|

In a time of rupture, bold forecasts will matter less to investors than discipline and diversification.

Long after most of the speeches made at Davos 2026 are forgotten, the one message that will reverberate is that politicians, businesses and investors face a rupture in the international order. All three groups are drawing the same ineluctable conclusion: they must diversify to survive and thrive in the new environment.

Politicians face an international landscape that is increasingly transactional. At best, small pragmatic deals on specific issues are replacing the grand bargains of the past that offered mutual benefits to all parties. At worst, might-is-right policies may be deployed. Meanwhile, financial or security levers are often being used for economic ends. And although relations between the United States and China may stabilise this year, the world’s two biggest economic powers are motivated by incentives, rather than trust.

Against this backdrop, it was encouraging to see the European Union present a more united front, especially over Greenland. But the bloc must display equal resolve in delivering a single capital market, ramping up its capacity to defend its borders and ensuring energy security. Speed is crucial on all these fronts if Europe is going to live up to its ambitions. Fortunately, politicians are showing signs of stepping up to the challenge.

For example, European Commission President Ursula von der Leyen is pushing to simplify and unify European Union markets, unlock investment, and make energy markets more interconnected to ensure prices become more affordable. Another notable example is the EU-India free trade agreement, which diversifies supply chains away from China, hedges against US tariff uncertainty, and underpins Europe’s effort to secure trusted partners in a more fragmented global economy.

Businesses are also busy diversifying. The rewiring of the global economy, which began during the Covid-19 pandemic, has accelerated because of geopolitical shifts that are forcing companies to focus more on building resilience than on efficiency. As a result, supply chains and capital flows are being reshaped because of security and political constraints. This is particularly true in the technology sector given intense geopolitical rivalry over Artificial Intelligence (AI), as well as the energy, water and skilled labour on which the AI ecosystem depends.

Innovations in AI and areas such as defence and biomanufacturing are also guzzling up huge amounts of capital. But only the companies that end up controlling scarce goods – such as critical chips and software, power equipment, and grid infrastructure – will reap the benefits of this investment. Figuring out which firms will emerge in pole position is a case of screening for robust cash flows, margins and pricing power while avoiding overly-indebted companies and narrative-driven market excesses.

Here too, diversification is the watchword – this time for investors. Our approach to building more resilient portfolios takes account of downside risks, such as energy shocks, an escalation in trade tensions that could dent corporate margins, or monetary and fiscal policy missteps. Nor do we ignore the potential for positive surprises, be it a faster-than-expected diffusion of AI technology that boosts productivity or a de-escalation in geopolitical tensions that compresses risk premia across asset classes.

As a result, we favour sectors where political imperatives align with the big macro and market themes:

In the United States, this includes companies that offer exposure to innovation and defence; in Europe, ones that will benefit from infrastructure and defence spending; and in Japan, businesses that can make the most of corporate reform plans and the government’s willingness to reflate the economy. Meanwhile, China offers tactical opportunities.

Commodities can also play a tactical role, this time as hedges against both upside and downside risks. This explains the appeal of energy and the industrial metals that are used in grids and AI. Even gold, which has had a superb run, has scope to climb further. Meanwhile, in the world of real assets and alternatives, we favour assets that are explicitly linked to inflation or are in scarce supply as long as the illiquidity premium is appropriate.

Such granular examination of the risks and rewards is essential when navigating a world of heightened uncertainty. So is an ability to enhance the resilience of portfolios while retaining exposure to long-term transformations. In this environment, bold forecasts will matter less than discipline and diversification.

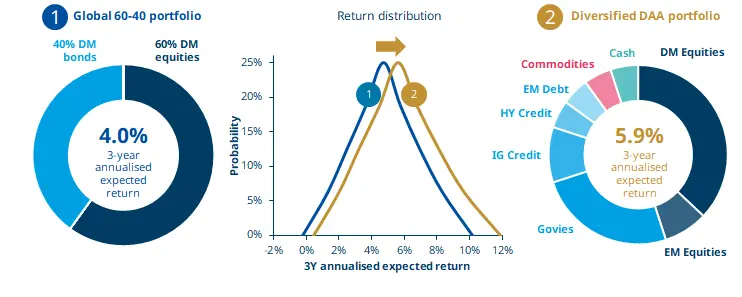

The appeal of diversification

Source: Amundi Investment Institute. The diversified portfolio comprises 18 asset classes and is derived from Amundi Investment Institute’s Dynamic Asset Allocation (DAA) models. The portfolio is for illustrative purposes only, it does not include currency considerations and is based on some portfolio constraints (equity 45%-75%, credit 5%-40%, government bonds 20%-40%, commodities 0-5%, gold 0-15%, cash 0-15%). Past performance is not a guarantee of future results.