Summary

This article summarises some of the key findings of a recent Amundi Investment Institute paper, focusing on the role of real assets and inflation protection throughout the retirement accumulation phase1.

We encourage you to read the full working paper here:

Introduction

Retirement used to be a simple arithmetic problem: work, save a portion of your income, invest in a mix of stocks and bonds, then spend down the nest egg. But rising life expectancy, persistent inflation episodes, and a changing investment landscape have made that arithmetic far more complex. This research reframes retirement planning as a continuous lifecycle problem — one that links the accumulation of wealth, the preservation of purchasing power and the practical realities of market frictions. It combines extended theoretical models with empirical analysis to argue that traditional stock–bond glide paths can be improved.

The traditional glide-path approach

For many investors and plan sponsors, target-date funds and simple glide paths — gradually shifting from equities into bonds as retirement nears — have been the solution. Classic models predict a decreasing exposure to risky assets across the lifecycle, with younger investors able to tolerate higher allocations because of a longer time horizon and substantial human capital (put differently, younger investors have a relatively high future earning potential compared to older members).

Within this lifecycle, going beyond traditional equity and bond allocations can yield significant improvements: incorporating real estate, infrastructure, private equity and private debt into glide paths changes the de-risking trade-off. While there is no onesize-fits-all approach to integrating real assets, plan members can capture several benefits such as diversification, inflation linkage and an illiquidity premium, improving long-term outcomes while still allowing a disciplined, staged de-risking as retirement approaches. This is to say: incorporating real assets into the lifecycle can serve as an extension of the traditional approach.

Impact of including real assets

Including real assets materially alters the risk return profile of pension accumulation strategies in ways that matter directly for retirement adequacy.

Expected terminal wealth increases and downside outcomes improve. Real assets introduce return drivers that differ from public equities and nominal bonds and often offer an illiquidity premium. Over long horizons these features shift the distribution of final wealth to the right — raising median outcomes and strengthening results at the 5th–10th percentiles that matter for conservative cohorts. The impact on performance is substantial: when real assets are included in a global calibration, we estimate an annualised performance uplift of about 164 basis points; a mixed public/private approach delivers an intermediate gain of 87 bps. In our Eurozone calibrations the uplift can be larger — reported up to 190 bps — materially increasing the probability of meeting reasonable retirement objectives.

The probability of meeting retirement goals increases. When real assets are added to a multi asset glide path, we find a clear rise in the probability that a plan will achieve realistic replacement rate or real return targets. The improvement is concentrated in the lower tail of outcomes, so members most vulnerable to shortfall benefit most. This impact is substantial: our analysis shows some mixed strategies reach success rates2 in the mid to high 90% range versus substantially lower rates for public asset only universes.

In addition, real assets support explicit inflation management and align accumulation with liability‑driven thinking. Many real‑asset cash flows (rents, tolls, contractual escalators, long‑term service revenues) are linked — directly or indirectly — to price levels, making these instruments natural components of a liability‑hedging portfolio. In the context of inflation protection, investors should prioritize notably infrastructure and real estate.

When we model inflation explicitly, the optimal accumulation allocation decomposes into a performance portfolio plus a liability‑hedging portfolio. For pension funds this implies that integrating selected real assets into accumulation glide paths is an effective method to preserve members’ real purchasing power. Integrating these real assets can help preserve real purchasing power in the long run, but hedging is never perfect, particularly in the short run. We also find these benefits remain material after accounting for transaction costs and liquidity constraints, provided illiquid exposures are managed across the lifecycle (ramped up early and phased down well before retirement).

Implications for pension funds

Including real assets in a pension fund’s accumulation strategy offers a clear path to stronger retirement outcomes — but there exists a need to treat this as an integrated item within the lifecycle, not a single allocation line in a spreadsheet. Going beyond public equities and bonds brings different return drivers, partial inflation links and an illiquidity premium. Those features can lift median outcomes, tighten the downside and raise the probability that members will reach realistic replacement rate targets. Yet they also introduce distinctive operational risks. The practical question for trustees and investment teams is therefore not whether real assets are valuable — they are — but how to include them without creating new vulnerabilities at the point when members need access to their savings. While there are many considerations at play when integrating private assets, three pillars should be kept in mind.

