – even when gender isn’t the primary focus. Issuers may not always structure a bond around gender equality goals, but opportunities exist to embed gender considerations in areas like supply chains, product design, workforce diversity, or care infrastructure. These touchpoints enhance social impact and investor relevance – without derailing core financing objectives. Regulation can play a key role in surfacing these opportunities by making gender materiality visible across sectors and instruments.

Case study 2: Integrating Gender in National Sustainable Finance Taxonomies

These taxonomies are helping codify what gender-aligned investment looks like at a sovereign level. By embedding gender considerations into sustainable finance definitions, they:

|

4. The role of global norm-setters

Beyond issuers and investors, a broad set of ecosystem actors – including standard-setters, data providers, development finance institutions, and market infrastructure bodies – play a pivotal role in shaping the credibility and scalability of the gender-focused bond market. These organizations essential to the creation of a coherent, transparent, and investable ecosystem for gender-focused fixed income instruments.

As one issuer put it, “We don’t need more frameworks - we need to know which ones matter. Most issuers struggle to navigate overlapping frameworks and inconsistent expectations – especially in emerging markets where gender data is weak or unavailable.”

These actors can accelerate progress by:

Enhancing guidance on disclosure and reporting, including standardized gender-disaggregated impact metrics and issuer accountability frameworks;

Supporting the development of market standard taxonomies and investment frameworks that explicitly integrate gender equality objectives into sustainable finance classifications – similar to recent national taxonomies in Mexico and Brazil;

Strengthening validation and certification infrastructure, such as third-party opinions, gender performance indicators, and evolving mechanisms under the Orange Bond Initiative, which seek to establish global best practices for intentional, transparent, and impactful gender financing.

Harmonizing standards and coordinating guidance across ICMA, 2X Challenge, OECD policy markers, and GSSB frameworks is essential. It reduces confusion, especially for emerging market issuers, and encourages consistency in how gender impact is evaluated and reported.

By building the tools, standards, and accountability mechanisms needed to support credible gender-lens investing, ecosystem actors help reduce fragmentation, increase market confidence, and enable greater alignment between capital flows and SDG 5.

Conclusion

Gender-lens investing is no longer a peripheral innovation – it is an essential evolution in sustainable finance. As this report underscores, the integrity, scale, and impact of gender-focused investments depend on bridging intent with accountability, embedding gender into issuer strategy, and aligning capital with measurable outcomes. By strengthening data infrastructure, harmonizing frameworks, and expanding technical assistance, investors and issuers alike can help catalyze a more inclusive financial ecosystem. The opportunity is clear: mainstreaming gender across capital markets is not only a moral and social imperative, it is a material driver of long-term value and resilience.

- See https://orangemovement.global/orange-bonds

- https://wbl.worldbank.org/en/reports

- International Monetary Fund. (2018) Staff Discussion Note: Economic Gains from Gender Inclusion: New Mechanisms, New Evidence. https://www.imf.org/en/publications/staff-discussion notes/issues/2018/10/09/economic-gains-from-gender-inclusion-new-mechanisms-new- evidence-45543

- ILO (2020). Building back better for women: Women’s Dire Position in the informal economy. https://www.ilo.org/publications/building-back-better-women-womens-dire-position-informal-economy

- https://data.worldbank.org/indicator/SL.TLF.CACT.FE.Z; https://ilostat.ilo.org/topics/women/

- IFC (2025) MSME Finance Gap Report. https://www.smefinanceforum.org/data-sites/msme-finance-gap

- IFC (2022) Closing the Gender Finance Gap Through the Use of Blended Finance. https://www.ifc.org/en/insights-reports/2022/closing-the-gender-finance-gap-through-blended-finance

- https://population.un.org/wpp/

- https://www.unwomen.org/sites/default/files/2025-01/e-cn.6-2025-3_sg-report-on-beijing30-advance-unedited-version-en.pdf; https://www.oecd.org/content/dam/oecd/en/publications/reports/2018/07/the-long-view-scenarios-for-the-world-economy-to-2060_f3352d87/b4f4e03e-en.pdf

- IFC (2025), Banking on Women: Assessment of the Bond Market for Women’s Economic Empowerment https://www.ifc.org/en/insights-reports/2025/bond-market-assessment-for-women-s-economic-empowerment

- ICMA, UN Women, IFC (2021), Bonds to bridge the gender gap: A practitioner’s guide to using sustainable debt for gender equality. https://www.unwomen.org/en/digital-library/publications/2021/11/bonds-to-bridge-the-gender-gap

- The Index consists of emerging market equities that align with gender equality criteria defined by Equileap.

- For examples of investors demonstrating commitment to strong stewardship on gender, see the 30% Club Investor Groups page: https://30percentclub.org/investor-groups/

- Please see our publication "Investing in gender equality: Momentum is growing" (https://www.amundi.co.uk/professional/article/esg-thema-17-investing-gender-equality-momentum-growing) and our 2024 Engagement Report (https://www.amundi.com/institutional/files/nuxeo/dl/5994803c-6af1-4d7e-89e0-f1134f6374a7?inline=) for more examples and key observations on issuer practices and progress.

- Excluding engagements related to Board diversity.

- The 30% Club Germany Investor Group is an initiative launched by four members (Allianz Global Investors, Amundi Asset Management, Columbia Threadneedle Investments, and Sycomore AM), representing around 3.2 trillion euros in assets under management.

- For more information on Amundi's engagement on gender diversity, please see our 2024 Engagement Report available here: https://about.amundi.com/article/engagement-report-2024