Summary

The Trump trades are over, and market rotation outside the US mega tech continues: Rising uncertainty regarding Trump’s policies, particularly the economic impact of tariffs, has increased in recent weeks. This, coupled with weak economic data, has led to further weakening in US equities, with the Nasdaq Index down almost 10% since the start of the year. In contrast, European stocks have outperformed in 2025 thanks to improving sentiment due to a possible ceasefire in the Russia-Ukraine conflict. The European plan for increased defence spending has recently triggered an extreme move in the euro (at its highest value versus the dollar since Trump’s re-election) and European bonds, which have surged in recent weeks at a time when Treasury yields have decreased amid rising concerns over US growth.

US economic slowdown: The US economy is slowing more rapidly than expected, as companies have been frontloading imports to discount higher tariffs, and policy uncertainty has dented consumer confidence. While we do not anticipate a recession in 2025, fears may increase if policy remains unstable. We believe that tariffs will primarily be a threat to growth rather than have an impact on inflation that, in any case, would be temporary. Hence, we maintain the view that the Fed will cut interest rates in Q2 this year.

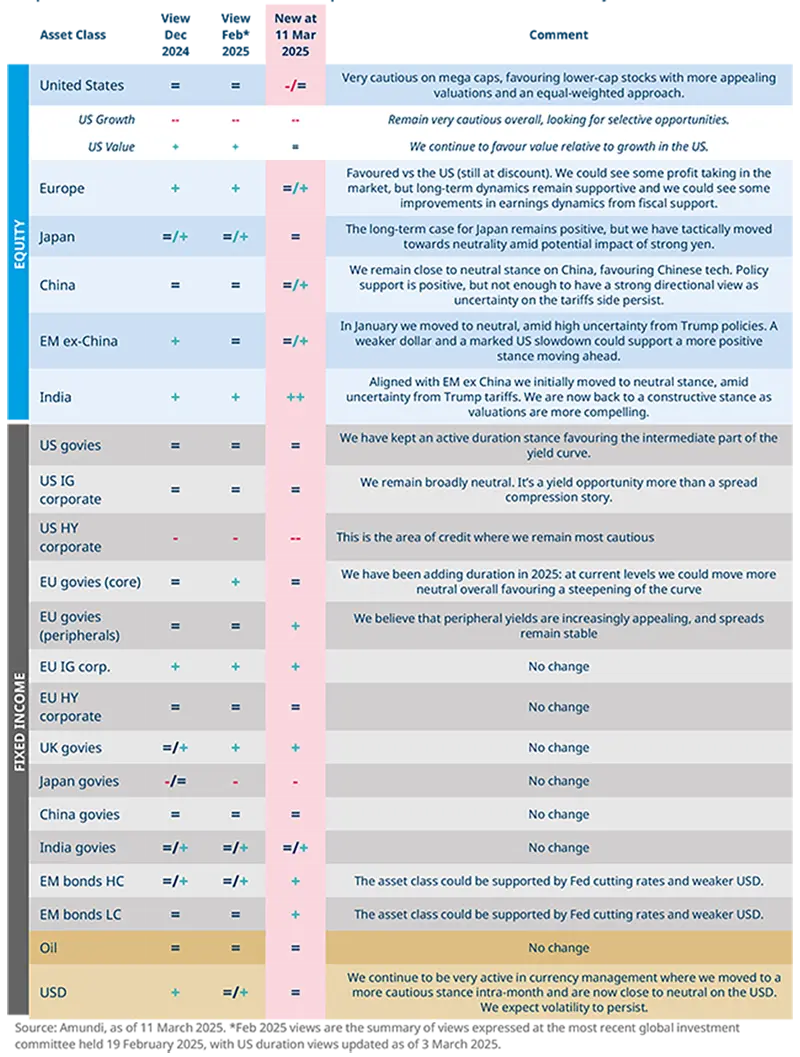

Investment convictions: Despite the recent selloff, we believe the awaited correction in areas of excessive valuations in the US equity market may continue, leading to a continuation of the recent rotation in favour of Europe and China. In bonds, it’s key to maintain an active duration approach. Since the start of the year, we have first become more constructive on European duration and, most recently, we have started to move towards neutrality. We also moved to a neutral view on US duration, and we expect the US 2-10 year yield curve to steepen. In credit, we remain cautious on US high-yield bonds and favour European investment-grade credit. As our original target for the EUR/USD of 1.10 approaches, we expect volatility to remain high and believe there is still room for a further correction for the dollar. Overall, we believe it’s key to maintain a balanced and diversified allocation, including gold and hedges to address the rising risk of downside for equities.

Rising concerns for US growth amid high policy uncertainty have triggered a strong rotation outside of the US mega caps.

What has been happening across financial markets in recent days?

