Summary

Germany: from crisis comes opportunity

Key takeaways

The short-term economic recovery faces some risks. Germany is experiencing a phase of structural stagnation after weak growth in 2025 and two preceding years of recession, with industry and exports in crisis. A large fiscal pivot — a €500bn off‑budget fund and extra borrowing for defence — aims to rebalance the economy and boost demand from 2026. In the longer term, we believe that reforms could enable stronger expansion from 2027 if they are accelerated decisively.

We believe German equities have room to continue to deliver attractive returns in 2026 and even outperform European equities. Markets should begin to price in an improving earnings outlook, supported by fiscal stimulus and monetary easing, fading tariff risks and a more benign FX backdrop. Industrials and Financials — the largest sectors — are likely to benefit from higher defence and infrastructure spending.

The German economy has entered a phase of structural stagnation. Growth remained weak in 2025, following two consecutive years of recession. The export sector and industry as a whole are in crisis. The shift in fiscal policy at the beginning of the year, coupled with the relaxation of the debt brake rule, is expected to boost growth in 2026, but to what extent? Analyses by economists differ, both within public bodies (such as the Bundesbank, the federal government, and the OECD) and in the private sphere. These analyses pit those who expect a rapid impact (via the classical Keynesian effect) against those who emphasise the importance and difficulty of overcoming structural challenges. We see this difficulty more as a temporary phenomenon rather than a general one.

| Germany’s structural challenges |

The German model is experiencing a systemic crisis, the like of which has not been seen since the end of WWII. It is likely to take many years for industry to adapt its production apparatus, but from crisis comes opportunity. The dramatic shift in fiscal policy at the beginning of 2025 was prompted by this crisis. The aim of public investment in infrastructure is to revitalise domestic supply and rebalance a model that is overly dependent on the export manufacturing sector. However, despite being essential to ensuring the success of the stimulus measures, structural reforms are still pending. |

A spectacular fiscal stimulus package

With the easing of Germany's debt brake, the federal government has considerable fiscal leeway. A new off-budget fund of €500bn (equivalent to 11% of GDP in 2025) was created in the spring to finance infrastructure and climate investments over the next 12 years. In addition, the government can finance defence and security spending in excess of 1% of GDP through new borrowing. Excluding the Länder, the government is planning cumulative net borrowing of around €850bn over the 2025-29 period. This means that total federal debt (€1.7tn at end-2024) is set to increase by half over five years.

We know that in times of economic weakness, fiscal stimulus policies have a greater impact (multipliers are higher at the bottom of the cycle). This should be all the more evident given that the government has simultaneously implemented measures to stimulate private domestic demand directly, by increasing the minimum wage and offering tax incentives for investment. That said, domestic supply must still be able to meet the increased demand. Efforts in defence and infrastructure are primarily focused on revitalising and diversifying the national industrial fabric. However, the shortage of skilled labour in certain sectors, particularly infrastructure, will cap the multiplier effect. The same applies to its cumbersome bureaucracy and excessively slow decision-making process.

Efforts in defence and infrastructure are primarily focused on revitalising and diversifying the national industrial fabric. However, the shortage of skilled labour in certain sectors, particularly infrastructure, will cap the multiplier effect.

