Summary

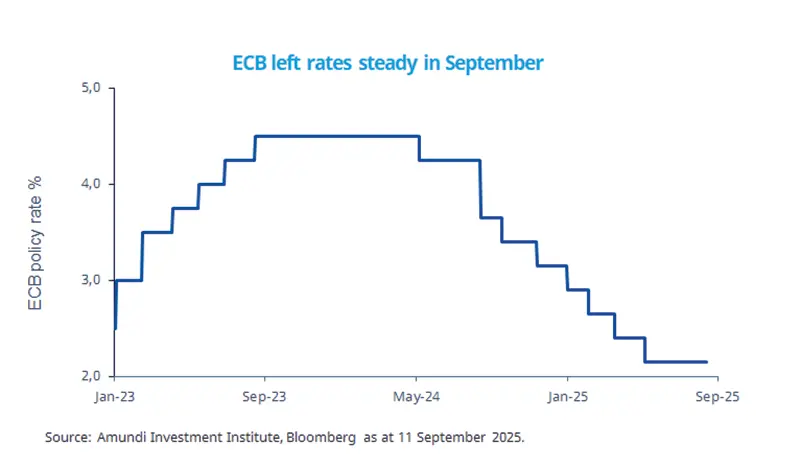

The ECB held rates steady in September and raised its growth forecast for this year. But we believe that, as tariffs start taking effect in the second half of the year, additional monetary support will likely be needed to bolster domestic demand and investment.

The ECB maintained rates at current level, staying in a vigilant mode.

The ECB raised inflation forecasts for this year and the next, while lowering 2026 growth.

With growth affected by tariffs, the ECB remains data dependent and open to possible further cuts later in 2025/early 2026.

The ECB kept policy rates unchanged at its September meeting, emphasising a data-dependent approach before deciding on further rate cuts.

The central bank raised its forecast for economic growth this year and noted that growth has been resilient so far due to domestic demand and labour markets. Secondly, the bank expects that consumer spending and investments could get a boost from rate cuts already implemented. Importantly, the ECB slightly downgraded its expectations for growth in 2026, hinting some growth concerns beyond this year.

We would like to emphasise that, while the US-EU agreement has reduced some uncertainty on trade, tariffs on EU exports remain higher than they were previously. As a result, these could affect the region’s growth, underlining the need for further monetary easing.

This week at a glance

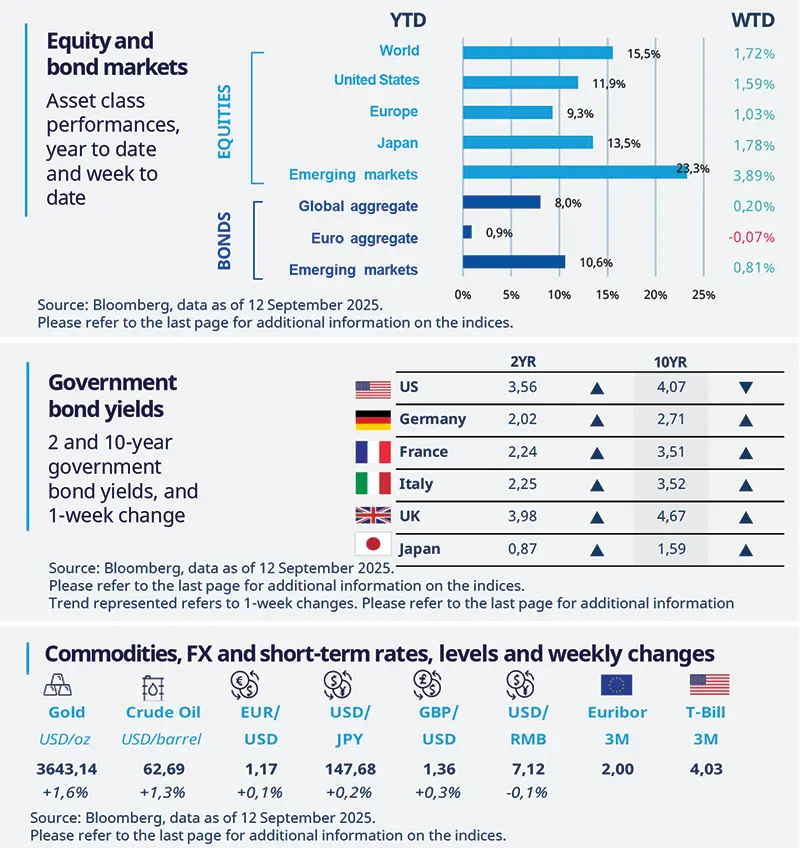

Equity markets were generally up last week, with higher-than-expected US jobless claims data pushing up expectations of US official rate cuts. In commodities, gold touched its all-time high levels, and oil prices also rose. Finally, government bond yields were mostly higher over the week.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 12 September 2025. The chart shows the ECB policy rate.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Higher US inflation may not prevent Fed rate cut

US inflation rose to 2.9% YoY in August, its highest level since January, after holding at 2.7% in June and July. The pass-through of tariffs has been gradual thus far, but it is starting to show up in the inflation data. Also, price growth may accelerate faster over the next months as companies have now depleted their inventories. Despite this, the US Fed is still expected to cut rates at its September meeting amid signs of economic and labour market deceleration.

Europe

France appoints a new Prime Minister

Following Bayrou’s resignation after a confidence vote loss, President Macron named Sébastien Lecornu as the new Prime Minister (PM). The new PM declared that his term would differ from that of his predecessor, leaving the door open to negotiations and concessions with other parties. His goal appears to be broadening coalition support and finding common ground on key issues like the budget, pensions, and security.

Asia

Price pressures fade in China

China’s CPI inflation surprisingly turned negative again in August, printing -0.4% YoY after recording 0% growth in July. The drop was mainly driven by weak food inflation, which declined further to -4.3% YoY in August from -1.6% YoY in the previous month. Core inflation has continued to improve in annual terms, with a low base last year. Pockets of weakness have re-emerged in China’s consumption demand, with effects of government subsidies fading.

Key dates

15 Sep China industrial production, retail sales and fixed asset investment |

17 Sep Fed interest rates decision, UK inflation, US housing starts and building permits | 19 Sep MoM BoJ interest rate decision, Japan inflation rate |