Recent market activity has been marked by increased volatility. In the US, this has been mainly driven by growing concerns about the trajectory of the US economy, particularly in light of the erratic statements from President Trump with regard to tariffs. Additionally, the latest economic data has been disappointing. Consequently, the market's expectations for US growth for the current year have been revised downwards, moving in line with our more cautious estimates, which see the US economy heading towards a slowdown (see box on the next page). This environment of significant economic and policy uncertainty has led to a strong rotation outside of the US tech mega caps and in favour of Europe and China (see Figure 1).

Focus: US economy is slowing

The US economy is slowing faster than we had anticipated, most likely because of the extreme level of policy uncertainty. It is also leading to difficult policy dilemmas for the Fed. While we do not expect a recession in 2025, there will be heightened fears of a recession if policy remains volatile.

Consumer confidence and consumption expenditure have fallen abruptly, despite household balance sheets remaining relatively healthy. This is partly due to the uncertainty about prices and inflation as consumers fear higher tariffs on a large number of US imports. Mexico, Canada – both deeply rooted in US supply chains – and China account for about 40% of US imports. And there is a strong expectation that the EU, another region that accounts for a large share of US imports, will soon be subject to higher tariffs. As a result, US imports have been unusually high over the last few months in anticipation of impending tariffs. Weaker consumption and higher imports are indicative of an impending slowdown – the Atlanta Fed GDP tracker suggests flat GDP growth in Q1 at best. The labour market remains resilient, which is encouraging, but here too, the increase in the number of part-time jobs is a concern.

With near-term inflation still well above the Fed’s target and consumer expectations of rising inflation (primarily a function of tariffs), the Fed will likely be forced to hold rates higher for longer to ensure that inflation expectations stay anchored. But, through the course of this year, it will be able to reduce interest rates, both because slowing growth will reduce inflation pressures and tariffs, while leading to higher prices, will not lead to higher medium-term inflation. We note that business expectations of inflation remain anchored. We continue to believe that tariffs will primarily be a threat to growth rather than have a permanent impact on inflation. We therefore expect the Fed to cut interest rates three times this year to end 2025 at a 3.75% policy rate (upper Fed Funds target range).

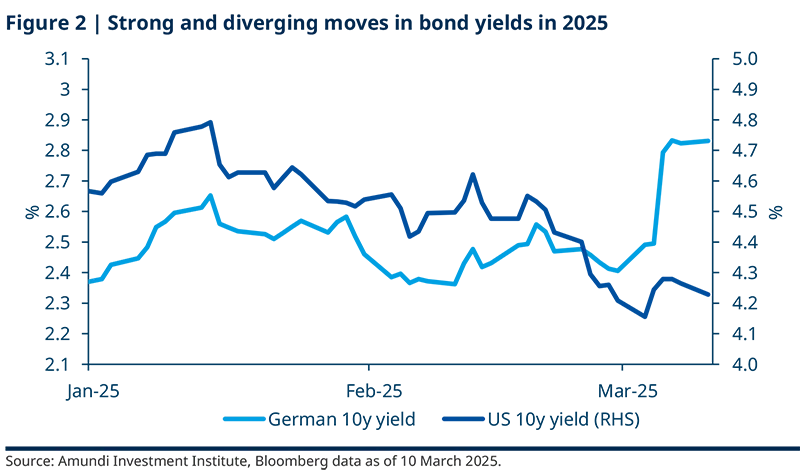

The second big market mover has been the recent news flow in Europe, with hopes for talks towards a ceasefire in Russia-Ukraine and, most importantly, the announcement following the German elections of an ambitious plan to increase defence spending in the coming years.

On the currency side, the euro has risen above 1.09, up from 1.03 just ten days ago, reversing the Trump trade in favour of the dollar which has dominated markets since Trump’s re-election (with many market narratives even predicting that the euro would fall below parity) and moving towards our original target for the EUR/USD of 1.10 by the year end.

European interest rates have experienced their worst streak in over two decades. The German Bund yield has surged to 2.8%, compared to less than 2.4% ten days ago, while the French OAT has risen to almost 3.6%, up from 3.13% ten days ago – levels not seen since the sovereign debt crisis of 2011 – while spreads on BTP-Bund have remained pretty stable. In contrast, US rates have declined amid rising concerns on economic growth, with the 10-year yield at 4.23%, down from a peak of 4.8% just over a month ago.

European markets have reacted sharply to the announcement of increased defence spending, with the Euro soaring to its highest level against the US dollar since Trump’s re-election and bond yields surging.

European stocks have also experienced some consolidation in recent days, but maintain a very good performance year-to-date, with the German Dax at almost +14% and the CAC at +9% – primarily driven by gains in defence stocks and banks. In contrast, the Nasdaq has declined by almost 10%.

