Summary

Macroeconomic focus

Signs of deceleration, but not yet a recession, in the US economy

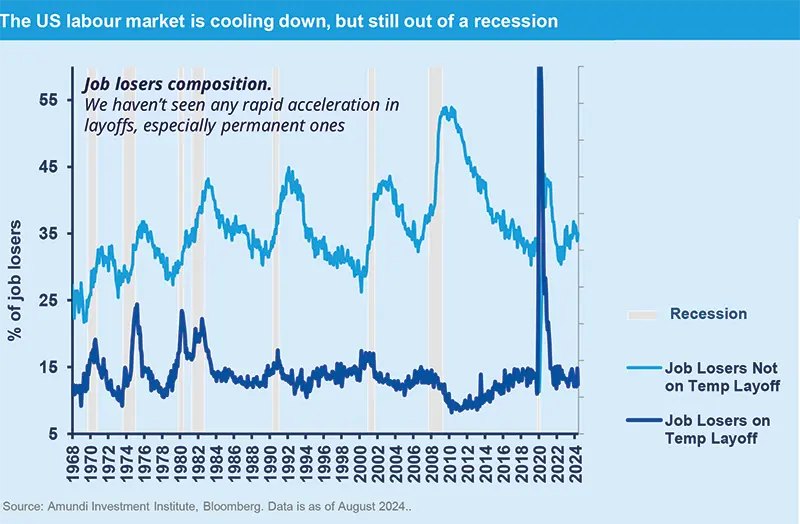

The rise in the July unemployment rate to 4.3% (latest reading in August is 4.2%) triggered a significant market concern about a possible weaker-than-expected US labour market, raising the risk of an impending recession. We do expect a significant slowdown of the US economy, but not a recession. We expect a significant deceleration in the next few quarters, consistent with a broader weakening of many labour market indicators.

Thus far, labour market weakness has been relatively “soft”: more a rebalancing of supply/demand imbalances than anything portending a contraction. Declining demand for labour has been mainly visible in an incremental reduction in job openings and lower hiring, but, so far, we haven’t seen any rapid acceleration in layoffs, especially permanent ones. The gradual increase in unemployment has been largely due to an increase in labour supply, thanks to a higher participation rate, especially among younger age cohorts and immigrants. Consequently, wage growth has progressively cooled and it is set to moderate further as many leading indicators suggest. Signs of further weakness are already visible: employment growth, recently revised down with payrolls, has been driven by non-cyclical sectors like education, health care, and government; while, in cyclical sectors, it has been less exuberant in recent months. Continuing claims have shifted higher and stabilised around a higher level over the last few months. Similarly, layoffs are beginning to rise and the duration of unemployment is lengthening. As wage growth has been moderating, workers are no longer switching jobs as before.

Nonetheless, while all of these indicators are down from their peak levels, most of them are not at typical recessionary levels yet. We remain mindful, however, that in the past when growth slowed, labour market deterioration accelerated. Thus, looking ahead, the statistics related to employers’ behaviour, particularly the pace of permanent layoffs, will be key indicators to watch – and will determine the difference between a soft patch and a deeper downturn.

CHINA

Weakening China's short-term outlook

China’s retail sales continued to grow at a tepid pace in July, climbing 2.7% YoY, reflecting soft consumer demand. The path ahead is not rosy. The average consumer in China has to deal with both increased uncertainties around the job market and shrinking wealth.

| For the former, PMI employment indices show heightened pressures of unemployment, particularly in the construction sector. For the latter, the ongoing declines in home prices and soft equity markets have led to a reduced propensity to consume. Lacking evidence on the policy side to address the demand issue, the slow burn among consumers will continue and start to weigh on overall growth as the exports-led recovery plateaus. |

Source: Amundi Investment Institute, CEIC. Data is as 28 August 2024. |

INDIA

The picture is still robust, despite softer Q2 24

As expected, India’s Q2 Calendar Year (CY)-24 GDP moderated in comparison with the previous four quarters at 6.8% YoY versus an average of 8.2% YoY. On a positive note, Household Consumption was the strongest contribution to growth (4.2% out of 6.7%), highlighting more inclusive growth dynamics than in the previous quarters, and was dominated by the performance of Investments.

