Summary

Executive summary

|

Monica DEFEND |

Amaury D'ORSAY |

2022 was the year of a great repricing in bonds as global central banks took a hawkish turn in their fight against inflation. While the great repricing resulted in extreme bond volatility, we have entered a new phase of adjustment for the yield curve, where bonds are starting to be back in focus.

In this ‘bonds are back’ phase, more attractive yield levels, alongside lower rate volatility, drove a return of demand for the asset class in late 2022 and we expect the trend to continue this year. Moreover, since the Covid-19 crisis, corporates have generally strengthened their balance sheet position, reducing net leverage and interest coverage ratio. This should help them go through the economic slowdown. However, peak credit quality is probably behind us, as corporates will face more challenges this year, including higher funding costs, sluggish growth, rising energy prices and high labour costs (the latter mainly in the United States), which should result in higher high-yield (HY) default rates this year. These factors will require investors to be selective when picking investment opportunities. Overall, we favour investment grade (IG) over HY, as we believe the HY-IG spread will widen this year. In the IG space, our preference is for the EUR- and GBP-denominated credit over US credit, as the former is very cheap by historical standards. We hold a positive view on financials, especially banks, and on euro-subordinated debt. Regarding the HY segment, recent spread tightening has made us relatively cautious, but we see opportunities for the second half of 2023.

After 2022’s great repricing, global credit is back in focus. Investment Grade is favoured for the first half of the year. Entry points for HY are likely to materialise in H2, when uncertainty on monetary policy fades.

Focus to shift from inflation to growth risk

This year, we expect the global economic environment to feature sluggish growth and an extended period of sustained high inflation. For the credit market, it will be a tale of two halves:

Hawkish monetary policy and inflation risk will remain the primary focus of investors' attention…

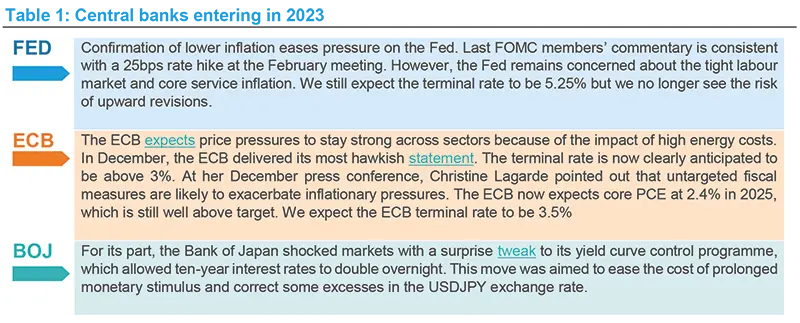

In late 2022, the ECB and the Fed took a hawkish turn in the face of more-persistent-than-expected inflation. Recent signs of moderation in headline inflation were not enough to reassure central bankers (see Table 1). Both central banks did not want the market to interpret the reduction in the size of rate hikes as a dovish pivot or as a lack of commitment to fighting inflation. Central bankers were not happy with the recent easing in financial conditions, as – if it persists – restrictive monetary policy will lose its effectiveness. In the first half of 2023, we expect the extreme level of bond volatility to decline, as investors should be more confident in the level of rates required to lower inflation sustainably.

… before switching to growth concerns

Moving into 2023, we think the market will focus on the economic slowdown. Equity volatility should become the main driver of credit markets with increasing differentiation across sectors and names depending on their ability to navigate the sluggish growth environment and to capture the rebound that will follow later.

This is creating opportunities for active global credit investors after the strong dislocation that occurred in 2022, but selection will be key as a few specific bottom-up risks could come to the fore, such as:

- For the United States, our 2023 growth forecast of 0.9% reflects the cumulative effect of monetary tightening. Such an effect will be particularly clear in H2 2023. The more the US economy exhibits resilience to interest rate hikes, the more aggressively the Fed will have to tighten monetary policy further, thereby increasing the risk of recession. The Fed is ready to withstand a recession in order to bring inflation down to 2%. As such, it sees a better risk-reward in overtightening.

