Summary

Gold beyond records

Key takeaways

The recent rally in gold prices signals more than just a market trend; it indicates, in our view, the beginning of a gradual transition from a US-centric international monetary system to a more multipolar one.

Gold is gaining traction as a structural portfolio diversifier, and we believe that prices have the potential to reach $5,000 an ounce by the end of 2028. Supportive factors for gold prices include structural demand for diversification by global investors, geopolitical uncertainties, and central banks’ reserve diversification at a time of dollar weakness.

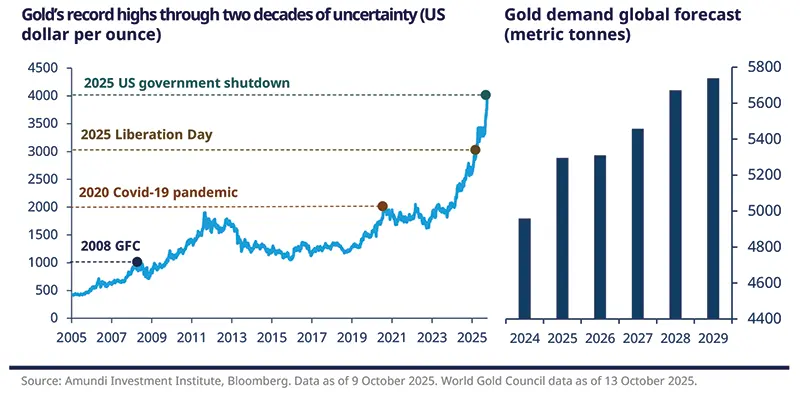

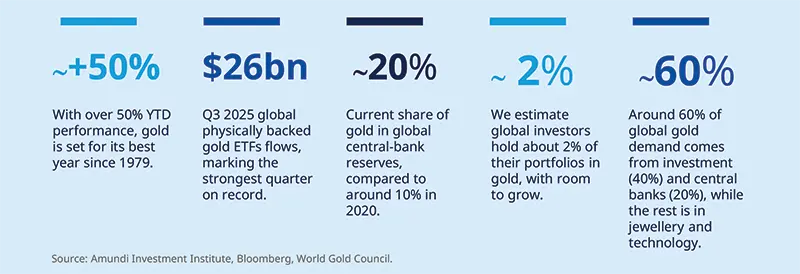

Gold has hit multiple record highs in 2025, recently surging past the $4,000 mark and climbing over 20% since mid-August. In our view, both cyclical and structural factors are contributing to this growth: growing unpredictability in macroeconomic and geopolitical landscapes, demographic shifts, structurally higher demand from central banks (CBs), expectations of Fed rate cuts, and a weak dollar are all supporting factors, and most recently, higher political uncertainty with the US shutdown.

Looking ahead, the key question remains: how far can this rally go? While valuing gold remains complex, our models (which incorporate both macroeconomic and microeconomic fundamentals such as inflation, central bank balance sheets, and government bond yields) suggest that there is further upside potential, though limited in the short term.

For 2026, our target for gold is $4,200 an ounce. On a three-year horizon, we believe that there is more room for gold prices to rise, eventually reaching a target of $5,000 an ounce in 2028 due to a structural change in demand for the metal by investors and central banks.

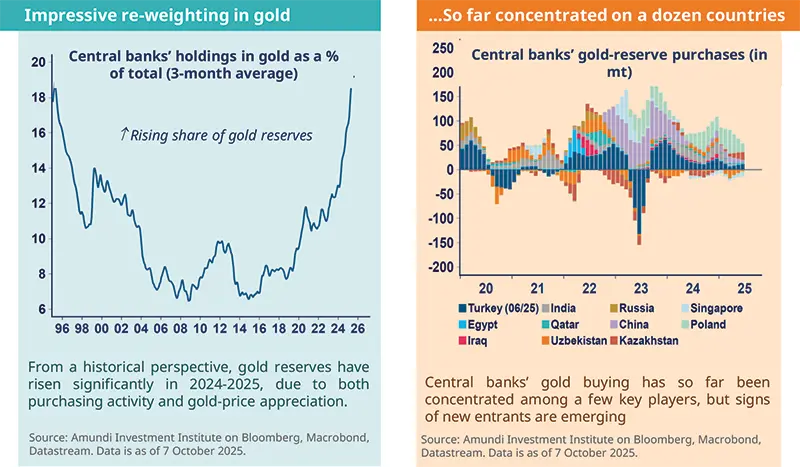

In recent years, the rising demand for diversification has been the primary propeller of gold’s appeal. Since 2022, central banks have sought to diversify their reserve currencies, which ultimately has supported the gold rally. Although the rapid pace of gold purchases appeared to slow in the first part of the year, the overall direction remains the one of accumulation.