|

Fixed Investments’ contribution remained sizable at 2.6% out of 6.7%. The data doesn’t change the picture of a country growing at a robust pace, 6.8% in CY-24 (up from previous expectations of 6.7%). |

Source: Amundi Investment Institute, CEIC. Data is as of 1 June 2024. |

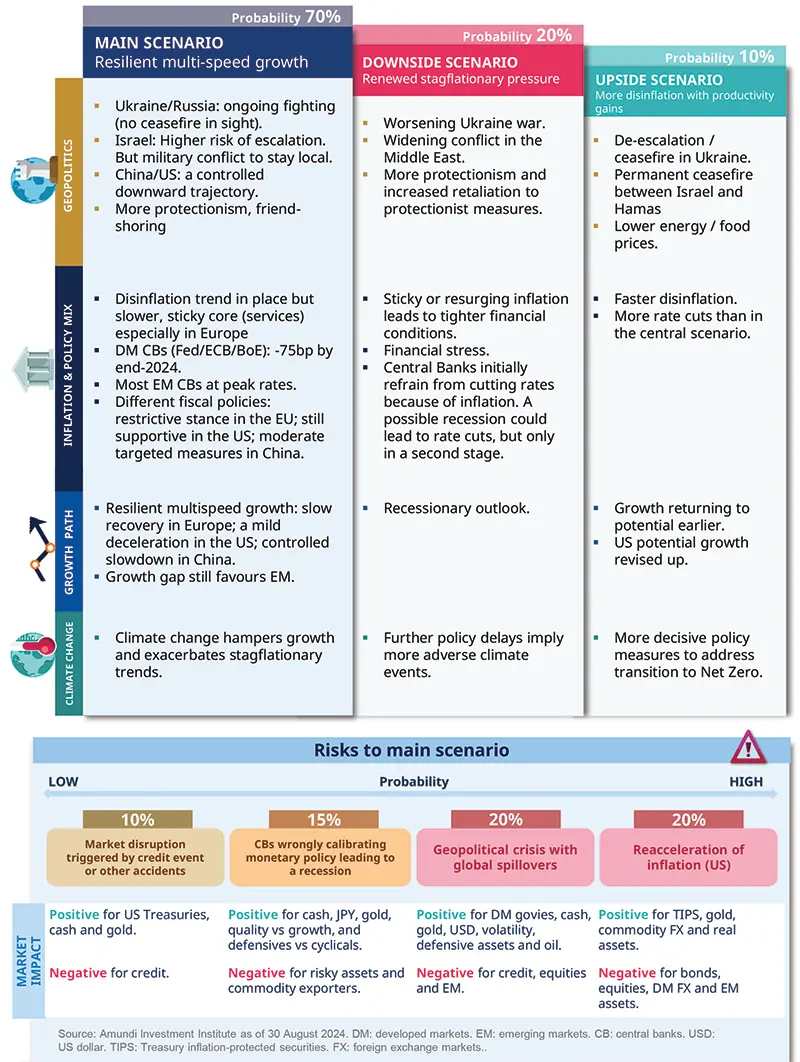

Macroeconomic snapshot

For the US economy, we expect a notable deceleration over the next few quarters in line with a broader weakening of many labour market indicators, although we do not expect a recession. Gains in productivity and softer demand will allow inflation to ease, even for the stickier services component, and reach its target by mid-2025.

We still expect Eurozone growth to firm and progressively reach potential as consumption recovers supported by improved real income growth as inflation eases, although wages continue to catch up and remain above trend. Growth and inflation patterns remain heterogenous across the Bloc’s members as do vulnerabilities to external factors.

The UK economy surprised on the upside in H1, leading to an upward revision of our 2024 and 2025 forecasts, although we expect some moderation in growth in H2. Headline inflation continues to slow down towards target, with positive developments from services, thus underpinning real disposable income growth and domestic demand even in a context of a cooling labour market.

