Summary

A breather after buoyant markets

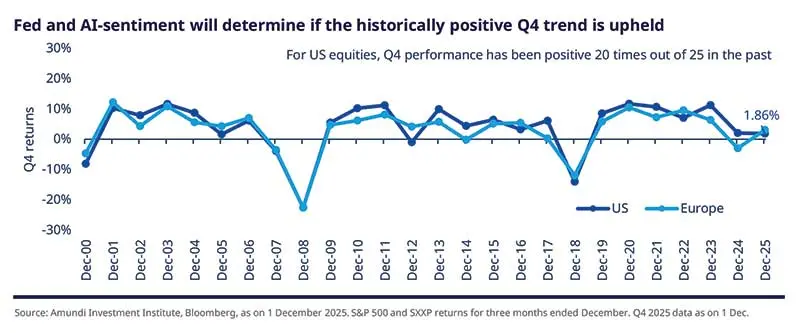

The year is drawing to a close with most risk assets in positive territory, and global stocks and metal prices seeing multiple highs. Even the longest US government shutdown in history didn’t curb market enthusiasm. We think markets have been looking through the weakness in the belief that monetary and fiscal policy levers will be available for support, that profitability of AI investments is almost a given, and that corporate earnings will continue to exceed expectations, following a strong results season in the US, somewhat less so in Europe. The tariffs’ impact on consumption is also largely being ignored.

However, recent concerns over artificial intelligence-led euphoria in the US affirm our stance. We maintain our view that AI capex is boosting the US economy, but is not leading to job creation. Furthermore, while monetary and fiscal support may stabilise the economy, risks in the form of fiscal dominance and financial repression persist. In particular,

- US growth picture is mixed. AI investments are positive, but consumption and labour markets are softening. Although the top income earners have been driving spending this year, as low- and middle-income consumers struggle, overall consumption will be affected. For instance, expiring health care subsidies at year end will lead to an increase in health care costs for such households. In addition, softening of US labour markets will continue and wage growth will moderate. Finally, risks to the independence of the Fed remain. If the Fed yields to the pressure, it might cut rates more than what’s needed purely by economic considerations. This may de-anchor inflation expectations.

In an environment of high valuations and scrutiny of AI-investments, we are particularly interested in seeing an improvement in productivity and earnings.

- Eurozone (EZ) 2025 growth upgraded from 1.1% to 1.3% (in line with the EC’s autumn forecasts), but weak domestic demand prevents us from changing our qualitative assessment. This revision is mainly due to stronger than expected Q3 numbers (France and Spain), but we do not change our assessment of the EZ economy. We see demand showing only very slow improvement, which is consistent with an elevated savings rate. Second, the fiscal stance outside Germany is neutral in Europe. And third, the external environment on exports to the US is ambiguous. Even if the US Supreme Court bars Trump from using his emergency powers to implement tariffs, he has the option to use sectoral tariffs.

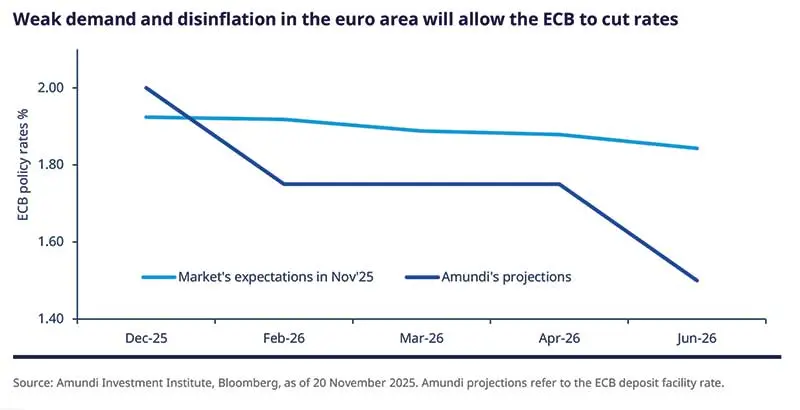

- No change to EZ and US inflation forecasts. US inflation is set to remain above the Fed’s target in the near term. In the EZ, disinflation continues, with 2026 headline CPI projections close to 1.7% and then rising very slightly in 2027. Importantly, the ECB estimates 2027 inflation at 1.9%, but this is dependent on ETS2 (Emissions Trading System 2) being implemented. Any delay to ETS2 beyond 2027 is likely to lead the Bank to lower its inflation projection for that year. For US inflation, we confirm the outlook will depend on both the speed of deceleration in core services inflation and how quickly and strongly tariffs are passed on to the prices of core goods.