- For the Eurozone, we expect economic activity should remain stable instead of the 0.5% contraction we expected at the end of 2022. Eurozone business activity made a surprise return to modest growth in January. The slowdown in economic activity is not as deep as feared mainly thanks to fiscal policies and mild weather, which have helped to cut natural-gas consumption. In the Eurozone, we will monitor carefully the financial stability risk in case of persistently high energy prices, as the ECB will have to balance its credibility against financial stability. On credibility, the ECB will have to keep rates at restrictive levels to guard against the risk of a persistent rise in inflation expectations. A central bank has few tools to fight cost-driven inflation. On financial stability, high debt levels and growing financing needs will put a limit on the ECB's willingness to tighten monetary policy. Net government bond issuance, net of ECB flows, will more than double in 2023.

Mixed picture for technicals

The technical backdrop has improved as yield levels have become attractive, recession risks for the Eurozone have diminished and the threat of inflation in the US has receded. Technicals were a challenging factor last year up to the summer, especially in the Eurozone and for HY bonds because of heavy outflows. However, the technical backdrop improved over the past few months, as more attractive valuations and lower rate volatility drove a return of demand for the asset class. Following many months of outflows, fresh inflows materialised and investor positioning became less defensive, both in IG and HY. Due to the yield retracement, we have seen not only institutional investors willing to enter the market, but also retail and wholesale ones, as well as some fund allocators, who see fixed income – including IG credit – as a diversifier.

After a challenging 2022, in 2023 the technical backdrop is improving amid attractive yields, with investment grade favoured by investors.

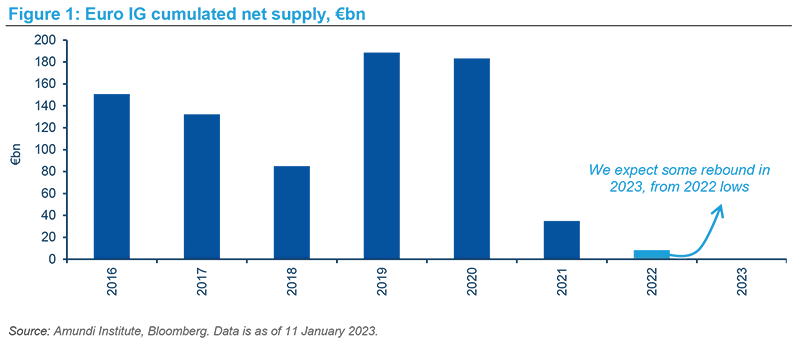

Technicals’ dynamic has been similar in the United States and Europe, with flows and positioning improving recently and IG seeing more support on a relative basis versus HY. On the supply side, primary market activity was heavier in the United States than in Europe in the IG space. HY supply was down significantly in Europe, while it enjoyed more volume in the United States, despite experiencing one of its lowest cumulated issuance of the past few years.

We expect net supply to increase in 2023, thanks to the use of cash available on balance sheets, the limited resort to the primary market in recent quarters, and rising redemption volumes. However, net supply should be modest by historical standards, despite issuance likely being higher than in 2022.

We expect ECB quantitative tightening (QT) – expected to start in March – to have a limited impact on markets. Despite rising corporate debt volumes being absorbed by markets, we expect QT to have a limited effect due to the modest volumes announced for the overall asset purchase programme (APP) and to the limited volumes for the scheduled corporate sector purchase programme (CSPP) redemptions.

We expect Japanese investors to remain cautious on foreign bond investments. Japanese investors were net sellers of foreign sovereign bonds in 2022 -- mainly dollar-denominated ones). On the corporate bond side, the picture appears more mixed despite referring to more modest volumes than for public debt. Rising currency hedging costs – especially for dollar-denominated bonds – contribute to explaining the cautious attitude of Japanese investors towards foreign bonds, despite the attractive carry attached to the latter.

Healthy balance sheets to help corporates go through the slowdown

Since 2020, corporates have generally strengthened their balance sheet position. During the Covid-19 crisis, issuers were proactive in locking in their financing plans, while benefiting from exceptional financing conditions. Primary market activity hit record levels. Corporates hoarded cash, lowered the average cost of debt and increased the average duration of their debt.

