Summary

Differences in economic paths across countries may lead to diverging monetary policies, creating potential opportunities for global bond investors.

- The BoJ raised policy rates after many years, ending the era of negative interest rates.

- However, banks such as the Fed and BoE are looking to cut rates this year, if inflation returns to their targets.

- These divergences in global economy and central bank policies may present opportunities in bonds and equities.

On 19 March, the Bank of Japan (BoJ) ended its negative interest rates policy, after raising rates for the first time in 17 years. The BoJ set a new policy rate range between 0.0%-0.1% as it became confident that inflation would increase towards its target. However, the governor’s insistence on maintaining accommodative financial conditions indicates that this is not a new rate hiking cycle. Instead, the bank is likely to be data dependent.

On the other hand, the Fed and the Bank of England kept rates on hold. The Fed showed confidence that inflation is moving towards the 2% target, but did not provide a timeline for its first rate cuts. We think these central banks will keep a keen eye on incoming inflation, as they decide their future policy actions for this year and beyond.

Actionable ideas

- Global government bonds

Upcoming interest rate cuts and regional divergences could create opportunities for global fixed income investors. - Global quality credit

Resilient global economic outlook, prospects of cut rates from Fed and ECB should support high quality credit.

This week at a glance

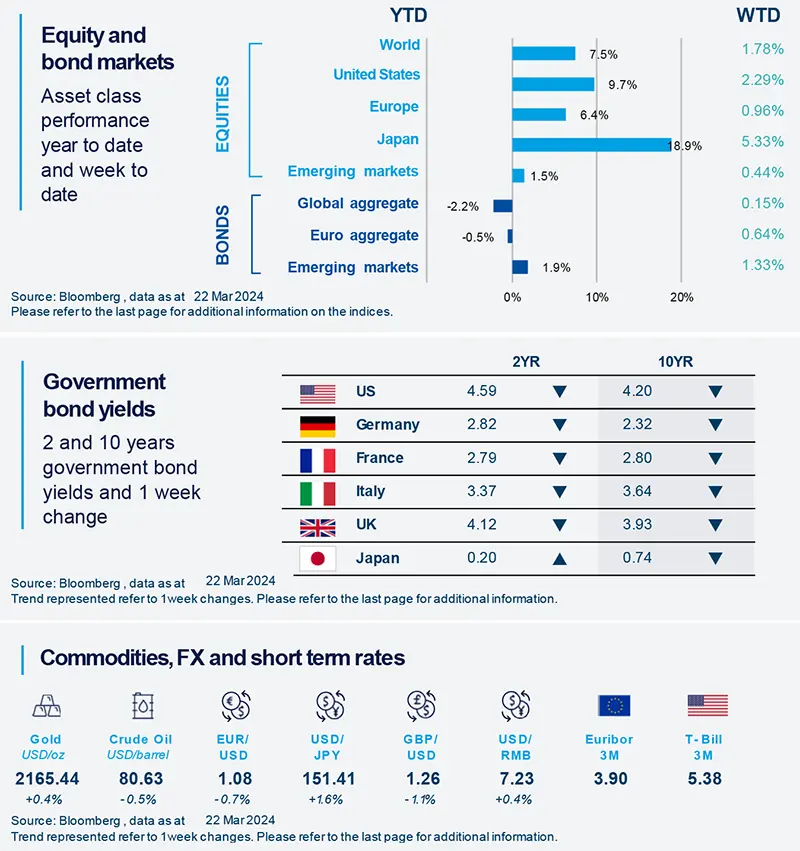

US and European bond yields retreated this week, a movement accelerated by the relatively dovish messages from the Fed. US and European stocks traded higher with many indices reaching new historic highs. The dollar ended the week slightly stronger while oil prices moved in a narrow range.

Amundi Investment Institute Macro Focus

Americas

Slowing retail sales momentum in US

The trend in retails sales growth shows signs of moderation. A weakening in discretionary spending was observed, along with subdued consumers’ spending intentions. We think consumers’ perception of labour market strength matters when it comes to their spending habits. Thus, weakening labour markets may be behind this slowing momentum in retail sales.

Europe

European core inflation shows some resilience.

The disinflationary process in the Eurozone is proceeding towards target, but at a slightly slower pace as the main external drivers of the past deceleration no longer play a major role. Sticky domestic inflation is underpinned mainly by strong wage growth and strength of the labour market. Companies are still keen to retain skilled workers, even though end consumer demand does not require such level of workforce.

Asia

Taiwan hiked policy rates.

Taiwan’s central bank hiked its policy rate to 2% on 21 March, after keeping it unchanged for three consecutive quarters. We think it is to minimise the negative interest rates gap with Japan and reduce pressures on the Taiwanese dollar. We also believe this is likely to be a sporadic one-off hike, given that the central bank expects inflation to moderate throughout the rest of the year.

Key Dates

|

27 Mar Eurozone Economic |

28 Mar |

29 Mar USA, Core PCE Inflation |