Summary

Markets, economy and valuations: debate rages on

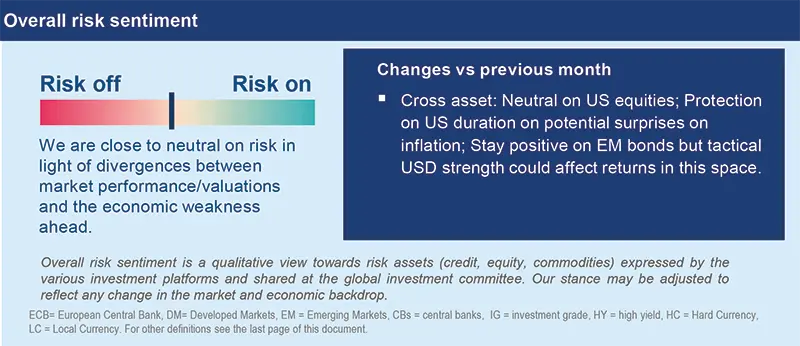

An extension of the economic cycle keeps us close to neutral on risk, but we are monitoring the uncertainty on domestic US consumption and extreme valuations in some segments.

The strength of economic activity, and the market’s expectations of central bank policies and corporate earnings, have been driving asset prices. Valuations are excessive in some segments such as mega caps where profit margins are also high. But the key question is whether these high margins justify current valuations? And will these companies be able to grow their top line quickly, while maintaining margins in a context of increased global competition and exhausted consumers? On the other hand, judging the direction of the economy is becoming increasingly difficult. We think the following factors will be important going forward:

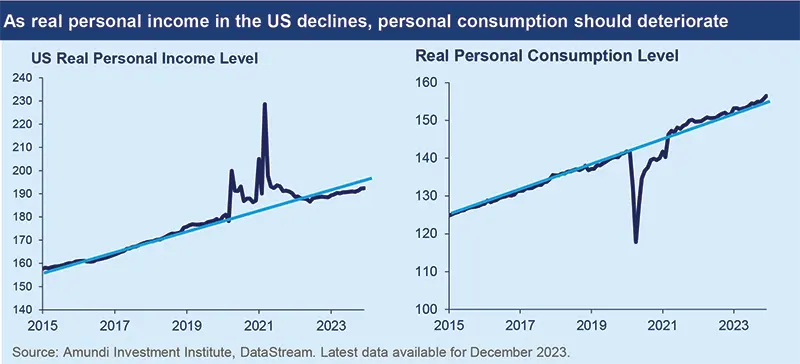

- A delayed but pronounced US slowdown: We see a slowdown in domestic demand owing to limited/no fiscal push and strains in the corporate sector. So far consumption has been supported by a dip in savings, and even excessive borrowings. But as labour markets weaken, this reliance could fade, thereby impacting the economy.

- Divergences/flattish growth in Europe: Germany, which is facing many structural challenges, is likely to be the main laggard this year due to weak investment and exports. Countries such as Spain should fare slightly better. In this context, the role of collective EU fiscal and political strength is important amid the green transition.

- Monetary policy. Beginning around the end of H1, the Fed, ECB and BoE are likely to start cutting rates – total rate cuts of 100 bps for the Fed this year and 125 bps for ECB and the BoE. If inflation continues to fall, we see little reason for the Fed to keep rates restrictive.

We see value in four main areas:

