Summary

A summer of calm on surface, turbulent currents beneath

US equities touched new highs in August and European markets traded close to their March levels, while corporate credit spreads compressed over the summer. Sentiment was led by expectations for AI capital expenditure, a strong US earnings season, and a relatively dovish Fed at Jackson Hole. Markets seems to be ignoring the risks around economic activity (e.g., labour markets), political pressure on the Fed, fiscal deficits, and corporate margins.

We believe the themes below are likely to drive the markets now:

Tariffs will have a bigger impact on US growth than on inflation. Inflation pressure is likely to be transitory, but may not materialise all at once (ie, service vs goods). Growth will remain in a soft patch this year and in 2026 due to a cooling labour market and slowing wage growth (not yet visible clearly). Higher near-term inflation will also weigh on consumption for the rest of the year. Also, the Eurozone will be affected by tariffs, but the ECB will continue its support. Growth in the second half of the year will be weaker than in the first half of the year. Nonetheless, domestic demand is holding up, supported by real wage growth, but export risks are high.

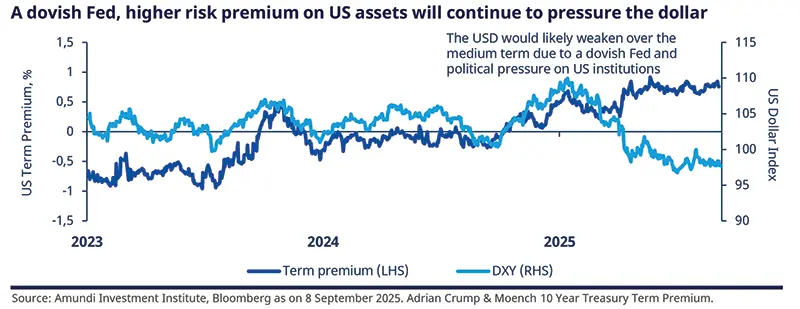

The Fed’s focus is shifting from inflation to growth, while political pressure on the Fed is rising. Overall, we maintain our projections of three rate cuts this year (the first in September) by the Fed, driven by a weakening economy as the Fed shifts its focus toward employment. The ECB will likely remain data-dependent and open to rate cuts in the coming months.

A higher risk premium on US assets (dollar, Treasuries) will have implications for portfolio construction, given their traditional role in asset allocation

EM growth revised up slightly for this year (4.2%) compared with our July projections. External pressures on China have somewhat eased, leading us to upgrade our growth forecast to around 4.8% for this year. While this is closer to the government target, we expect a slowdown to persist because domestic demand remains weak. Trump’s transactional approach, including tariffs, may accelerate the push towards multilateralism and a multi-polar world (eg, BRICs) – the opposite of what he has said he intends to do. India is dependent more on domestic consumption for growth than on exports. We think the negative impact of US tariffs on growth is being mitigated by fiscal measures, including rationalisation and reform of the goods and services tax that will boost domestic consumption.

Risks of fiscal profligacy from a rising debt trajectory in the developed world and pressures on US corporate margins from tariffs. At this stage, we think what matters most for corporate earnings is the effect of tariffs on corporate margins — specifically, whether companies can continue to pass on costs to avoid margin erosion. Hence, we are closely monitoring the dynamics between US producer prices and consumer prices.

