Summary

The dollar’s era of unchallenged centrality is giving way to contested dominance. Public institutions are diversifying reserves to mitigate risk, but the private sector’s reliance on the dollar remains largely unchanged.

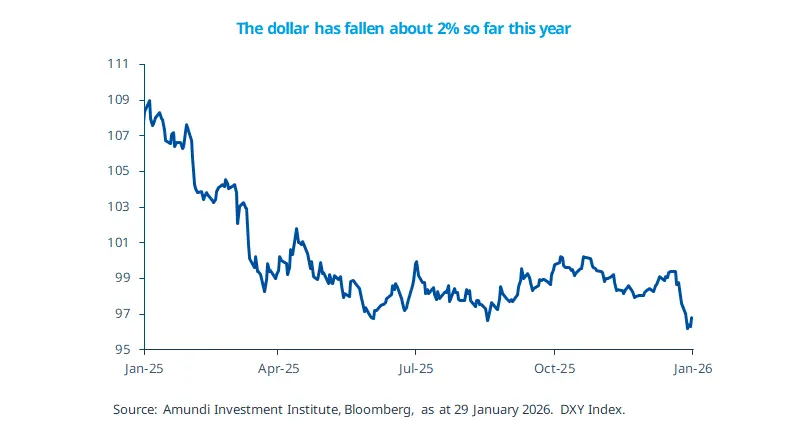

- The dollar index has fallen by about 2% so far this year, in addition to the more than 9% decline seen last year.

- The dollar’s path will depend on US economic resilience, the Fed’s decision‑making, and policies of the US administration.

- We think the incoming Fed Chair Kevin Warsh is unlikely to ease policy beyond what is justified by economic fundamentals.

In a week in which the Fed left policy rates unchanged, citing a ‘solid pace’ of economic activity, market attention focused on the dollar, comments from the US administration, and the Fed’s leadership. President Trump’s remarks were interpreted by markets as signalling a desire to intervene in foreign‑exchange (FX) markets. Looking ahead, we expect concerns about currency debasement and challenges to the dollar’s safe‑haven status to persist this year. This may reflect global central banks diversifying away from the dollar and the Trump administration’s unorthodox policies. Given mixed signals on consumer spending and the labour market, it is crucial that the Fed retain its independence. Therefore, the policy path requires a more nuanced assessment of the economy, inflation, and possible political pressure.

This week at a glance

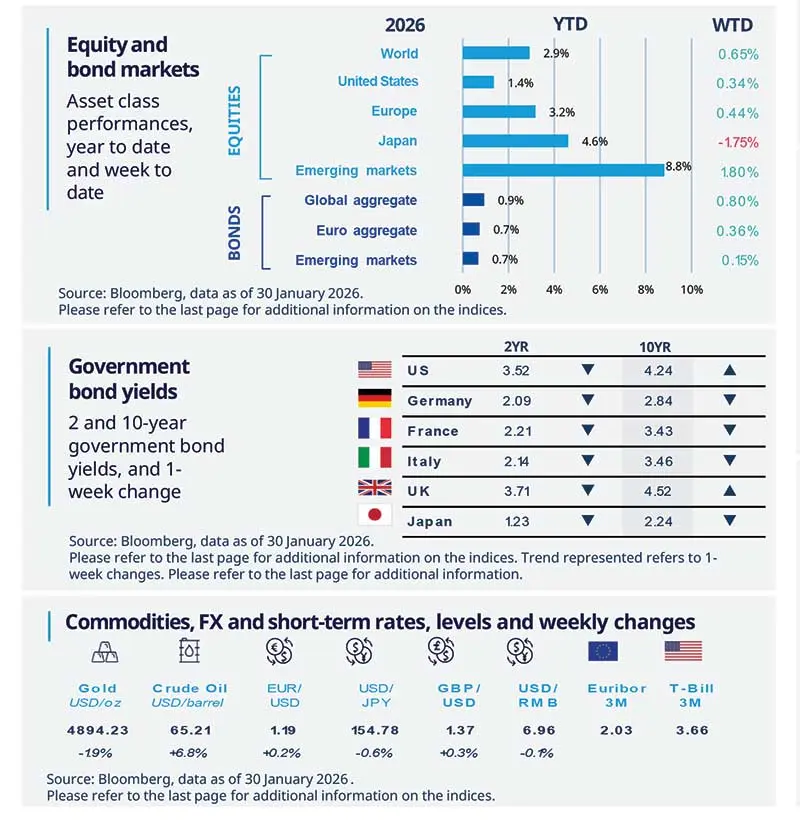

Global equities rose on the back of robust earnings growth, but Japanese equities declined as concerns around yen appreciation persisted. Bond yields were mixed. Short-term yields in the US and Europe eased, but long-term US yields rose amid worries about inflation and fiscal policy. In commodities, oil prices rose due to higher geopolitical tensions, whereas gold prices retracted.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD). All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 30 January 2026. The chart shows US headline and core CPI.

Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US Consumer Confidence falls in January

The Conference Board’s Consumer Confidence Index fell to 84.5 in January, its lowest level for some time. Both the Expectations Index (the forward‑looking component) and the Present Conditions Index declined. We believe this reflects consumers’ concerns about high prices, sluggish job growth and geopolitical tensions. Rather than relying on a single measure of sentiment, we prefer a holistic view. Other indicators point to a mixed picture.

Europe

EU Passenger car registrations up in 2025

EU passenger car registrations rose 5.8% YoY in December 2025, marking six consecutive months of growth. Overall volumes, however, remain well below pre‑pandemic levels, underscoring the challenges facing the industry and consumers. Data for 2025 indicate a continued shift toward greener vehicles: battery‑electric models have increased market share, while hybrid‑electric cars remain popular. The combined market share of petrol and diesel vehicles declined.

Asia

Slowing inflation in Japan

Tokyo CPI decelerated to 1.5% YoY in January, for the second consecutive month. The sharp softening in prices was largely driven by base effects in the food category, which are expected to continue weighing on inflation in the coming months. This overall benign inflation print supports the case for the Bank of Japan to proceed with a gradual policy normalization, rather than the faster pace currently priced in by markets.

Key dates

EA Inflation Flash Estimate and Composite PMI, US ISM Services |

EA retail sales; BoE and ECB policy; Banco de Mexico policy |

US labour markets and consumer confidence, RBI policy decision |