Summary

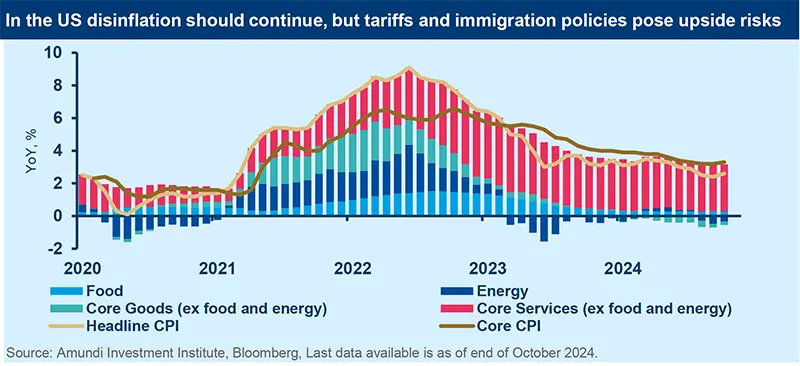

After Trump victory, all eyes on inflation

A resilient US economy, the anticipation and eventual victory of Donald Trump and his recent appointments along with risks around inflation have been driving nominal and real yields over the past months. But US equities and the dollar rose amid a belief that the US economy would benefit from Trump’s policies at the expense of the rest of the world, i.e., Europe and some Asian countries. While we agree that US policies would reverberate across European assets and emerging markets, the actual impact depends on specific measures and countermeasures. We think the following factors will be major market drivers

- Fiscal impact of US policies (tax cuts, deregulation etc on consumption not clear Indications are it would be positive for growth in the near term 2025 and then weigh on growth in 2026. But concerns about the high fiscal deficit and debt could put additional pressure on bond yields.

- Fed is walking a tightrope in its attempt to weed out the last leg of inflation. Policies around immigration control (subsequently wage pressure) and import tariffs could create upward risks on inflation. Hence, the Fed will become more data dependent and may ease less than currently expected. This would have implications for the ECB and other global central banks.

- Balancing EU fiscal governance rules with the need to invest more to improve productivity enhance competitiveness and improve defence will be tough. Hence, fiscal policies in countries such as Germany Schuldenbremse post elections, France and Italy become more important.

- China realises that negotiating with Trump is difficult. The country will respond proportionately to the US. Potential responses include a fiscal boost, export controls of critical minerals and CNY devaluation.

