Summary

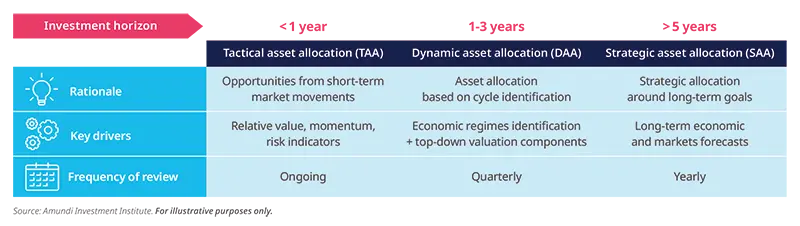

Following the unprecedented period of excess liquidity from central banks after the Great Financial Crisis, the post-Covid resurgence of inflation has ushered in new long-term paradigm shift. Economic cycles are more unpredictable, inflation volatility is increasing, and economic fluctuations may become more pronounced, exacerbated by erratic policies. Understanding the economic landscape over the next one to three years is crucial also for long-term investors, such as pension funds, who can capitalise on medium-term allocation opportunities. By considering growth, inflation, monetary policy, and leverage, we can identify regimes and discern return patterns which are the base of our Dynamic Asset Allocation (DAA) framework.

This combines our economic backdrop models (Advanced Investment Phazer – AIP – and Inflation Phazer) with top-down valuation of fair values for each asset class. The former allows assessment of the probabilities of upcoming economic financial cycles and inflation regimes and inference of the expected return distribution for the main asset classes, while the top-down valuation of fair values for each asset class helps gauge price action. As valuation discrepancies decrease over the medium to long term, this is a key variable to assess future return potential. Undervalued assets can enhance the potential for positive returns, while overvalued assets may restrict upside opportunities. By combining these two components, we get our three-year expected returns pattern for each asset class and how they differ from a long-term average, with their implications for asset allocation.

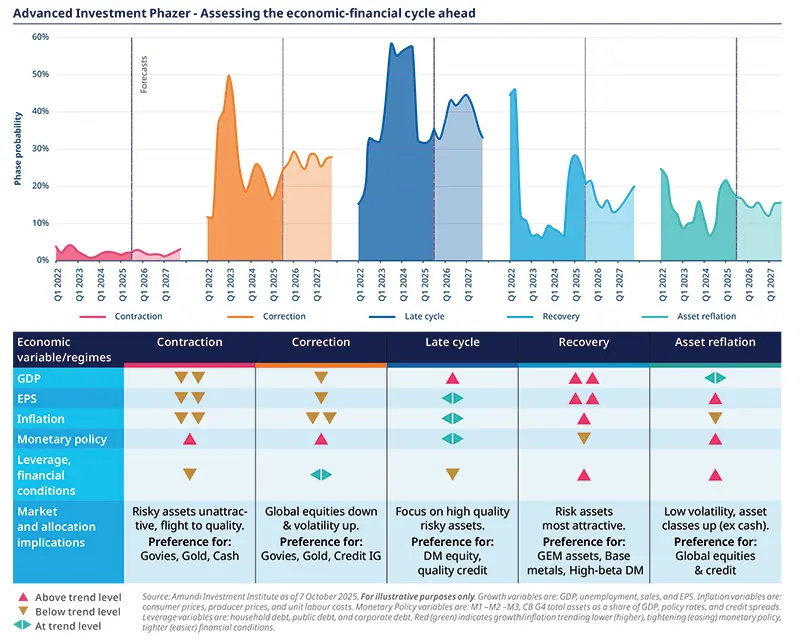

Advanced Investment Phazer

We have developed a disciplined approach where regimes are identified by a clustering algorithm applied to a set of macrofinancial variables split over four dimensions: growth, inflation, monetary policy, and financial leverage. We use this dataset (starting in 1875) to identify the most relevant recurring five regimes – correction, contraction, recovery, late cycle, and asset reflation – and screen the overall cross-asset universe to detect which allocation models would have worked best during the various regimes. The Amundi Investment Institute’s AIP’s goal is to assess a financial regime’s likelihood of persisting over a certain time horizon and assess the asset allocation model that should be favoured in relation to the forecasted financial regime probabilities. We found that asset classes and sectors display different behaviours during each regime, which investors should consider within their portfolio allocations. As a model output, we can identify different asset allocations depending on the probability distribution, favouring the combination of assets that is expected to perform best in the central scenario deemed the most likely to materialise.