In a world where US growth is slowing, but not sharply, stock valuations are high, yet opportunities remain; diversification away from concentrated segments and towards higher income asset classes is the name of the game. This is complemented by challenges to US exceptionalism, which we expect to be reflected in a weakening dollar over the long term.

Amundi Investment Institute: Weak Eurozone growth will prompt the ECB to cut rates

|

We now expect the ECB to reduce policy rates next year, once each in the first and the second quarter, for a total of 50 bps, with much depending on evolution of growth and inflation.* We also believe that markets are not considering downside risks to European growth, and are not pricing in any significant cuts between now and June 2026. We differ from the markets here. In the case of the Bank of Japan (BOJ), we have raised our projection of the terminal rate from 0.75% to 1.00%, with one hike expected in December and another next year. The Bank will seek to manage yen depreciation resulting from any fiscal expansion. A weaker yen makes imports more expensive, thereby pushing up inflation, and the BOJ would like to avoid that. No change to expectations for the Fed and the Bank of England (BoE). We still project a Fed cut in December, but we are monitoring the internal debate at the Fed, given the concerns about sticky inflation and signs of economic resilience. Regarding the BoE, we have not changed our expectations and believe a rate cut in December looks imminent. On the fiscal side, market volatility around the pound and yields is likely to remain high. |

While we have upgraded our growth expectations for the eurozone for this year, we think domestic demand will be weak and this along with disinflation may lead the ECB to reduce policy rates twice next year.

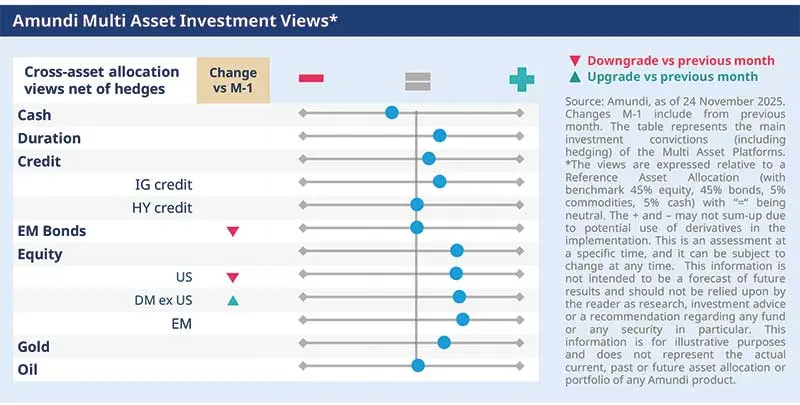

Our main asset class convictions are highlighted below:

- In fixed income, we are neutral on duration overall, and see scope for regional divergences across the yield curves. For instance, we moved to upgrade EU duration to positive, but turned less positive on the UK and are close to neutral/marginally cautious US. At the same time, we remain constructive on EU investment grade credit and constructive on the fixed income space in emerging markets, where the case for income and selection is high.

- In equities, we keep our barbell approach with quality cyclical sectors, and defensive stocks. Our main focus is on identifying businesses with strong fundamentals and attractive valuations. We find a combination of such businesses in Europe, Japan, and emerging markets. Within EM, the appeal of equities is driven by strong inherent economic growth of the region and their diversification potential.

- In multi asset, we strive to maintain a more balanced stance in risk assets. While we stay overall positive on equities, we have made some adjustments by reducing our conviction on the US and upgrading European equities where pricing is more attractive. Additionally, we have downgraded emerging market bonds following the spread tightening. We maintain that this segment shows very limited negative catalysts at the moment, and may present opportunities going forward.

We believe investors should remain well-diversified with a moderately risk-on stance, which captures value across different regions in Europe, Japan, and emerging markets.

FIXED INCOME

Agile duration: evolving inflation, policy

Amaury D’ORSAY |

Economic growth in Europe is being affected by a cautious consumer, even as we expect disinflation to continue. Headline inflation in the EZ is likely to be below the ECB target by the year-end. Both these should lead the ECB to reduce policy rates. In the US, fiscal impulse amid US mid-term elections next year could put some pressure on the markets there.

The fiscal side is also in focus in the UK as the government tries to plug the gap between its revenues and expenses. Any fiscal tightening would affect growth expectations. Our steepening bias remains across the developed world except in Japan. Overall, we look for opportunities across yield curves, in DM, as well as EM in the search for higher income.