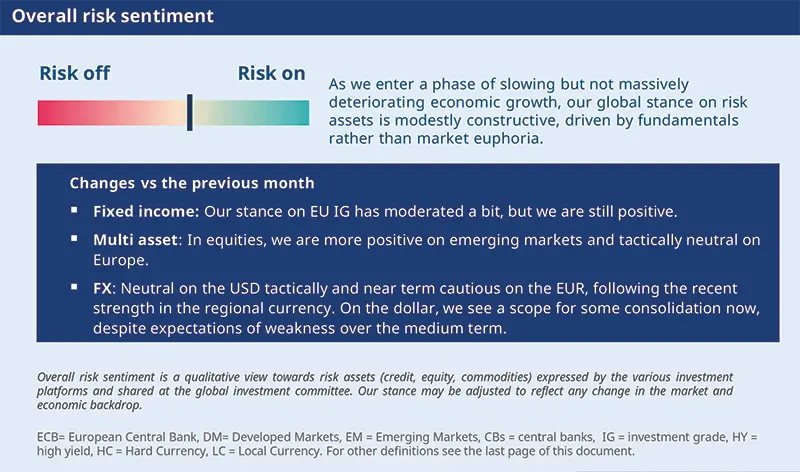

To summarise, high debt levels in the developed world, political pressure on US institutions, and the need for more policy action in Europe will keep the markets’ attention, whereas in emerging countries, the growth story is selectively improving. We also note complacent US markets, which are looking the other way from the risks on our radar. This backdrop allows us to maintain our mildly risk-on stance.

| Amundi Investment Institute: Yield curve steepening, corporate earnings in focus |

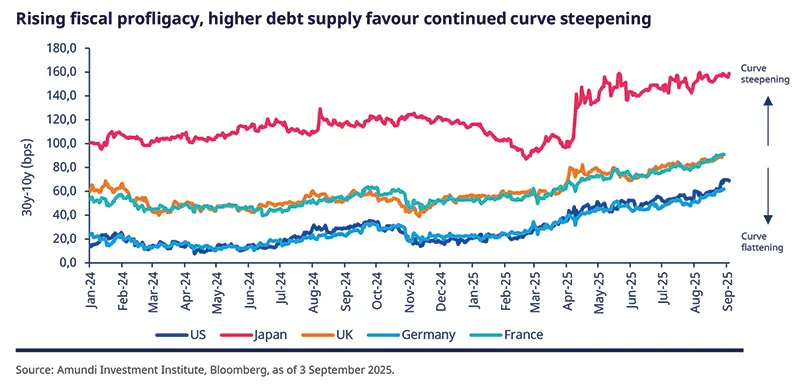

Rising inflation expectations, larger fiscal deficits and higher term premium would put upward pressure on yields at the long end of the curve, whereas monetary easing would lower short end yields. We expect curve steepening to continue across most major developed markets such as the US, Japan, and the UK. In Europe, German fiscal spending plans and reform to pension systems particularly in the Netherlands, will likely pressurise the long end of the curve. US corporate earnings for the second quarter were much stronger than expected led by the communication services and the information technology sectors.* This pushed the markets further up. Looking ahead, in the very near term, we think market outlook will be driven by macroeconomic factors (labour markets, consumption, and any potential near term push to inflation in the US) and monetary policy. *Around 95% of companies in the US reported, as of August-end. |

We believe fiscal deficits concerns, inflation expectations and monetary easing will continue to drive yield curve steepening across developed markets, particularly in the US.

Credit conditions are stable and momentum in the markets is strong, but this could change if disappointment on earnings emerge. We are balanced and slightly positive on risky assets:

In fixed income, fiscal spending concerns, inflation, and central banks easing will be the focus of the markets. We are neutral on duration overall, but see potential for curve steepening. In corporate credit, we are marginally less positive on European high grade, but it still remains a sweet spot in terms of its valuations.

Concentration risks in US equities are high, and any weakness on the economic front could exacerbate volatility. Hence, we prefer to keep a diversified and global approach in favour of Europe, the UK and Japan. We are also monitoring whether volatility in these regions could present opportunities for high quality stock picking.

