Summary

- Italian government crisis, likely outcome: snap elections the most likely outcome. Prime Minister Draghi would remain at the helm of a caretaker government, until a new one is formed after the elections, but clearly government action will be constrained and able to handle routine activities only.

- Economic implications: the draft budget law has to be sent to the EU Commission by mid-October for approval. If elections take place at the end of September, it is unlikely that a government will be in place to oversee the process according to these deadlines (recently, formation of a government took several weeks after elections). This scenario could mean that the 2022 budget is rolled-over into 2023. This would clearly be negative for growth, as no counter-cyclical measures and fiscal support could be activated if needed. Additionally, Italy has to deliver a series of reforms to access NGEU funds. Some of these reforms could, however, be within reach of a caretaker government in order to avoid any delay in the 2023 NGEU disbursement that could negatively impact potential growth.

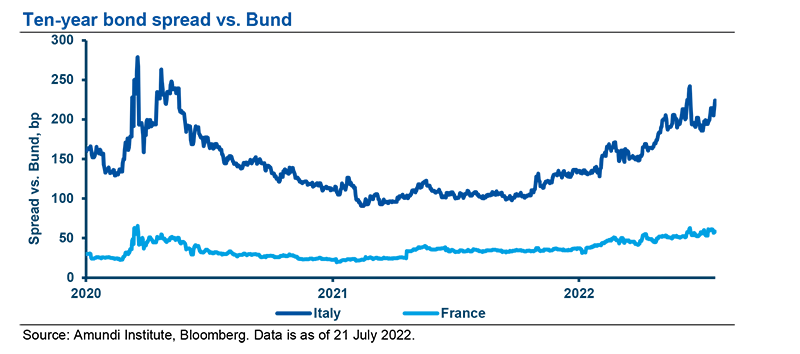

- Investment implications: despite recent political instability and the ECB’s bold move in hiking rates by 50 bps, market reaction on Italian BTPs has been constrained. The new transmission Protection Instrument (TPI), which includes eligibility of public and private debt, temporarily eased pressure on the BTP. Investors have seemingly evaluated it as a powerful new tool, that was approved unanimously. However, we believe that uncertainty and volatility on BTPs will remain high in the coming weeks. It’s hard to imagine the ECB will use its new tool to address country-specific risks stemming from political turmoil. The conditionality embedded in the TPI, for example explicit compliance with commitments submitted in the Recovery and Resilience Plans or the reference to fiscal sustainability, clearly states that the tool’s objective is to limit the negative impact of higher rates on financial conditions. Therefore, we maintain a neutral exposure to BTPs, and look for better entry points and/or a clearer outlook regarding the election calendar.

Given the resignation of Prime Minister (PM) Draghi, what scenarios does Italy face?

After a series of events that started on 14 July, when the Five-Star Movement (5SM) abstained from a Parliamentary vote on a number of economic measures, Draghi’s time as Italian PM comes to an end. On 21 July, any remaining uncertainty disappeared. PM Draghi resigned following a clash and tight confidence vote during the Senate session the day before, wherein the centre-right parties abstained from voting.

While the President of the Republic may still run consultations to evaluate the possibility of a majority (at the time of writing, Draghi’s resignations have just been presented and President Mattarella has summoned the House and Senate speakers this afternoon), we think that Italy is headed for snap elections as early as 25 September, according to constitutional procedures.

PM Draghi would remain at the helm of a caretaker government until a new one is formed. Clearly government action will be constrained and limited to handling routine activities only. However, the second half of the year is full of important deadlines, including:

- 2023 budget law: normally the budget process starts around 27 September with a multi-year budget plan, followed around October 20 by a draft budget submission to the Parliament, where it is discussed and amended until final approval by 31 December. In the meantime, the draft has to be sent to the EU Commission by mid-October for approval. If elections take place at the end of September, it is unlikely that a government will be in place to oversee the process according to these deadlines (recently, formation of a government took several weeks after elections). In this case, it is likely that the 2022 budget will be rolled-over in nominal terms (i.e. adjustments for potentially adverse geopolitical events will not be possible, such as new measures to address the energy crisis in a gas-rationing scenario). This would clearly be negative for growth, as no counter-cyclical measures and fiscal support could be activated if needed.

- Recovery and Resilience Plan deadlines to unlock NGEU disbursement for 2023: in H2 2022, Italy has to meet 55 targets and milestones according to the Recovery and Resilience Plan in order access NGEU funds. Meeting these goals would unlock the next €19bn instalment to be received in early 2023. On the bright side, most of these targets currently do not require Parliamentary intervention or legislative action. However, their implementation may be at risk due to lags caused by political change. Some of the reforms already discussed could, however, be within reach of a caretaker government in order to avoid any delay in the 2023 NGEU disbursement. Delays would negatively impact both potential growth and the short term investment boost which was expected to support growth to just above potential (barring new external shocks) between 2023-2026.

Downside risks to growth are materialising.

The economic outlook for Italy, in a scenario of mild contraction over the winter as the cost of living crisis hits consumers, portrays a flattish growth for 2022 overall (the 2.6% YoY headline figure is mainly a carry-over benefit from 2021) and a decent 1% growth in 2023 (partly thanks to the estimated impact of Recovery and Resilience Facility investments - RRF).

As we write, more clouds are gathering on the horizon. There are significant downside risks to growth (and upside on inflation), ranging from reduced gas supplies jeopardising storage targets and requiring energy-saving policies to be implemented as soon as August, to more severe gas rationing in the event Russia closes its taps. A more severe stagflationary shock, implying an EU-wide state of emergency and significant gas rationing, would have profound economic implications. It could lower our GDP baseline projections by more than 5% over the next 12 months, implying less than 1% growth in 2022 (i.e. severe recession in H2 2022), and a contraction in 2023 by more than 2% (severe recession in H1 2023, at least). This is in line with Bank of Italy July estimates. While this is not our central scenario, a caretaker government with limited powers will not be in the strongest position to tackle this sort of crisis. The short term would clearly be negative for growth.

What is your view on BTPs in light of recent political developments in Italy?

Volatility in Italian BTPs will persist amid political uncertainty.

Markets tend to dislike political uncertainty that generates volatility and widening of spreads. Our conviction is that Italy’s political crisis has not been taken into account in the ECB’s decision-making process. In the euro fixed-income space, we remain neutral on BTPs and look for better entry points and/or better visibility on the election calendar.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Credit spread: Differential between the yield on the 10-year Italian BTP and the 10-year German Bund. Treasury yield.