Summary

- Political developments in France: on 16 March the French government forced the approval, without a vote, of the new pension law, which aims to raise the minimum retirement age from 62 to 64 years, by using article 49.3. We believe the “motions of censure” presented in response to this act, to block the pension law approval, will fail and the law will definitively be adopted. However, there could be some obstacles to the law, including the risk of rising protests that could lead to the law being suspended. Should the law be rejected, which is not our main scenario, there is the risk of a possible dissolution of the Assembly and new elections with an uncertain outcome.

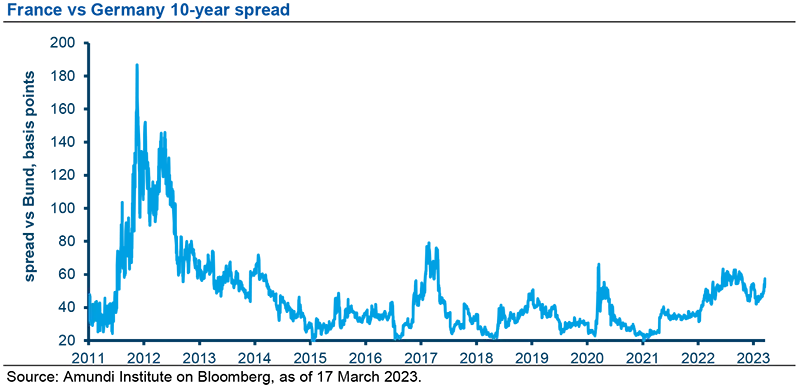

- Bond markets: recent limited spread widening in the French 10-year government bond versus the equivalent German bond has mainly been driven by the risk-off environment, triggered by the issues regarding US regional banks and Credit Suisse. This suggests that there is no major pricing of idiosyncratic risk for France at present. Should the political situation deteriorate further, we could see additional spread widening with some over-reaction. However, investors should also keep in mind that French bonds are liquid, highly rated and could attract investor demand.

- Equity markets: The recent correction was largely in line with the European equity market and it is essentially a correction of the strong performance since the beginning of the year. In terms of structure, the French market is fairly balanced and valuations are broadly in line with the European market. Should the situation really deteriorate, there could be some impact on equities but, in our view, there is little reason for French equities to deviate significantly from those of other European countries at this stage. Moreover, the economy is doing quite well, with inflation lower than in other European countries as energy costs tend to rise less due to France’s nuclear-intensive energy mix.

The French government has just pushed through a pension reform without a vote thanks to a specific constitutional tool (Article 49.3). What reaction is expected in Parliament and around the country?

In the National Assembly (lower house), the centrist alliance Ensemble (Renaissance, Modem, Horizons) represents 250 deputies, which is not enough to obtain an absolute majority (287). The absolute majority (289 votes in normal circumstances) is currently 287 because four seats remain unfilled. Article 49.3 (see Box 1) was activated because Republican staff warned President Macron that less than half of his 61 deputies would vote in favour of the text: a number that was therefore insufficient to obtain a majority.

Multiple scenarios are now open:

Motions of censure

Two motions of censure were tabled on Friday. One by the RN party (far-right, Marine Le Pen), the other by the centrist LIOT group. Only the motion of the LIOT group, presented as being "transpartisan " can pass as it is supported by both the NUPES (left-wing alliance) and the RN parties. However, even if all the deputies of NUPES (149), RN (88), LIOT (20) and independents (5) are counted, it only reaches 262 which is not enough to obtain an absolute majority (287 required). It would therefore take at least 25 LR (right-wing, Les Républicains) MPs (out of 61) to vote for the motion to bring down the government. Both motions will be considered on Monday 20 March from 4 pm CET.

The adoption of a motion of censure would probably result in the abandonment of this bill. While, technically, it would be possible to continue with a new examination in Parliament (Assembly and Senate), politically it would be untenable. The failure of the “motions of censure” remains by far the most likely scenario. The pension reform would then definitively be adopted. However, there are still some possible obstacles before its effective implementation.

Box 1: How does 49.3 work?

This constitutional article allows for the "forceful passage" of legislation without a vote. More precisely, paragraph 3 of Article 49 allows the Prime Minister, "after deliberation by the Council of Ministers", to "engage the responsibility of the government before the National Assembly" for the vote on certain texts.

- When such a procedure is initiated, the deputies have the option of tabling a "motion of censure" within 24 hours.

- If this motion of no confidence is supported by an absolute majority of MPs, the law is rejected and the government must resign.

- If it does not have a majority, the law is adopted at first reading and then goes to the Senate. It then returns to the National Assembly for a second reading, during which the government can again activate the 49.3 if it wishes, under the same conditions.