First, there exists a need to redesign the glide path. A glide path that once simply dialled equities down in favour of bonds can evolve into a broader multi asset schedule. Younger cohorts, with long horizons and steady contributions, can accept staged illiquid exposure to capture long term premia; older cohorts need earlier phase downs and larger liquid cushions.

Second, liquidity management is key. Private markets are illiquid by design; without disciplined liquidity rules they can force fire sales at inopportune times. Defining ramp up and run off windows, setting a conservative retirement age cap on illiquid exposure and holding a dedicated liquid buffer sized to cover near term liabilities, distributions and potential capital calls during the run off can help manage liquidity risk.

Third, treating costs and structure as central is crucial, not peripheral. Gross private market returns can be misleading if higher fees, transaction costs and valuation lags are ignored. Pension plans should opt to model outcomes on a net of fees, net of transaction cost basis and stress those assumptions in low return and high inflation scenarios.

At a governance level, this approach demands close oversight and clear communication. Trustees can opt to approve cohort specific glide path parameters, liquidity policy and conservative net return assumptions; an implementation committee should manage manager selection and operational readiness. Members deserve straightforward explanations: why illiquid assets are being used, what buffers protect their access, and how this shifts the odds of a better retirement.

For practitioners, the implication is clear: although implementing multi-asset glide paths that incorporate real assets can be operationally complex, the substantial gains in risk-adjusted returns and retirement security make this evolution worth considering.

2026 Outlook

Main Convictions for 2026

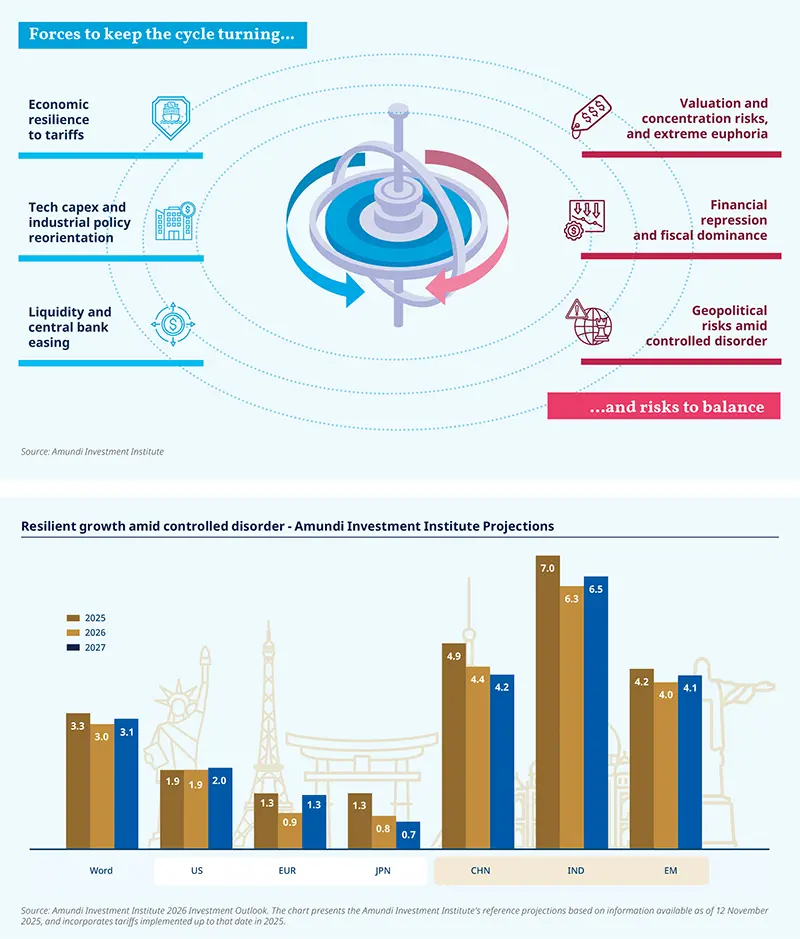

2026 will be a year of transition as the global economy adjusts to a regime of “controlled disorder”. AI-driven capex, industrial policy shifts, greater business resilience to tariffs and likely monetary easing should sustain activity and extend the cycle further. Investors will have to weigh equity concentration and valuation risks, rising public debt, structural geopolitical frictions, and sticky inflation from reshoring and the energy transition. Global GDP growth is set to moderate at 3% in 2026 but remain resilient.

