Summary

Deal or no deal, prepare for a volatile summer

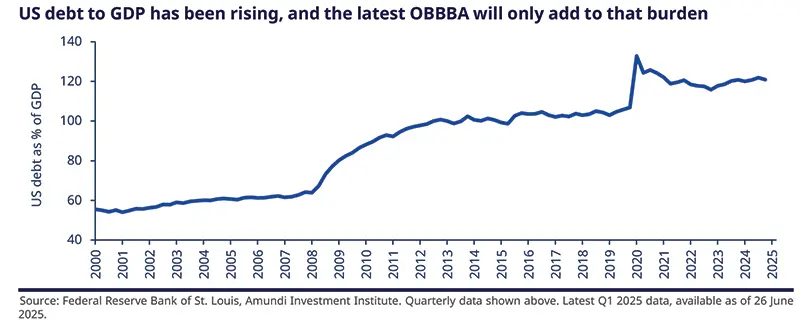

Global equities reached new record levels in July on expectations of trade deals, easing of US tariff threats and hopes of a short-term boost to US growth from the One Big Beautiful Bill Act (OBBBA). This has happened despite US tariffs moving higher (when compared with before Trump came to power), indicating some complacency in risk assets. On the other hand, bond yields in the US, the UK, Europe, and Japan are reflecting concerns over debt sustainability.

We think that, with so much uncertainty over policies, any good news regarding the economy and decisions on tariffs, such as the one with Japan, is being welcomed by the markets. However, Trump’s transactional approach will persist even after agreements with trading partners are finalised. This policy uncertainty is perhaps most evident in the USD.

We outline below factors that could cause market turbulence this summer:

OBBBA – short-term gain, long-term pain, and social consequences. In theory, the bill will likely boost consumption, investments and GDP growth in the short term, through front- loaded tax cuts. However, it would add more than $3 trillion to US debt over 10 years and is likely to hurt the income of the most vulnerable households when social spending cuts will take effect in October 2026. Secondly, cuts to Medicaid mean that people may set aside additional funds for emergencies, impacting their spending patterns. Finally, in addition to increasing the deficit, the bill is likely to put further upward pressure on long-term rates.

The rosy scenario priced in the markets ignores any volatility stemming from Trump following through on his tariff threats, which may weigh on US growth

US companies or consumers, someone will have to bear the cost of the higher tariffs. If companies pass on the costs to consumers, then consumers’ disposable income will be affected. So far, however, companies and importers are bearing the brunt. Corporate forward guidance this earnings season should provide more details on the impact of these tariffs on profitability, and whether companies are putting their capex plans on hold. In Europe, the focus is on how the strength of the EUR/USD exchange rate could affect corporate earnings in the regional currency. On the consumer side, weakness in personal consumption expenditure, moderation in real disposable income growth, and cooling — but not massively deteriorating — labour markets will make consumers more discerning with respect to discretionary spending.

Final tariffs and retaliation, if any, will affect growth expectations. Given the still evolving situation, we will assess the final tariffs by the US, EU and other countries in estimating our growth forecasts. Q2 GDP data for the US and the Eurozone US-EU trade negotiations, particularly on tariffs and retaliation, will affect our growth projections. Any substantial increase in import duties raises the downside risks to US growth.

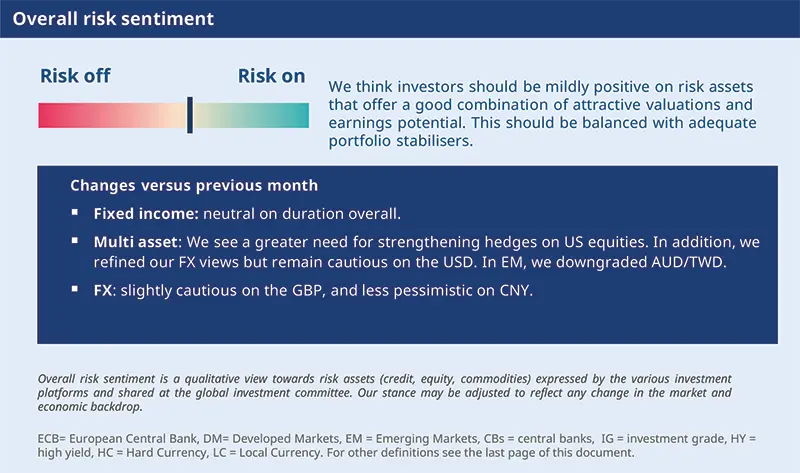

Markets’ expectations for US profits this year have declined, compared with April, and are now closer to our estimates. Additionally, trade negotiations, and geopolitical risks could exacerbate volatility. While liquidity is sufficient in the markets at the moment, this could change if these risks materialise. Therefore, we believe investors should refrain from taking up directional risks in expensive segments. We are moving towards a more nuanced stance on risk, with scope for ample safeguards.