This article has been used 100 times since 1958, including 11 times by PM Elisabeth Borne.

Towards a referendum on popular initiative (RIP)?

The organisation of such a referendum proposing the abandonment of the reform is theoretically possible, but time constrained. In fact, the RIP requires a bill to be initiated by one-fifth of MPs, i.e. at least 185 of the 925 parliamentarians (577 deputies, 348 senators). The proposal must also be supported by 10% of the electorate (4.87 million people), whose signatures must be collected within nine months.

This procedure would thus allow the reform to be blocked for 9 months. 252 parliamentarians, NUPES deputies and senators from different left-wing groups, filed a RIP request on Friday to prevent the legal retirement age from being raised beyond 62. The President of the National Assembly is due to examine whether this bill is admissible on the morning of Monday 20 March and, if so, she would forward it to the Constitutional Council without delay, which would then examine whether a referendum can be held. The Council has one month to deliberate.

Towards an appeal to the Constitutional Council?

Within fifteen days of the final adoption of a law, at least 60 parliamentarians may refer the matter to the Constitutional Council. The referral, which suspends the time limit for the promulgation of the law, must be examined within one month. Article 61.3 of the Constitution allows the government to ask the Constitutional Council to examine the text as a matter of urgency, which reduces the deadline to eight days. The LFI party promises to refer the matter to the Constitutional Council.

There could be some obstacles to the law, including the risk of rising protests that could lead to the law being suspended.

Towards a withdrawal of the reform in the face of very strong social mobilisation?

The example of the 2006 First Employment Contract (CPE) is often cited. This law, which created a special youth employment contract with a two-year trial period, was also adopted with the use of the 49.3 by Prime Minister Dominique de Villepin and then promulgated. But it was immediately suspended, due to extreme social tensions (violent demonstrations with nearly 3 million people on the streets).

Since the launch of the reform at the end of January, France has seen a series of demonstrations. The one on 7 March mobilised up to 1.3 million people according to the Ministry of the Interior (3.5 million according to the CGT union). A ninth day of strikes and demonstrations is expected on Thursday 23 March.

The movement could harden if the motion of censure is rejected. Several spontaneous demonstrations (encouraged by LFI) have taken place since the use of 49.3, leading to multiple incidents over the weekend. Polls show that almost 75% of the public is opposed to raising the retirement age. The use of 49.3 could broaden the base of the protest, as young people are more sensitive to democratic issues than to the pension issue.

Towards a dissolution of the assembly?

If the law is rejected. Emmanuel Macron would then have the choice to appoint another Prime Minister or to maintain confidence in Elisabeth Borne. In practice, such a choice would probably provoke a dissolution of the Assembly, even if the law does not require it. It is important to note that the President is not constitutionally bound to act within a certain time frame. Subsequently, before changing government, he may want to buy time to assess the forces at work.

Under Article 12, the President has the possibility of dissolving the National Assembly after consultation with the Prime Minister and the Presidents of the two Assemblies. New elections are then organised within 20 to 40 days. In another context, in 1997, President Chirac lost his majority by provoking early elections. The manoeuvre would be risky for President Macron. Because the big winners would probably be the NUPES and, above all, the RN and if could be difficult to form a majority governing coalition. However, this threat has been put forward on several occasions to encourage the LR to vote for the law.

What will be the financial cost of pension reform?

One of the government's main objectives for the pension reform is to balance the pay-as-you-go pension system.

One of the government's main objectives is to balance the pay-as-you-go pension system. The Pension Advisory Council (COR, Conseil d'Orientation des Retraites) forecasts a deficit of around €13.5 billion in 2030. The pension reform is supposed to bring in €17.7 billion by 2030. In theory, this leaves €4.2 billion to finance the compensatory measures intended to mitigate the effect of the extension of the contribution period and the increase in the legal retirement age.

Except that the list of compensations has grown longer. This would increase the cost by some €700 million according to some experts:

- Those who started working early will be able to retire before the legal age (the scheme has been extended to those who started working before 21 years versus 20 years originally).

- 5% increase in pensions for mothers, provided they have all their quarters by the age of 63.

The complexity of the subject makes it very complicated to make macroeconomic projections on the estimated cost of this reform over seven years. But one thing is certain, it is not the sustainability of the debt that is at stake with the pension reform but the dynamic of supply-side reforms and thus future potential growth.

Macron has implemented many pro-business reforms since 2017 and the French economy did quite well versus its peers. Can this momentum continue?

We believe the reform of unemployment benefits, coupled with that those of pensions and vocational training, should gradually improve labour force participation and thus strengthen potential growth.

