Summary

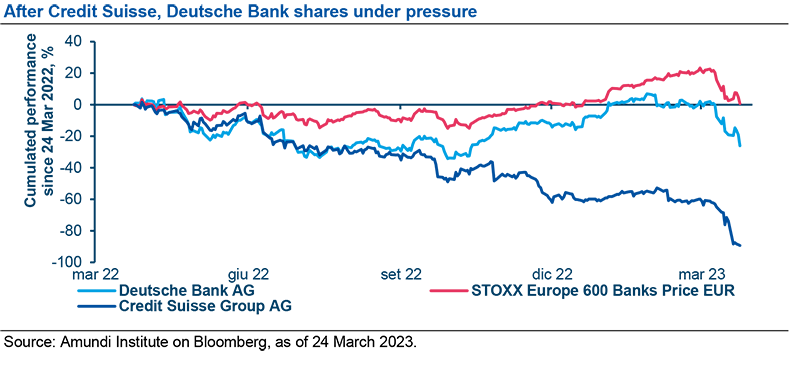

- Uncertainty in markets continued at the end of last week, with additional volatility in the banking sector and Deutsche Bank experiencing pressure in particular. In an attempt to calm markets down, ECB President Christine Lagarde reiterated the strength of the European banking sector, while German Chancellor Scholz also said that Deutsche Bank appears profitable and there is no reason to worry.

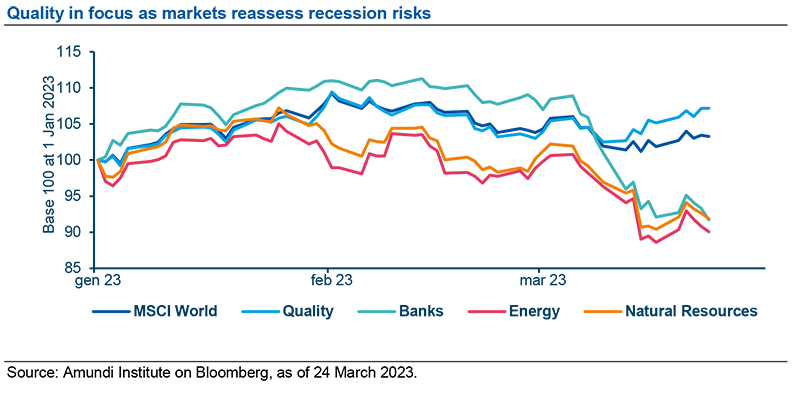

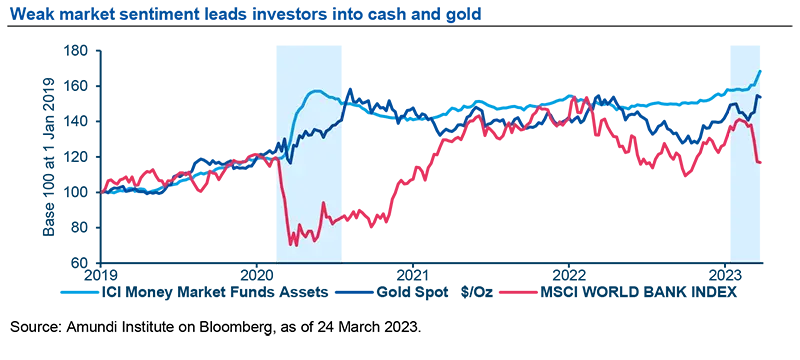

- Markets appear to be mostly driven by rising recession fears at present, following a strong start to the year amid excessive complacency; however, we see little change in terms of the fundamentals in comparison to previous weeks. Bank stocks are not the only ones being heavily impacted. Energy and basic resources stocks, as well as oil prices, have also taken a hit. On the opposite side, investors have moved towards gold, money markets and government bonds in a search for safety.

- While we see credit growth continuing to decline, we do not expect to see a credit crunch in Europe. Importantly, European corporates and households are not carrying excessive leverage. European banks have plentiful capital and liquidity to support the real economy, so we expect them to remain open for business and to continue extending loans to credit-worthy customers.

- European banks’ fundamentals are solid and banks, including Deutsche Bank, have capital and liquidity levels above regulatory requirements. We also note that the ECB and other central banks have provided explicit reassurance that they stand ready to address any liquidity shortfalls in the system. In addition, all European regulators have reassured bank investors that they would respect the capital hierarchy in the event of any resolution or merger, confirming that the Credit Suisse episode was an exception. Within the sector, we continue to prefer retail banks with stable, diversified deposit bases that are able to generate high levels of profitability and cover their cost of capital. In a higher interest rate environment, where the market is more discerning about business models, the ability to deliver sustainable profits will be increasingly important.