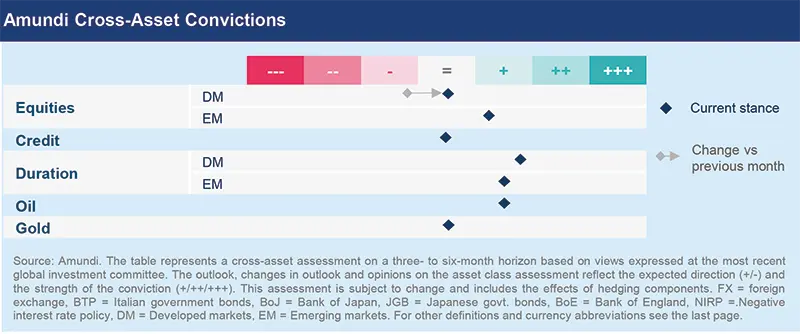

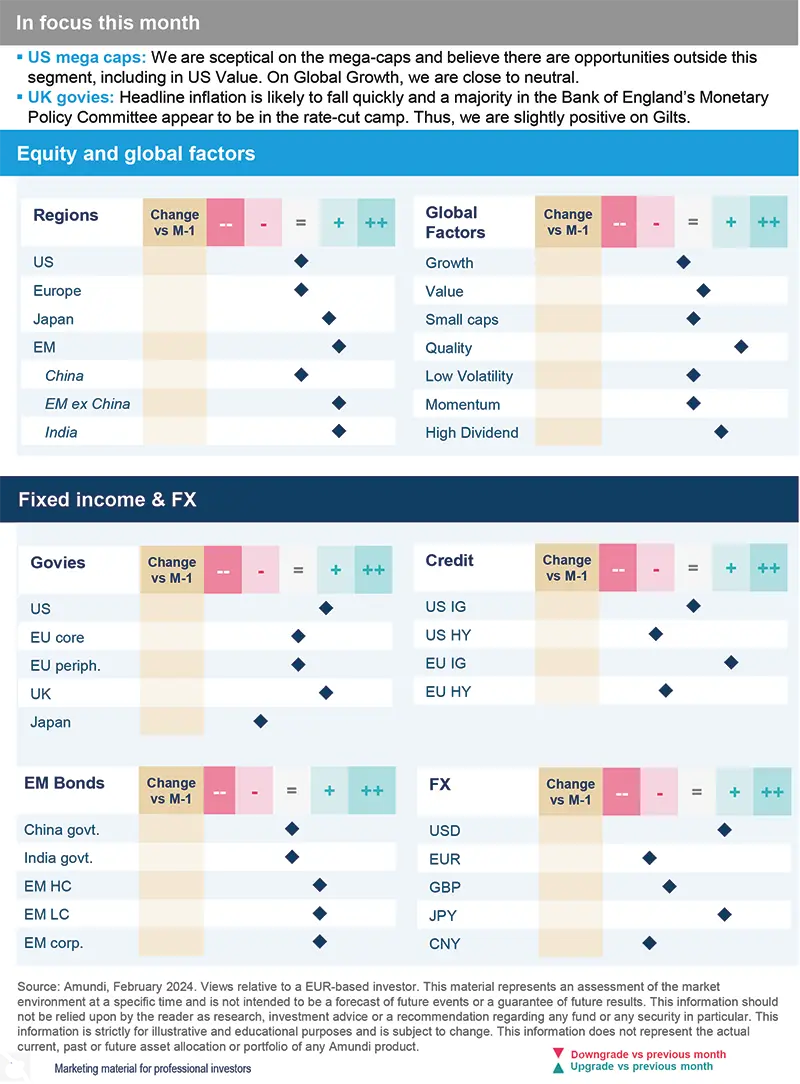

- Cross Asset. We are now close to neutral on Developed Market equities as the economic cycle is proving better than previous expectations. But given current high valuations, we avoid getting too exuberant and look for regional opportunities in Emerging Markets (EM) and Japan. We have become neutral on the US. On duration, we are cautious on Japan, but positive on the US and Europe. Given the potential for fiscal stress and inflation surprises, investors should be active in managing duration. In addition, any near-term strength in the dollar could affect EM bond returns, and thus, calls for vigilance. Finally, oil is a good hedge amid geopolitical stress and potential for mild upside amid tight supply in the near term.