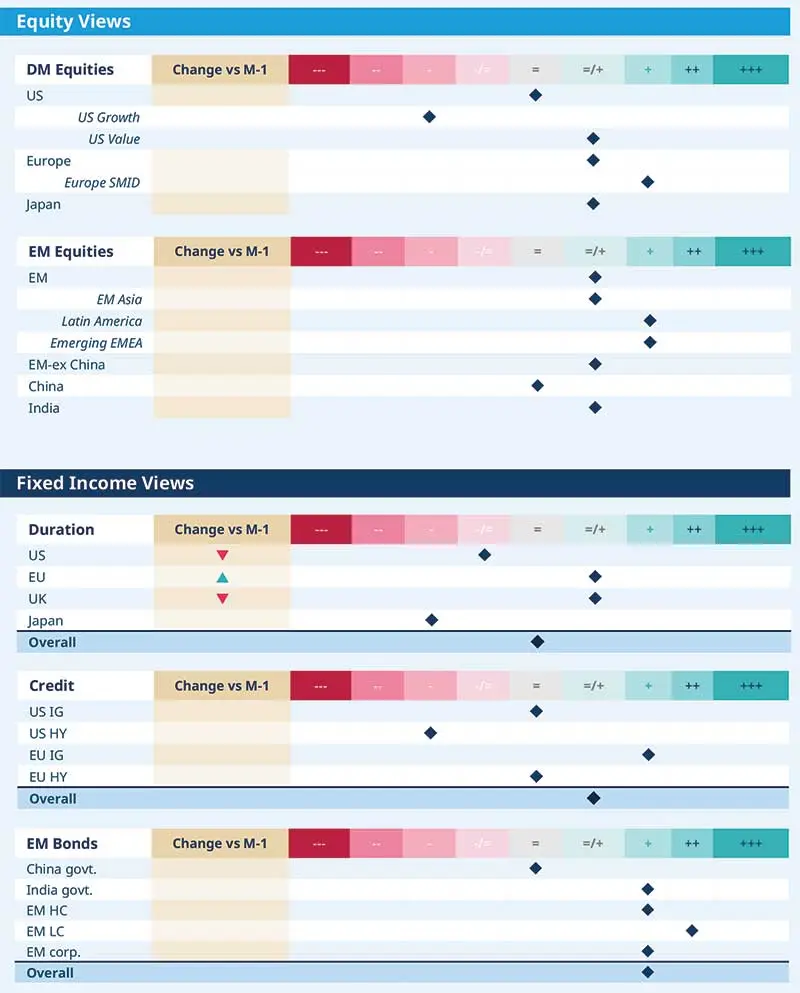

- While our overall duration stance is neutral, we see scope for slight divergences across regions. For instance, we are now slightly positive on EU. Here we like Italian BTPs.

- We have slightly reduced our duration stance in the US, but are positive on linkers. We have moved marginally less positive on UK bonds, and are monitoring fiscal policy.

- In Japan, our cautious stance is affirmed by the government’s recent fiscal expansion.

- Globally, we are constructive on EU credit, and neutral on US and the UK. In EU IG, corporate fundamentals are robust, especially in the financials sector, and Q3 earnings confirm this. We like short-dated bonds, subordinated financials, and corporate hybrids.

- In EM bonds, our positive stance is unchanged, and risks are well balanced. There’s good scope for idiosyncratic stories such as Argentina where we remain positive on HC bonds.

- We are neutral on the US dollar. We think the dollar has been in a consolidation phase since June 2025, and seasonality could cause volatility around year-end. Japan’s fiscal stance means pressure on the yen would continue, but we are monitoring any potential intervention by the Ministry of Finance and BoJ hike.

- In EM, we are constructive on LatAm FX such as BRL, CLP. The momentum in commodities has weakened and may affect FX of some commodity exporters.

EQUITIES

Valuations favour a global approach

Barry GLAVIN |

Equities have delivered strong returns this year to-date mainly due to both positive sentiment around AI and robust corporate earnings, despite mixed signals on economic activity in the US and Europe. Now, the primary question for us is how much of the good news is priced into valuations. Elevated levels increase the potential for a reversal if revenues or margins disappoint. Thus, any volatility before year end or next year beginning may present opportunities in quality businesses that benefit from structural growth drivers.

