Summary

The economic impact of the US government shutdown depends on the duration for which government services remain suspended, and whether President Trump permanently cuts essential and productive jobs.

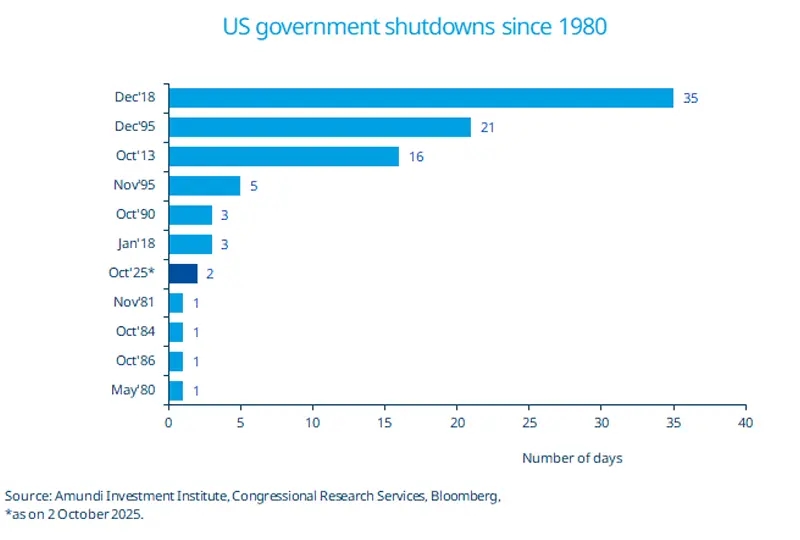

- The partisan conflict in the US led to a government shutdown due to spending disagreements. This is not unprecedented.

- The shutdown is not due to a breach of the US debt ceiling which, in theory, could lead to a default. The US has never defaulted on its debt.

- Nonetheless, this situation could create volatility and affect investor confidence. For the time being, markets are ignoring this.

The US government shut down on 1 October, following disagreements between Republicans and Democrats over healthcare-related spending. In particular, the Democrats are demanding an extension of the premium subsidies provided under the Affordable Care Act, which are due to expire by year-end. The last shutdown occurred in 2018-19 and was also the longest, as illustrated in the chart. Essential government services will continue to operate. The primary concerns relate to federal employees who may be furloughed, the consequent loss of income, and the broader economic costs, given the suspension of non-essential services. Once the government reopens, furloughed employees, as well as those who worked without pay, are likely to receive their salaries retroactively. Therefore, while some economic activity will be recovered, it will not be fully restored. The overall impact depends on the duration of the government closure.

This week at a glance

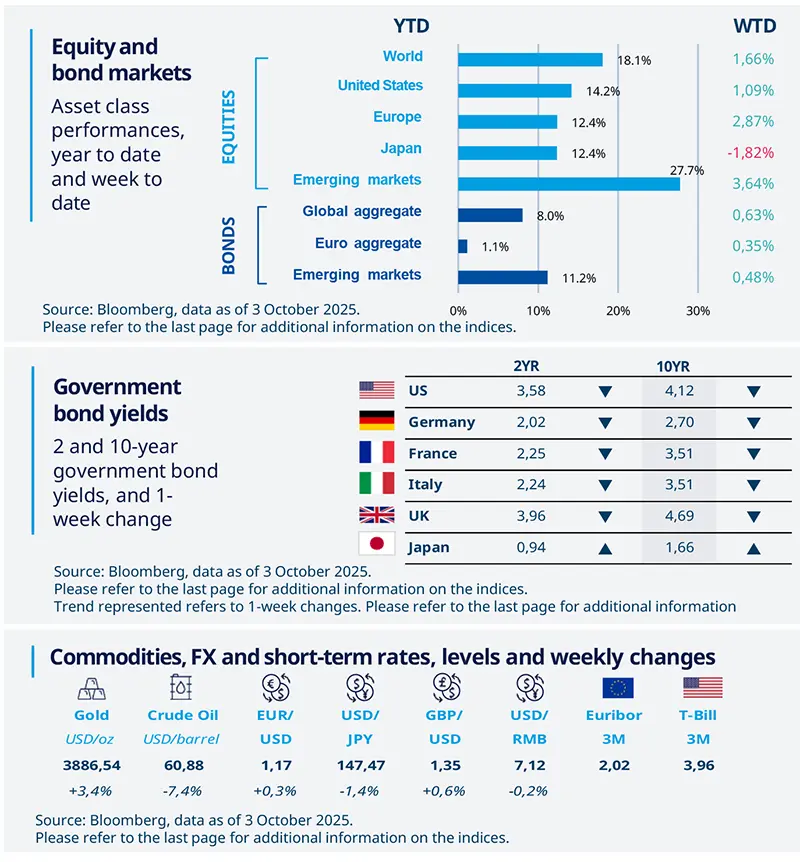

European stocks proved strong last week, driven by optimism over AI developments. US equities were also up, despite the first government shutdown in seven years. Government bond yields were generally lower, gold hit new all-time highs, while oil prices were down due to expectations that OPEC+ countries may increase production.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 3 October 2025. The chart shows the duration of US government shutdowns.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US employment weakness is confirmed

The ADP report showed a decline in private sector employment by 32,000 in September, with notable drops in sectors such as leisure and hospitality, while education and health services saw gains. Goods-producing industries also saw a slight decrease. This data aligns with a weakening labour market, suggesting that the Fed may have room to cut rates if labour market data confirms this trend, especially if layoffs pick up.

Europe

EZ inflation edged up in September

Eurozone inflation accelerated to 2.2% YoY in September, driven by higher energy inflation offsetting declines in food inflation, while core inflation remained steady at 2.3%. Services inflation edged up and monthly trends showed a decrease in services, but a rise in goods inflation momentum. Country-level data showed an upside surprise in Germany due to stronger core inflation, while France saw weaker-than-expected inflation; Italy and Spain were broadly in line with expectations.

Asia

Tankan survey points to October rate hike

The latest BoJ's quarterly Tankan survey showed that business sentiment and expectations remained buoyant. This is underpinned by resilient sentiment among large manufacturers, construction, and services sectors, while small manufacturers reported mixed results. In particular, the iron and steel sector and processed metals were hit by US tariff news. Overall, the solid sentiment has backed the corporate inflation outlook, which strengthened in the 3–5-year horizon. We think this Tankan survey has raised the likelihood of an October hike.

Key dates

Germany’s factory orders, |

Germany’s industrial production, |

Italy’s industrial production, |