The BoJ hiked against our expectations in the summer. It projected confidence in achieving its 2% inflation target despite the softening of CPI prints, while signalling additional hikes to normalise the real interest rates bar market turbulence. We expect two more hikes in 2025, with a 0.75% terminal rate that will land in the lower bound of the estimated nominal neutral rate range. A risk to our forecast is an earlier hike if wage growth accelerates further.

The Bank of Korea (BoK) resisted the market pressure to cut in August by keeping policy rates unchanged at 3.5%, holding a hawkish bias and highlighting the risk of house price reflation and elevated household credit growth. With domestic financial risks staying well contained and overall growth running just below potential, the BoK is likely to pace its easing, cutting policy rates once per quarter. We expect the first cut in October, and four cuts in total to bring the policy rate down to 2.5% by the end of 2025.

In mid-August, Indonesian President Jokowi announced a draft budget for 2025. The fiscal deficit targets for 2024 and 2025 comply with the fiscal rule of 3% of GDP, at 2.7% and 2.5%, respectively. As anticipated, the free meal programme implementation has been prudently planned in steps, with the first accounting for 0.3% of GDP. While the commitment to fiscal prudence is there, some revenue or expenditure targets may change in the final version by the end of the year, as the new cabinet will only be set by 20 October.

The Brazilian economy is looking robust YTD benefiting from Lula’s fiscal measures and interest rate cuts – GDP could expand by 3% this year and inflation has trended higher lately due to base effects. The BCB would like to stay high for longer but might have to undergo a small hiking cycle that would be highly out of sync with the Fed to boost credibility and stabilise inflation expectations. The 2024 fiscal target is now within reach, but still requires a small ($R10B?) budget freeze/additional revenue measures which we believe are likely.

Mexican economic activity has been much softer this year than in 2023 raising Banxico’s concerns that outweigh malign headline inflation dynamics in the recent past – core inflation has been better behaved recently. The CB will likely cut policy rates at every meeting going forward in a split fashion, despite MXN underperformance amid the uncertainty relating to AMLO’s reforms, the US elections, Mexico’s tough fiscal starting point and also Banxico potential actions.

Central Banks Watch

Fed easing is coming and it is dominating also the EM narrative

|

Developed Markets |

Emerging Markets | |

|

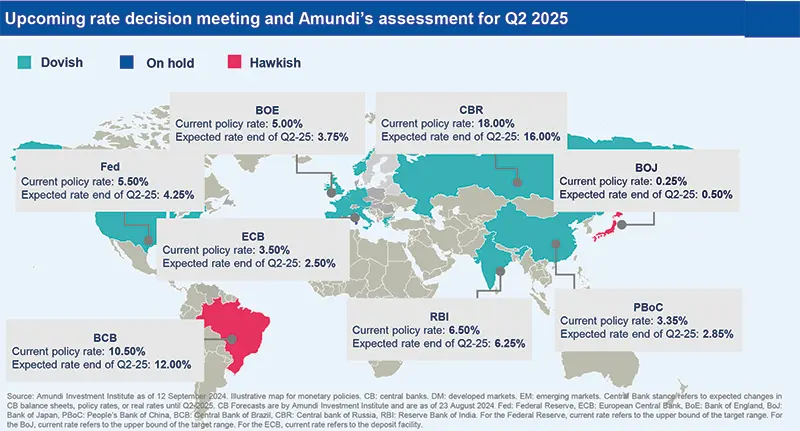

The Fed is likely to start cutting rates at its September meeting: the latest FOMC and messages from the Jackson Hole meeting show increased confidence in the disinflationary trend and the focus is turning to growth and the weakening labour market. Our baseline scenario has moved from two to three cuts before yearend, each being 25bps. Following a July pause after June’s first cut, the ECB resumed easing in September, as the disinflationary trend is supported by recent moderation in wage growth and slowing growth momentum. The Bank of England started cutting rates in August and, like the ECB, is expected to keep reducing policy tightness with three further cuts before year-end. Following its surprise hike, and despite hawkish guidance, the BoJ looks unlikely to move again until late Q1 next year, probably after March’s wage negotiations. |