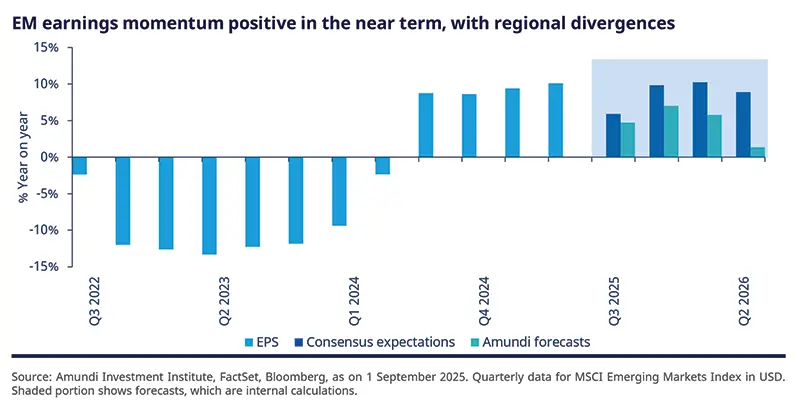

Positive earnings‑growth expectations in emerging markets and a weaker dollar allow us to remain constructive on the structural EM story, even as we monitor the trade developments. We also confirm that the idiosyncratic factors remain the mainstay of our views. We stay positive on Latin America and EM Asia. In fixed income, Fed easing and generally controlled EM inflation keep us constructive.

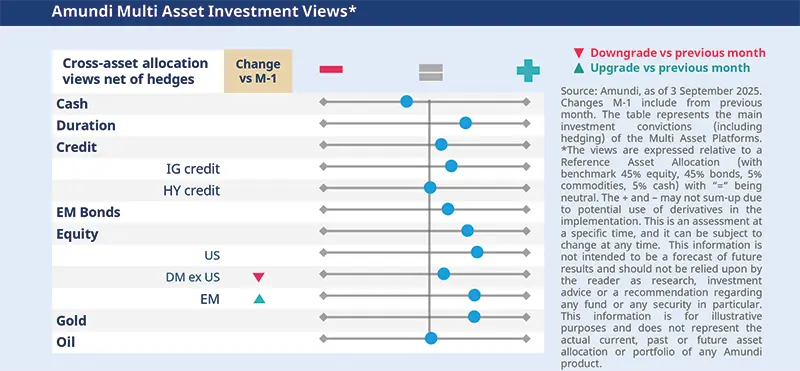

In multi-asset, we acknowledge a nuanced environment playing out in the global economy and hence remain well-balanced, slightly tilted towards risk assets such as EM equities. At the other end, we maintain a positive stance on government bonds and commodities like gold.

Valuations, potential margin pressure from tariffs in the rest of the year, and below-potential US growth prevent us from raising our stance on risk assets.

FIXED INCOME

Curve steepening amid deficit concerns

Amaury D’ORSAY |

Higher US inflation expectations in the short term, fiscal spending plans in the US and EU (ie, higher bond supply), and continued monetary easing are the main themes we will focus on in the medium term. Collectively, this has led yields in the US, Europe, the UK, and Japan to rise, particularly on the long end of the curve. Additionally, reforms to the pension system in some countries in Europe would further push long term yields upwards.

In the UK, we have our eyes on inflation and the government budget (in November) and whether it can reassure the markets that funding will not be an issue. On the other hand, corporate spreads are tight but we see selective value and attractive carry for instance in European high-quality.

We are neutral on duration overall, including on the US as risk-reward is not attractive. But curve steepening will continue.

On the EU also we are also neutral. Tactically, we have turned slightly cautious on core duration (Germany and France) amid the evolving fiscal plans, but we are positive on peripheral bonds (Italy and Spain).

In the UK, curve steepening is attractive. But in Japan fiscal deterioration and inflation keep us cautious.

Following the recent spread tightening, we have lowered our constructive stance on EU IG. The asset class still offers attractive carry, keeping us positive. We continue to prefer names in higher‑beta and banking sectors, and medium-term maturity instruments (3-7Y).

In EU HY, while overall we are neutral, it still offers selective value, particularly in the near-term maturities in the financials and telecom sectors.

On the USD, we are close to neutral now, after its sharp decline. However, we maintain that rate cuts by the Fed and potential for international capital repatriation would weigh on the currency in the medium term.

