Summary

Executive Summary

2024 was the second consecutive very good year for global developed credit markets. Full-year 2024 excess returns show the outperformance of high-beta segments (riskier market segments which provide higher return potential) and EUR markets.

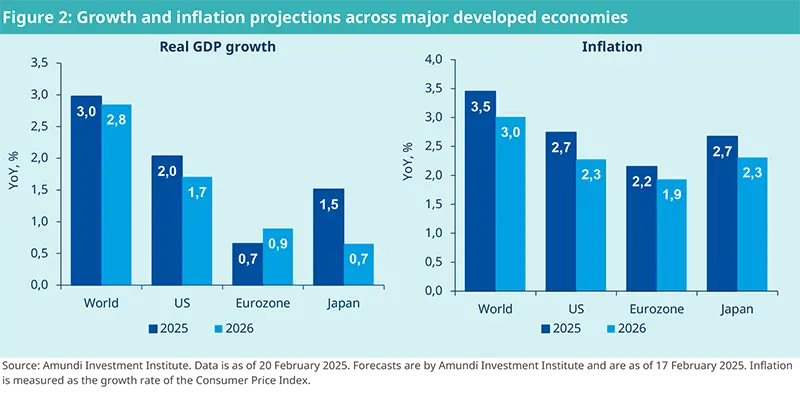

2025 remains a favourable year for credit markets for many reasons. Firstly, the global picture is positive and supported by a combination of resilient economic activity, inflation convergence to target, and less restrictive monetary policy in both the United States and the Eurozone. Our main concerns relate to possible upside risks to US inflation data, notably with tariffs, and downside risks to Eurozone growth.

Secondly, corporate fundamentals remain solid, as companies have taken advantage of the post-pandemic period of ultra-low interest rates and the economic recovery to improve their credit profiles. Companies have made good progress in extending maturities, easing near-term liquidity pressure on many low-rated borrowers. Resilient economic activity means credit quality should remain solid, especially in high yield (HY). We expect default rates around 3% in the US, close to their long-term average. The market is wide open, even for low-rated names, which can easily access the market to refinance. In the United States, higher rates for longer could be a challenge for the weakest credit quality cohorts, such as CCCs. In the Eurozone, the risk is more towards a more pronounced-than-expected slowdown in economic activity. Finally, private debt financing is also supportive of companies in sectors such as healthcare.

Thirdly, technical conditions remain supportive. Structurally higher interest rates should support demand for corporate credit from yield-seeking investors, who seek income before central banks cut rates further. Official rate cuts could help support bond flows from money markets towards interest rate products with a longer duration to lock in higher income. Net supply remains limited, as issuance is largely used for refinancing purposes. Finally, CLO1s’ buoyant dynamics are also fuelling demand for HY bonds indirectly, contributing to the overall support for demand in this market segment.