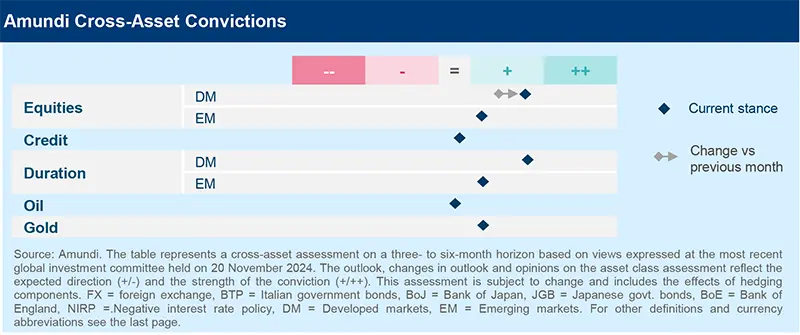

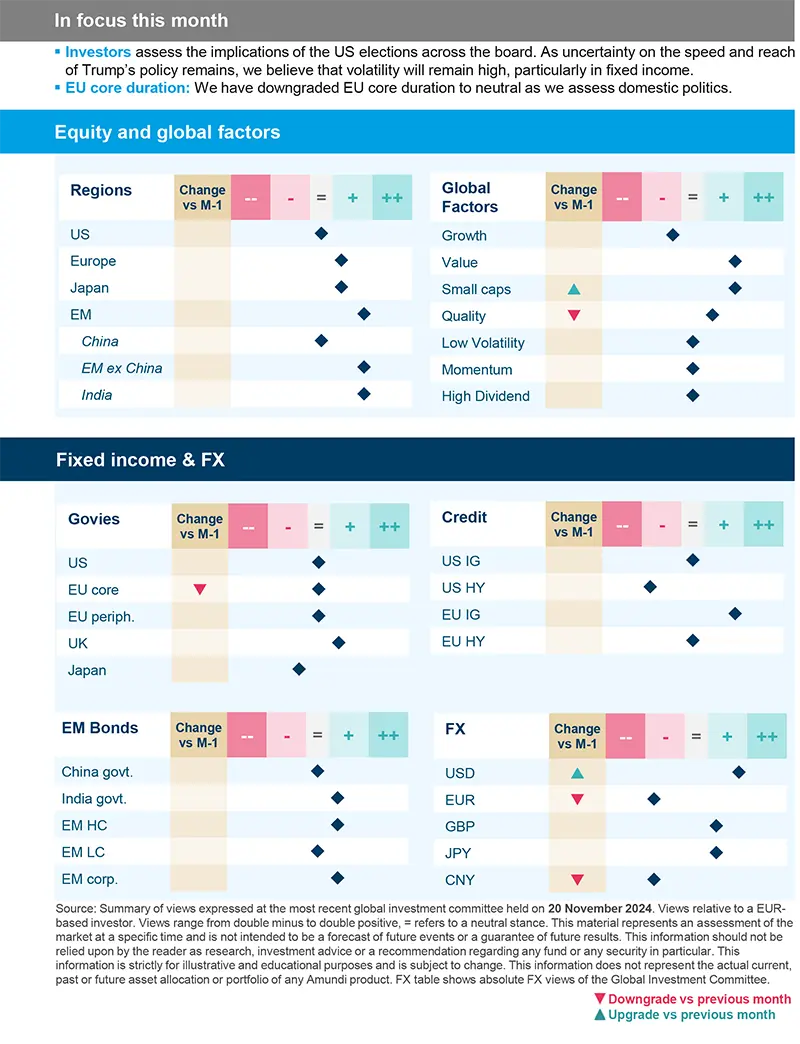

US economic resilience and Fed rate cuts are marginally constructive for risk assets, and we prefer to play areas where earnings momentum is favourable and valuations are less of a concern.

The already-high valuations of risk assets could face headwinds from higher bond yields as a consequence of potentially higher inflation and lower-than-expected easing by central banks. This in turn favours a continuation of the market rotation towards areas which are more attractively priced. Hence, we aim to carefully balance market fundamentals with valuations and our expectations on policymaking.

- Cross asset. We have upgraded US equities by turning positive on US mid-caps. US stocks should benefit from a combination of positive sentiment stemming from a growth impetus, potential deregulation and favourable tax policies. We also remain marginally positive on the UK and Japan. In fixed income, we remain constructive on US and EU duration and have raised our curve-steepening expectations. We think gold still holds the potential to offer portfolio stability. In addition, investors should consider maintaining safeguards on equities and duration, if US inflation surprises on the upside.

- Duration is all about granularity and taking yield volatility into account. In the US, where we are close to neutral on duration, we think there is good value in the intermediate part of the yield curve. But we have tactically downgraded core European duration to neutral, and see political uncertainty persisting in the near term. In US credit, we remain tilted towards quality, and in securitised credit, we prefer high-quality AAA-rated debt in commercial real estate. Our stance is unchanged for EU credit.

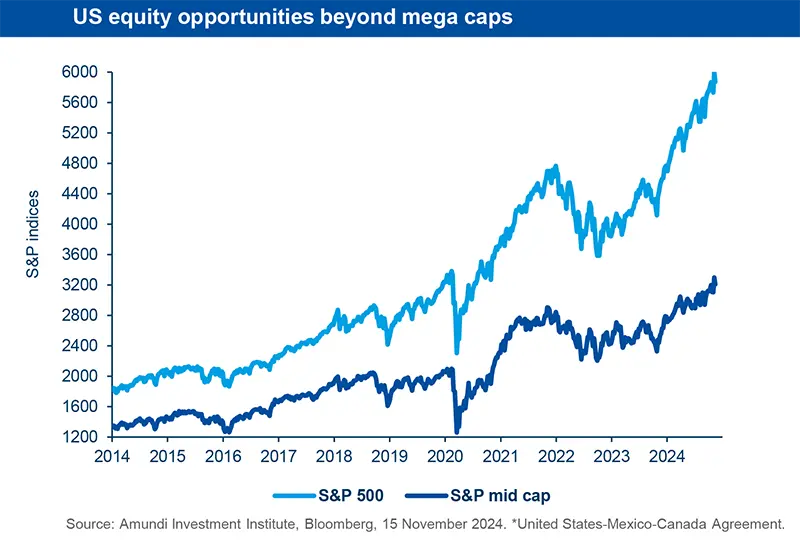

- Gains in US equities despite rising real yields indicate high market expectations. It is worth looking beyond over-priced stocks. The actual impact on growth would depend on the degree to which Trump’s agenda is implemented. Instead of playing this positive sentiment through expensive large caps, we prefer to rely on areas that display better valuations, such as S&P equal-weighted, value and quality. In Europe, stock picking is likely to gain importance, as weak domestic demand meets uncertainty on international trade.