| Amundi Investment Institute: Fed independence, trade negotiations, euro strength |

Risks around Fed’s independence are increasing again. The Fed would like to wait for clarity on tariffs and their inflation impact before taking any decision, and rightly so in our view, but pressures from the government to take policy actions may cause the market to question the bank’s decisions. For now, we maintain our stance of three rate cuts this year. If inflation does stay persistently above the Fed’s comfort level, we will also see a weakening of economic growth due to tariffs. The Fed may then choose to ignore inflation and focus on the growth part of its mandate. The ECB appears comfortable with inflation but will likely be vigilant on tariffs. |

EU-US trade negotiation, along with any retaliation, is a major factor that could affect growth and inflation expectations for the region, thereby affecting ECB’s policy decisions.

While profit forecasts remain volatile and valuations stretched, we don’t see a case for structural de-risking but focus on adding hedges to navigate any volatility during the summer.

In fixed income, attractive carry, a no-recession scenario, and central banks in easing mode allow us to be positive on corporate credit. While liquidity in the market is ample at this stage, this could change amid any pressures from higher tariff rates. Thus, we focus on carry and quality in credit. Tactically, we are now close to neutral on overall duration.

US and European stocks rebounded from April lows, but during that time policy uncertainty has increased. In both cases though, market breadth is narrow. We are keen to identify resilient business models less impacted by tariffs and focus on quality through balance sheet strength. In particular, we prefer Europe over the US, and we like Japan and the UK.

Emerging markets have been resilient and economic growth robust. Tariff and trade negotiations could create volatility, leading us to be more selective. We like EM bonds with attractive real yields. In equities, we favour franchises that can capitalise on domestic demand and look for geographic diversification - emerging Europe, UAE, Latin America, India.

In multi asset, we remain slightly positive on equities and risk assets. We combine this view by enhancing and maintaining dynamic safeguards that take into account sharp market movements. In FX, we stay cautious on the dollar, but acknowledge a potential for some near-term consolidation. At the other end, we are constructive on US and EU duration, and on commodities such as gold.

Uncertainty from geopolitics and/or trade negotiations and disappointment on earnings could trigger a correction in areas that are more expensive.

FIXED INCOME

Balance carry and quality in credit

Amaury D’ORSAY |

US macro data is holding well, and due to declining inflation, central banks such as the ECB and the BoE are on an easing trajectory. Even the Fed will eventually resume easing. At the same time, our base case is one of no recession in the US and Europe. However, exacerbated by uncertainties around international trade, growth will likely slow down. The fiscal lever becomes important in this context, with its aim to boost spending and security ambitions for instance in Germany.

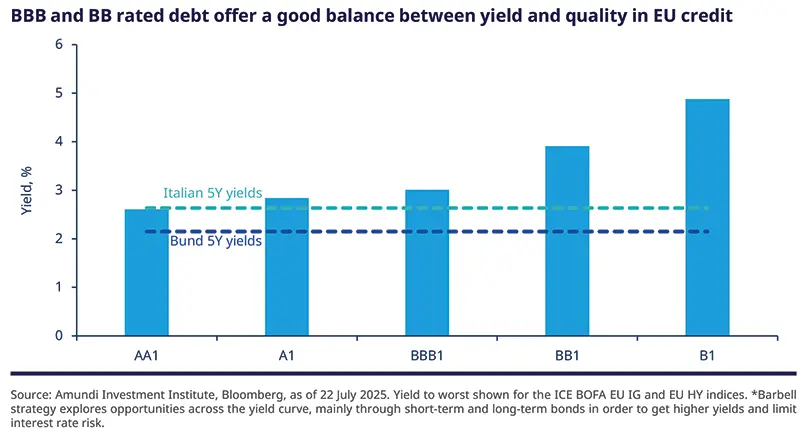

This implies that the pressure on the long end of the curve will persist, creating steepening opportunities. Another key area to enhance income is carry in credit. We prefer to do this through the quality segments better equipped to withstand pressures from the economy and geopolitics.

Tactically, we moved close to neutral on duration overall. This stance is mainly reflected through neutrality on the US and the EU. In the US, term premium and fiscal risks are getting more attention.

However, we are constructive on Italian BTPs, and on UK duration amid a dovish BoE. We are also exploring the potential for barbell strategies along the UK curve.*

On Japan duration, we remain cautious.

In an environment of generally sufficient liquidity and decent corporate fundamentals, we are constructive on credit, primarily EU IG (carry is attractive vs. sovereign yields) and sub. debt.