- In fixed income, we remain slightly cautious on Europe and Japan duration but positive on the US as inflation continues its declining trajectory and in global quality credit. In Europe, we are monitoring the ECB’s assessment of the region’s economy for any signs of policy actions. In the UK, we are slightly constructive amid pressures on the BoE to cut rates. Corporate credit remains an area of carry but liquidity considerations are important, particularly in HY. Thus, we are positive on IG in the US and even more in the EU. In the US, we like short maturity credit and insurance-linked securities. Overall, we are cautious on lower rated HY but see selective value in non-cyclical sectors amid rising dispersion.

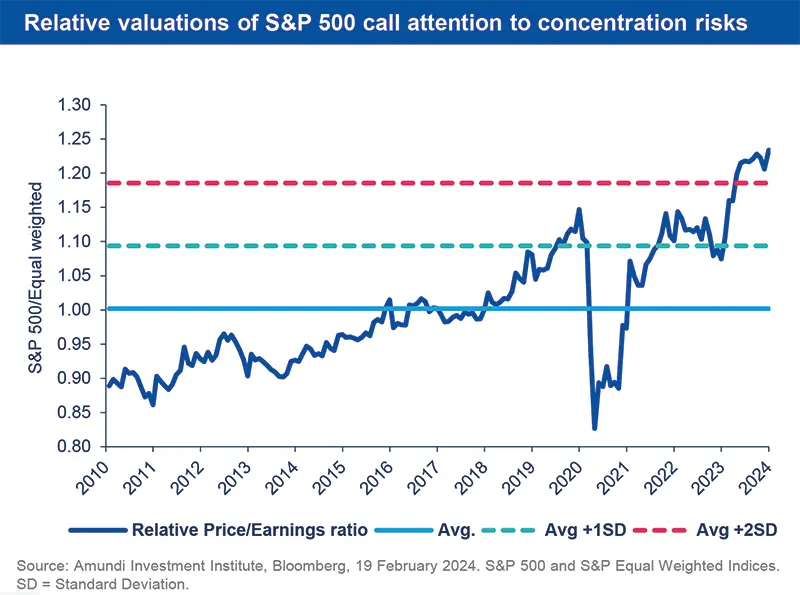

- Recent movements in US equities have been driven by select mega-cap stocks and this raises concentration risks. This, to a lesser extent, is also true for Europe. As the economic cycle evolves, markets should start focusing more on earnings trajectory. We keep a selective stance and we are slightly cautious on the most expensive areas in the US and Europe. But any market anomaly around earnings and valuations is an opportunity to benefit from idiosyncratic stories. From a style/regional view, we stay positive on high margin businesses (quality), US Value and Japan.

- Attractive EM yields and continuing disinflation keep us positive on both Hard and Local Currency debt with a preference for HY over IG. Regionally, we favour LatAm and are more selective in Asia and EMEA. Unsurprisingly, the region is full of idiosyncratic stories such as Argentina. We are constructive also in equities, particularly in Asia (India, Indonesia, South Korea) and LatAm.

