Summary

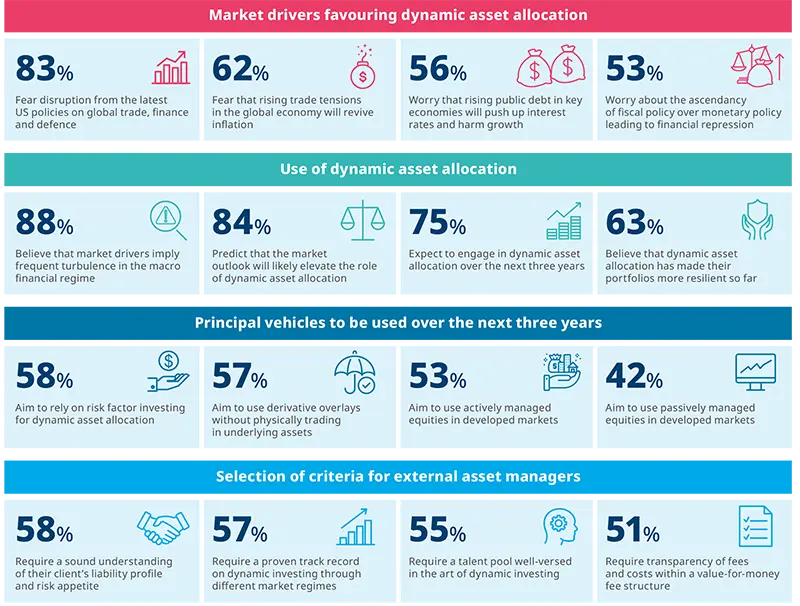

Since Covid, pension investors have entered a new regime of controlled disorder: a multipolar world reshaped by the tech revolution and fiscal divergence. Inflation risks have become more structural. High volatility and asset mispricing have become widespread. Recent turmoil on the geopolitical landscape, in particular, has challenged the role of strategic asset allocation. It worked well in the long bull run following the Great Financial Crisis marked by stable economic growth, low interest rates, low inflation and low market volatility. However, the steep rate hikes to curb inflation led dynamic asset allocation to gain traction with investors in their desire for a more nimble approach. The 2025 Amundi-CREATE global pension survey examines how pension investors define and approach dynamic asset allocation, looks at the outcomes, and explores what’s in store for the future.

A rising role: From tactical deviations to portfolio guardrail

Dynamic Asset Allocation (DAA) gained momentum among pension investors when key central banks started their aggressive rate hiking cycle during 2022-23. These actions brought the long era of suppressed volatility that had favoured Strategic Asset Allocation (SAA) to an abrupt close. The trend received fresh impetus from a raft of new policy measures in the US, ranging from tariffs fuelling inflationary fears to big tax cuts forcing up interest rates in the future.

73% of respondents now use DAA to varying extents to achieve their investment goals. For small and medium-sized pension plans, this often means outsourcing to external asset managers via multi-asset dynamic funds or outsourced CIO models. By contrast, larger plans, with the right governance and expertise, are moving towards the total portfolio approach, using dynamic pivots over a wide opportunity set to meet their funding goals (more detail on page 5).

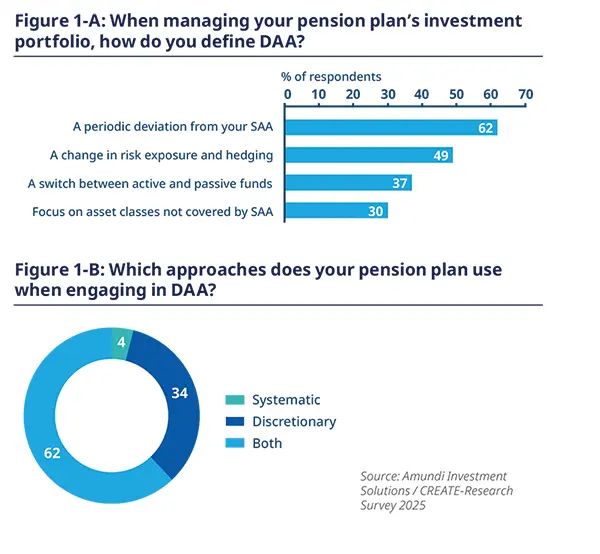

For 62% of survey respondents, DAA is seen as a pragmatic periodic deviation from SAA in response to changing macro financial regimes, market conditions and asset valuations (Figure 1–A). This approach is as much about mitigating newly emerging risks as it is about profiting from short- to medium-term opportunities from market dislocations.

