Summary

Key takeaways

- After a strong 5-month rally, global equity markets, driven by the mega caps, are implicitly factoring in a strong rebound in the economy and profits.

- A breather and/or a broadening of the participants in this rally make sense, opening a window of opportunity for lagging cyclical and value stocks.

- European markets could participate, with small caps also joining in eventually. Their profits have started to outperform, unlike their share prices, making them more attractive.

Equities have performed very well in the first quarter of the year. Where do we go from here?

Japan leads the major equity markets (Topix +17%) so far this year. The US and Europe are more or less on an equal footing, depending on the index: the S&P500 (+10.2%) outperformed the Stoxx600 (+7.1%), but the EuroStoxx50 (+12.4%) beat the Nasdaq100 (+8.5%) over the period, which shows that European blue chips are performing better than their US peers. How far could this rally go?

After 5 months of gains, equity markets have already factored in a lot of good news. In the US, the performance of equities relative to bonds is now consistent with an ISM manufacturing print of around 60*; in Europe, the performance of cyclicals relative to defensives implicitly points to the manufacturing PMI being around 55.

On this basis, we believe that three factors should guide our equity investment choices over the coming months:

1) the possibility of a pause or consolidation (not chasing the rally);

2) a broadening of the participants (favour those equities which have lagged);

3) the fact that the expected slowdown is simply a mid-cycle slowdown and not a recession (look for opportunities on the pro cyclical side rather than the defensive side).

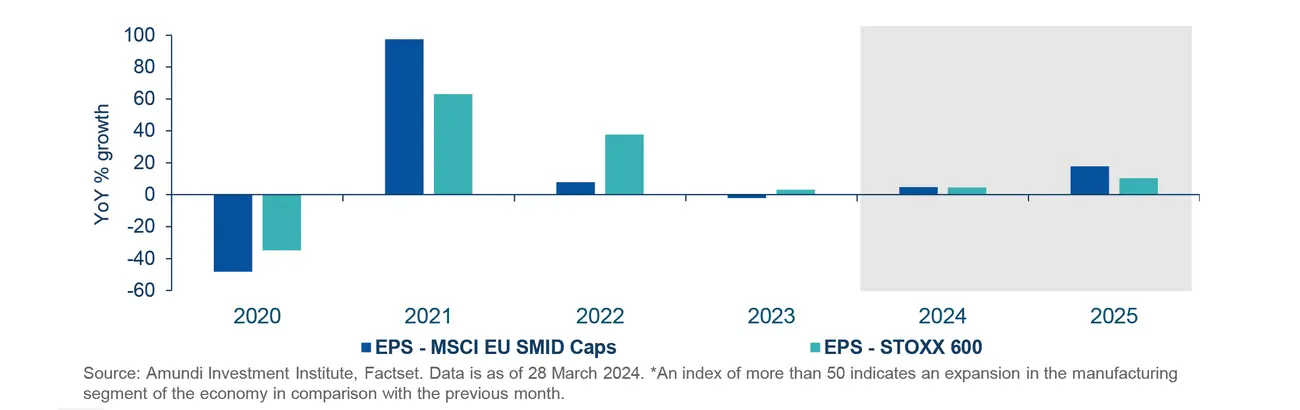

European earnings growth turning more favourable for European mid- / small-caps

The broadening of participants beyond the Mag 7 should benefit equal-weighted indices in the US, but the European market is also a good candidate for taking advantage of this window of opportunity. The main segment of the European market to have taken advantage of the rally has been the large caps; we believe that an extension of this broader participation could eventually also benefit European small caps.

Focusing on mispricing could be rewarded again, and Europe equities should participate.

Three further remarks:

- The US and European markets have contrasting growth and valuation characteristics, which explains our neutrality between the two regions.

The US market benefits from more dynamic earnings growth than the rest of the world, but its valuation is much higher than that of other markets. In the fourth quarter, US corporate profits rose by 10%, beating expectations, which were only 4.4% at 1 January. Profits in the three sectors that include the Mag 7 were up by 24% for IT, 37% for Consumer Discretionary and 53% for Communications Services. However, this comes at a price, and the 12-month forward price / earnings of the MSCI USA is at 21.4x, more than one standard deviation above its historical average since 2000, in comparison with 17.9x for the MSCI ACWI.

Conversely, the European market is very cheap, but its profit momentum is also weaker. At 13.8x 12-month forward profits, the MSCI Europe is trading at multiples that are in line with its historical average since 2000. On the other hand, fourth-quarter earnings were down 6.5% year-onyear for the Stoxx600, decreasing for a third consecutive quarter, and remain in line with expectations (-6.4% expected on 1 January). It should be noted that the Ibes forecasts for the next quarter are still in the red (-11%), compared to an increase (+5.1%) for US forecasts.

- In the short term, however, Europe's value characteristics could be an advantage.

The MSCI World Index of Growth stocks relative to that of Value is on a triple top; the valuation differential between the two is also very wide, even more so than in 2000. As the elastic is stretched, it is tempting to think that, in the absence of a recession, it will relax in favour of Value, which is more pro European markets than American ones, which partly explains why European indices have stabilised versus the US since the start of the year.

- If the Fed is expected to cut rates this year, so will the ECB, which could reinvigorate the neglected market cap factor, especially in Europe.

Despite their cyclicality, small caps have not yet joined in the shift in favour for cyclicals over defensives, which was reinforced by December’s FOMC (Federal Open Market Committee) meeting acting as a game changer.

Having more leveraged balance sheets and being financed by banks rather than directly by the market, small caps generally react favourably to falling interest rates, which could eventually act as a catalyst, when it becomes a reality.

Why look specifically at European Small Caps?

The fall in interest rates could act as a catalyst for the size factor overall, but as we are mid-cycle rather than in a recovery from a deep recession, focusing on mispricing rather than a strong profits turnaround could be a good argument for positioning on this theme in Europe, whereas we favour the theme of broader participation in the equity rally in the US by focusing more on equal weight.

Indeed, having faced stronger pressure than large caps since 2022, European small caps’ earnings have been outperforming those of large caps since mid-2023, contrary to their US counterparts; Factset forecasts that this trend should continue (see the chart on the previous page). This makes sense to us given the low recovery profile we expect. As their share prices have been underperforming, small caps are becoming more attractive in terms of valuation (the gap of P/E with large caps is at its highest level since 2003) and an interesting option for the catch-up by cyclical value laggards that we expect.