In August we kept seeing little easing action by EM Central Banks. It’s worth mentioning that while Romania and the Philippines started their easing cycles, Peru and Mexico continued to unwind monetary policy restrictions at a softer pace. The upcoming Fed cuts, together with USD depreciation, have dominated the narrative for EM CB actions rather than any nasty surprises on the inflation side. This is particularly evident in the Philippines and Mexico, where higher-than expected inflation didn’t prevent monetary policy easing from starting/continuing. For the first time in a while, we haven’t lifted next year’s EM policy rates; in fact, we see more easing along the way for several countries (Poland, Peru, SA, Chile, Colombia and Mexico). Particularly in Brazil, where the BCB is possibly contemplating an out-of-step small hike as higher risk premiums stemming from fiscal targets appear more and more out-of-reach unless a further budget freeze is announced or new revenue sources are found.

|

Key Dates

|

18 Sep US Federal Open Market |

19 Sep BOE Monetary Policy Committee meeting |

17 Oct ECB Governing Council meeting

|

Geopolitics

What to expect from Harris’s foreign policy

Not much is known about Kamala Harris’s stance on many foreign policy issues. Overall, we can expect her to stay close to the foreign policy of the Biden administration. Her advisors were close to both the Clinton and Obama administrations, and are seen as traditionalists and internationalists. On Russia/Ukraine, Harris is expected to be more hawkish on Russia and more supportive of Ukraine as her track record seems more concerned about Russia’s aspirations over the longer term. On the Middle East, she will likely continue to support Israel, but put more pressure on Netanyahu for a ceasefire and the need to find a two-state solution. She has been a supporter of the Abraham Accords, which seek to improve Israel’s ties to its Arab neighbours and wants to de-escalate US/Iran relations. In the past, she has been more hawkish on Saudi Arabia and has supported legislation restricting arms sales and military assistance. With regard to the US attitude toward China and the South China Sea, we expect a continuation of the Biden policy. She will likely continue initiatives to deepen alliances in Asia and the Pacific. On Europe and NATO, Harris has been supportive and will likely develop deeper ties with the UK under Keir Starmer, given their similar political and career background. Overall, Harris cares about climate change and the issue will likely also shape foreign policy.

Harris cares about climate change and the issue will likely shape foreign policy.

Policy

Fiscal direction for the Eurozone in 2025?

The fiscal stance in the Eurozone (EZ) was very expansionary between 2020 and 2023. The European Commission (EC) estimates the fiscal impulse over this period was 4% of GDP. 2024 was a turning point: with the withdrawal of support measures, fiscal policy became restrictive (with a fiscal impulse of around -0.75% of GDP for the EZ). The situation varies greatly from one member state (MS) to another. The good news is that investment spending financed at a national level has been preserved or even increased, and spending financed by the grants from the Recovery & Resilience Facility (RRF) has had a positive, albeit small, contribution. Assuming no change in discretionary policy, the EZ fiscal stance should become neutral again in 2025. This is the working hypothesis of most forecasters, starting with those of the EC. But is this realistic? The new fiscal governance will apply from 2025. MS with deficits in excess of 3% of GDP will have to reduce their spending further. It is up to them to define the strategy for achieving this (the adjustment can be made in 4 or 7 years under certain conditions). They must communicate their plan to the EC this autumn. The fiscal stance for the EZ as a whole should therefore be restrictive in 2025, unless there is a new shock to growth. According to EC simulations, the contractionary fiscal stance would be between -0.25% and -0.5% of GDP in 2025 (depending on whether the adjustment is carried out over 4 or 7 years). That said, those MS that have to make an effort will likely seek to smooth it out as much as possible, given the persistent weakness of domestic demand.

Lean years after the fat ones: fiscal consolidation is inevitable in the Eurozone.