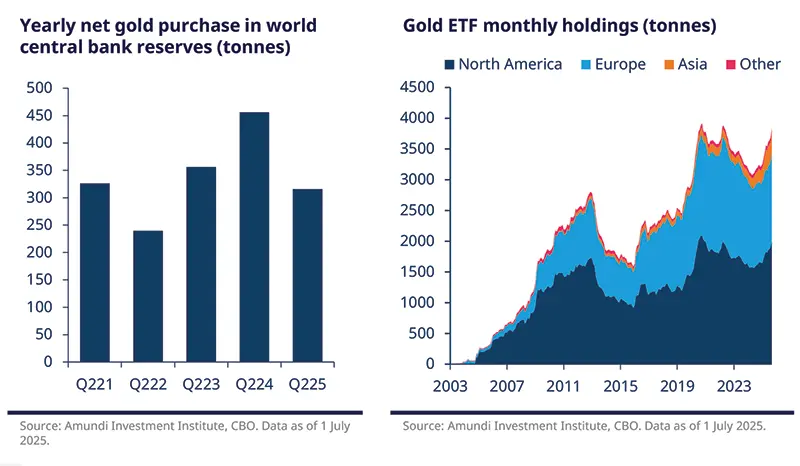

Overall CB net purchases for H1 2025 totalled to 415 tonnes, marking a 21% decrease compared to H1 2024. Data from the World Gold Council shows that over the summer, CBs continued to build their gold reserves, although overall activity remains below the levels seen at the start of the year. Nonetheless, the trend of accumulation has continued, with seven central banks reporting increases in their gold holdings in August, while only one recorded a decrease.

Beyond central banks, growing interest from institutional and retail investors has also fuelled the recent surge in gold prices. Heightened geopolitical risks have increased awareness of the need to manage portfolios in a world where the likelihood of inflation and commodity market shocks (such as those experienced in 2022) is higher. The rising risk of stagflationary scenarios, or situations where the traditional stock-bond correlation breaks down, has prompted a reassessment of traditional Strategic Asset Allocation (SAA).

Investors are increasingly incorporating real assets, especially commodities, into their portfolios to enhance diversification and resilience; consequently, gold is gaining traction as a structural portfolio diversifier. Moreover, the erosion of confidence in sovereign debt is driving investors to gold, as recent fiscal policies characterised by rising deficits and explosive debt trajectories challenge the traditional safe-haven status of government bonds, such as US Treasuries.

Demographic shifts are also influencing gold demand, as younger generations, with different investment preferences and a greater affinity for non-traditional assets and digital platforms, are more likely to support increased gold purchases.

On the back of this rising demand, global physically backed gold ETFs recorded their largest monthly inflow in September 2025, resulting in the strongest quarter on record at $26 billion. The trend of accumulation into gold ETFs appears well sustained, despite higher prices, with a more regionally diversified base. In our view, this trend is set to continue, as the allocation to gold is still very low.

While central bank gold purchases have moderated recently, there is still room for further buying, particularly from emerging market countries like India and China.

The combination of macroeconomic and geopolitical uncertainty, fiscal concerns, and evolving investor behaviour is driving renewed interest in gold, supporting an increased role for the metal in strategic asset allocation.

Over the last 25 years, gold has experienced distinct phases that have driven its price upward. The first major shift followed the Global Financial Crisis of 2009, as central banks fundamentally altered their monetary policy thinking, introducing unconventional tools such as quantitative easing. Concurrently, central banks worldwide shifted from being structural sellers to becoming buyers of gold.

The European debt crisis, the expansion of central bank balance sheets, and persistently low nominal and real interest rates further bolstered gold’s status as a last-resort reserve asset to manage financial uncertainty. This reflationary theme remained strong even during the COVID-19 pandemic.

This shift in central banks reserve allocation may well represent the early stages of a long-term global pivot in monetary power.

The geopolitical boost for gold: Russia–Ukraine War

2022 marked a turning point for gold. The outbreak of war in Ukraine and the accelerating rebalancing of power among different regions triggered a surge in demand for gold, particularly from Asian central banks. These institutions sought to diversify their reserves away from the US dollar amid concerns about the stability and neutrality of dollar-based assets.

The freezing of a significant portion of Russia’s USD and EUR reserves, along with its exclusion from the Western-led financial system (including SWIFT), underscored the political risks tied to dollar assets. By immobilizing more than $300 billion in Russian foreign reserves, Western sanctions sent a clear message: dollar-based assets are vulnerable to geopolitical pressures.

From 2022 to 2024, net central-bank gold purchases more than doubled, surpassing 1,000 tonnes on a yearly basis. This surge was primarily driven by central banks in Asia, including those of China, India, and Japan, as well as emerging markets more broadly.

Despite the tightening of monetary policies globally (characterised by higher interest rates and shrinking central bank balance sheets aimed at curbing inflation), the demand for gold remained robust. This resilience has led to a disconnection between real global interest rates and gold prices, with gold maintaining its appeal as a safe haven.

This gold price rally signals more than just a market trend; it indicates, in our view, the beginning of a gradual transition from a US-centric international monetary system to a more multipolar one — a structural realignment in reserve management.

Central banks’ gold reserves: where are we now?

| Seven drivers of central banks’ gold allocation |

1 | Economic Stability & Size: More gold held in weak macro conditions 2 | Inflation & Currency Risk: Gold hedges against inflation and FX devaluation 3 | Reserve Diversification: Diversify across assets 4 | Cultural Factors: Historical and political reasons 5 | Global Uncertainty: Geopolitical or financial crises boost gold demand 6 | USD Debasement Risk: Fear of dollar depreciation may drive gold buying 7 | Gold Price Volatility: High volatility may curb gold purchases |

Central bank’s gold buying has been driven by inflation risk, geopolitical uncertainty, and diversification needs, particularly during USD weakness. Most central banks have already made their move, with China and select Asian nations leading. The reallocation to gold continues, but the pace is slowing.