Summary

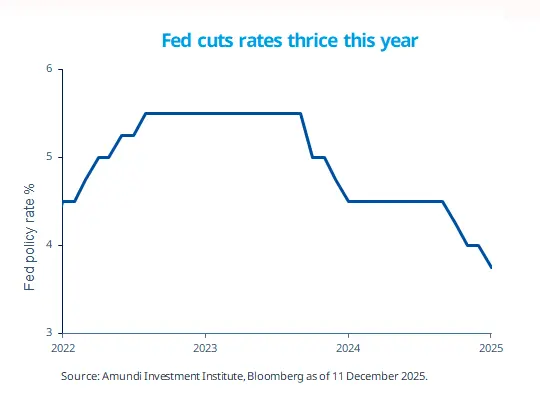

The Fed cut rates as expected. Our priority is understanding how it intends to reconcile support for a weakening labour market with some inflation concerns, particularly in light of rising political pressure to loosen policy.

- With its recent rate cut decision, the Fed has lowered its benchmark rate for a total of 75bp this year.

- The Fed emphasised that the “extent and timing” of future decisions would be based on the incoming data around employment, inflation, and economic activity.

- The Fed also initiated purchases of T-bills to maintain liquidity in the markets.

The Federal Reserve (Fed) reduced its target federal funds rate by 25bp at its December policy meeting. Chair Powell acknowledged that risks to both sides of the Fed’s dual mandate — inflation and labour markets — remain. However, we believe some signals from the Fed suggest labour markets are weaker than current data indicates. For instance, Chair Powell pointed out that current data may be overstating monthly payroll growth. We believe such concerns may explain why the majority of FOMC members voted for the rate cut, with one member dissenting in favour of a larger cut and two members voting for no change. Looking ahead, we maintain our projection of two rate cuts next year because of weakening consumption and softening labour markets. Inflation, which remains above the Fed’s 2% target, is likely to slow from current levels, but tariffs are a risk we are monitoring.

This week at a glance

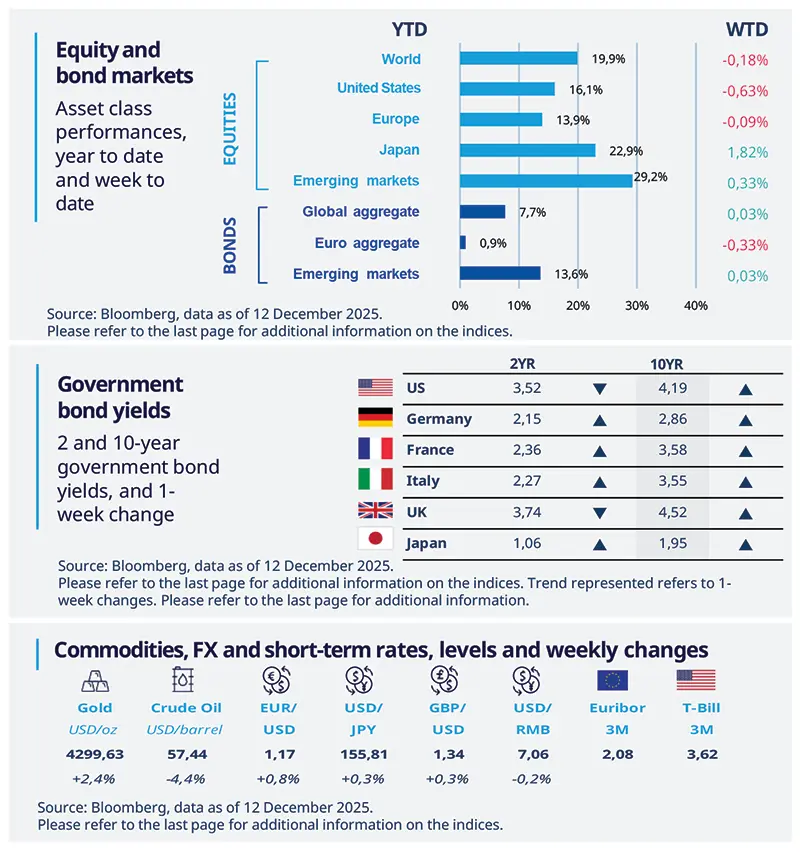

Global equities were mixed last week amid the Fed rate cut and the bank’s dovish tone. Hawkish comments by ECB member Isabel Schnabel paved the way for a sell-off in European bonds. Gold climbed again, testing the record highs reached in October, supported by expectations of further US monetary easing.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 12 December 2025. The chart shows US Fed Funds target rate (upper bound).

1 Diversification does not guarantee a profit or protect against a loss.

GLOSSARY

BoE: Bank of England

BOJ: Bank of Japan

Bp: Basis points

ECB: European Central Bank

Employment cost Index: Quarterly economic series that measures changes in the cost of labour for employers in the US

EZ: Eurozone

Fed: Federal Reserve

FOMC: Federal Open Market Committee

PMI: Purchasing Managers’ Index

QoQ: Quarter on Quarter

T-bills: US government debt securities with short-term maturity of up to one year.

YoY: Year on Year

Amundi Investment Institute Macro Focus

Americas

Employment cost index eased in Q3

The Employment Cost Index rose 0.8% QoQ in Q3 2025, with a 3.6% YoY increase – the slowest pace since Q2 2021 – continuing a slowing path. Other indicators on wage dynamics also point to gradually cooling wage growth and inflationary pressures, reflecting cooling labour demand which has clearly slowed.

Europe

EZ growth proved resilient in Q3

EZ Q3 real GDP growth was revised up to 0.3% from 0.2% QoQ as originally reported. Analysis of spending components shows that the area’s expansion was largely driven by government spending and investment, whereas private consumption stayed relatively subdued, showing signs of deceleration. PMIs point to positive growth also in Q4, showing somewhat higher resilience to trade and domestic political uncertainty, especially on the investment front.

Asia

Small policy rate cuts ahead for China

China's Central Economic Work Conference (CEWC) explicitly acknowledged the imbalance of strong supply, but weak demand, pledging to revive negative investment growth and reiterating reflation as a key objective for monetary policy. While pledging to maintain same policy easiness in 2026 as in 2025, CEWC implies reduced easing bias. The meeting reaffirms our views of small policy rate cuts, with the first cut likely in May.

Key dates

US nonfarm payrolls, US housing starts and building permits |

BoE and ECB interest rate decision, US inflation rate |

BoJ interest rate decision, Japan inflation rate |