Three hot questions

|

Monica DEFEND |

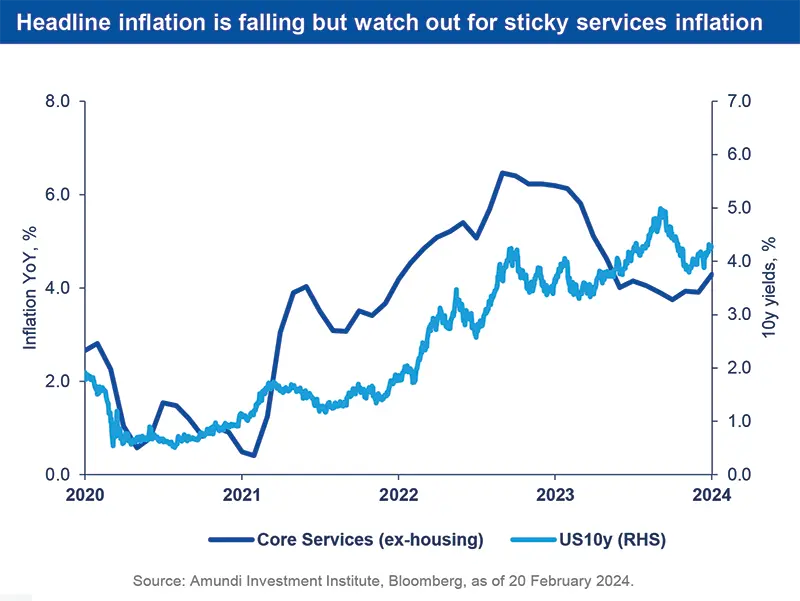

While we expect the Fed, Bank of England and ECB to start rate cuts around June, we would still keep an eye on the pace of disinflation for any surprises.

1| How will the major Developed Market central banks respond to slowing inflation?

Even as disinflation is underway in Europe, the risks of overtightening and the ECB falling behind the curve are not priced in by the markets. The central bank is monitoring incoming data, labour markets and the recent loosening of financial conditions. We maintain it will start rate cuts around the end of H1, with 125 bps of total cuts this year. The BoE has also dropped its hawkish guidance and is likely to reduce rates by 125 bps, beginning around mid-year, although we do not rule out the possibility of a surprise cut sooner. In the US, the Fed would need to be sure that inflation trend is moving towards its targets.

Investment consequences:

- US & UK duration: slightly constructive

2| What is your view on equities reaching new highs?

As US and European equities reached record levels in February, it is a good time to reassess valuations. The broader markets appear stretched, and it is difficult to believe an additional premium to valuations can build up quickly and significantly. In addition, while the economic backdrop is less defensive than before, tight valuations are preventing us adopting a more favourable view on equities. If a tactical correction happens it could present opportunities to add more into this asset class at attractive levels. By then, we would have more clarity on the economic backdrop as well.

Investment consequences:

- Close to neutral on the US and Europe

-

Slight positive on Japan

3| What is your outlook for commodities in the near term?

Oil prices may see some near-term strength owing to strong technicals and still resilient global growth. But we expect limited gains in the medium term owing to factors such as spare capacity and low supply discipline from OPEC. On the other hand, gold prices seem to be in a wait and see mode. Given modest valuations for the metal and fading hopes of an early Fed pivot, we expect marginal upside in the short term. However, if the Fed cuts sooner than expected, that could provide bigger upside.

Investment consequences:

- Brent target: $85/bbl in the short term

- Gold: $2050/oz

MULTI-ASSET

Dynamic allocation: neutral, vigilant on risk

|

Francesco SANDRINI |

John O'TOOLE |

US disinflation/ growth mix and rate cut expectations are providing impetus to US equities, making us tactically neutral on Developed Market equities.

While we expect a slowdown in the US, the situation is not straightforward, particularly when we consider earnings and risk asset valuations. Hence, we maintain a dynamic assessment that takes into account near-term nuances and balances long-term convictions. Even though we turned neutral on DM equities, we are basing our conviction on geographical divergences (DM vs Asia). At the same time, we stay well-diversified through commodities, and have fine-tuned our FX views and hedges.

The Global equities environment is increasingly uncertain, with the US economic cycle extending, but future growth looking challenging. We turned neutral on the US amid disinflation and robust growth. In addition, we are cautious on Europe, and slightly positive on Japan despite recent data. However, our stance is more forthright in EM (Indonesia, Korea, India).

We stay marginally constructive on US and European duration in light of uncertainty on future activity and expectations of interest rate cuts. Given that inflation and fiscal imprudence/stress (due to US elections) could affect CB actions and yield movements, we remain very flexible. On Italian BTPs, we believe there are limited idiosyncratic risks and there is further potential. However, we are cautious on JGBs and monitoring how the latest GDP data could act as a headwind for the BoJ to exit its NIRP.

In DM credit, we like EU IG, given its high quality and attractive relative valuations. Elsewhere, the disinflationary trend in EM and start of DM central banks’ easing cycle in the near future paint a positive picture for EM bonds. EM yields are attractive but higher-than-expected US inflation, better US growth prospects (vs rest of G10), and dovish monetary policy priced into the dollar (scope for appreciation) could prolong USD strength. Thus, investors should consider this aspect in their allocation.