- In this uncertain backdrop, as markets reassess the economic outlook, we reiterate the need to maintain a cautious investment stance. Investors should seek a balanced approach with a focus on government bonds, which are once again acting as an equity diversifier, and gold. In equities, having a tilt towards quality is key in the current environment. Quality stocks are those with low leverage, reliable and stable earnings and strong balance sheets. Cyclical areas (such as banks, energy and basic materials) will likely continue to be exposed to a weak economic outlook and therefore remain under pressure until more clarity is re-gained. This will open entry opportunities later in the year.

Do you see a credit crunch risk in Europe that could harm the economic outlook?

We see a continuation of declining credit growth which is consistent with monetary tightening, but no credit crunch.

No. We see a continuation of declining credit growth which is consistent with monetary tightening, but no credit crunch. Most European banks have plentiful capital and liquidity to support the real economy: We expect them to remain open for business and to continue extending loans to creditworthy customers. European banks are not lumbered with weak assets that would pose challenges to capital or liquidity levels. Those that are experiencing declines in asset prices all have capital levels well above regulatory requirements. Moreover, European corporates and households are not carrying excessive leverage.

Regarding the macroeconomic implications, as we had already lowered our GDP growth forecast for the Euro area following the US banks and Credit Suisse episodes, we believe that our below consensus forecasts are now conservative enough, that said the new stress over Deutsche Bank means that risks are now a bit more tilted towards the downside.

In detail, we maintained our Euro Area 2023 GDP growth forecast at 0.3% (notably because Q1 will probably be less weak than initially thought, although still weak), but reduced our 2024 projection from 0.9% to 0.7% as a result of more subdued growth in H2 2023. Aside from the unfolding banking stress, the Euro area economy is caught in a tug-of-war between opposite forces, where the positives from lower energy prices and China’s reopening are slightly offset by the incoming US recession.

We have also revised our inflation outlook for the Euro area: on average, lower energy prices, both current and expected according to our scenario, will bring 2023 headline inflation slightly lower and slightly “faster” (with downward “jumps” due to base effects between Q1 and Q2, and between Q2 and Q3). Our 2024 inflation projections remain overall stable in a range above 2%. It must be noted, though, that the expiry of some of the special measures related to the energy crisis implemented at a country level may generate upside risk to our forecast in 2024 for some countries, as mentioned also by the ECB.

Regarding the ECB, while market expectations of the terminal rate are very volatile, we maintain our expectation that the rate peak will be at 3.5% (deposit rate).

We have seen pressure mounting on Deutsche Bank in the market: what is happening?

Share price action has been volatile due to concerns about the liquidity and capital situation of the global banking sector post the SVB and Credit Suisse episodes, but the European banking sector overall is solid.

Market confidence in the banking sector continues to be shaken against a backdrop of central bank tightening and the instability of US regional banks. Share price action has been volatile due to concerns about the liquidity and capital situation of the global banking sector post the SVB and Credit Suisse resolutions. Also, due to a rise in recessionary expectations over the last few days, there has been more focus on asset quality risks. The market is therefore worried about which banks in Europe could have potential vulnerabilities.

Regarding Deutsche Bank, sentiment had recently improved towards the group following a period of de-risking; the market did previously have some concerns in 2016/2017 when the franchise was weaker. However, Deutsche Bank is now on a fundamentally stronger footing after successfully restructuring its businesses and settling legacy litigation cases. Despite these achievements, the cost of insuring the bank’s bonds against a default (CDS spreads) has recently widened, which has started to weigh on the share price.

What is the outlook for the bank and how do we expect EU regulators to deal with the crisis?

The ECB and other central banks (BoE) have provided explicit reassurance that they stand ready to address any liquidity shortfalls among European banks.

Credit Suisse had viability and profitability challenges as it was struggling to turn around its investment bank franchise. On top of that, it was one of the banks with the lowest amount of insured deposits in the sector (c. 15% of total). The set-up and strength of Deutsche Bank are much better – the group is profitable, while its liquidity is very robust with a loan-to-deposit ratio of 78% at December 2022 year-end (vs Credit Suisse’s 113%) and significant liquidity reserves. Moreover, we would expect the group to benefit from a more loyal, stickier diversified depositor base compared with Credit Suisse, as a greater proportion of Deutsche Bank’s deposits fall under government guarantees.