Given the EUR/USD’s appreciation so far, we have tactically moved negative on the regional FX due to weak growth dynamics in core countries and political environment.

On GBP, we stay cautious.

EQUITIES

Diversify in times of concentration risks

Barry GLAVIN |

Despite the ongoing geopolitical noise and policy uncertainty, global equity markets continued to climb higher. AI sectors are supporting markets, while hard data is, as yet, showing no signs of impact from tariffs. Corporate earnings were better than expected in the US, but concentration risks are rising. Hence, we favour a continuation of a shift away from the US market towards Europe and Japan.

We believe Europe is better-positioned to mitigate some tariff-related impacts through fiscal and monetary policies. It should also benefit from reforms aimed at enhancing competitiveness at EU level and declining energy costs. Across markets, we expect volatility to persist, and aim to capitalise on any share price weakness among quality stocks. Overall, our preference for balance sheet strength and idiosyncratic risk is retained.

We believe US valuations are a concern, and we prefer staying out of the expensive tech segments.

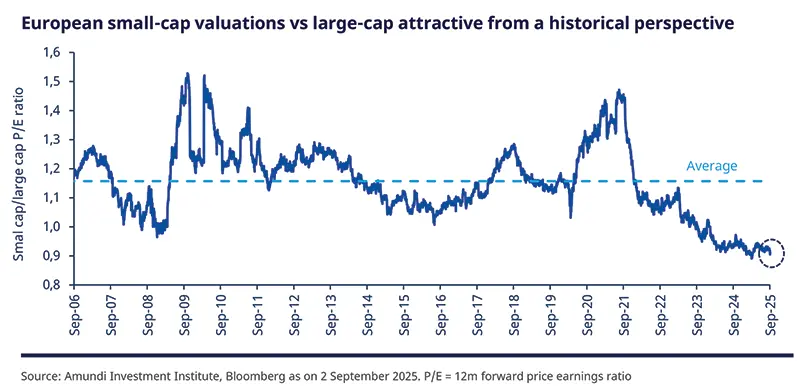

In Europe, we remain constructive, particularly on the small/mid-Caps segment, given their exposure to domestic markets and attractive valuations relative to the large-caps. We also retain our stance on the UK due to a combination of its valuations and high dividends, although we keep an eye on deficit dynamics in the country.

In Japan, we seek quality international businesses and remain positive on the corporate reform story. We also like small-caps, given their robust earnings and valuation levels.

We retain our barbell views, preferring domestic exposure among the defensive companies and quality cyclical stocks within the industrial and material sectors.

In the US, the tariff impacts on the growth stocks ensure that we favour the value areas. We also like quality companies that are relatively protected from Trump's policies. Within financials, select large cap banks may benefit from a steepening yield curve, benign regulatory changes and lower taxes.

Bouts of short-term market volatility are likely to be a feature before year end. Hence, we are positive on low volatility factor.

