Summary

US exceptionalism is being challenged by markets due to uncertainty over the country’s policies and rising fiscal deficit and debt. This, along with concerns regarding growth, may shift the views on the dollar, but this is a long-term phenomenon.

The dollar declined so far this year due to expectations of rate cuts by the Fed and concerns over deteriorating government finances.

The US-Japan trade deal led to some stabilisation in the dollar and prompted a recovery in Japanese equities.

The dollar weakness could continue amid the country’s high financing needs, but this may not be a linear trend.

The dollar fell by around 10% this year, as on 22 July, mainly due to uncertainty over President Trump’s trade policies and concerns over US debt and fiscal deficit.* Issues like the political pressure on the Fed to cut rates aggressively have also weighed on sentiment. Traditionally, US assets are considered safe havens partly because of the credibility of US institutions, stable policies and exceptional US growth. However, Trump’s use of US leadership in global finance to further his ambitions on trade is creating uncertainty. The recent agreement with Japan lowered the tariff rate on Japanese exports compared with what was previously feared. But there is a risk that US consumers or companies will bear the higher cost. This may affect domestic consumption and eventually growth, opening up opportunities across different regions.

Actionable ideas

Global equities

Investors may explore strong businesses that rely more on domestic consumption in Europe and the UK. High dividends in some of these markets are also attractive.

Japanese equities

Japan offers a combination of corporate governance reforms, favourable market dynamics and attractive valuations. It also offers diversification1 opportunities.

This week at a glance

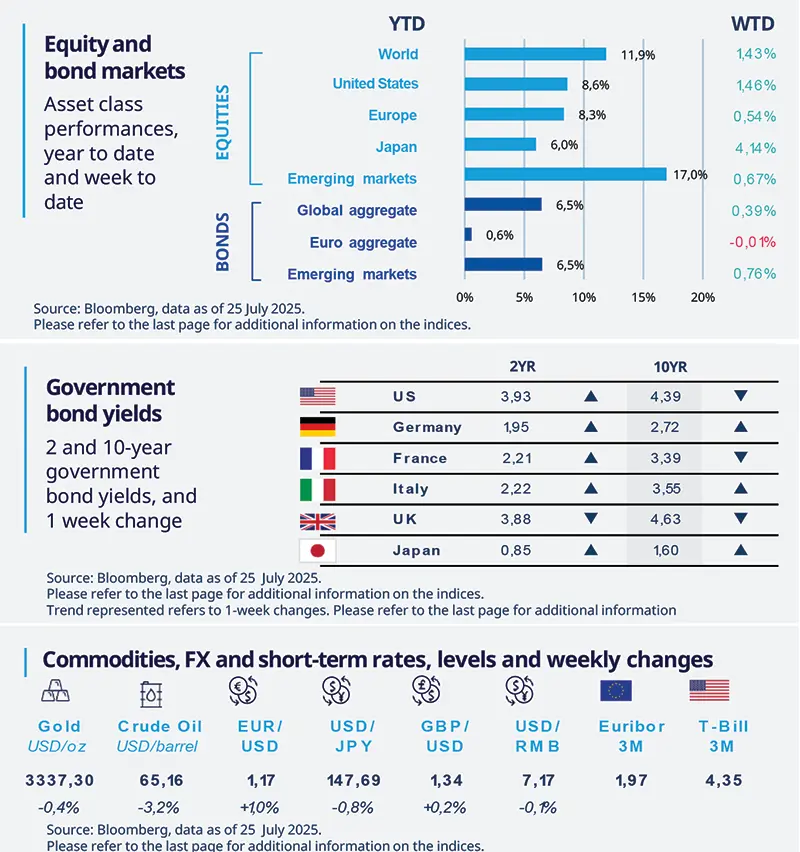

Equity markets were up last week. The US-Japan trade deal sparked some stabilisation in the dollar and prompted a recovery in Japanese equities. Government bond yields were mixed, with US long-term yields declining and those in Germany rising. In commodities, oil prices fell.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 25 July 2025. The chart shows the US Dollar Index.

1Diversification does not guarantee a profit or protect against a loss.

* Excess of government expenditure over revenues.

Amundi Investment Institute Macro Focus

Americas

Mixed macro pulse in the US, Fed to stay on hold

June existing-home sales fell 2.7% MoM, and initial jobless claims rose, pointing to only gradual labour-market softening. The Conference Board Leading Economic Index slipped another 0.3% in June. Housing weakness, steady but not alarming jobless claims, and a sagging Leading Economic Index reinforce expectations that the Fed will stay on hold next week while monitoring how upcoming tariff hikes feed through to prices and activity.

Europe

Eurozone PMI hits 11-month high

The flash HCOB Eurozone Composite PMI climbed to 51.0 in July (June 50.6), an 11-month high. For the first time in over a year the new-business gauge touched the 50-point breakeven, while services input-cost inflation slid to a 9-month low, hinting at softer price pressures ahead. The ECB kept all key rates on hold (deposit 2.25%), emphasising that domestic cost pressures are ‘easing’ and that incoming data remain consistent with inflation returning to target.

Asia

As August looms, Asia moves towards trade deals

The Philippines reached a deal with the US, setting tariffs at 19%, slightly higher than the 17% announced on Liberation Day. This new rate aligns closely with those for other ASEAN countries - Vietnam at 20% and Indonesia at 19%. With the August 1st deadline approaching, more announcements are expected, especially as Japan’s deal sets a precedent for exporters like South Korea to negotiate lower sectoral tariffs on automobiles.

Key dates

30 July Federal Reserve Interest | 31 July Bank of Japan Interest |

01 Aug US Unemployment Rate, Euro Area Inflation Rate YoY |