On the capital side, the group’s CET1 Ratio was strong at 13.4% as at Dec 22 while regulators have approved buybacks, which would not be allowed if they were not comfortable with its capital or liquidity profile.

Deutsche Bank actually redeemed €1.5 billion of Tier 2 subordinated capital on Friday 24th March, which required regulatory approval. Again this would not have been granted if regulators had reservations about the institution’s balance sheet.

Some of the latest market concerns appear to be focused on DB’s Commercial Real Estate (CRE) exposure, which is an area of attention for the global outlook. The group had €33 billion of CRE lending in its investment bank as at Dec 2022 which is c. 7% of total loans; within this, US CRE accounts for c. €16.8 billion or c. 35% of the group’s CET1 capital which is broadly in line with the sector. While it is possible that the group will incur some provisioning on this exposure over the coming period, the quantum should be easily manageable and should not impact capital.

When it comes to EU regulators, the ECB and other central banks (BoE) have provided explicit reassurance that they stand ready to address any liquidity shortfalls among European banks. All European regulators have reassured banks’ investors that they would respect the capital hierarchy in the event of any resolution or merger. In our view, this will ensure that there is no contagion from the recent UBS takeover of Credit Suisse. It is true, however, that the market would like to see the €100k government guarantee threshold in Europe increased substantially to give more assurance on liquidity. Similarly, further coordinated action by global central banks to support deposit guarantees and funding would improve confidence and calm funding markets.

What could be the spillover effect on the banking sector and do you see any other areas of vulnerability?

The market moves clearly suggest not only a turn in sentiment around the banking sector but also a repricing of recession risk by equity markets.

The failure of Silicon Valley Bank was the first “real world” clear impact from the yield curve inversion and the following weeks highlighted other signs of stress caused by the rapid spike in rates. The inversion and steep rates indeed create problems for “carry trades” – i.e. investing in long-term, higher-yielding securities and financing them with short-term ones. This was a known risk for markets but one that, as time went by and no issues surfaced, some equity investors had started to price out.

Regarding the banking sector, the continued turbulence in the system is likely to increase competition for high-quality deposits and higher funding costs going forward, which will weigh on net interest margins and earnings. However, the market moves clearly suggest not only a turn in sentiment regarding the banking sector but also a repricing of recession risk by equity markets. The banks have not been the only heavily affected area of the market: energy and basic materials stocks, as well as oil prices, have also taken a large hit. This repricing of recession risks occurred after a period during which many market participants were positioned for a “no landing” scenario, i.e. that raising rates would have little negative impact on the economy.

Nonetheless, systemic risks should not be anyone’s base case and markets are not pricing in a systemic event. Markets are still marginally positive year-to-date and are simply shifting from pricing a “no” landing / recession to pricing “a” landing / recession. As always with equity markets, the starting point is very important. We see these pricing dynamics as being more in line with fundamentals than the excessively optimistic pricing in mid-February.

What could be the optimum strategies for trying to protect portfolios from current market volatility?

It is important to bear in mind that little has changed in terms of fundamentals during the last few weeks.

The issue markets face is one of a confidence shock and not a credit shock. While negative sentiment can have a powerful impact, especially in sectors where confidence by customers and investors is as important as it is for the banks, it is important to bear in mind that little has changed in terms of fundamentals over the last few weeks. The one change is that on margins we should expect tighter credit conditions and, consequently, a higher cost of capital and weaker economic activity. However, these are largely not new information, as they are a return to pricing in an economic downturn which had already been priced in during the second half of 2022 but had partially been priced out. This could mean that after some calm returns to markets, we see equities in a better position than before the turmoil. However, until we have more clarity over the magnitude of the economic and earnings downturn, as well as on potential sentiment-driven problems in other banks, we could continue to see sharp volatility and caution is needed for now.

Across equity portfolios, the key protection mechanism in our view is a preference for quality, i.e. stocks with low leverage, reliable and stable earnings, etc. Having a portfolio tilted towards quality stocks across all sectors is key in the current environment. In addition, some cyclical areas, which are highly exposed to a recession such as banks, energy and basic materials, are likely to continue to see volatility until some clarity is re-gained. In the banking sector, we continue to prefer retail players with stable diversified deposit bases, that are able to generate high levels of profitability and cover their cost of capital – in a higher interest rate environment, where the market is more discerning about business models, the ability to deliver sustainable profits will be increasingly important.