Main and alternative scenarios

Amundi Investment Institute Models

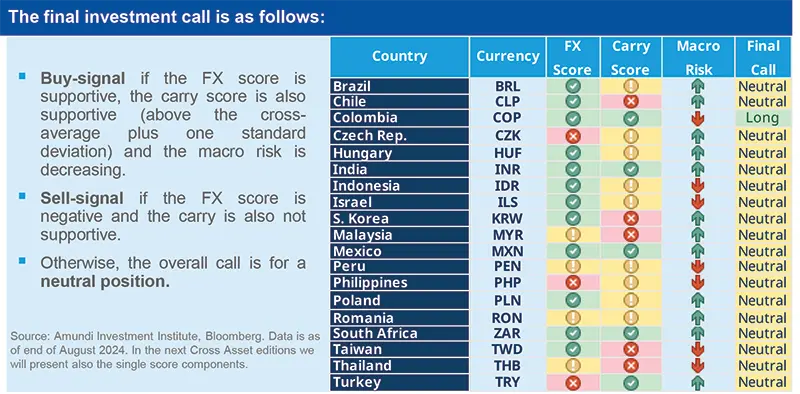

FX Score, Macro Risk and Carry all contribute to identifying opportunities in the EM FX space.

EMFX Process: the Tactical Signals

This systematic and multi-faceted approach aims to identify attractive opportunities and manage risks in the Emerging Markets FX space. The model concentrates on signals that have empirically proven valuable in forecasting currency movements. These individual signals are then combined into a composite indicator for each currency. The signals generally exhibit low correlations among themselves. The model is composed of three key elements:

1- FX Score: This combines various input factors to arrive at a composite score for each currency. It’s based on:

- Valuations: The model looks at the deviation from the Real Effective Exchange Rate trend as well as short-term dislocations.

- EM FX Momentum: The model employs a momentum-based investment strategy. Momentum trading has been one of the most popular and historically successful investment approaches.

- Economic Surprise Indices: They measure data surprises relative to market expectations. Positive readings indicate stronger than expected data, and vice versa.

- Commodity Momentum: The model aims to capture the relationship between commodity price momentum and its impact on EM currencies.

2- Macro Risk: The EM Macro Risk Indicator (from Citi) measures economic risk in emerging countries.

3- Carry: The model takes into account the carry (interest rate differential) of each currency, as it represents a relevant portion of the overall FX return performance.

Equities in charts

DM: Summer panic in a range bound market

|

The case for a range-bound market has been clear for the MSCI ACWI equal-weighted index since April 2024, while the market cap-weighted index has been more volatile. Both are now trading back in their upper range. Seasonality and the US election suggest that this trend will continue for now. |

Source: Amundi Investment Institute, LSEG Refinitiv. Data is as of 26 August 2024. |

EM: Second positive reporting season in a row confirms earnings recovery

|

About 50% of MSCI EM constituents have reported (as of 19 August). GEM Q2 2024 net income YoY growth is positive (+11% in USD) for the second reporting season in a row confirming a recovery in earnings, which has been expected for a while, and also includes the tech sector. Negative YoY results were only recorded in Mexico, Turkey and Brazil. At a sector level, the best results (on average) were in IT, HC and Industrials; the worst in Energy. |

Source: Amundi Investment Institute, S&P Capital IQ. Data is as of 19 August 2024. |

Bonds in charts

DM: Markets have been repricing potential cuts from the Fed

|

Over the last three months, markets have significantly repriced both short-term and medium-term potential cuts from the Fed: doubling the expected move by year-end from 50bps to 100bps, the market currently expects the Fed rate to land close to 3% in 2 to 3 years time. |

Source: Amundi Investment Institute, Bloomberg. Data is as of 27 August 2024. |

EM: There is still room for EM Local Bond yields to fall before the Fed pivot

|

EM Local bond yields have decreased in recent days, as the first Fed rate cut approaches which is now largely expected to take place on 18 September. However, uncertainties linked to the Fed’s willingness to start the cutting cycle – and ongoing worries about inflation – have created some hesitation among investors, in recent months, about buying EM local bonds. As of today, the decrease in yields over the last 45 days has been much lower compared to the 2019 Fed cutting cycle, with the only exception being South Africa. We can expect an acceleration in the fall of yields over the coming months, as soon as the Fed confirms its decision to cut. |

Source: Amundi Investment Institute, Bloomberg. Data is as of 28 August 2024. |

Commodities

Extra gains for Gold from pivot. Metals look fundamentally cheap.

Currencies

The USD is not the best diversifier when the Fed is repriced.