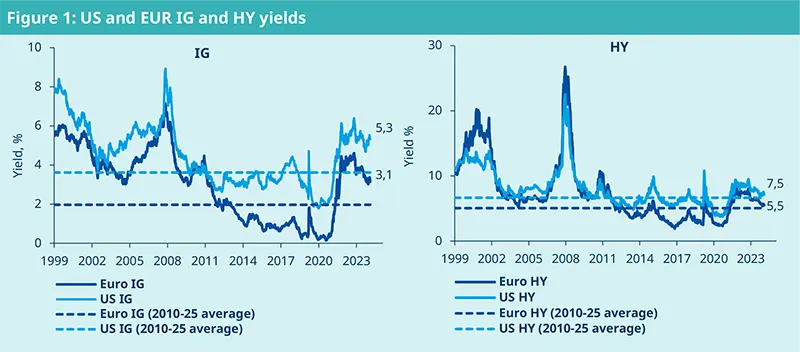

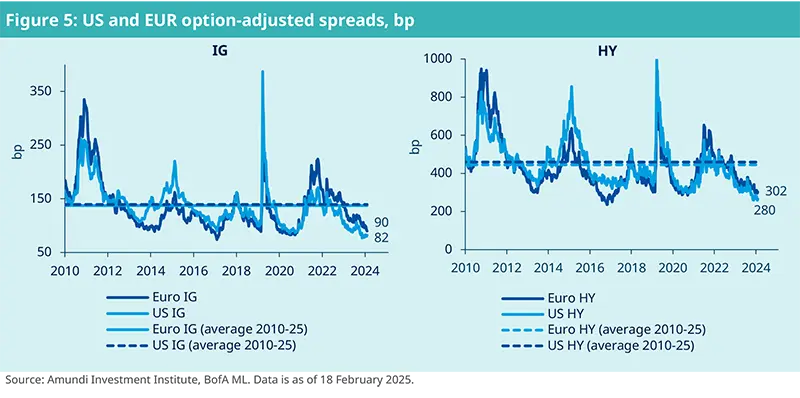

Finally, spreads are tight, but yield hunting remains the name of the game for most investors. We think spread compression may have run its course for this cycle. After two consecutive good years, credit spreads across both investment grade (IG) and HY are indisputably tight, but yields remain attractive compared to longterm trends. We believe corporate bonds should remain an attractive place to obtain income in 2025.

2025 remains a favourable year for credit markets; corporate fundamentals are solid, as companies have taken advantage of the post-pandemic period

of ultra-low interest rates and the economic recovery to improve their credit profiles.

Credit markets in 2025

In this paper, we assess views on global credit markets in developed countries, focusing on liquid instruments. For these global credit markets, 2024 has been a second consecutive very good year, with excess returns confirming the outperformance of HY against IG. In our view, 2025 will remain a favourable year for credit markets. We expect the macroeconomic picture, healthy fundamentals, and technicals to provide a favourable environment for corporate credit over the next twelve months. After two consecutive good years, credit spreads across both the IG and HY segments are tight, but yields remain attractive (see figure 1). As such, credit markets will remain an attractive place to get income.

Source: Amundi Investment Institute, Bloomberg. Data is as of 17 February 2025.

Supportive global macroeconomic picture

US growth is slowing, but economic activity remains resilient; confidence remains that the 2% inflation target will be achieved as we move towards 2026. Central bank rate cuts remain on the table. 2024 US GDP growth came in at 2.5%. 2025 US GDP growth should slow close to 2.0%, its potential rate. Growth is supported by consumer spending and non-residential investment. US economic outperformance compared to other developed economies can be explained by solid productivity gains resulting from massive investments in digital technology and upbeat private consumption. Continued productivity gains are essential for wages and stock valuations to keep growing. The consumption boom has been driven by high-income households, which benefited from a positive wealth effect: even after adjusting for price changes, household net worth has risen by nearly 20% since end-2019.

The Fed should pause its monetary easing cycle in Q1 2025. The disinflationary trend has slowed over the past six months and inflation remains somewhat elevated. We expect inflation to be back to target only at end-2026. The new US administration’s policies add uncertainty to the projected trajectory of inflation.

In the Eurozone, 2025 GDP growth should remain low, at 0.7%. Economic activity is driven by private consumption, which is supported by positive real wage growth. The consumption dynamics are disappointing because gains in purchasing power result in a significant rise in savings rather than consumption. Tighter financing conditions and subdued foreign demand should weigh on economic activity in the near term. Corporate investment remains penalised by high interest rates. To a larger extent, the subdued Eurozone economic performance underscores structural weaknesses (e.g., lack of investment, weak productivity).

We expect the ECB to cut rates further to support economic activity. The disinflation process is on track and monetary policy remains too restrictive in the Eurozone. ECB chief economist Philip Lane said too little rather than too much inflation is now a risk that rate-setters need to take into account. Borrowing costs should not “remain too high for too long”, as growth could be so weak that “inflation could fall materially below target”, Lane said. He stressed that, like high rates of inflation, “that is also undesirable”. Major risks remain:

Downward revision to GDP growth. We are closely monitoring this risk in Europe. The impact of still tight monetary conditions could be felt this year, questioning the labour market’s resilience, especially in Germany and France.

Persistent inflation could call central bank rate cuts into question. The new US administration’s policies create uncertainty regarding the growth-inflation profile. Tariffs, budgetary considerations, and tax policy could lead to stronger inflationary pressures that could halt the Fed's easing cycle.