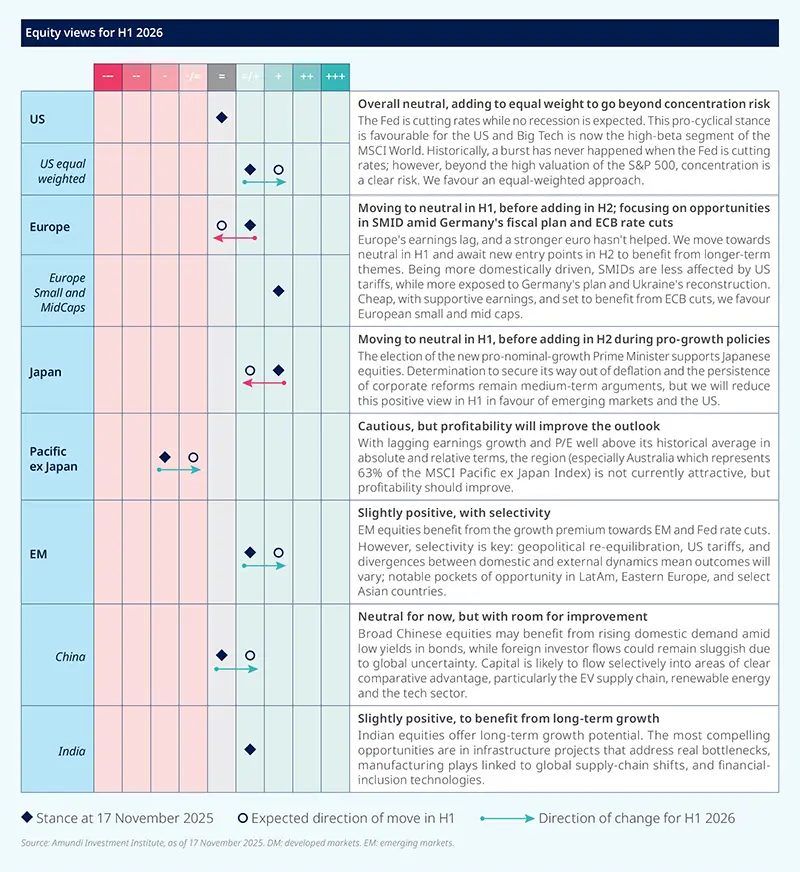

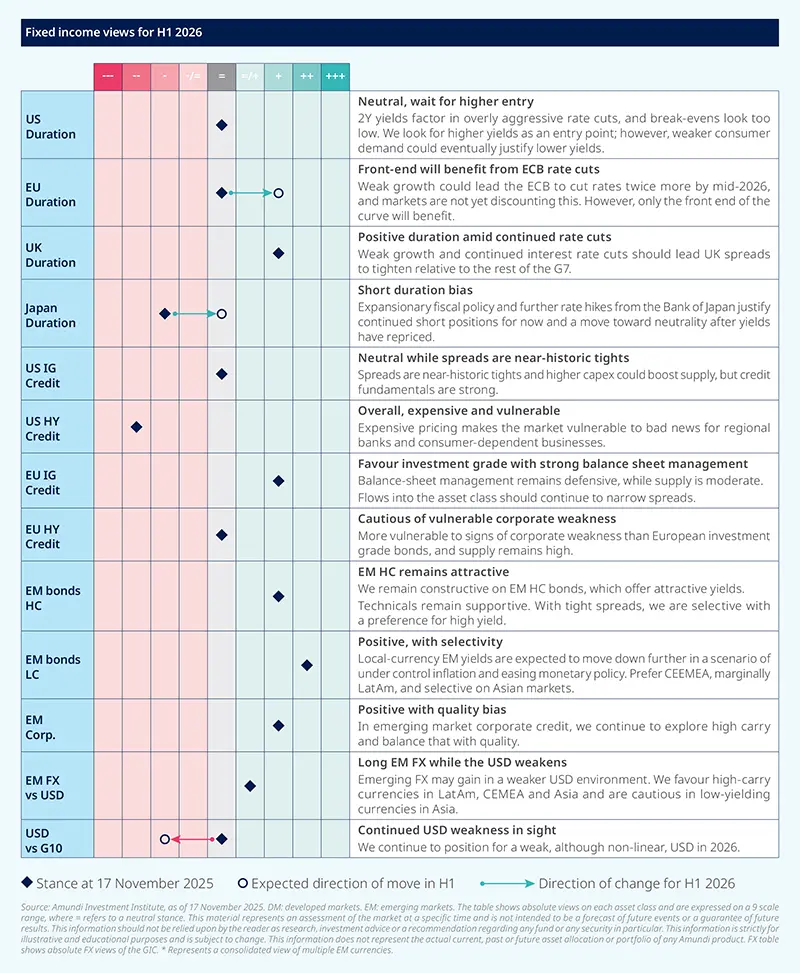

“Controlled disorder”, where governments and businesses seek to maintain trade and global level. Our base case for 2026 is mildly pro-risk, supporting equities and investment grade credit. With significant risk stemming from vulnerabilities and valuation excesses, portfolios should combine growth exposure with hedges — gold, selected currencies (JPY, EUR), and inflation-linked instruments — and a greater but selective allocation to private markets. Private credit and infrastructure are in the spotlight to improve income and inflation resilience, and to benefit from structural themes such as electrification, reshoring, AI and robust demand for private capital, particularly in Europe.

The tech capex cycle remains central, but the tech theme is broadening beyond the US to China, Taiwan, India, Europe and Japan. Concentration risk in US mega caps and the possibility of US exceptionalism fading argue for geographic and sector diversification. We favour combining AI exposure with defensive and cyclical themes: financials and industrials set to benefit from higher investment, defence names tied to security spending, and green transition stocks linked to electrification and grids.

Policy choices will drive markets. US debt is unprecedentedly high, which adds risks to the Fed’s independence at a time when inflation is still above target. This balance of forces should keep US yields range-bound, favouring a tactical duration stance and inflation-protection. In 2026, European bonds remain a key call for global investors, with a focus on peripheral bonds and UK Gilts. In credit, we like euro investment grade, with solid fundamentals and are cautious on US high yield, which is exposed to regional banks and is consumer dependent. We believe the USD will continue to weaken, but the journey will not be linear.

