Summary

Key Takeaways

The impact of rate increases on businesses is expected to intensify in 2024. Businesses haven't been impacted much by higher rates so far because they have used the cash they collected during Covid and refinance needs have been limited. However, refinancing needs will rise in 2024 Small and medium sized companies and lower rated HY issuers will be most impacted. The spillover from higher rates will be more limited for IG companies.

Corporate fundamentals are deteriorating, but from healthy levels

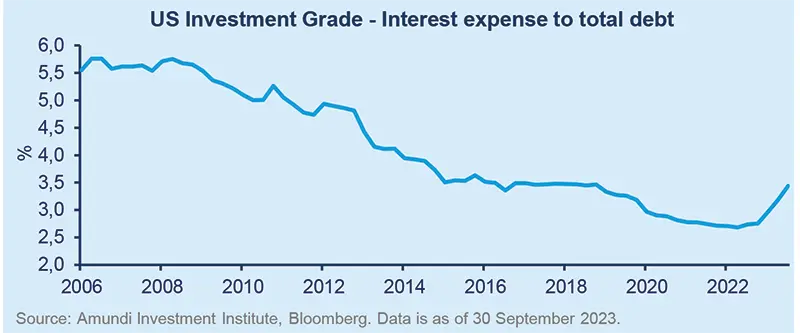

In the United States, as in Europe, companies emerged from the Covid crisis with solid fundamentals (high margins, high interest coverage rates, record levels of cash etc.). Companies benefitted from the low cost of debt, as a result of years of historically low interest rates. Indeed, businesses have not been too affected by the rate hike so far. Corporate fundamentals are now deteriorating, but from healthy levels (see chart).

Following two years of quite low supply, the gross issuance of non-financial corporate bonds is finally likely to increase in 2024, mostly driven by refunding needs. With less need for capex, dividends or M&A, net issuance should not record meaningful growth for both IG and HY.

No immediate wall of maturities is foreseen in credit markets in 2024, especially in high-beta segments, like US and EUR high yields. In Europe, while net issuance of non-financial IG is likely to remain modest, as in recent years, financials will probably confirm their leading role in 2024. However, as most of the targeted longer-term refinancing operations have already been repaid and a weaker growth outlook means lower lending activity needing to be refinanced, the extent to which financials’ net supply could surprise to the upside appears lower than in 2023 and 2022.

So far, the demand side has been showing persistent flows into IG rather than HY, both in the US and in Europe: this is due to the attractive combination of absolute yield offered and duration risk, despite credit spreads not being at historically high levels. In the lower risk-free rate environment that we expect in 2024, supported by weaker growth and cycles in monetary policy turning, the demand for high-quality corporate bonds should remain resilient: IG corporates will still represent an attractive alternative to sovereign debt, especially accounting for the different supply v volumes, estimated to remain high by historical standards in the sovereign debt market.

HY low-rated companies to drive an increase in default rates

EUR HY default rates on an issuer and a par-weighted basis were respectively 2.7% and 1.2% in October, which is still very low historically and below the long-term median. Furthermore, the defaults were entirely represented by lowest-rated CCC names, while both B- and BB-rated names have remained at flat levels over the past year. There are many reasons to explain this benign cycle, especially for higher-quality issuers. Top-down factors are represented by 1) the sound starting point of fundamentals, 2) slowing, but still positive, economic growth and 3) the time needed for monetary policy transmission on limited refinancing needs, thanks to the record primary market activity during the pandemic years and accumulated cash. Benign bottom-up drivers are mainly represented by the very low weight of CCCs in Europe, no clear sector issue and distress ratios remaining quite low by historical standards.

We expect slightly higher defaults in 2024, albeit at levels closer to the long-term averages and still concentrated in low-rated names and SMEs. Our baseline scenario, assuming no recession in Europe but very low levels of growth, is for a 3.5%/4.0% level, with risks tilted to the upside in the case of a worsening macro environment. Even if the Eurozone avoids a recession, higher funding costs will be the most significant driver of defaults.

We expect defaults to remain concentrated in low-rated HY issuers.

Maturity walls clearly matter but, in this respect, 2024 looks manageable, as in the last year companies have already started to address 2025 maturities, reducing their stock in the loan market and, to a lower extent, in the bond market. Our projections of scheduled maturities see 2025 and 2026 being more challenging than 2024. The transmission mechanism of higher rates into coupons takes time and the average coupon has only just reached 4.1% now versus 3.6% in 2022 and this rise is likely to continue but the aggregate impact on corporate fundamentals will take several years to play out, most probably in 2025 and 2026.

Ultimately, we expect default rates to peak at lower levels, but probably for a prolonged period of time. In our view, low-quality issuers will keep driving the trend, while high-quality names, representing the dominant share of the EUR speculative grade markets, will remain resilient. Moreover, a historical denominator of default cycles is the presence of a 'problematic' sector or sectors. For example: retail/consumer services/hotels in the pandemic crisis, energy in 2016, and telecoms/technology in 2001. Current distress ratios show no specific sectoral stories potentially driving the cycle.

Finally, we believe that small and medium companies will be impacted more than the mid-high-rated names of the HY market while distress ratios remain quite low by historical standards and bank lending standards remain in highly restrictive territory, alongside the much more rapid impact of higher rates through loans.

In the US, we expect HY default rates to reach slightly higher levels than in Europe, at 5.5/6%, mostly driven by the lowest-rated names. Contrary to some rating agencies’ baseline scenarios for a peak in Q1/Q2 followed by a downtrend in H2, we expect defaults to plateau at these levels.

|

3.5/4% Default rates expected |

5.5/6% |

CCCs We expect defaults to remain concentrated in this space, which has a very low weight in Europe. |

Source: Amundi Investment Institute as of 28 November 2023.