In 2022, corporates strongly improved their net leverage and interest coverage ratio credit metrics thanks to careful balance sheet management and a much steeper-than-expected earnings recovery. For both US and European corporates, net leverage declined below pre-Covid-19 levels, despite falling cash levels. The fallout of monetary tightening on corporate fundamentals was limited by low refinancing needs and the high use of cash holdings. In the United States, cash was used to finance share buybacks.

Corporates are entering a more challenging environment (higher funding costs, sluggish growth and higher business costs) with healthy balance sheets.

The peak of credit quality is probably behind us. In 2023, corporates will have to deal with higher funding costs, sluggish growth, and high energy prices in Europe and high labour costs, mostly in the United States. However, to smooth away the immediate fallout of the above factors, the redemption schedule for this year is benign, especially for the first half, as few issues be due in H1 2023. The refinancing issue may come into focus in H2 2023, when rising funding costs and slower earnings growth will pressure weaker and rate-sensitive balance sheets. Our concerns are CCC- and low-B-rated issuers. We do not expect IG issuers to be overwhelmed by higher debt costs, as rising rates should take years before hitting their cost of capital, thanks to high average maturity and the low average cost of debt, due to a decade of accommodative monetary policy.

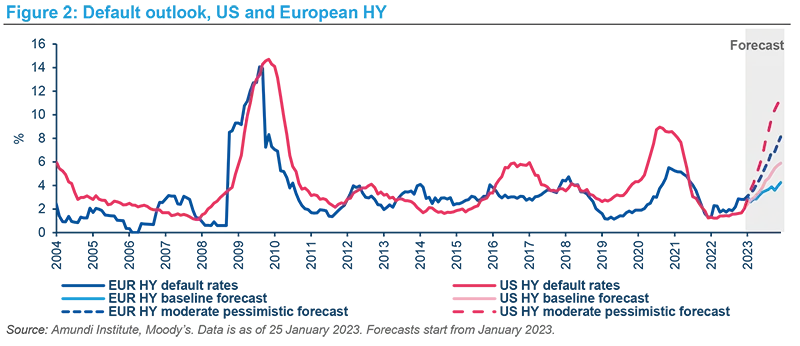

In 2023, HY default rates are likely to rise close to their historic average from rather low current figures. According to our baseline macroeconomic scenario of a shallow recession in Europe and modest US growth, and to the leading financial conditions indicators (e.g., distress ratios and bank lending standards), default rates should rise close to 5% and 4% in the United States and Eurozone, respectively, by end-2023. Risks are tilted to the upside and appear mostly dependent on a stronger-than-expected deterioration in macroeconomic perspectives.

Attractive IG valuations and HY opportunities in 2023

Corporate bond markets have recorded a strong start to the year. HY outperformed IG. This rally, not fully expected by investors, was driven by (1) attractive valuations, (2) a better economic perspective in Europe, (3) China reopening and (4) lower US inflation. For HY, the lack of supply while flows turned positive has strengthened spread tightening.

After this strong spread tightening, we still favour IG over HY. We retain a strong conviction in the HY-IG decompression view. We think that the HY compression experienced in 2022 was technically driven by the almost closed primary market. We expect HY to decompress from IG in 2023.

We favour IG over HY, as we believe the HY-IG spread should widen this year.

IG market

Valuations for euro IG remain attractive despite recent spread tightening. Going into Q4 2022, IG valuations were very cheap by historical standards following the previous spread widening. European and UK spreads were pricing in a worst-case scenario that was much bleaker than our macroeconomic expectations. The subsequent year-end rally meant we are now almost back to the middle of 2022’s range. Despite this rally, we remain constructive on credit. In detail:

- We favour EUR- and GBP-denominated credit over US credit. The level of European and UK spreads offsets a far bleaker backdrop than what we expect and are very cheap by historical standards. We are more neutral on US credit given current levels, since spreads do not offer the same level of comfort as for other regions and are more aligned with historical standards.