We explore businesses with low debt, medium-term maturities and BBB and BB-rated debt in the EU.

Higher tariffs could lead to deterioration in fundamentals, leading us to focus on quality.

We have downgraded GBP slightly following its strong performance. UK macro data and its potential impact on the Bank of England are important factors for us to monitor.

We are less pessimistic on the CNY, given that the US tariffs on China (so far) have been better than we expected. We remain vigilant as the country navigates domestic issues and volatility on the trade front.

EQUITIES

Focus on resilient market segments

Barry GLAVIN |

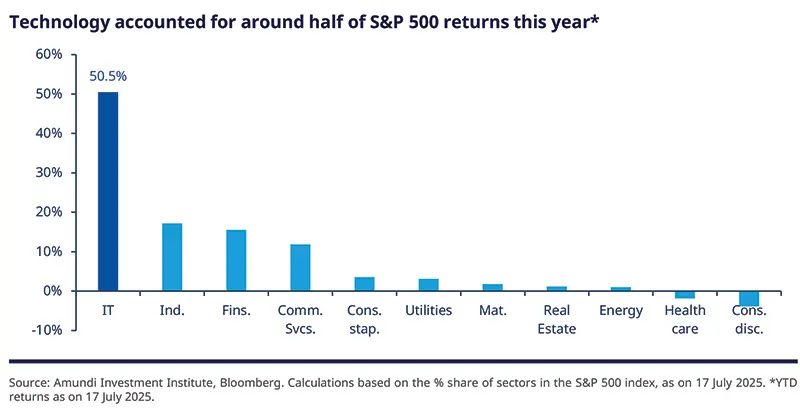

While markets reached record levels in July, the returns this year have been driven by a handful of stocks in the US, as well as in Europe. This increases concentration risks, but on the other hand, it signals that there are market segments that have lagged behind. We are on the look-out for such segments and believe the main push to these businesses could come from how well they are able to maintain earnings resilience.

In addition, even though valuations in Europe are better vs. the US, the big question is how these valuations can be sustained in the face of tariff risks. And if volatility persists, our approach will be to focus on selection and diversify away from expensive areas in the US. We also aim to take advantage of such volatility with a focus on balance sheet strength of companies for example in Japan and Europe.

We believe over the past months there has been a lot of noise on the tariff fronts. As a result, many quality names have de-rated, leading us to enhance our views on these, underlining the role of selection.

We maintain our barbell views, and are constructive on Europe, particularly small and mid-caps. Some European businesses should be able to adjust to a trade war with the US, given the diversification of their revenues. We also like UK stocks due to the high dividends on offer.

We are positive on Japan where valuations are very attractive. The recently concluded trade agreement with the US only adds to this sentiment. Japan is also home to high-quality international companies.

We are positive on defensive sectors such as consumer staples and pharmaceuticals. On the latter, we turned slightly more positive through some quality opportunities in the personal care business available at attractive prices. On the other hand, we also explore quality cyclical businesses in the industrials and materials sectors. Overall, we tend to maximise idiosyncratic risks.

In the US, we see high dispersion and the premium for the Mag 7 as too high. Hence, we stay cautious on US growth and tech names as we believe they are driven more by sentiment and less by fundamentals.

EMERGING MARKETS

EM strength tested by trade volatility

| Yerlan SYZDYKOV Global Head of Emerging Markets |

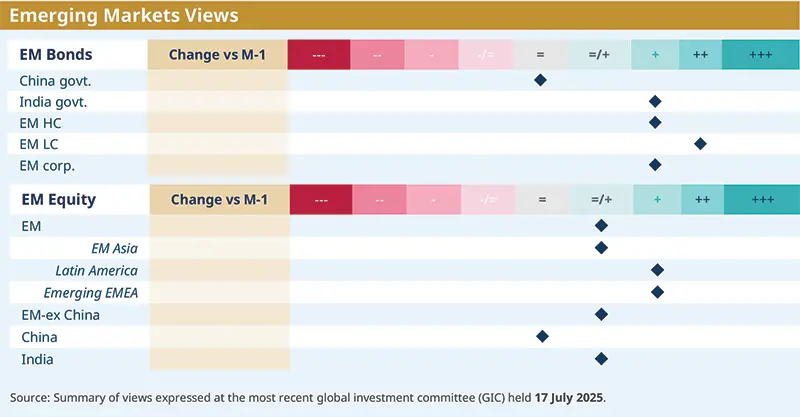

Global trade has remained strong in the first half of the year, and we’ve witnessed front-loading in exports to the US because of tariffs. Looking ahead, stronger EM growth (vs. DMs) will likely persist amid a generally contained inflationary backdrop, but tariff-related newsflow with respect to any US trade deals with EMs (for instance with Indonesia) and new announcements by the US could create volatility.

