Summary

- Over the weekend, the United States launched airstrikes on three key Iranian nuclear sites, escalating tensions in the Middle East. While the full extent of the damage remains unclear, we expect Iran to retaliate, though likely in a manner aimed at avoiding deeper US involvement.

- Market reactions have been cautious, with modest declines in Asian and European stocks, while oil prices remain close to last week’s levels. Gold, the US dollar, and US bond yields have also seen little change compared to the previous week.

- Multiple scenarios remain possible, yet we believe the US will be reluctant to deepen its involvement but remain committed to maintaining deterrence. Israel is determined to neutralise Iran’s nuclear threat and is likely to pursue a regime change to ensure a less hostile government.

- Oil prices continue to reflect rising risks around Iran’s oil production. A potential closure of the Strait of Hormuz would pose significant risks to supply and prices, but in our view, a permanent loss of capacity is unlikely at this stage. We expect volatility to continue, but prices will likely revert towards fundamentals by year-end.

- With heightened geopolitical risks, we favour a well-diversified allocation, including hedges and exposure to commodities. While we continue to follow developments, we do not currently see reasons for a structural change in our economic outlook and reaffirm the views in our Mid Year Investment Outlook.

How has the Israel-Iran conflict evolved over the past few days, and what has been the market reaction?

Over the weekend, the United States entered the escalating Middle East conflict by launching airstrikes on three key nuclear sites in Iran. The strikes were ordered by President Donald Trump, who stated that the targeted facilities were ‘completely and fully obliterated.’ The US justified the strikes as a necessary measure to prevent Iran from advancing its nuclear capabilities, which Washington views as a direct threat to regional and global security.

The exact degree of disruption to Iran's nuclear plants following the US strikes remains unclear for now. Official assessments are still ongoing, and there is limited verified information about the extent of damage inflicted on the targeted facilities.

Iran’s response was swift and defiant, declaring that the time for diplomacy has passed, signalling a potential for further escalation. The international community, including the United Nations, has expressed serious concerns about the safety risks posed by the strikes, as the targeted nuclear sites are sensitive and any damage could lead to hazardous consequences.

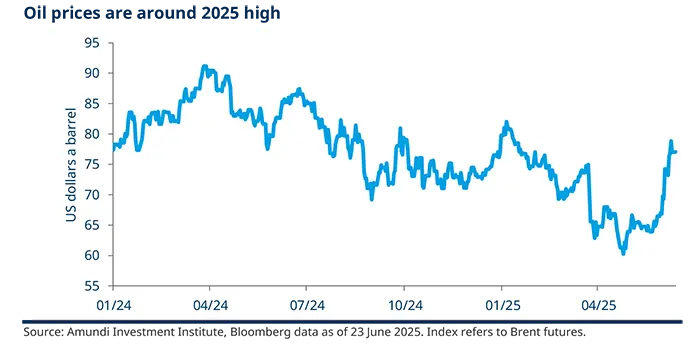

Market reactions were initially contained, with Asian and European markets showing some decline. Brent crude remained steady at around $77 per barrel. The US dollar strengthened somewhat against other G10 currencies, while gold and bond yields remain in line with past week levels. So overall, there are no signs of a significant risk-off move in the market.

What is your perspective on the recent escalation?

The US is likely to remain a reluctant participant, with domestic political pressures pushing for an exit if deeper involvement in the conflict occurs.

There are still many unknowns surrounding the recent escalation, including whether the US strikes effectively crippled Iran’s nuclear capabilities, the extent of Iran’s remaining military and missile capabilities, and the current cohesion within the Iranian regime.

The recent escalation reflects a complex interplay between the US, Israel, and Iran, each driven by distinct strategic calculations:

- The US is likely to stay a reluctant participant, seeking to avoid deeper involvement due to domestic political pressures. However, the strike on Iran has bolstered US deterrence, making it difficult for Trump to back down if Iran responds aggressively. This delicate balance suggests that the US will aim to manage the conflict carefully, avoiding prolonged engagement while maintaining a strong posture.

- Israel’s actions indicate a determined approach to neutralising Iran’s nuclear ambitions, but the conflict is unlikely to end soon. Since it remains uncertain whether Iran’s nuclear capabilities have been sufficiently damaged, Israel may continue its campaign to ensure a less hostile regime in Tehran. Given Iran’s likely ongoing attacks against Israel, the country’s objective may extend beyond immediate military goals toward a form of regime change.