- Financials over non-financials. We are constructive on financials, especially on banks. We do not expect bank credit quality to come under material pressure. Although the cost of risk will deteriorate in the future, it will be absorbed by better profitability thanks to the end of the zero-interest-rate policy, while capital levels are strong. We also favour the car, technology, media and telecom sectors. On the other hand, we are cautious on consumer goods, capital goods and transportation.

- Positive view on euro-subordinated debt. We see value in euro-subordinated debt. Absolute yields in the subordinated debt market are currently higher than inflation and dividend yields and compensate for any potential volatility. Equally, despite the increased extension risk that has developed in some parts of the subordinated market, we think this will create more opportunities.

- We see the best value in the five-to-seven-year segment of the euro IG curve, as spread curves remain flat. In 2022, issuance was skewed towards shorter maturities. As such, the higher relative supply in the five-to-seven year part of the curve created a premium in this segment.

- We see the best value in the short-end and belly of the US IG curve.

HY market

Recent tightening of HY spreads makes us relatively cautious, but we see opportunities, probably in the second half of the year:

- The carry now offered by the asset class is attractive on a mid-term investment horizon (near 8% for European HY and 9% for US HY). In the context of a challenging macroeconomic environment, we expect spreads to be volatile over the course of the year.

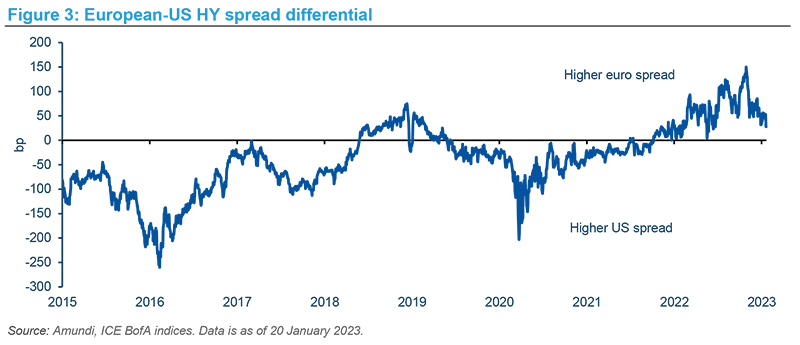

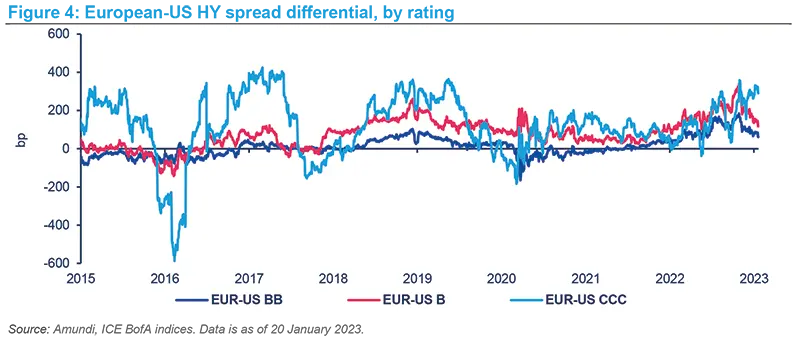

- The differential between Europe and the United States could reverse at some point. Despite better credit quality – with 67% of BBs and only 5% of CCCs for US HY against 51% and 10% – the European HY option-adjusted spread (OAS) is still wider than the US HY one, although it has shrunk recently. This can be explained by the different macro outlook between the two continents, with a recession more likely in Europe than in the United States at present. The Russia-Ukraine war and the related energy crisis are also weighing on Europe. We believe that the reversal trend in the differential between Europe and the United States could continue, especially since default rates are likely to be higher in the United States. However, it will be important to monitor the geopolitical and energy outlook in Europe.

In the context of a challenging macroeconomic environment, we expect spreads to be volatile over the course of the year, offering better entry points.

