Summary

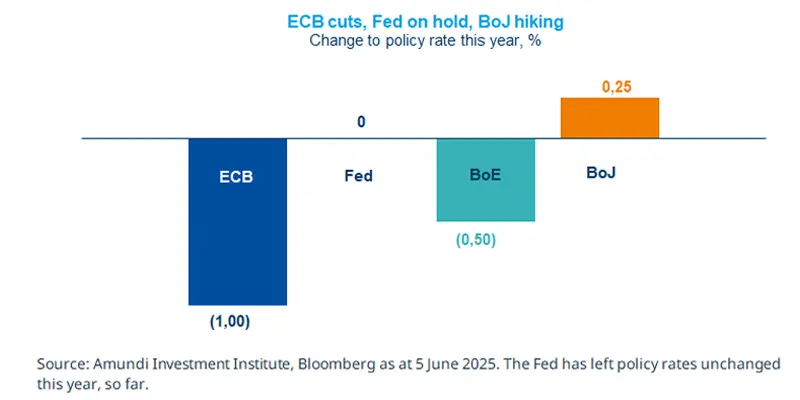

Policy decisions by global central banks are getting more nuanced, with the ECB staying on its rate cut path, the Fed in a wait-and-see mode, and the BoJ being the only major outlier.

The ECB cut rates in June but has not pre-committed to any path. It will consider inflation, trade war, and labour markets in its decisions.

While the Fed has stayed on hold so far this year, it is likely to resume rate cuts. The BoJ will continue to hike this year.

These divergences in policy making underscore the importance of keeping a global approach to fixed income.

The ECB reduced interest rates in June, bringing the cumulative easing to one percentage point (pp) this year. The bank also downgraded its inflation forecasts by 0.3 pp for this year and the next, primarily due to lower energy prices and a strengthening euro. We believe the ECB will remain on an easing path this year, provided inflation stays close to its 2% target over the medium term. It will also need to consider vulnerabilities stemming from US trade policies, and the impact of increased spending on infrastructure and defence on growth and inflation. In the US, the Fed is assessing the impact of import tariffs on inflation, whereas the Bank of Japan is likely to raise rates this year. In general, global central banks will remain vigilant regarding how large fiscal deficits are affecting bond yields, particularly for long maturities.

Actionable ideas

European bonds and credit

Decelerating inflation in Europe should be supportive of EU government bonds. In addition, robust economic growth paint a positive backdrop for quality EU credit.

European equities

In light of easing inflation and central banks in an easing mode, European equities may present attractive opportunities that are better priced. UK is another area of potential opportunity.

This week at a glance

Equity markets were mostly up on the week, thanks to the surprise Trump-Xi call which raised optimism about possible fresh trade talks. Government bond yields were mixed, while gold proved strong over the week after President Trump doubled steel and aluminium tariffs to 50%, supporting demand for safe-haven assets such as gold.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 6 June 2025. The chart shows main central banks’ official rates.

*Diversification does not guarantee a profit or protect against a loss.

*Diversification does not guarantee a profit or protect against a loss

Amundi Investment Institute Macro Focus

Americas

Tariff-related uncertainty weighs on ISM surveys

The manufacturing ISM index unexpectedly fell to a six-month low of 48.5 in May, marking the third consecutive month of contraction in the manufacturing sector. This highlights mounting uncertainty and cost pressures, driven by the US volatile trade policies. Also, the services ISM index dropped into contractionary area, falling to 49.9 in May, with price pressures intensifying to the highest level since November 2022. Respondents reported difficulties in planning due to tariffs uncertainty.

Europe

Eurozone composite PMI points to soft patch in Q2

Eurozone composite PMI dropped to 50.2 in May, remaining in expansionary area (above the 50 threshold). The index was weighed down by weak demand. The inflation indicator cooled, mostly due to falling costs and charges in the manufacturing sector. The data points to soft growth in the second quarter, due to trade-related uncertainty. We expect some stabilisation once the trade fog dissipates. Inflation does not appear to an issue for now.

Asia

RBI eases monetary policy more than anticipated

Reserve Bank of India (RBI) unexpectedly cut the Repurchase rate by 50bp against a consensus of 25bp. In addition, RBI announced a Cash Reserves Ratio cut by 100bp in four steps starting from September. The bolder-than-expected RBI action has to be meant as frontloaded easing. Indeed, the RBI turned its stance from accommodative to neutral and the room to ease further is now limited.

Key dates

9 June China CPI, PPI, and trade balance, Japan GDP | 11 June US CPI and core CPI, Japan PPI | 12 June UK GDP and industrial production, India inflation rate |