EMERGING MARKETS

EM idiosyncratic stories make a comeback

| Yerlan SYZDYKOV Global Head of Emerging Markets |

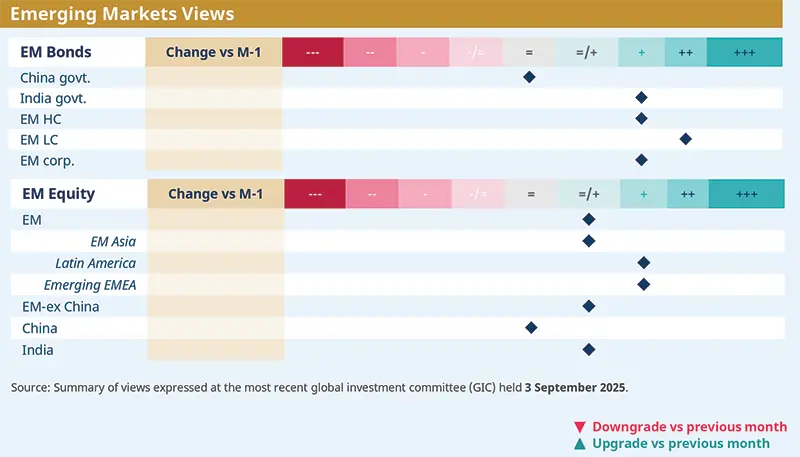

Global emerging markets are displaying a return of country-specific factors – some improvements observed in the economic environment in China (external pressures have abated but domestic demand still weak) and India, whereas politics is coming back in focus in Brazil and Indonesia. However, volatility on the trade front still remains a factor across EM. In countries such as India, internal tax reforms bode well for domestic consumption, which is a mainstay of growth.

Overall, in light of a dovish Fed, global investors should benefit from better growth in EM and positive earnings momentum that will allow them to diversify away from the US. That said, we are monitoring geopolitical risks and developments on the trade front.

Declining rates in the US and contained EM inflation backdrop is generally constructive for EM bonds.

In particular, we are positive on local‑currency debt in Brazil, Mexico, and Peru. We also like Hungary and South Africa, where real yields are attractive and central‑bank actions should be supportive.

With a selective approach, we remain constructive on hard currency bonds in LatAm and Europe. We acknowledge that valuations have compressed, but we believe there is additional room for compression, particularly in the high yield segment.

In Asia, our neutral stance on Chinese government bonds is unchanged, and we stay constructive on India.

In China, while we acknowledge that sentiment is improving, we stay neutral given persistent overcapacity in many industries. We are monitoring closely how the government’s anti‑involution policies affect corporate earnings.

Indian valuations are more attractive now, and earnings‑growth expectations are also positive. We remain constructive on the structural story, although uncertainties persist around private capital expenditure and tariffs.

Regionally, we are constructive on LatAm and emerging EMEA. Valuations in Brazil are attractive, but we are monitoring the fiscal situation and tariffs impact.

MULTI-ASSET

Pro-risk stance with a rotation to EM

Francesco SANDRINI | John O’TOOLE Head of Multi-Asset Investment Solutions |

While maintaining a constructive stance on risk, investors should explore rotation opportunities, such as those in EM, in light of the evolving macro environment.

Over the summer, we did not see any extreme macro data coming out of the US or Europe, leading the markets to stay relatively calm. We did, however, note a deterioration in US labour markets even as higher US tariffs were confirmed. Both these should pressure consumption – we affirm our stance of a decelerating growth in US. Monetary policy, on the other hand, looks likely to be accommodative in the EU as well as US. Hence, we are slightly optimistic on risk assets, including EM, and see a need for safeguards in the form of gold (geopolitical risks, fiscal deterioration) and equity hedges.

We are positive on equities, including the US (balanced between large and mid caps) and, slightly on the UK, but have tactically downgraded Europe to neutral (tariffs could weigh on corporate earnings) in order to raise our views on EM. EM offers a wide basket of markets, such as India, and we are more positive on them. They should benefit from a weaker dollar, and a dovish Fed likely to cut rates soon. Second, while we remain positive on China, we have partially shifted our stance from China towards the wider EM. Regulators’ concerns around the sharp market rally in the country could pave way for a short-term correction.

We have been staying positive on DM govt. bonds for many months amid a general disinflation trend and easing central banks. Given the fiscal deficit concerns (eg, in US), we prefer to stay on the intermediate parts of the curve (5Y). We are also positive on Europe and UK duration, and like Italian BTPs. Growth in the UK will likely be below consensus, and the BoE’s decision should support some compression between Gilts and UST. However, on JGBs, we remain cautious. Our mildly constructive stance on EU IG and EM bonds is maintained.

Amid rising concentration risks, we see a bigger need for protections on US equities, and keep our views on other hedges, should there be volatility in risky assets. In FX, are cautious on the USD, but are positive on the NOK and JPY. In EM, we favour LatAm FX over the CNY.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.