Emerging Markets and Europe are areas where short-term opportunities meet long-term themes. The EM rally has room to continue into 2026: a weaker dollar, potential Fed cuts, and the EM growth edge support EM bonds for income and selective EM equities. Europe’s appeal should increase throughout the year as reforms combined with defence and infrastructure spending turn into tangible opportunities, particularly in euro credit and smalland mid-cap equities (with a focus on domestic trends and compelling valuations).

Resilient growth amid controlled disorder

We are in a transition – not a downturn – driven by AI capex, defence and industrial policies that reallocate capital and reshape trade, raising costs and moderating activity without collapsing globalisation.

It’s unclear if AI productivity will offset demographic headwinds, although US IT investment is cushioning domestic demand. High public-debt pressures are tempered for now by tax cuts and higher defence and infrastructure spending.

Growth is resilient but unlikely to accelerate sharply, while inflation risks are becoming more structural due to reshoring and the energy transition. Concentration and stretched valuations are key risks to manage.

Market implications:

Strong focus on diversification, mildly positive for risk assets, weaker USD.

Fiscal-led upside/easing geopolitics

Easing geopolitical tensions, tariff relief, higher fiscal-driven investment in the US and Germany, deregulation, QE and broader signs of AI-led productivity gains are factors that could lift sentiment and improve the outlook.

Market implications:

Positive for equity and credit, negative for government bonds.

Political/financial shock

Political instability, a de-anchoring of inflation expectations, tightening liquidity, credit events, or earnings/capex disappointments in a concentrated, expensive market could trigger a downturn.

Market implications:

Negative for risky assets and long-dated govies; positive for gold, commodities, and linkers.

Asset class views

1. Retirement Accumulation Strategies with Real Assets and Inflation Risk; Bruder, Roncalli, Schittly, Xu; Amundi Investment Institute; October 2025

2. “Success rate” means the probability that the strategy attains a specified real return or replacement rate target by retirement.

| A spirit of endurance has characterized the market rally of the past year. |

Read more