Summary

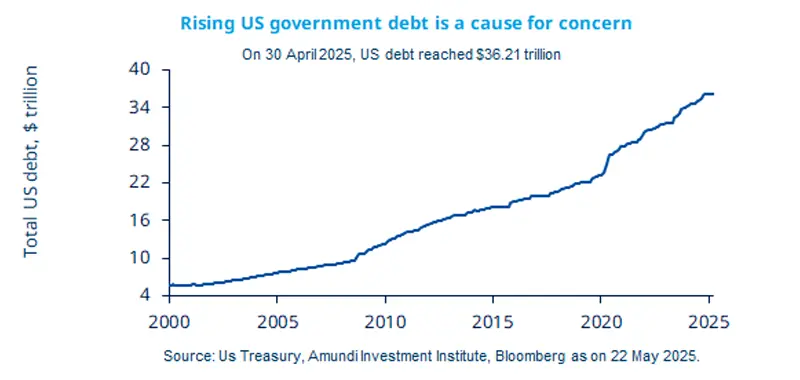

As US debt and fiscal deficits rise, leading to higher volatility in government bonds, investors should favour a global approach and explore opportunities in European bonds.

The US government lost their top-notch AAA rating on their long-term issuer debt recently, from Moody’s Ratings.

The debt trajectory is in focus after the House approved the tax and spending bill, which is now moving to the Senate.

While US government bonds remain key, financial and policy issues are leading to higher volatility.

Moody’s Ratings recently downgraded the US government’s credit rating by one notch from AAA (the highest possible score from the company) to Aa1. Rising government debt and interest costs, a high fiscal deficit (excess of expenditure over revenues), and government inaction to address these issues are the main reasons behind this move. The recent approval of President Trump’s tax and spending bill in the House could negatively affect government finances. It is still pending Senate approval, but it has caused alarm in financial markets, with yields on the 30-year Treasuries recently crossing the 5.0% level. Increased volatility in the US market may enhance the appeal of other markets, such as the European bond market, to global investors.Moody’s Ratings recently downgraded the US government’s credit rating by one notch from AAA (the highest possible score from the company) to Aa1. Rising government debt and interest costs, a high fiscal deficit (excess of expenditure over revenues), and government inaction to address these issues are the main reasons behind this move. The recent approval of President Trump’s tax and spending bill in the House could negatively affect government finances. It is still pending Senate approval, but it has caused alarm in financial markets, with yields on the 30-year Treasuries recently crossing the 5.0% level. Increased volatility in the US market may enhance the appeal of other markets, such as the European bond market, to global investors.

Actionable ideas

- European bonds

European government bonds may benefit from the ECB’s easing stance. In addition, inflation expectations are less of a concern for the ECB than for the Fed.

- Multi asset

High government debt and uncertainty around economic growth could create volatility in the markets. A balanced and diversified* approach could help investors navigate these risks and enhance returns over the long run.

This week at a glance

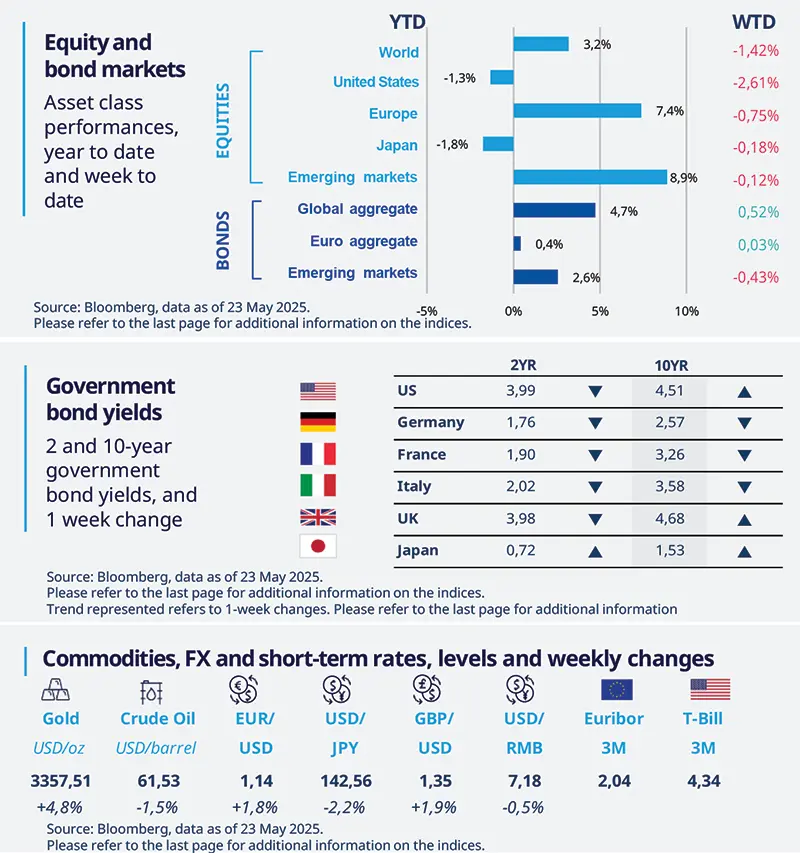

Stocks declined following the threats of high tariffs from President Trump on the EU. Bond yields were mixed, but long-end yields in the US and Japan rose amid worries over high fiscal deficit and government debt. In commodities, gold prices rose, but oil fell due to discussions among OPEC+ members to increase supply.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD). All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 23 May 2025. The chart shows the University of Michigan inflation expectations over the next year.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US unemployment claims more or less unchanged

The initial jobless claims for the week ended 17 May declined slightly to 227,000 (vs. 229,000 prior). The number of people receiving unemployment insurance as a percentage of the total labour force stayed at 1.2%. We do not see any evidence in this data that businesses are getting more aggressive in laying people off. At this time, we think, a major deterioration in the labour markets is unlikely, until there is more clarity on the economic impact of tariffs.

Europe

UK inflation jumped higher in April

UK inflation was higher than expected in April, at 3.5% YoY, with core inflation (inflation excluding food and energy components) also accelerating to 3.8%. Services inflation proved to be the strongest component, driven by regulated price rises and volatile components such as utilities. We expect the BoE to stay on hold in June but cut rates later this year to support weakening domestic demand and labour market.

Asia

Japan core inflation accelerated in April

Core inflation increased by 3.5%, y-o-y, in April (from +3.2% in March) due to reduced electricity/gas subsidies and ongoing food price inflation. More importantly, services prices remain strong, confirming that higher wages are impacting prices. Based on these numbers, we maintain our outlook for a rate hike by the Bank of Japan in July 2025.

*Diversification does not guarantee a profit or protect against a loss

Key dates

28 May FOMC minutes, ECB inflation expectations | 29 May Bank of Korea policy, US GDP | 30 May US personal consumption expenditure, German CPI, Brazil and India GDP |