- Emerging markets are home to many uncorrelated bottom-up stories, but US rates are a risk. Thus, we remain vigilant and selective, preferring countries such as Turkey and South Africa in local currency debt. In hard currency and corporate credit, we are positive. In equities, we are slightly less constructive on Brazil but remain positive on Indonesia and India.

Three hot questions

1| What is the likely impact of Trump’s announced policy on the US economy and the Fed path

Anticipated tax cuts, deregulation, and larger fiscal deficits may lead to resilient growth and higher inflation by 2025. Tariffs could boost inflation by 0.5pp, but are unlikely to offset tax cuts completely. Sequencing and the timing of tariffs will be key to assessing their economic fallout. Immigration controls may also add to inflation, possibly hindering the achievement of the Fed’s inflation target. While higher than expected inflation may suggest a hawkish Fed, tariffs could hinder growth by 2026. All in all, the Fed may need to reassess its rate cutting path. We expect the ten year US Treasury yield to be 4.30% by Q2 2025.

Investment implications :

- Look for inflation protection and strategies favouring the steepening of the US yield curve

2| What could China’s response to US tariffs be?

We foresee three possible scenarios: i) increasing fiscal stimulus, expected by March 2025, potentially up to 2% of GDP to try to offset the fallout of US tariffs on China’s economy; ii) export controls on key rare minerals which are essential for the electronics industry; iii) a one off RMB devaluation, especially if US tariffs are particularly severe. This is not China’s first option for retaliation; fiscal and targeted retaliation should come earlier. I f the tariff hike is phased over the course of Trump’s second term, China may respond cautiously , weighing its relationships with other developing countries by re routing exports.

Investment implications :

- In China, we prefer equities versus bonds. Sentiment has stayed positive despite the US election result, but careful selection is needed.

3| What could the impact of US elections be on the US dollar?

We see three main channels of transmission that may lead to a stronger USD and higher FX volatility, in the near term: i ) With a decline in World Trade, export oriented economies should suffer more than the US, which is domestically oriented; ii) China’s excess capacity may induce further disinflation in Europe. This could augment fears of policy divergence with the Fed, in turn supporting the USD; iii) The combination of policies may lead to higher inflation in the US and thus higher uncertainty over the Fed’s actions. However, higher tariffs may weaken the US economy, leading to a potential USD decline by 2025.

Investment implications :

- Constructive on the USD in the short term. EURUSD not expected to reach parity.

The Fed in an easing mode might be forced to reassess the speed and timing of its rate cuts if fiscal policy becomes too expansionary and creates problems for the former’s inflation objective.

MULTI-ASSET

Diversify towards attractive segments

|

Francesco SANDRINI |

John O'TOOLE |

We acknowledge the limited upside potential in US equities, but are mindful of areas that could benefit tactically from the positive sentiment.

Trump’s clean sweep in the US elections is positive for near-term growth in the country and should continue to drive market interest. This, at a time when the Fed is cutting rates, should be mildly positive for risk assets. However, we aim to benefit from this through equity segments where valuations are attractive. Interestingly, the same factors that could boost American assets (growth, high deficits etc.), may create upward pressure on US yields, and opportunities around curve steepening. In addition, any protectionist tendencies from the US, and consequently from other parts of the world, could create headwinds for markets. Hence, we prefer to maintain a diversified stance in this evolving economic backdrop.

We are positive on equities via the US, Japan and the UK. On the US, we have raised our stance tactically by turning constructive on mid-caps that are more likely to gain from the more domestic focus of the incoming administration. This also allows us to diversify our views slightly from our existing equities stance. In emerging markets, we currently remain optimistic on China due to its valuations and expectations that Chinese policymakers are likely to maintain their support.