Both allocation approaches are seen as largely complementary: One focuses on asset mix and overarching goals within a disciplined framework. The second provides portfolio guardrails during periods of market upheaval. A majority of respondents (62%) blend both approaches, while 34% rely on discretionary calls (Figure 1–B).

For smaller pension funds, DAA tends to be seen in a narrower context; as an automatic switch in overall risk exposure and portfolio hedging (49%), for liability-driven investing (LDI) for Defined Benefit plans or target date funds for Defined Contribution schemes; as a switch between active and passive funds (37%); or as a vehicle for new asset classes not covered by SAA (30%).

Positive tailwinds for dynamic asset allocation in a new era

A number of market drivers have accelerated the arrival of a radically different new era, defined by geopolitical upheaval, policy dilemmas and structural trends such as ageing demographics and rapid technological advancements.

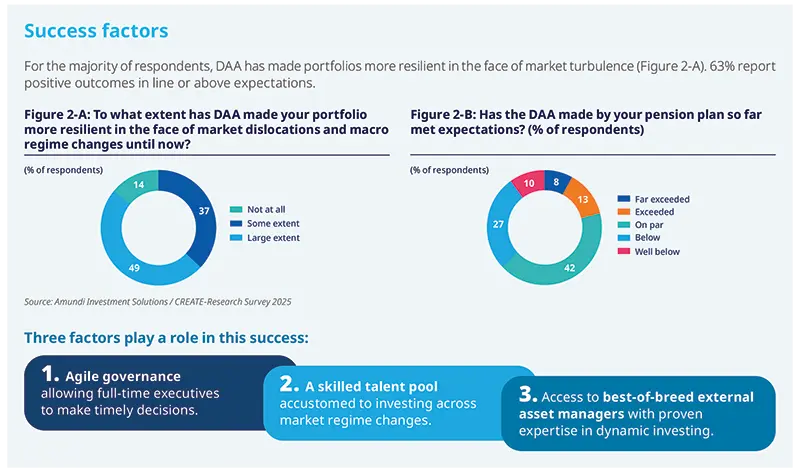

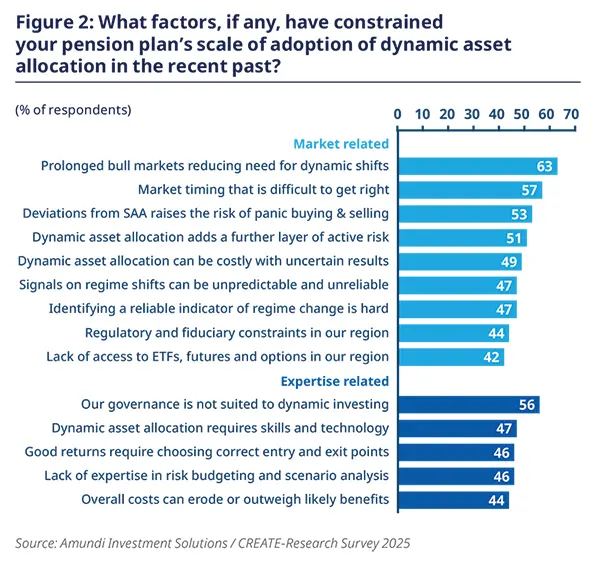

In the preceding regime of 2009-2021 with its prolonged bull market and mostly subdued volatility, several factors constrained the use of DAA, either related to market behaviour or to the required expertise capitalise from it. The prevailing consensus had been that SAA was the more suitable approach while markets were less volatile (63%). DAA on the other hand, had come to be perceived as ‘market timing’ (57%): a device for buying and selling securities based merely on short-term predictions about future changes in securities prices. Investors were also concerned about suitable governance (56%) and adding additional risk (51%) (Figure 2).

As capital markets move to a new regime and investors seek to cope with interconnected, nonlinear risks, DAA has become a vital tool and one that is likely to grow in popularity until the uncertainty recedes. This volatile environment is expected to persist with 80% of respondents believing US policies to rewire global architecture on trade, finance and defence will be the main driver of capital markets over the next three years.

In this new market context, pension funds have moved from managing risk to managing uncertainty. Caution is the new watchword, reflected in their risk tolerance. The bulk of respondents report their risk tolerance as being conservative (14%), moderately conservative (23%) or moderate (52%). At the other end, the numbers are decidedly low for moderately aggressive (10%) or aggressive (1%).

