Summary

The eventful first 100 days in office of Donald Trump put into question the dominant role of US assets, thus pushing global investors to look to other areas such as Europe in search for diversification*.

Trump’s approval rating -- currently at 41% -- is the lowest for any president at 100 days since Eisenhower.

The dollar has not rebounded after the 90-day pause announcement, being weighed down by uncertainty on US trade policy.

- Global investors could potentially look at European markets to diversify* at a time of high US policy uncertainty.

Source: Amundi Investment Institute, Bloomberg as of 29 April 2025.

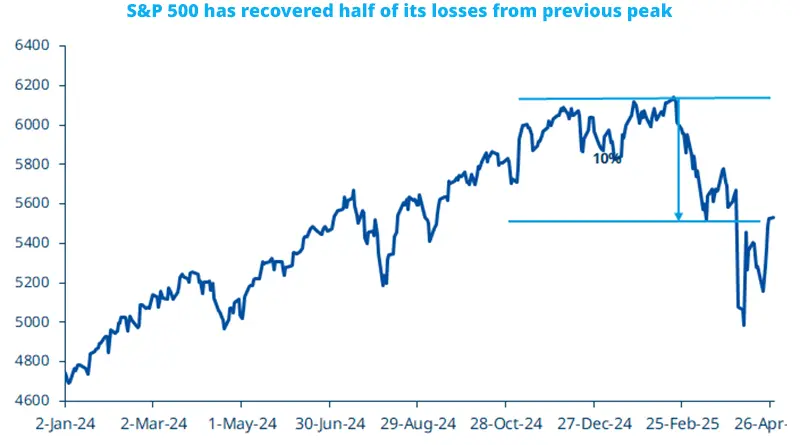

During Trump’s first 100 days in office, the S&P 500 index was down almost 9%, the worst performance for any US president since Nixon in 1973. This performance was influenced by the tariff-related sell-off, after which the US market rebounded when a 90-day pause was announced. The S&P 500 has now recovered about half of this drop. US equity volatility remains high and we expect this to continue until early July, when the 90-day pause in US tariffs will be reassessed. Overall, sentiment remains weak, with consumers increasingly worried about prospects for inflation and personal finances, as reflected in the University of Michigan consumer sentiment, which surveys hundreds of households each month.

Actionable ideas

- European bonds

European government bonds may benefit in an environment of weaker growth and offer diversification* to US assets.

- European equities

The ongoing rotation out of US assets may support EU equity, for which the benefits of fiscal stimulus and infrastructure spending could potentially offset the impact from US tariffs.

This week at a glance

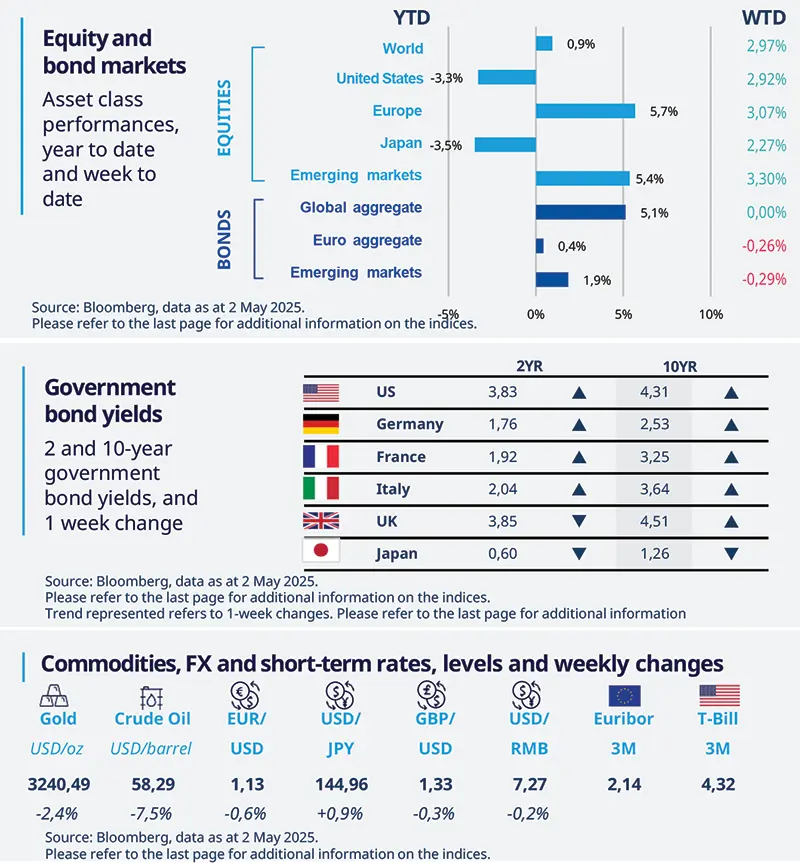

Global stocks rose on strong earnings of some US tech companies on hopes of resumption of trade talks between the US and China though the situation remains fluid. Most bond yields were up. Oil prices fell on concerns over higher supply from the OPEC+ coalition, together with demand worries.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 2 May 2025. The chart shows the S&P 500 index.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US economy contracts ahead of tariffs

The US economy contracted in the first quarter of 2025, the first GDP decline in three years. A sharp surge in imports contributed to the slowdown, as businesses and consumers stockpiled goods ahead of the tariff announcement. Growth in consumer spending was also weak, while fixed investment grew at a healthy pace. To sum up, the GDP numbers show a slowdown in demand, but the data remains volatile, so monitoring upcoming releases will be key.

Europe

EZ growth above expectations in first quarter (Q1)

Q1 GDP grew by 0.4%, quarter on quarter, accelerating from the pace of the previous quarter. The acceleration was supported by stronger domestic demand, driven by easing inflation and lower borrowing costs. These developments helped offset persistent concerns over US tariffs policy. Among major economies, Germany grew at 0.2%, but Spain and Italy outperformed EZ’s largest economy.

Asia

China data came in weak in April

China manufacturing PMI dropped to 49 from 50.5 in March. The highly punitive US tariffs, effective 9 April have started to take their toll on Chinese exporters. The export orders index dropped to its lowest level since China reopened from Covid-19 in early 2023. We think the weak data will invite policymakers to step up their support, first with interest rate cuts. The government will also look for clearer evidences to show up in the following months.

*Diversification does not guarantee a profit or protect against a loss.ect against a loss.

Key dates

6 May China Caixin PMIs (manufacturing, services, and composite) | 7 May US Fed rate decision, EZ retail sales, China foreign reserves | 9 May China trade balance, India foreign exchange reserves |