- Iran’s response remains unpredictable due to uncertainties about its remaining nuclear and missile capabilities. If its nuclear program is intact, Iran’s priority will likely be to save face and avoid further escalation while rebuilding its strength. Despite weakened missile forces and militias, Iran continues to signal openness to negotiations and values its improving relations with Gulf states. This suggests Tehran may prefer a cautious approach, balancing resistance with diplomatic engagement to preserve regional ties.

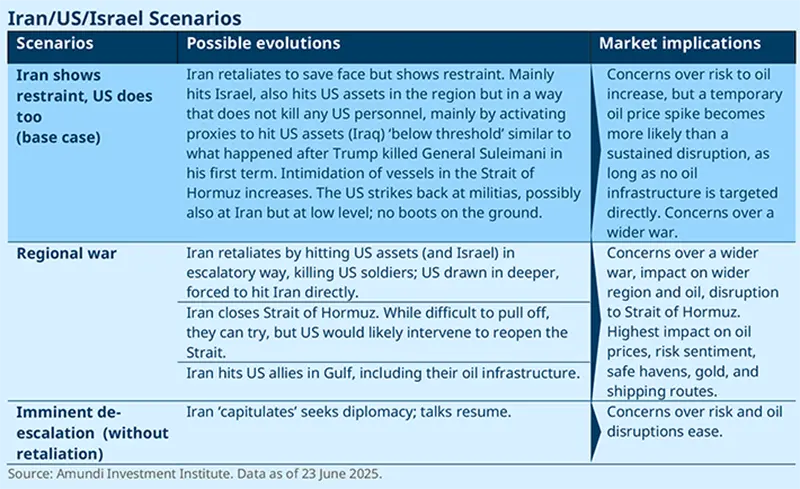

What are the most likely scenarios moving forward?

Following the US strike on Iran, we expect Iran to retaliate cautiously, aiming to avoid escalating the conflict into a broader regional war or drawing the US into deeper involvement. The US is likely to respond to Iranian actions, primarily by targeting Iranian proxies, maintaining reluctance to escalate unless Iran crosses a critical threshold, such as killing US personnel or if it becomes evident that the US failed to significantly damage Iran’s nuclear capabilities. Meanwhile, Iran and Israel are expected to continue their exchanges.

What is your view on oil?

Oil prices will continue to factor increased risks, but we don’t expect significant upside as the risks of a permanent loss of capacity in the Strait of Hormuz is low in our view.

Oil prices initially surged above $80 per barrel (Brent crude) following the US strikes on Iran but then retreated, reflecting market optimism that the conflict could be contained, with hopes of limited retaliation and a reduced nuclear threat. Meanwhile, oil shipments from the Gulf and transit through the Strait of Hormuz have continued without disruption.

As mentioned also in our previous assessment of the Israel-Iran conflict, the crucial factor for oil prices will be whether the Strait of Hormuz could be closed or if regional oil exporting infrastructure is attacked in Iran or in the Gulf countries. In our central scenario, we do not expect a blockade in the short term, as such a move would also severely impact Iran’s oil revenues, which it needs now more than ever. Additionally, it risks alienating regional powers like Qatar, which Iran may require for diplomatic support. That said, if Iran exhausts other retaliatory options, disruptions to shipping and increased militia activity could become more likely. Isolated attacks or intimidation in the Strait would negatively affect risk sentiment and push oil prices higher. In the unlikely event of a complete transit halt, Brent crude could surge to between $100 and $120 per barrel. It is important, however, to distinguish between a temporary blockage of the Strait and a permanent loss of extraction capacity.

Despite the rising geopolitical risk premium, we maintain our current price targets for now, pending clearer visibility on any actual supply damage, with Brent crude expected to reach $63-68 and WTI $60-65 in 2026. Volatility is likely to persist, and Brent prices may temporarily exceed our targets. Should this happen, increased production from the US and other OPEC members could help ease inflationary pressures, potentially bringing prices back below $70 by year-end. The most probable scenario is a period of heightened volatility with potential sharp price spikes, followed by a gradual return to market fundamentals over the course of the year.

What are the investment implications of this situation?

The recent developments reinforce the need to maintain a well-diversified stance with hedges in place and exposure to commodities.

With risks rising, we reaffirm our view that it is key to keep hedges in place over the summer. Despite a recent two-week decline, the S&P 500 remains roughly 3% below its February record high, following a strong rebound from the April downturn when the global equity index surged over 20%. With recent rising geopolitical risks, we emphasise the importance of maintaining a well-diversified stance, with equity hedges and gold to help mitigate volatility and enhance overall portfolio resilience during these uncertain times.