Summary

Our short-term outlook for the second half of 2025 highlights significant shifts in the global rewiring of trade and financial markets, alongside historic changes in tariffs and fiscal policy. These developments carry important implications for long-term investors, particularly pension funds, for which we see three key investment themes.

First, inflation remains a central theme. History shows inflation can be persistent and unpredictable, especially amid geopolitical tensions, shifting trade policies, and evolving fiscal stances. The impact of tariffs on prices is still uncertain, and with the Federal Reserve’s data-dependent approach, interest rate easing may be delayed. For investors, it will be key to review the fixed income allocation favouring investment-grade credit in Europe, actively managing duration and exploring opportunities in inflation linked bonds.

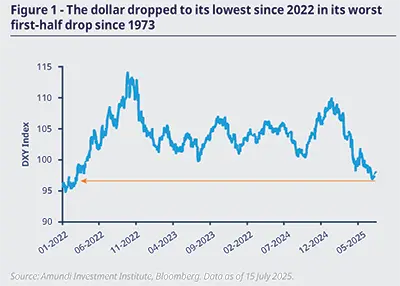

Second, we observe a structural shift in the US dollar’s role (Figure 1) and a likely moderation of US exceptionalism. The dollar’s traditional safe-haven status is challenged amid rising uncertainty over long-term Treasury yields, driven by growing deficits linked to recent fiscal policies. This environment calls for a reassessment of geographic diversification and currency exposures within portfolios.

Global investors have already started to reconsider their hefty US exposure and are looking at hedging currency risks. We believe this trend is set to continue, as we expect a weak USD trend moving forward due to high fnancing needs and reduced appetite from foreign investors.

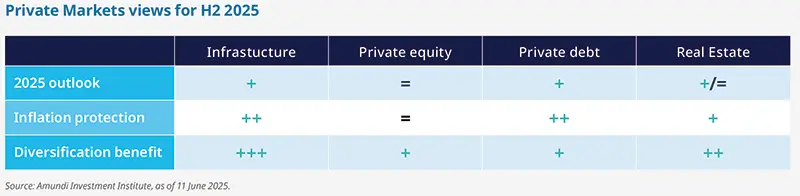

Finally, the shift toward alternative and private markets has accelerated in past years and demand is set to remain strong. With substantial fiscal stimulus in Europe and the US, alongside rising investment needs for strategic autonomy and the energy transition, private capital will play a vital role, but selection is becoming increasingly relevant. Infrastructure and private debt are, in our view, the most appealing asset class in the private market space.

Pension funds that anticipate and adapt to geopolitical and policy changes will be better equipped to fulfil their fiduciary roles, ensuring consistent, risk-adjusted performance for their members.

Main Convictions for H2 2025

Monica DEFEND | Vincent MORTIER Group Chief Investment Officer |

1.The toll of tariffs and fiscal policy on the US economy We expect US real GDP growth to slow to 1.6% in 2025, largely due to weakened private demand. Higher tariffs will raise prices, dampening consumer sentiment and spending, while uncertainty will weigh on investment. Although fiscal measures and deregulation may provide some relief, the impact is likely to be limited, with average tariffs around 15% (as per our base case) leading to economic losses and a temporary resurgence in inflation.

2. Higher geopolitical risks call for greater diversification A more contentious geopolitical environment, with the US administration contributing to rising tensions through tariffs and reduced commitments to European security. This could further unify Europe, with leaders recognising the benefits of collective negotiation as they seek to diversify trading partners through new trade agreements. The US–China relationship is set to deteriorate further, though both nations will seek to avoid escalation. In this environment, diversification away from US assets is set to continue, favouring European assets.

3. Asset allocation: mildly pro risk, adjusted with inflation hedges Despite the sub-par growth outlook, we do not anticipate an earnings recession, as businesses show resilience. This, coupled with the Fed's anticipated rate cuts, supports a mildly constructive asset allocation with inflation protection. Global equities favoured with a focus on valuations and pricing power, along with commodities, gold, and hedges against growth and inflation risks stemming from geopolitical uncertainty. Infrastructure investments can offer stable cash flows. Currency diversification will be crucial amid shifting correlations.