Technicals: demand-supply balance to stay supportive for credit markets in 2025

2024 saw strong demand for credit products. We experienced record demand in Europe, with the longest period of strong, steady monthly inflows into EUR IG bonds and no monthly outflows from the EUR HY market. The latter closed the year with cumulative flows comparable to EUR IG as a share of assets under management (AuM). Flow dynamics into US credit markets were similar and, while not reaching historical record volumes, they proved higher than equities and money markets as a share of AuM. Unlike other historical phases in which flows tended to be led by previously delivered total returns, the recent demand trend looks resilient to market volatility. The level-shift in the demand trend has been persistent and we believe it is a reflection of higher yields; as such, we may expect it to persist over the coming quarters. The German curve steepening is another factor underpinning inflows into short-term EUR IG corporate debt. The expected path of ECB rate cuts and the resulting further steepening should keep inflows coming into this market segment.

Net supply recovered across the Atlantic, and was stronger in the United States than in Europe, but overall it failed to match the steady, strong rise in investment flows. In HY, issuance has largely been due to refinancing activity to address upcoming maturities. Looking forward, the positive trend of fund flows is likely to stay both in the short and medium term, as investors lock in yields ahead of expected rate cuts throughout 2025.

Moderate pressure is coming from primary markets. The legacy of the heavy supply volumes of 2019-20 will drive a surge in Europe in 2025-26, meaning ongoing high volumes of gross issuance. Any new additional debt to be absorbed by markets is unlikely to match 2024 levels, with the latter remaining below 2019-20 yearly volumes for non-financial companies. Furthermore, we anticipate that financials have already partly frontloaded 2025 refunding needs on the back of the stronger-than-expected primary market activity recorded in the second half of 2024. In the United States, the stronger refinancing progress recorded so far, especially among HY companies, means lower volumes ahead, reducing the risk of pressure from the primary markets.

Strong CLO demand is also supportive for HY bonds. In Europe, 2024 was a record year in terms of new CLO origination (€45bn). 2025 is expected to be around the same level. New CLO launches are likely to boost demand for HY bonds packaged into CLOs.

In our view, 2025 should experience a similar pattern in the demand-supply balance, as the current paradigm of attractive yields -- especially in the United States -- ahead of likely rate cuts (mostly in Europe) creates a powerful demand, while supply is unlikely to be disruptive.

Healthy fundamentals

We expect corporate fundamentals to remain healthy in both the United States and Europe:

Companies have not levered up over the past year despite tight credit spreads. Rather, they have taken advantage of the post-pandemic period of ultra-low rates and economic recovery to improve their credit profiles.

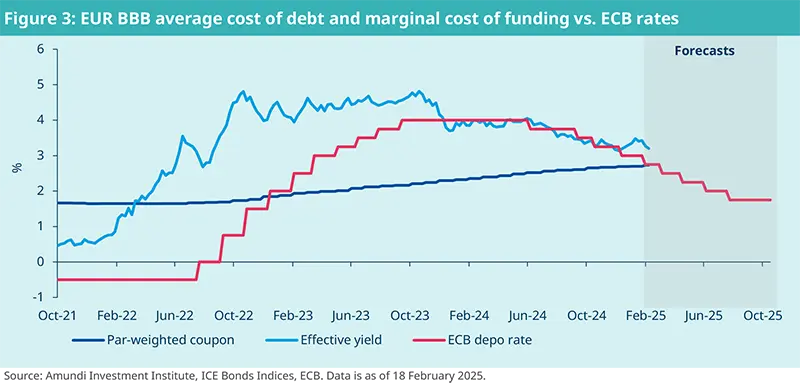

Companies have successfully navigated the high-rate phase. The impact of the rise in rates on the fundamentals of IG companies remained gradual thanks to the long average maturity of corporate debt. Thanks to strong investor appetite, companies have made good progress in extending maturities, which has eased short-term liquidity pressure on many low-rated borrowers.

Resilient economic activity means credit quality is to remain solid, especially in HY.

The market is now open, even for low-rated names. Private debt financing is also supportive of companies in sectors such as healthcare.

Further rate cuts should support corporate fundamentals.

Finally, CCC credit metrics stabilised after a strong deterioration over the past quarters on several fronts: margins, interest coverage rate, leverage, and cash ratio.

