Summary

Japanese equities may further benefit from the major transformations in the country’s economy and markets.

- The Bank of Japan has paved the way for an exit from its Negative Interest Rates Policy (NIRP) in Q1 2024.

- Japan’s exit from deflation is transforming the behaviour of corporations and households.

- These changes, combined with recent reforms should continue to support Japanese equities, after their strong 2023 rise.

As expected, the Bank of Japan kept major policies stable at its December meeting. However, it also projected a positive trend in wage growth and inflation, paving the way for a very probable end of its negative interest rate policy in Q1 2024.

More broadly, the exit from the long entrenched Japanese deflationary trend is bringing major changes in terms of behaviour of Japanese corporations (towards more investment) and households (towards directing savings to more risky assets). Moreover, the Tokyo Stock Exchange has been conducting a major reform aimed at improving corporate governance.

This sets a new, promising backdrop for Japanese equities whose valuations, even though they have risen, remain reasonable by long-term standards.

Actionable ideas

-

Japanese equities

Japanese equities are benefitting from improving domestic activity and the country coming out of deflation. We believe that this asset class may bring value to an equity allocation. -

Global equities

The global equity markets may offer investors the opportunity to widen the investment universe and explore value in multiple regions/countries, such as Japan.

This week at a glance

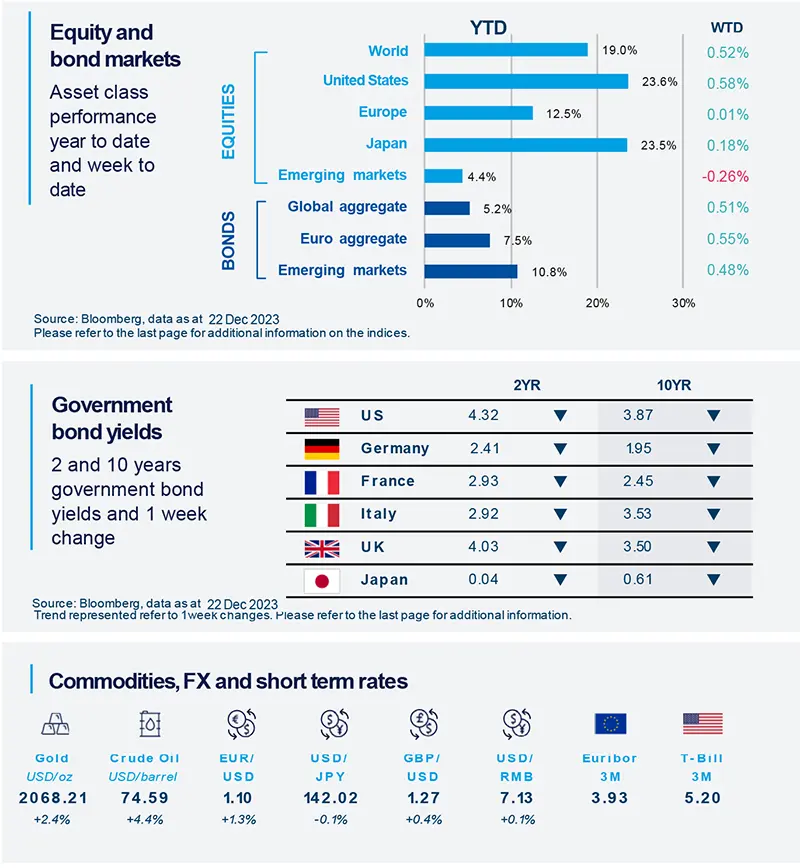

Bond yields continued to retreat this week, with US 10 year back to this Summer’s level while German 10 year broke below 2%. Equities, for their part, were mostly flattish, consolidating after several weeks of sharp rises. Oil prices recovered significantly from their large drop since end-November.

Amundi Investment Institute Macro Focus

Americas

Inflationary forces moderating in the US, labour market still tight according to Flash PMIs

Services Output Price Flash PMIs remain in expansionary territory but the pace of improvement is slowing according to the last print. The momentum for disinflation seems positive. Flash PMIs also hint at resilience of the labour market (expansion).

Europe

Flash PMIs indicate weakness in growth and in the labour market

Composite Flash Euro Area PMIs are still weak but show improvement particularly in Germany. These signal a potential turning point as also forward looking subcomponents suggest improvements ahead. Both sectors improved while remaining in contraction territory, with manufacturing still behind. The UK is entering an expansion area.

Asia

Bank of Japan: policy unchanged, but hints that NIRP will soon come to an end.

The BoJ’s December meeting unfolded with few surprises. Major policies were kept stable, yet the accompanying statement stressed the rise in inflation expectations and major price indices. Even though it has not provided explicit forward guidance, the BoJ is very likely to bring NIRP to an end in Q1 2024. However, unlike the market, we do not believe that it will rise rates above 0% in 2024.

Key Dates

|

26 Dec Macro data, USA |

28 Dec |

29 Dec Macro data, USA |