Over the next 3 years, 59% of investors anticipate a rollercoaster ride in the markets, and 56% see a need to protect portfolios from sizeable drawdowns.

In the coming three years, pension investors largely expect market drivers to create favourable conditions for DAA: 18% said to a large extent, 57% said to some extent, while 25% said not at all.

How do pension funds deploy dynamic asset allocation?

The primary goal driving the implementation of DAA is risk minimization — particularly limiting severe losses that can permanently erode capital — rather than maximizing short-term returns. 58% of respondents emphasize downside protection, with upside capture secondary (34%).

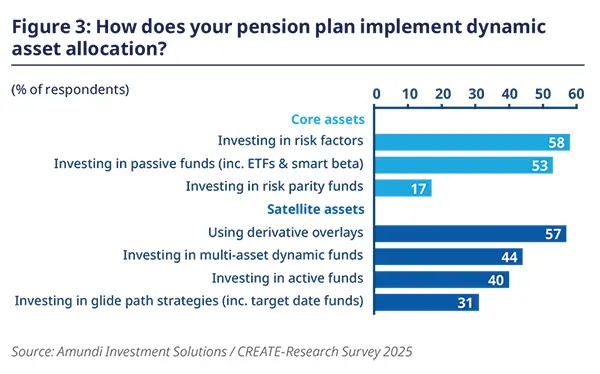

As with SAA, the familiar core–satellite model is being reshaped by blending strategies to implement DAA. A active-passive separation remains. Some asset classes are typically best accessed via low-cost index funds in markets that are informationally efficient and highly liquid. Other asset classes, in contrast, have the potential for excess returns in less efficient and more illiquid markets and are thus more suited to active style.

In the core portfolio, survey respondents currently deploy distinct strategies mostly relying on passive funds (Figure 3). The most popular uses risk factor investing (58%), followed closely by investing in passive funds and ETFs (53%).

For satellite assets, derivative overlays are the most popular approach (57%). They serve to hedge out various risks – such as equity, interest rate, inflation, currency and commodity – without deviating from asset weights in SAA while capturing any upside. Multi-asset dynamic funds (44%) are also common. These mix asset classes in a single vehicle to deliver all-in-one outcome-oriented solutions that aim to protect funding status. Active strategies are used by 40% of respondents and glide path strategies by 31%.

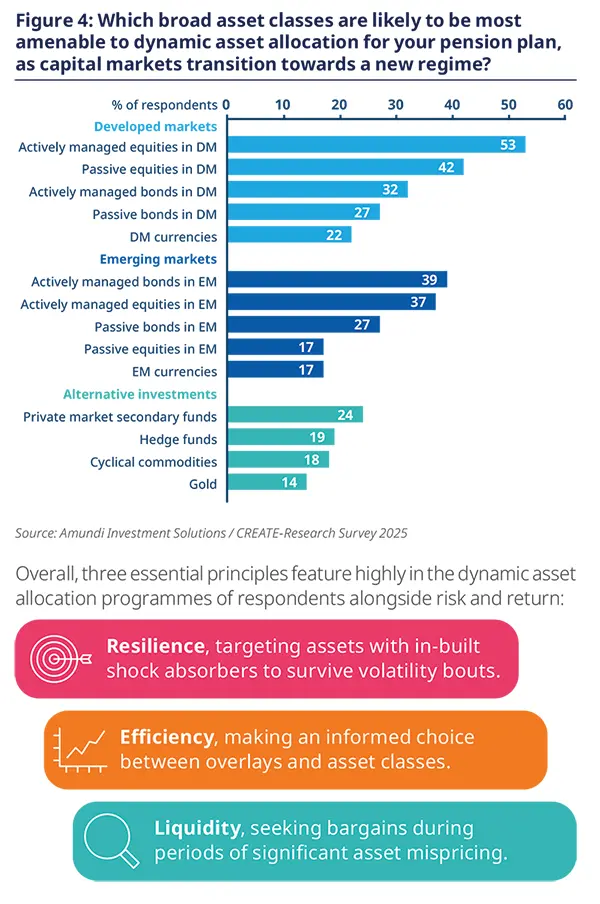

In terms of choice of asset classes for implementing DAA, (Figure 4), developed markets top the list, with actively managed equities (53%) and passive equities (42%). Developed market bonds are less popular, both actively (32%) and passively managed (27%). Outside traditional asset classes, interest for alternatives is muted, with private market secondary funds (24%) the most popular. Limited liquidity, high volatility or past performance are the key reasons for this.