We see such businesses for instance in Europe, the UK and Japan and the emerging markets. European fiscal and monetary policy and Japanese corporate reforms, together with a focus on attractive valuation multiples in the UK and small cap, remain important themes for us.

- Japanese valuation levels do not yet reflect the recent robust results season, buybacks, and the early-stage structural reform momentum. We continue to favour select high quality international businesses there.

- In Europe, long-term reforms to enhance EU competitiveness, fiscal stimulus, and declining energy costs will help the region offset near-term impact on US tariffs. We prefer the small and medium-cap businesses due to their earnings growth potential and domestic exposure. We also like UK, but are watchful of excessive debt and fiscal deficit.

- In the US, where valuations are high, monitoring investment cycles, particularly related to AI, and how they translate into earnings is essential.

- EM equities will be supported by economic growth, their diversification potential, and a global shift towards multilateralism.

- Despite the rapprochement between China and the US, we think their long-term economic rivalry will continue. Additionally, the trade truce showed that China emerged stronger from the spat on the trade front. From an economic perspective, the country’s exports and domestic consumption both remain weak.

- In India, while relations with the US are gradually improving, we think valuations are on the higher side. Nonetheless, our positive stance is justified by India’s long term structural growth and stability.

- Elsewhere, we are positive on Latin America, including Brazil and Mexico, and emerging Europe.

MULTI-ASSET

Adopt a more balanced stance on risk

Francesco SANDRINI CIO Italy & Global Head of Multi-Asset | John O’TOOLE Global Head - CIO Solutions |

Changing earnings dynamics in US mid caps and valuation concerns in the large caps have led us to partly shift our positive view on the US towards European equities.

In this current phase of a late-cycle economy, we are witnessing nuanced backdrops across different regions, even as global competition between the US and China continues. For instance, in Europe, economic growth will likely be decent but below potential, US consumption stays fine for now, but a softening labour market means this cannot be sustained. Thus, we are adapting our allocation stance to these nuances, and are looking for value across asset classes. In doing so, we keep a diversified stance towards regions where earnings, valuations and macro environment provide a good risk-reward. Thus, we stay risk- on, with mild adjustments, safeguards, and a positive view on gold.

We are constructive on equities, and see higher potential to play the diversification trend towards regions outside the US, following the strong market movements this year. We closed our positive stance on US mid caps because of weakening earnings dynamics and potential volatility around Fed rate cuts. Additionally, we reduced our constructive view on the S&P 500 owing to both valuation concerns and exuberance in AI-related names. In contrast, we stay positive on the UK and have turned optimistic on Europe owing to its valuations and strong earnings expectations going into next year. We continue to like EM in general and Chinese equities in particular.

In fixed income, we are slightly positive on duration overall, and also keep a positive stance on Italian BTPs (versus Bunds). Italy’s political stability and efforts to stabilise its debt trajectory affirm our stance. In credit, EU IG displays strong corporate fundamentals and technicals. EM bonds spreads have already tightened significantly; thus, we have tactically downgraded them. We reiterate that negative catalysts for EM are limited and financial conditions in general remain favourable.

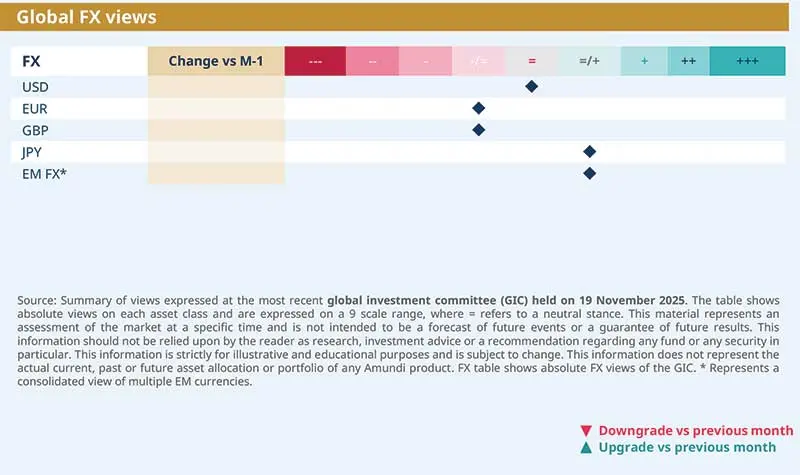

In FX, we are positive on EUR/USD, and on NOK and JPY vs the EUR. While structural drivers will likely weigh on the dollar, the NOK (in risk-on phase) and yen (normalisation by BoJ) should do well against euro.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.