Box 1: Net Zero investing in credit

Opportunities that aim to reduce GHG emissions in the real economy

Background

The Paris agreement set clear guidelines for the fight against climate change, with 197 countries agreeing to the objective of limiting global warming to well below 2°C. Despite the sharp acceleration of Net Zero commitments in recent years, all stakeholders have largely failed to deliver the efforts needed to set a new course to reduce global warming, making the goal of reaching carbon neutrality in 2050 even more challenging. We believe now it is the time for investors to start taking action and ensuring they are equipped to face the investment risks and opportunities related to the Net Zero journey. In our view, to be considered Net Zero, an investment portfolio should demonstrate a decarbonisation pathway consistent with a maximum temperature rise of 1.5°C above pre-industrial temperatures. At Amundi, we have set the initial intermediary target for 18% of AuM to have explicit Net Zero alignment by 20251.

How to invest in credit with a Net Zero approach

Our investment approach to Net Zero aims to ensure that not only do we contribute to the world’s decarbonisation, but we also support the energy transition. Indeed, our Net Zero approach intends to maximise our contribution towards reducing greenhouse gas (GHG) emissions in the real economy. To do this, we have adopted a highly selective approach that focuses on companies that have set a Net Zero trajectory, while engaging with those operating in high impact climate sub-sectors as they transition to Net Zero. Integrating our analysts’ views, we can favour corporates that not only offer solid credit fundamentals and valuations, but also the ones committed to decarbonisation.

In terms of data, the approach to Net Zero integrates Climate and ESG metrics, such as GHG emissions and intensity-reduction objectives and ESG scores. In addition, we consider Just Transition and TEE2 scores as they respectively focus on social challenges and energy transition risks. Given the timeline of the Net Zero target, we believe it is critical to also integrate forward-looking objectives like Science Based Targets (SBTi) and credible temperature trajectories. Our Net Zero Framework covers exclusions for coal and unconventional oil and gas, as well as Climate “Do No Significant Harm” criteria (Paris-aligned benchmark exclusions based on MSCI indicators). The Framework also features a constraint on limiting deviations for high climate impact sectors for Net Zero open-ended funds.

Opportunities in the Net Zero approach to credit

Integrating the Net Zero approach to our credit views presents an opportunity to invest in a filtered investment universe that fits our Net Zero criteria, while not having to compromise on performance. From our experience, we believe there is no detrimental cost associated specifically to a Net Zero approach, as the filtered investment universe for the Net Zero Framework remains broad enough to manage actively portfolios, engage with corporates and generate alpha. In addition, this filtered investment universe is expected to continue to grow in line with an increase in corporate commitments to Net Zero. As such, the market for labelled-bonds has been growing year-on-year. It stood at ~EUR 700bn in 2022 and is expected to continue to represent attractive opportunities for the Net Zero approach.

In fighting climate change, Green Bonds are a key tool that also tend to exhibit lower volatility than conventional bonds, making them an attractive proposition for many investors. Along with the Green Bonds market, the Sustainability-Linked Bonds (SLBs) market has also grown. SLBs instruments incentivise issuers’ achievement of predefined sustainability or ESG objectives through KPIs and Sustainability Performance Targets. Issuers are thereby committing explicitly in the bond documentation to future improvements in sustainability outcomes within a predefined timeline. SLBs are typically forward-looking performance-based instruments and bring diversification to the issuer base without compromising yield. These instruments are another way to finance the energy transition. Interestingly, more than 60% of SLB KPIs are linked to GHG emissions.

Finally, we believe that investors willing to embrace a Net Zero approach in credit, will benefit from attractive credit valuations in 2023, while also contributing towards reducing GHG emissions in the real economy. With a more strategic perspective, Net Zero investing in credit is also gaining attention among investors as a pillar of the CORE ESG allocation, while satellite ESG strategies tend to be built around impact investing.

1 See also https://about.amundi.com/our-climate-ambitions-actions

2 Transition Energétique et Ecologique, refers to energy-transition-related scores.

With the contribution of Abaza Nadine (Portfolio Manager – Global Corporate Bonds) and Francesca Panelli (Investment Insights and Client Division, Amundi Institute)