Investors will demand a higher premium for US Treasuries, amid uncertainty on trade policies, rising public debt, and substantial bond supply. In developed markets, long-term yields will remain under pressure. Central Banks cutting rates will continue to support short-dated bonds, driving yield curve steepening. Investors will seek diversification across markets, favouring Europe and EM debt. Continue to play quality credit, with a preference for euro investment grade (financial and subordinated credit). 5. For equities, tariff impacts will drive sector selection Equities may generate low single-digit returns in the second half, but rotations will continue. Europe’s appeal is likely to become a structural theme, favouring also small- and mid-caps, where valuations remain highly attractive. Globally, sector selection will be key. We favour domestic and service-orientated sectors to reduce the risk from tariffs, with a focus on themes such as US deregulation, European defence and infrastructure. 6. India and EM are winners from the rerouting shift Emerging market equities will be favoured in H2 2025, driven by recovering macro momentum and stabilising inflation. As US exceptionalism fades, India and ASEAN are emerging as key beneficiaries of the global supply chain rerouting. With a focus on domestically-orientated sectors, these markets are not just manufacturing hubs but dynamic growth engines, poised to capitalise on structural shifts and expanding consumer bases. 7. Keep on diversifying with real and alternative assets Extra selectivity is required given the surge of capital being invested in these segments. Overall, a challenging geo-economic backdrop will boost diversification through private assets, benefitting resilient domestic stories. Private debt and infrastructure are expected to remain the most attractive.

|

Private diversification still attractive With Jean-Baptiste BERTHON, Senior Investment Strategist, Amundi Investment Institute and Dominique CARREL-BILLIARD, Global Head of Real & Alternative Assets. While noise from policy shifts may decrease after the summer, we expect uncertainty to remain high, leading to above-par volatility. Tariffs might become more targeted, potentially denting global growth. However, a recession is likely to be avoided due to the shift toward more business-friendly policies in the US as Trump starts to eye the mid-term elections. Inflation is likely to remain uncertain due to policy changes in trade, fiscal stance, and immigration. This may delay Fed easing, while other central banks should have more flexibility to act. We thus anticipate increased corporate activity and deal flow, albeit constrained, with a gradual recovery in corporate risk appetite. Liquidity and credit conditions are expected to stay healthy, although US interest rates could remain elevated longer than in other regions. Investors will likely become more selective, with differentiation between segments affected by policy shifts and those that remain insulated. Investors will continue seeking enhanced portfolio diversification, benefiting private assets. We expect the industry to further adapt to growing demand with new means, such as evergreen funds or secondaries, to provide more liquidity and dynamic allocations. Selectivity will be the name of the game amid huge capital flows into these markets.

|

Emerging markets With Alessia BERARDI, Head of Emerging Macro Strategy, Amundi Investment Institute and Debora Delbò, Senior EM Macro Strategist, Amundi Investment Institute.

Equities

We maintain a positive outlook, driven by recovering macro momentum, stabilising inflation, and central banks on an easing path. While growth remains positive and earnings decelerate to low single digits, the key narrative is the fading US exceptionalism, highlighted by a weakening dollar and declining trust in US policy, which enhances the attractiveness of emerging markets (EM) through repatriation and diversification flows. The pending sectoral tariffs present risks, but they also fuel localised supply chain initiatives that benefit EM. We favour selective positioning in domestically-orientated sectors across regions: Turkey and South Africa offer compelling domestic consumption plays in retail and automotive, while undervalued Asian markets like South Korea, Indonesia, and Philippines present opportunities, with the latter two backed by young demographics and expanding middle classes. Commodity price stabilisation limits support for Latam exporters, reinforcing our preference for domestic industries that benefit from reduced foreign competition. The rerouting of global supply chains continues to shape EM dynamics and underscores the importance of EMs not just as manufacturing hubs but as dynamic markets with growing consumer bases. Against this backdrop, EM equities are well-positioned to benefit from structural shifts, provided investors focus on resilient sectors and countries adapting to global economic realignments.

Bonds EM bonds to benefit from the emerging-developed market growth differential and dollar weakness. The outlook for both hard currency and local currency, is cautiously optimistic for the next six months. Several factors, including moderating inflation, improving economic momentum and easing monetary policy, are expected to maintain a favourable environment for these assets. A weaker US dollar is also expected to benefit EM. However, challenges such as geopolitical tensions and trade tariffs continue to pose significant concerns, through a reacceleration of inflation. Hard currency bonds are likely to benefit from the growth gap between EM and Developed Markets (DM). EM bonds still offer yields that exceed those of DM, providing a buffer against the volatility of US Treasury yields, which is on the rise. Although the spread between EM yields and US Treasuries is tight, the high carry environment offers some protection against potential losses. Default rates are expected to remain contained. Favoured countries are those with strong fiscal discipline, stable political conditions, and improving credit profiles. Average inflation in EM is expected to stabilise in H2 2025, with a potential peak in the first quarter of 2026 due to base effects. This scenario could support bonds issued by Brazil, Mexico, Colombia, and South Africa, where real interest rates are attractive. |

Advertising

| Discover how to ride the policy noise and shifts with Amundi's Mid-Year Outlook |

Read more