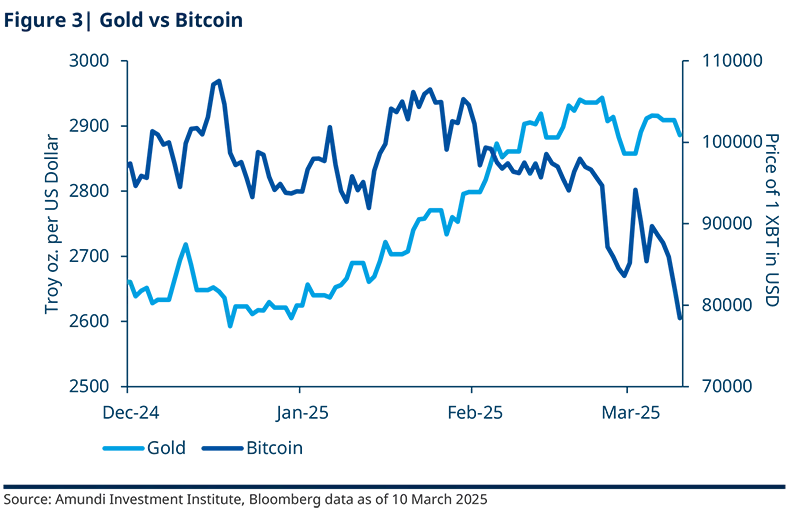

The reversal of Trump trades has also affected Bitcoin, which has dropped to below 80,000 after peaking at around 108,000, while gold continues to stay in demand at around $2,880 per ounce, marking an almost 10% increase year-to-date.

After the recent moves, what are your expectations for markets?

As we have seen, gains from the "Trump trade" have been entirely reversed, highlighted by a significant underperformance of US stocks and the powerful rotation taking place. Despite this, some parts of the US equity market remain overvalued, and the correction is likely to continue in these areas.

European equity markets have come a long way in a very short time, and we could now see some stabilisation around current levels. A pull-back at this point could present opportunities from a long-term perspective. The case for a relative preference for Europe vs the US remains intact, as valuations are more appealing and the fiscal push could support earnings dynamics. In Asia, Chinese stocks have risen on the back of technology announcements, with internet, autos and telecoms leading the gains. The upside in China may be coming at the expense of US companies and, indeed, if the advance in Chinese tech continues, multiples in the US could come under pressure. Therefore, we could witness a continuation of the current rotation out of the US and into European equities.

On the fixed income side, recent market movements confirm the need to maintain an active duration approach. In our view, the very sharp rise in German yields may present a short-term opportunity, but the supply outlook has clearly changed. Bunds are likely to continue to underperform peripheral markets. Although we think the ECB will cut rates down to 1.75% this year, given the weakness of current growth, yield curves could steepen further due to supply and an improving medium-term growth outlook. In contrast, US yields have fallen sharply, particularly at the front end of the curve. 2y yields could fall further towards 3.75%, which is where we expect Fed Funds rates to bottom this year. But 10y yields are more likely to rise than fall from current 4.20% levels, given their high supply and despite the slowing economic growth outlook. As a result, yield curves could continue to steepen between the 2y and 10y. Finally, in corporate credit, we remain constructive on European investment grade credit, with financials in particular likely to see further spread tightening. Moving to the dollar, it is selling off despite high US inflation, risks to global trade from tariffs, and underperforming US equities. While uncertainty remains, we believe the current trend is backed by two key factors that inform our bearish outlook for the USD in 2025.

Loss of safe haven status: historical analysis of correlation dynamics (since 2020) shows that the USD loses its safe haven status when stock market corrections are driven by "lower growth" rather than "higher inflation". We believe this will be the environment moving forward in 2025 as economic risks are tilted towards the downside.

Improving sentiment outside the US: Sentiment outside the US is improving amid increased EU spending, a potential ceasefire in Ukraine and lower energy prices. This further challenges the strength of the USD. However, the lack of execution details on the German fiscal package and uncertainty regarding its growth impact are factors to watch, as they could increase volatility ahead.

While some good news may already be priced in (with the euro already approaching our original target of 1.10 by the end of 2025), high USD positioning and valuation, along with the potential for a bull steepening of the US yield curve, indicate that the USD has room for a correction.

Overall, we think it is important to maintain a flexible and vigilant stance on duration as yields could move fast in a short period of time. Select government bonds, along with commodities such as gold, also offer diversification during economic and geopolitical uncertainty. At the same time, for risk assets, investors should consider rotation opportunities outside of expensive segments towards attractively priced areas that still offer robust earnings prospects. Thus, a well-balanced stance is crucial at this stage.

Following the recent bull run in European equities, we may see some stabilisation. Any pullback could present opportunities, especially if earnings expectations improve.

Updated views on the main asset classes compared to last month and the start of the year