Summary

The movements in Japanese equities and the yen over the past week signal the need for the government and the central bank to maintain a delicate balance between boosting economic growth and keeping the public debt in check.

- Japanese equities hit record levels, but the situation is still uncertain given political disagreements.

- We expect more clarity in the coming weeks as parties decide on their nomination for the PM.

- Further rapid weakening in yen could prompt the BoJ to hike interest rates in October, while a data-dependent approach suggests otherwise.

Japanese equities hit a new record in October following the election of pro-business Sanae Takaichi as the leader of Japan’s ruling political party (LDP). However, the dust hasn’t fully settled as the long-term coalition between LDP and its partner Komeito broke down on Friday. Markets were expecting that if confirmed as PM, Takaichi’s policies to increase government spending could boost the country’s economic growth. On the other hand, the yen weakened on worries that the push for higher spending could negatively affect the government’s financial situation.

On the economic front, while inflation is moderating, it remains above the BoJ’s target. Additionally, the Bank would like to stabilise the yen after its abrupt fall, and a rate hike in October may allow it to do that. The central bank will be monitoring the political situation and would like to minimise any damage to market sentiment from political uncertainty.

This week at a glance

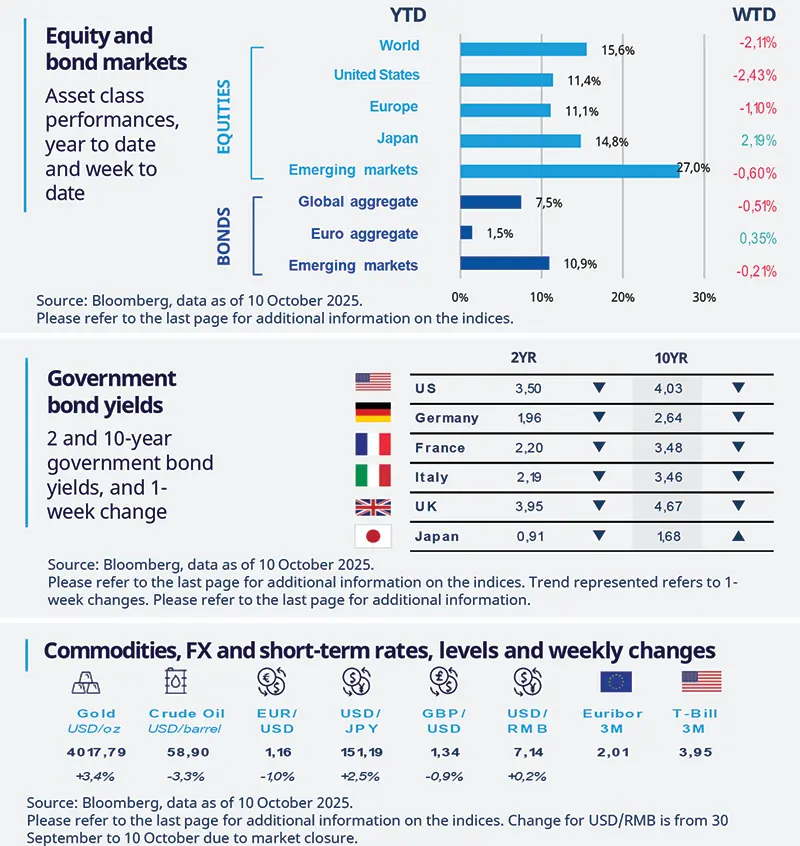

Most equity markets declined due to concerns over an escalation of a trade war between the US and China. Worries about an extended US government and speculation about the sustainability of the global equity rally also hurt sentiment. On a positive note, Japanese stocks rose. Bond yields generally declined. In commodities, oil prices fell following receding geopolitical tensions, but gold continued its ascent.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 10 October 2025. The chart shows the Nikkei 225 index.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

FOMC minutes show more easing ahead

The September FOMC minutes showed strong support among members for a rate cut due to rising labour market risks. Job growth is slowing due to both lower supply and demand, influenced by ageing population and less immigration. However, members disagreed on the future rate path. We expect further cuts as consumption moderates and labour markets soften. That said, inflation may run above the Fed’s target for a few quarters, boosted by the tariff effect.

Europe

Germany’s production tumbles in August

Germany’s industrial production dropped sharply in August, down 4.3% on the month, especially in the automobile sector, signaling weak growth ahead. Both factory activity and new orders are falling, reflecting low demand. This means the economy is unlikely to grow substantially in the coming months. Any improvement may depend on government support next year. A delay in the fiscal package implementation might dampen enthusiasm about 2026 growth.

Asia

Golden Week’s spending fell amid weak job market

China’s Golden Week saw record domestic trips and tourism spending, but per-capita trip spending fell 0.6% YoY and 2.6% compared to 2019, reflecting ongoing pressures in the labour market and property sector. Despite some growth in services and international travel, consumer confidence remains weak with high youth unemployment and slow wage growth. The last batch of consumer goods subsidies was issued recently and we think policymakers do not feel the need to introduce more in the near term, so we remain cautious on the fiscal stimulus outlook.

Key dates

China trade balance, India CPI |

EZ ZEW survey expectations, US small business optimism |

EZ industrial production, US CPI |