Total portfolio thinking

In periods of rising geopolitical risk, the benefits of dynamic investing increase due to the greater scope for forecasting error in traditional models from flawed assumptions.

As pension funds seek more flexible alternatives to SAA, a total portfolio approach (TPA) is growing in popularity, particularly among larger schemes with strong governance frameworks. 18% of schemes state they do not use external asset managers, preferring to manage their dynamic allocations themselves. This approach requires nimble governance structures, robust scenario analysis, and strong collaboration among investment teams.

The role of overlays in dynamic investing

Overlays have gained prominence with the rise of dynamic investing among survey respondents. 66% state they play a somewhat or very important role in their dynamic investing programme. They offer faster and more cost-effective routes to asset classes without trading the underlying physical assets, and

may provide insurance cover that either protects the downsides or delivers the upsides, or both. These attributes are especially welcome during periods of heightened geopolitical uncertainty. They can also be used to manage transitions to new asset classes not covered by SAA.

For many survey respondents, overlays provide an agile, more cost-effective tool, preserving the disciplines of SAA without disrupting the entire portfolio. They serve to rebalance the portfolio to strategic targets and avoid transaction costs (54%) and to optimise cash utilisation with less upfront capital to reach strategic targets (49%).

For schemes with the necessary governance and expertise, overlays are used alongside other approaches and asset classes to adjust portfolios cost effectively (48%); or to engage in tactical asset allocation in a cost-effective manner in changing market conditions (37%).

There is a clear difference in emphasis between types of pension plans. In DC plans, the overlays mainly cover equities and currencies. In DB plans, the emphasis is on inflation, interest rates, volatility and tail risk. In both types, a blend of overlays are used to target multiple outcomes.

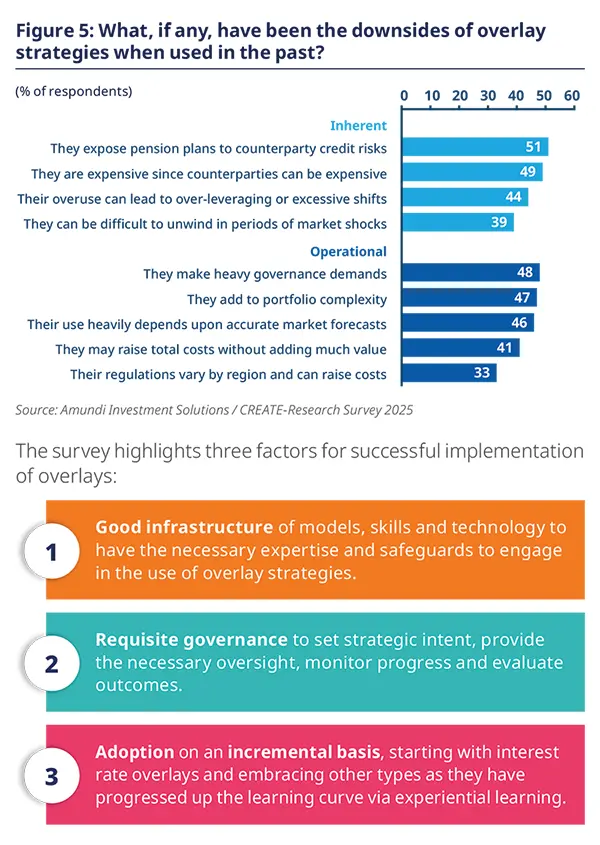

Overlays are likely to continue to play a significant role in DAA, but they are not without their limitations. Respondents cite the risks as; exposure to counterparty risk (51% - Figure 5); portfolio complexity (47%); heavy governance demands (48%); requirements for accurate and timely market forecasts (46%).

A TPA approach offers dynamic pivots across a wide opportunity set to meet funding goals with improved decision making, rather than just targeting excess returns. The responsibility for allocation decisions is passed from the governing board to the funds’ fulltime executives, who are able to look at the portfolio in its entirety. Funds adopting TPA report enhanced investment outcomes, with some noting significantly higher returns compared to static benchmark portfolios.

