Summary

The UK Chancellor, Rachel Reeves, proposed a budget featuring tax increases and reduced debt issuance, which helps to explain the recent decline in bond yields. This fiscal tightening could weigh on consumption and growth, allowing the Bank of England to cut rates.

UK budget projects less debt issuance in the near term (vs. market expectations), explaining the calm reaction in bond yields.

- However, an increase in the tax burden in the coming years will weigh on demand and economic growth.

- Consequently, the Bank of England could cut interest rates, although much would depend on its inflation assessment.

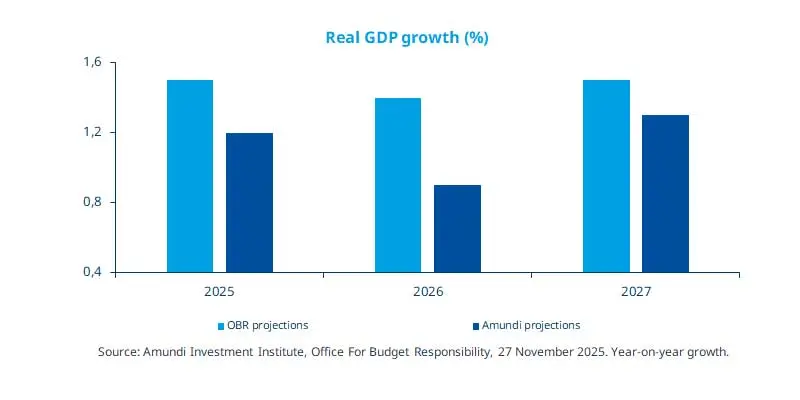

UK Chancellor Rachel Reeves presented the Autumn budget on 26 November, detailing government plans to improve the fiscal situation, hike some taxes on the wealthy and increase public spending. While the budget strives to reducing government borrowing (as a % of GDP) from 4.5% in financial year 2025-26 to 1.9% in 2030-31, it also raises certain taxes including on dividends and savings income among others. Overall, it balances fiscal prudence with economic growth, which we think will be subdued. As shown in the chart, our economic growth expectations are below the OBR’s projections because we think uncertainty over government spending and external geopolitical risks persists. Collectively, these would weigh on consumption and hence on growth. As a result, the Bank of England will likely reduce interest rates in December and twice next year, bringing the official rates down to 3.25% by the end of 2026.

This week at a glance

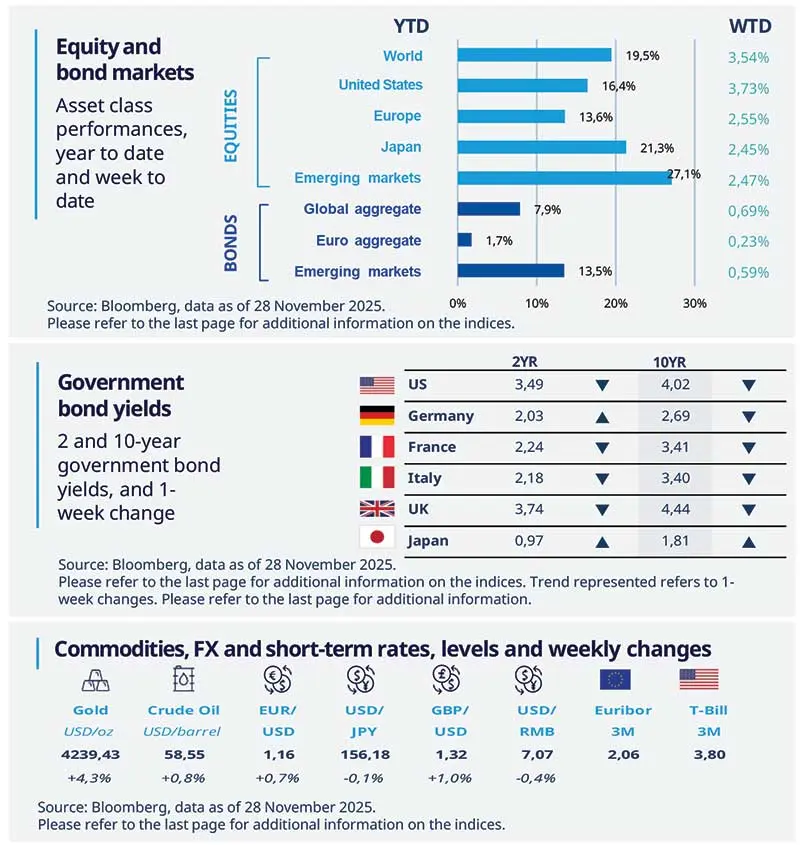

Global stocks rebounded this week as weak US data reinforced expectations of rate cuts by the US Federal Reserve. Long-dated bond yields were generally lower, including in the UK, where the budget was well received by markets. Gold and oil prices also rose as peace talks aimed at ending the Russia–Ukraine war drag on, leaving little prospect of a swift, lasting ceasefire.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 28 November 2025. The chart shows earnings growth for the S&P 500 stocks, the Magnificent 7 group, and the remaining S&P 493 stocks.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US retail sales weak for September

Retail sales (released with a delay after the shutdown) rose only 0.2% in September and were essentially flat in real terms, signalling a pullback from consumers. In particular, discretionary spending was subdued, amid weakness in e‑commerce, clothing, electronics, sporting goods and auto dealers. Overall, the pattern looks like a pause after a strong summer; it has not yet been impacted by the government shutdown.

Europe

Business and consumer survey for November

The business survey for the Directorate-General for Economic and Financial Affairs indicates that confidence grew notably in services, retail, and construction. This reflects stronger demand and brighter business prospects, whereas industry faced some headwinds from softer production and order expectations. Additionally, consumers remained steady in their outlook, balancing a slightly more positive view of the overall economy with caution about their personal finances.

Asia

Bank of Korea left policy rates unchanged

The Bank of Korea (BoK) held its interest rate steady at 2.5% on the back of an improving economic outlook underpinned by higher GDP growth and inflation expectations for 2025-26. Additionally, concerns about macro‑financial stability related to the Korean won have increased the likelihood that the Bank will keep rates on hold through the end of 2026.

Key dates

US ISM manufacturing, South Korea trade balance |

EZ unemployment rate and CPI, Brazil industrial production |

US PCE, Germany factory orders, Reserve Bank of India policy |