Renewed concern among manufacturers

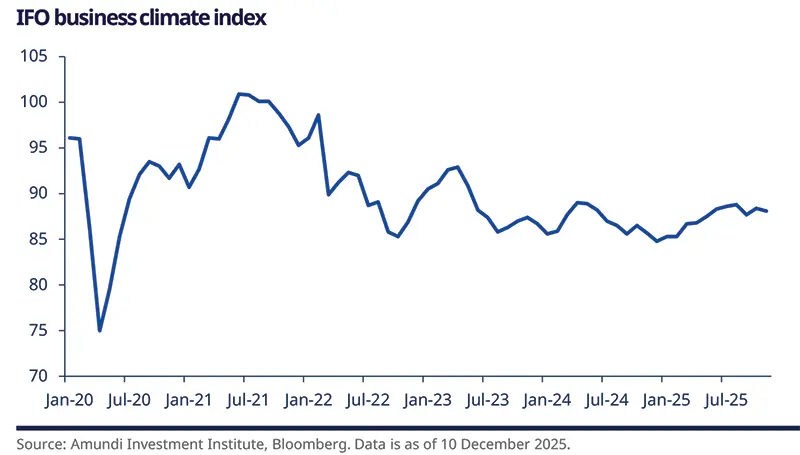

The latest Federation of German Industries’ (BDI) report highlights low capacity utilisation, particularly in the core sectors of German industry: chemicals, mechanical engineering and steel. Production from the chemical sector is currently at a 30-year low, with factories operating at less than 72% capacity – the lowest level since 1991. Since the beginning of the year, Germany has imported more machinery from China than it has exported. Furthermore, despite its rapid expansion, the defence sector in Germany remains too small to offset the decline in the automotive industry. A lack of industry diversification is hindering the recovery. It is hard to envisage how fiscal stimulus could stop these sectors from declining. Given this situation, it is unsurprising that the business climate has deteriorated since the spring upturn. Surveys show no increase in industrial orders, and business leaders are starting to question the prospects of a recovery.

Taking out loans does not necessarily result in immediate expenditure. Without viable projects to invest in, they simply swell the government's coffers. During its first month of existence in October, the special off-budget fund for infrastructure and climate took out loans amounting to around €13bn (one third of what was planned for 2025). Only €35bn has been spent of the €100bn armed forces fund created in 2022. Defence spending in 2025 amounts to €45bn (€24bn less than the target for the year). Military procurement amounted to €10bn, against a target of €22bn. Meanwhile, investment expenditure totalled €44bn (€19bn below the investment target set for 2025).

New off-budget fund.

Planned cumulative net borrowing over the 2025-29 period.

Total federal debt at end-2024.

Source: Amundi Investment Institute.

We remain optimistic for a stronger recovery from 2027 if reforms pick up pace.

In these circumstances, there are growing indications that the additional funds are being diverted to current expenditure. While this may impact growth next year, it should be noted that investment is necessary to increase potential GDP in the medium term. Overall, we believe that the risks to growth remain skewed to the downside in the short term. The expected upturn in activity will not be as strong as expected next year. However, we are optimistic about the medium term and anticipate a more substantial recovery from 2027 onwards, provided the pace of reforms accelerates.

Increased defence and infrastructure spending is expected to give a moderate boost to GDP growth in 2026. Such spending could add around 0.3-0.5 percentage points to growth next year, with further positive effects in 2027 and beyond as government investment increases and multiplier effects take hold. Infrastructure improvements will enhance economic efficiency, while defence spending could stimulate technological innovation and private-sector R&D. However, the initial impact in 2026 is expected to be limited due to the high import content. Overall, despite the short-term risks, there are potential upside risks on the horizon for 2027-28.

| Our scenario at a glance |

|

German equities set to see attractive returns in 2026

German equities have seen strong performance over the year (+20% for the MSCI Germany Total Return index*) in absolute terms. However, relative to the benchmark (MSCI Europe), they have been flat and actually underperformed over the last six months, as investors have grown increasingly sceptical about the ability of the new government to deliver the planned fiscal stimulus.

We recognise that the process will take time, but believe that momentum is there. Therefore, German equities are poised to see attractive returns from here and are likely to outperform European equities.

Despite short-term economic weakness, we believe German equities are set to deliver attractive returns in 2026, with Industrials and Financials in focus.

The MSCI Germany index currently trades at a 12m forward PE of 14.5x, well above its 15-year average of 12.5x, but slightly below the benchmark (14.8x for MSCI Europe). From such levels, earnings will have to do the heavy lifting to drive market performance. The IBES consensus EPS growth for 2026 stands at +14% (+12% for MSCI Europe), which seems a bit too optimistic. Nevertheless, given the German fiscal and global monetary easing, fading tariff worries and a more benign FX environment, the earnings outlook for next year looks much better than this year.

Looking within the market, German stocks are exposed to a variety of near- and long-term themes. The two biggest sectors are Industrials (28%) and Financials (22%, based on MSCI GICS). The former is a diverse sector and should see tailwinds from higher spending on defence and infrastructure, as well as electrification. Financials – especially banks – have performed very well, yet still look cheap. They have seen strong earnings revisions and have delivered high shareholder returns.

* Source: Bloomberg as of 11 December 2025.