While we stay tactically positive on the dollar, we think this trend is unlikely to be sustained. We are also constructive on EUR/GBP and JPY/CHF. Incidentally, US monetary policy and growth would also affect JPY. In EM FX, we maintain our preference for LatAm (BRL) over Asia.

US inflation is declining but any surprise could affect USTs, underscoring the need for some protection. At the other end, oil offers protection against geopolitical risks, given its strong technicals.

FIXED INCOME

Go global in bonds, with an eye on ‘last mile’ inflation

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

Markets have been reassessing their expectations (vs a few months ago) of Fed policy rate cuts on the back of central bank communication and US inflation data. Both the Fed and the ECB would like to see continued progress on inflation before they initiate their first rate cuts. And, given the recent trend in core services inflation in the US, it makes sense for them to be patient on this front. From an investor perspective, this means risk-free yields at current levels are attractive, particularly in the US. However, owing to uncertainty on the evolution of the economies, we remain very agile in bonds and look for global opportunities. We remain positive in global quality credit and in EM bonds.

Global & European fixed income

- We stay slightly cautious on core European duration. But this could change amid greater clarity on ECB actions.

-

On Japan, we are cautious and are monitoring BoJ actions.

-

In credit we like EU IG but stay agile to adjust for market movements. We favour financials and subordinated debt and IG over HY. In HY segments we notice high dispersion, with selective opportunities in short-maturity EU credit.

US fixed income

- We are positive on duration amid progress on inflation but are flexible.

- We prefer IG to HY and within IG we like financials. In addition, the intermediate part of the credit curve and shorter maturities offer better value.

- We are cautious in HY but look for higher-rated credit and insurance-linked securities. We are also mindful of liquidity.

EM bonds

- Continuing disinflation, robust EM growth and potential Fed easing are positive factors.

- We like HC and corporate debt but favour HY over IG, given attractive relative valuations and better carry. In LC, we maintain our tilt towards LatAm.

- We see positive idiosyncratic stories, ie, Argentina (strong harvest, attractive carry), Egypt.

- But we are cautious on the Middle East, while we like commodity exporters.

EQUITIES

Focus on earnings resilience and valuations

| Fabio DI GIANSANTE Head of Large-Cap Equity |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

As markets touched new highs and concentration risks increased in the US and Europe, we are assessing whether it is sustainable for stocks to push higher purely from a macro/growth perspective. Given full valuations, any downside catalyst in the form of disappointment in rate cuts, weak economic data etc., could hamper returns in the more expensive segments. So, the big question is whether we will see a slowdown in the US, and if so, how deep would it be? If we do see economic weakness in the US and Europe, earnings would be affected. Thus, investors should explore segments that offer the right balance of potential future earnings growth and valuations in the US, Europe, Japan and EM.

European Equities

- We prefer a barbell style, with positive views on quality defensives and cyclicals.

- Sector-wise, we are slightly more constructive on staples. Investors should also consider using market volatility to explore luxury businesses.

- In financials, we like banks offering high dividend yields and above-market earnings growth.

- But valuations of some semiconductor companies look stretched.

US & Global Equities

- In markets that are skewed towards mega caps, we aim to benefit from discrepancies in Value vs Growth, Equal weighted vs mega caps.

- Incrementally less positive on energy on oversupply concerns.

- We favour defensive with reasonable valuations and like quality cyclicals that are becoming attractive after recent earnings.

- In Japan, there is potential for adjustments, from a bottom-up perspective.

EM Equities

- Constructive on a divergent EM universe. We are vigilant on China owing to weak consumption, but the government’s willingness to improve sentiment is positive.

- Elsewhere in Asia, in South Korea, we are slightly more constructive amid improving corporate governance.

- Overall, we look for structural trends in Asia and LatAm, and continue to like India, Indonesia.

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.