HY default rate outlook: expect another decline

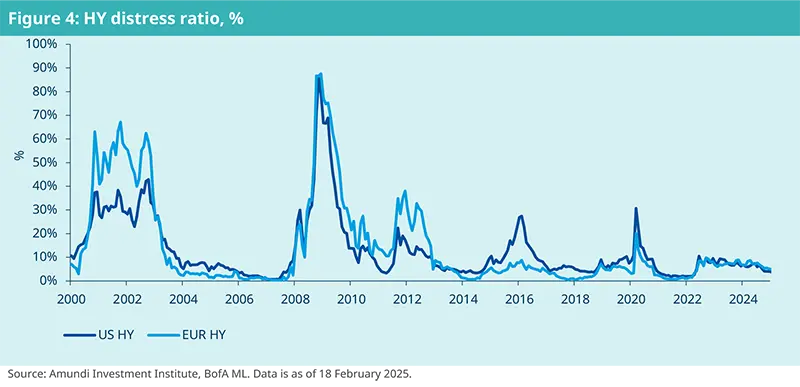

Global HY default rates as a share of issuers fell slightly last year, to 4.8% from 5.0% in 2023, despite hitting a peak in April at 5.3%. The gap with the default rate calculated as a share of debt volume remains wide, with the latter at just 2.1%, together with almost no rise in defaults of BB- and B-rated names and the concentration in CCCs. This reinforces our view that this cycle is dominated by SMEs and the low-rated most vulnerable companies.

Moody’s expects default rates to fall to 2.6% by end-2025, below the 4.2% historical average. However, distressed exchanges, which dominated 2024 credit events, remain an uncertain variable, as Moody’s recognised: “the global default rate may not fall as sharply as our model predicts because distressed exchanges, which are harder to predict than more conventional payment defaults and bankruptcies, are dominating this default cycle.” In terms of areas, the United States should drive the downward trend, as the rating agency projects the North American default rate to more than halve to 2.6% from the current level slightly above 6.0%, while Europe’s default rate -- already at a more modest 2.6% -- should finally show limited progress and stabilise at current levels.

We expect US HY default rates to slow to the 3.0-3.5% area. This assessment is consistent with a combination of expected resilient macroeconomic growth and benign indications from both distress ratios and bank lending standards, which usually lead defaults by one year.

European HY default rates should remain below their historical average (2.5-3.0%) thanks to the sector’s higher average credit quality compared to the United States and the more supportive perspective of rate cuts. We expect defaults to remain concentrated in low-rated names and among small and medium enterprises (SMEs). Our baseline scenario assumes low economic growth in Europe, with risks tilted to the upside in case of a deteriorating macroeconomic environment, while in the United States, sticky inflation represents the main upside risk.

Valuations: tight credit spreads, but yields remain attractive

Most segments of US credit spreads are trading at their tightest post-financial crisis levels and are tight compared to their European counterparts. Despite this, the yield measures of most pockets of both US and EUR credit markets remain attractive by historical standards.

In global fixed income, we favour EUR IG versus both USD and GBP IG. Despite a significant tightening of the wides seen in 2022, we believe European spreads have room to tighten further and are still relatively cheap compared to other regions by historical standards. We keep a neutral view on US and UK credit given current spread levels, but we think investors could add exposure to these assets if spreads widen on any weakness.

Idiosyncratic market risk should rise, meaning that issuer and issue selection will be key in 2025. Carry will be an important performance driver and we remain positive for the high-beta market segments (riskier market segments which also provide higher return potential). In financials, we like both T22 and AT13, with intermediate maturities remaining particularly attractive, especially callable bonds with large resets. Despite believing that corporate hybrid bonds look expensive from a headline level, there remain some pockets of value, with investors attracted by the high-quality income of the asset class, which provides a strong technical factor.

We favour financials over non-financials and remain constructive on banks in both Europe and the United States. Corporate results have been strong across the board on both sides of the Atlantic, driven by strong investment banking performance and net interest income (the difference between revenues generated by interest-bearing assets and the cost of servicing liabilities) guidance, while capital levels remain robust. US banks should also benefit from the proposed deregulation, but this could take time to feed through. Despite the strong compression seen in 2024, we feel that this trend can continue, with financial spreads trading inside non-financials. Among industrials, we favour the real estate sector, which has shown some healthy recovery and stabilising valuations. We also like insurance and energy sectors as well as telecoms and selective media names. We remain cautious on cyclical sectors such as consumer goods, capital goods, autos, energy, and transportation, believing that investors are not compensated for the potential risks ahead and that valuations are tight in this phase of the cycle.

We favour the three-to-seven-year segment of credit curves. However, we are beginning to see more value in the long end of the US curve after some spread curve steepening in 2024, but we remain selective. We also see opportunities in European HY. A low growth environment in Europe, good fundamentals, and strong technicals should support the asset class in 2025. Carry income should be the main performance driver.