What are the current signals? For 2026, the Late cycle regime remains the most likely despite rising probability of adverse regimes (Correction and Contraction), due to high geopolitical uncertainty. Conversely, the probability of more positive regimes (recovery and asset reflation) decreases.

Inflation Phazer

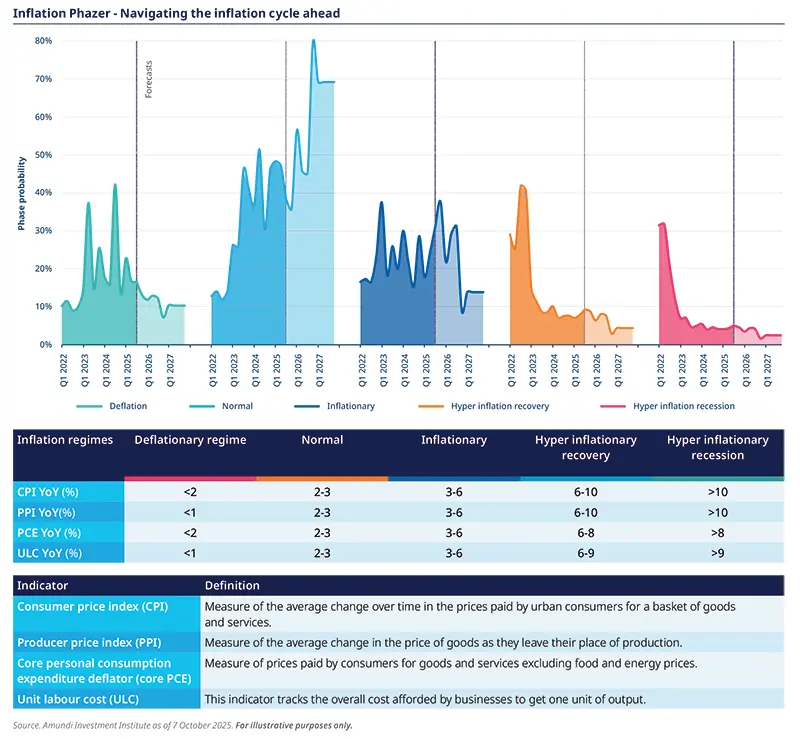

Inflation trends tend to follow economic growth. They drive both monetary policy and financial markets and define debt sustainability. In addition, financial markets and inflation-related instruments encompass anticipatory mechanisms. Hence, an ex-ante identification of inflation regimes is needed to fine-tune asset allocation choices, both tactical and strategic, as inflation regimes tend to endure over time. Assessing the evolution of the probability for alternative regimes is often the best indicator for capturing a change in expectations. As such, we developed an approach to the taxonomy of inflation regimes, in which we cluster price dynamics by building on US data starting from 1960. We use this dataset to identify the most relevant recurring inflation regimes and screen the overall cross-asset universe to detect which asset allocation models would have worked best during the various regimes.

The Amundi Investment Institute’s Inflation Phazer’s goal is to assess an inflation regime’s likelihood to persist over a certain time horizon and assess the asset allocation model that should be favoured in relation to the forecasted inflation regime probabilities. We found that asset classes and sectors display different behaviours during each inflation regime which investors should consider within their portfolio allocations. We can identify different asset allocations depending on the probability distribution, favouring the combination of assets that is expected to perform best in the inflation scenario deemed the most likely to materialise.

What are the current signals? The effect of US tariffs should exert upward pressure on US prices until end-2025. US CPI should peak in Q4 at around 3.5%, making the Inflationary regime (3-6% YoY) the most likely for this year. In 2026, the one-off effects induced by tariffs should fade and -- considering the slightly below-potential US growth we are projecting for next year -- the macro environment should lead to a return to the Normal regime (2-3% YoY) from Q1 2026. As inflation data has mostly underwhelmed expectations since Liberation Day, the risk of the extreme Hyperinflationary regimes over the next year has dropped.

To sum up, the combined assessment of our two Phazer models points to a still pro-risk stance, but mindful of high valuations in some segments, calling for diversification across the equity spectrum and favouring investment grade over high yield bonds. In addition, the inclusion of commodities may prove helpful for navigating the inflation risk.

| A spirit of endurance has characterized the market rally of the past year. |

Read more