Raising the bar on manager selection

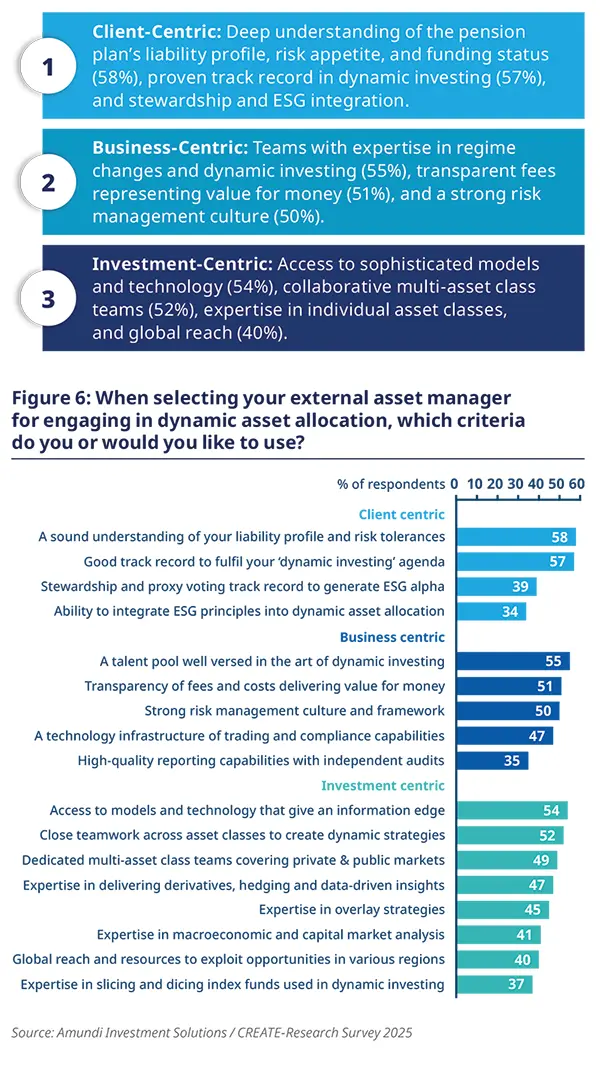

This advance into dynamic investing has resulted in more stringent manager selection criteria. Dynamic investing adds an extra layer of active risk for pension funds at a time when active managers have frequently failed to hit their benchmarks. A proven track record on dynamic investing has become vital, as well as evidence of capabilities that can meet pension funds’ dynamic investment goals. These manager selection criteria fall into three clusters (Figure 6).

The pension value chain is becoming more complex, but for now the division of labour is split between three principal activities; strategic oversight, advisory work and strategy execution.

79% of survey respondents’ define their own role as performing scenario analysis, setting strategy and providing the necessary oversight once the strategy moves into execution phase. The role of external pension consultants is skewed towards advisory activities (82%), while for 80%, external asset managers Function as executors of DAA in the marketplace.

Contributions from pension consultants are ranked as 13% made an excellent contribution, 31% were good, 37% were satisfactory and 19% were poor.

For external asset managers, 18% were rated as making an excellent contribution, 34% were good, 43% were satisfactory and 5% were poor.

Another trend is gradually emerging; strategic partnerships — 47% of respondents have begun engaging asset managers to some extent, not just as vendors, but as trusted advisors fully integrated into the fund’s investment decision process. 53% report good or excellent outcomes so far.

These partnerships require asset managers who have deep understanding of each client’s distinct needs and a proven track record of delivering outcomes consistent with dynamic as well as SAA. They are required to have experience of investing through changes in investment regimes to mitigate downside risks dynamically, especially during market turmoil.

Amundi-CREATE 2025 survey: Highlights

(% of pension plan respondents)

About the survey: each year, Amundi and CREATE interview pension plans to highlight insightful convictions for the year to come.

As market volatility has challenged the primacy of strategic asset allocation, dynamic asset allocation has been on the rise to protect

the downside and capture the upside. The 2025 edition aims to show how pension plans globally are using strategic and dynamic

asset allocation in tandem and asks four questions:

– How do pension investors define DAA and why is it currently on the rise?

– What have been the outcomes so far and which contributory drivers have been at work?

– Which approaches are likely to be used in DAA in the near future?

– What criteria are being used when selecting asset managers as pension plans deviate from their SAA?

The survey is based on 158 respondents Asia-Pacific, Europe and North America, collectively managing €2.9tn of assets.

Read more