Hence, trade deals are important but we also take into account market liquidity, domestic consumption environment and the fiscal strength of these countries to form our views across EMs. For instance, while we are seeing that Chinese GDP growth was better than expected and indicates the country may meet government’s growth target this year, domestic consumption issues persist.

In general, we are constructive on corporate credit and are mindful of earnings outlook which may be affected by macro uncertainty. HY offers opportunities but we are selective across countries.

We are also positive on HC debt, but prefer HY over IG, with a selective stance in markets in Sub-Saharan Africa, emerging Europe and Latin America.

Expectations of a weakening dollar and under-control inflation provide a constructive anchor for LC debt. In particular, we like LatAm countries such as Brazil, Mexico, Peru and Colombia.

We are mindful of volatility due to trade negotiations and based our stance on domestic, country-specific, and idiosyncratic factors.

For example, while we are generally cautious on the MENA region, we are positive on the UAE, where we see attractive, reasonably priced businesses. We are also positive on emerging Europe.

In Asia, we believe the Indian markets and the technology sector in Taiwan are likely to perform well, although trade negotiations with the US could act as a near-term dampener.

| Main convictions from Asia |

Asian markets have weathered the Middle-East conflicts, US fiscal uncertainties and renewed tariff scares, well so far. Both domestic and international factors provided anchoring for markets. Domestically, Asian economies have been resilient, with export growth holding up thanks to receding tariffs, while domestic demand was supported by incremental policy easing. Externally, buoyant global risk sentiment and dollar depreciation have kept financial conditions easy, supporting a re-rating of Asian assets.

|

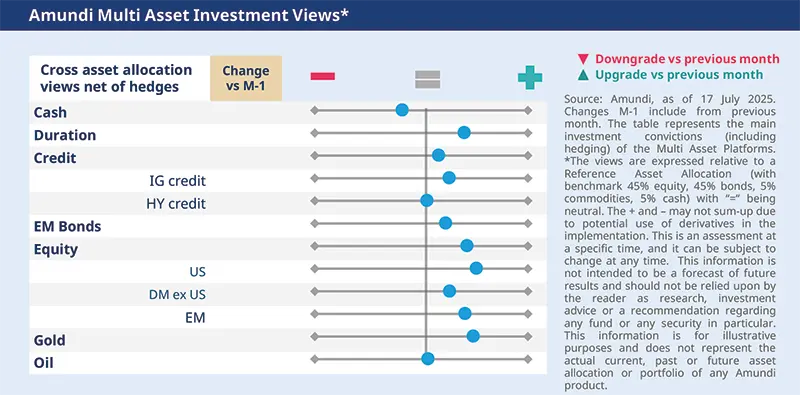

Multi-asset

Positive on risk, mindful of Trump factor

Francesco SANDRINI | John O’TOOLE Head of Multi-Asset Investment Solutions |

We think investors should consider taking advantage of low volatility to strengthen safeguards, particularly on US equities.

Even as US economic activity is decelerating, there are many sources of volatility coming from trade, consumption and Trump’s policies on tariffs. On the other hand, the recently approved OBBBA and any resilience in US data could provide a near-term fillip to risk assets. In the Eurozone (EZ), growth will be heterogeneous and supported by the German fiscal boost. With this in mind, we maintain our slightly constructive stance on risk assets, but acknowledge the need for dynamic protections and fine-tuned our FX views.

Equities are displaying strong momentum on the back of tailwinds in the form of a dovish Fed and an improving manufacturing sector in the EZ. This allows us to be positive on the asset class and we remain diversified. We like US, European and UK equities. We also see greater need for strengthening of protections in the US amid an earnings season that could be volatile. The UK offers a good diversification benefit in the broader European region, along with attractive

valuations and a defensive market. In EMs, we stay positive on China owing to a combination of tech-related and quality opportunities.

In fixed income, we stay optimistic on US 5Y, and on European duration due to continued disinflation. A small positive stance is also maintained on UK gilts, given weak growth and a supportive BoE, although we are pessimistic on Japanese bonds. In EU IG, strong corporate fundamentals indicate decent outlook for the asset class, while EM spreads offer a good carry at this stage.

We are monitoring any consolidation in the USD but maintain our negative stance. We reduced our positive views on the EUR/USD, and are no longer optimistic on the USD/CHF. At the same time, we raised our conviction on NOK/USD. The NOK depreciated excessively recently owing to a dovish central bank, and, we see space for a tactical rebound. In EM, we no longer like the AUD/TWD due to low carry and high volatility.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.