Summary

We expect the ECB to remain on hold in early 2026 and to reduce policy rates later, provided that services inflation moderates, growth slows more than expected, and long-term bond yields rise.

For now, the ECB is in a 'good place', with services inflation remaining high and activity data improving more than expected.

The Eurozone macroeconomic outlook points to decelerating growth and further disinflation this year.

- European equities are supported by a benign macroeconomic outlook, while fears of a potential hawkish pivot from the ECB appear to have been dampened.

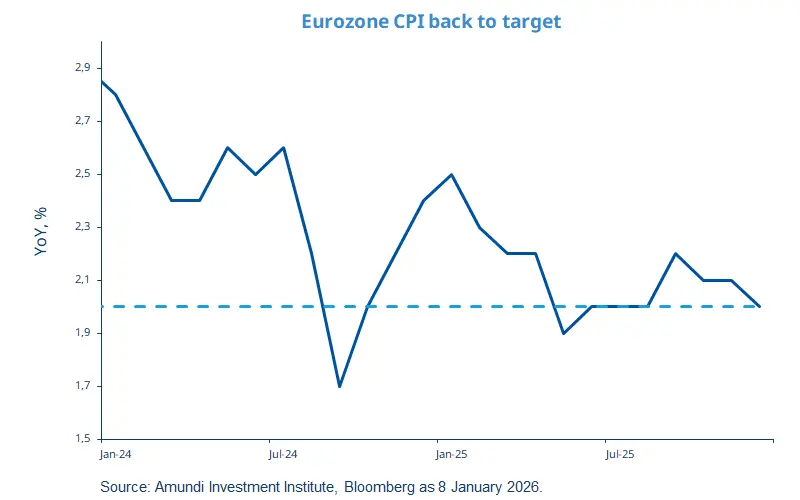

Eurozone inflation slowed to 2.0% in December, according to a preliminary estimate, hitting the ECB's 2% target for the first time since August. We expect inflation to stay below this target both this year and next year, while real GDP growth should slow overall in 2026 despite the recent positive momentum. Growth forecasts were upgraded, while inflation still signals a deceleration due to sluggish private consumption, slowing wage growth, and further euro appreciation (which tends to make exports cheaper).

This environment is supportive of European equities, and German equities recently hit new all-time highs. We believe the ECB will adopt a ‘wait-and-see’ approach in early 2026 and communicate a data-dependent stance. Conditions for further rate cuts to materialise would include a combination of moderating services inflation, subdued consumption, and softer-than-expected economic growth. Weak credit growth in the region and a stronger euro may also prompt the ECB to take action.

This week at a glance

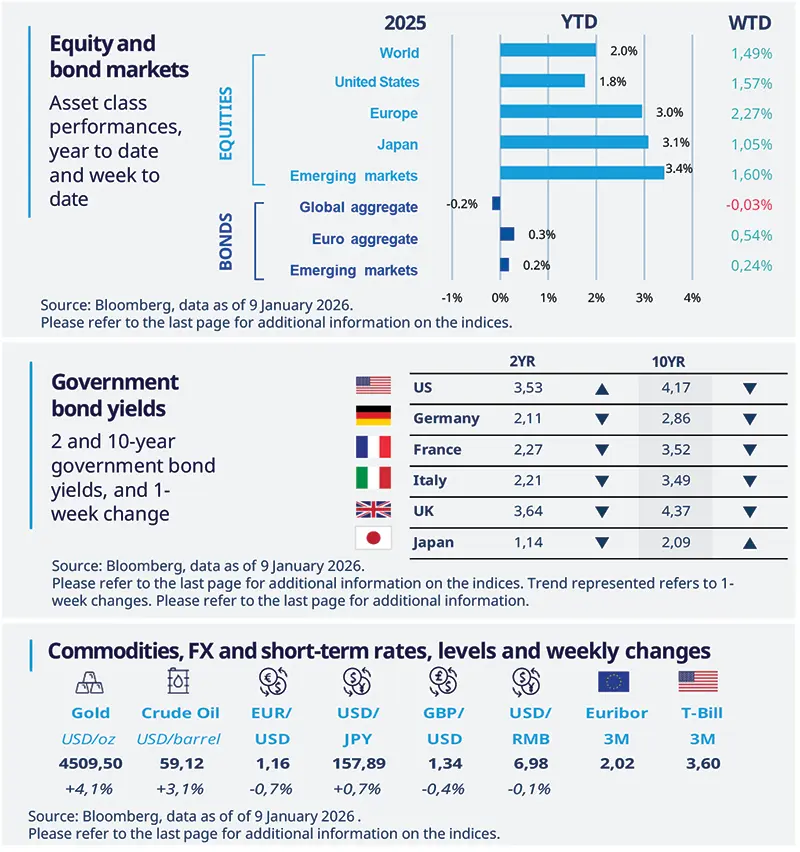

Equity markets were up last week and US equities hit new all-time highs, driven by a rotation away from technology amid concerns about AI valuations. Government bond yields were mostly down. Oil prices rose due to developments in Venezuela and worries about a short‑term oil supply disruption. Gold also proved strong, trading above $4,500 per ounce.

Equity and bond markets (chart)

Source: Bloomberg. Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of of 9 January 2026. The chart shows the Eurozone inflation rate.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US productivity rebounds strongly

US non-farm productivity rebounded strongly in Q3 2025, up 4.9% on a QoQ annualised basis, in line with market expectations, while the YoY growth increased by 0.4pp to 1.9%. Since late 2019, labour productivity has maintained a steady 2.0% annualised growth, underscoring a resilient trend of gradual efficiency gains. In addition, unit labour costs declined sharply in Q3, a positive sign for corporate margins and inflation dynamics.

Europe

EZ unemployment rate close to all-time lows

EZ unemployment rate dropped to 6.3% in November, from 6.4% according to Eurostat, close to its all‑time low of 6.2% recorded in 2024. This is the first drop in seven months, showing the labour market’s resilience despite the uncertain economic environment. Almost 11 million people were unemployed in November across the EZ. Referring to individual countries, Germany’s unemployment rate was unchanged at 6.3%.

Asia

India’s GDP growth estimate on the soft side

According to the government's preliminary estimate, FY26 GDP is expected to grow by 6.9% year‑on‑year (YoY), leaving calendar‑year 2025 (CY25) growth at 7.4%, slightly below our previous expectation of 7.7%. Overall, the preliminary estimate implies that growth rates in Q4 2025 and Q1 2026 are, on average, well below the 8% YoY pace seen in the two previous quarters. The preliminary estimate is in line with evidence from high-frequency indicators.

Key dates

US CPI and new home sales, Japan current account |

China trade balance, US retail sales and existing home sales |

US industrial production, Brazil business confidence |