In fixed income, we believe yields at the long end of the US curve could rise due to concerns around growth, deficits and inflation. Thus, while staying positive on US duration overall, we have turned cautious on US 30Y but positive on EUR 5Y. In Europe, the growth outlook is more subdued and inflation continues to decline, and thus we maintain our slightly constructive stance on duration in the region. We also like Italian BTPs vs German bunds, and are positive on UK gilts. In Asia, we think Japanese yields are likely to rise which could exert downward pressure on government bonds.

At the other end, we see value in EU IG and EM debt, especially local currency, given the rates differential with the US. But we are vigilant towards any risks from potential US policies around international trade. In FX, we think the USD may continue to strengthen in the near term, particularly against the CHF, which is very expensive. We are cautious on the CHF even vs the yen. Separately, we remain optimistic on the INR and the BRL.

We complete our allocation with a key pillar of stability in the form of gold which is likely to remain strong in the medium term. Investors should also maintain equities and duration hedges to safeguard any inflationary risks.

FIXED-INCOME

Stay tactical and granular on duration

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

The Trump trade has seen a sharp move upward in bond yields and the next leg up should come from the actual implementation of Trump’s agenda around taxation, international trade and immigration etc. In particular, there has been a debate about how much of all this would push up yields at the long end of the curve, but we still see value in the intermediate part. More recently, the fall in yields points to how quickly markets’ perception of fiscal policymaking could change. In Europe, political uncertainty in select countries could affect yields along with the ECB’s stance on rates. The ensuing volatility underscores the importance of identifying which parts of the yield curves across which geographies offer attractive risk-free yields and stability. At the other end are corporate credit and EM debt that could enhance investors’ long term returns.

- Our duration stance is neutral, but it differs across yield curves as we take country and regional dynamics into account. We have slightly downgraded European duration to neutral, are positive on the UK but cautious on Japan.

- We maintain our stance on curve steepening (30Y-5Y) in Europe and the US.

- Our preference for banking and insurance sector in European IG stays. But we are selective in HY with a bias towards non-cyclicals

- We keep a dynamic stance on US Treasuries. At the moment we are neutral, but a strong increase in yields would strengthen the case for duration. It’s important to identify which part of the curve offers most value. The long end is likely to be affected by deficits and potential inflation.

- TIPS are attractive amid high real rates.

- In securitised credit, we see opportunities in high-quality commercial real estate and also like agency MBS.

- After Trump’s election, we assess how his policies and less (than previously expected) easing by the Fed could affect EM debt.

- Our strategy is to identify less-correlated stories. LC debt in countries such as Turkey and even South Africa shows potential. In LatAm, we explore areas like Mexico where the sell-off has been substantial.

- We like HC and corporate credit, particularly HY due to valuations and attractive carry.

EQUITIES

Play equities beyond US mega caps

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

Markets have moved quickly to price-in near-term nominal economic growth in the US but we would like to question that narrative because the starting point of the ‘Trump trade’ is different this time when compared to 2016. When Trump was elected President for the first time, US stock valuations, the fiscal deficit and public debt were not as high as they are today. However, this time around, the Fed is in an easing mode, although this could be challenged if there is volatility around inflation. As a result, we could see an upside for equities, but it would be characterised by rotation favouring cheaper segments and those that show earnings resilience. In particular, we see select opportunities in small and mid caps, Europe, Japan and emerging markets in companies displaying pricing power and balance sheet strength.

- Despite markets being carried away by fears of a hawkish Trump, we think there are ample opportunities, driven by corporate fundamentals.

- Pricing power is key, and this is not the time to compromise on balance sheet strength.

- In the region, we have become more positive on consumer staples and healthcare.

- Conversely, we are now more cautious about technology and industrials.

- We agree that fiscal policies could provide a short-term fillip to equities but we disagree on the way to play this, i.e., segments where valuations are attractive and operational efficiencies are not yet priced-in.

- Importantly, if Treasury yields rise significantly due to inflation or deficit concerns, valuations could be affected.

- We avoid mega caps but like value and quality. A move down in market cap remains an important conviction for us.

- In China, where we keep a neutral stance, we may see fiscal packages to support exporters if Trump goes all out on tariffs.

- For global EM equities, we focus on stories such as India that are relatively immune from this geopolitical competition. We like Indonesia due to structural trends, but have downgraded S. Korea to neutral.

- Brazil, Mexico are attractive but we monitor fiscal risks and any volatility from renegotiation of USMCA.*

*United States Mexico Canada Agreement

VIEWS

Amundi asset class views

Definitions & Abbreviations

Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.