GDP growth in France was at 2.6% in 2022 (versus 1.9% in Germany) supported largely by the relative importance of its services sector, a sector less penalised by rising energy prices than German industry. The French economy has additionally benefited from the tariff shield adopted in 2022 which has proved to be very effective in containing inflation and second-round effects, leaving French households better off than those in neighbouring countries.

The French economy also benefits from pro-business measures taken during Emmanuel Macron's first term, particularly the reform of unemployment insurance, initiated in 2019, which tightened the rules on compensation and prevented excessive recourse to short contracts. These measures have contributed to strengthen the French labour market which has performed very well in recent years, with historically high employment and labour force participation rates and a historically low unemployment rate. Nevertheless, participation rates remain lower than in many peer countries and problems remain (youth and low-skilled unemployment). In the medium-term, we believe the reform of unemployment benefits, coupled with those of pensions and vocational training, should gradually improve labour force participation (of young and older people) and thus strengthen potential growth.

In the short term, however, economic risks are skewed to the downside because of the period of uncertainty that is opening up amid repeated strikes and social unrest. In short, the momentum of supply-side reforms, which are essential to stimulate job creation, is likely to slow down.

Intra-Euro spreads have been rather calm recently. Are you confident that the spread of French OATs versus Bunds will remain contained despite the current political situation? What is your view on French bonds?

So far there is no sign of idiosyncratic risk in French bonds, as recent spread widening appears to be driven by the recent risk-off market sentiment.

On the fixed-income market, the spread between sovereign bonds is the usual metric for measuring the idiosyncratic stress on a country. While it is true that the French 10-year spread versus Germany is getting closer to its recent high of 58bps, this move appears to be mainly driven by the current flight-to-quality mood that followed the recent issues regarding US regional banks (SVB in particular) and Credit Suisse. The risk-off market sentiment has led the spreads of all Eurozone countries to widen versus Germany. The only idiosyncratic movement related to France occurred last Friday (17 March) with a very limited widening (3 basis points) versus other semi-core countries. This happened just after the adoption of the Pension reform by the use of the 49.3 article and may open up a sequence that increases market nervousness.

During the last pre-electoral periods, the spread between France and Germany widened to 80 bps pricing in the probability of a possible anti-euro government. Of course, we cannot fully rule out that given the current “risk-off” environment, some investors may overreact to the current French political story. This could be amplified if the situation deteriorates further, that is if a no-confidence vote brings the government down and there are new parliamentary elections that could potentially lead to an anti-euro government. Note, that the success of a no-confidence vote is not the most likely scenario and that, even then, new elections may occur only upon President Macron’s decision and if forming a majority parliamentary group is not a done deal. However, investors should also keep in mind that French bonds are liquid, highly rated and could attract investor demand.

What is the outlook for French equities?

The recent correction in French equities is in line with the overall Eurozone market.

As of 17 March, the French market has seen a correction since the beginning of the month (-4.6% for the MSCI France Index), however, this is in line with the MSCI EMU Index and is essentially a correction of the strong performance since the beginning of the year, with France outperforming other European markets (+6.7% for France vs 6.3% for the EMU index). This correction does not call the positive trend and the market's outperformance at the global level into question, for the moment at least.

In terms of structure, the French market is fairly balanced: the two most important sectors in the MSCI France Index are consumer discretionary (20.8%) and industrials (22%). Financials (10.3%) are only in third place, on par with consumer staples. Healthcare (9.9%) is more represented than energy (8.3%). Although cyclical, the first two sectors in the Index typically show resilience. Luxury goods stocks, which account for the bulk of consumer discretionary, have undeniable pricing power and interesting exposure to Chinese growth; Industrials are present in long-term projects (aerospace, industrial gases, electrical equipment).

In terms of valuation, France ranks as average. With earnings growth expected to be stable over 2023, in line with the US market and the global MSCI World ACWI, the 12-month P/E (13.1x earnings) is slightly higher than in Europe (12.8x), but well below that of the US market (18x). The yield (2.9%) is higher than the MSCI World AC (2.3%).

Overall, the French market has rather attractive characteristics among equity markets with valuation being a rather neutral factor. Regarding current political events, it is true that should the situation really deteriorate there could be some impact on French equities, notably in the banking sector and the utilities. Indeed, extreme left and right political parties could make some gains, and they have very critical, yet different views of these sectors, with stated goals of nationalisation for the extreme left and tax increases for the extreme right. A further rise in policy uncertainty could also increase the risk premium on French equities.

There is little reason that French equities should deviate much from those of other European countries.

However, we are far from this yet: For the moment, Macron remains President and there is little reason for French equities to deviate significantly from those of other European countries. Moreover, the economy is doing quite well, with inflation lower than in other European countries as energy costs tend to rise less due to the country’s nuclear-intensive energy mix.

With the contribution of Frédéric Rosamond (Senior Portfolio Manager – Head of French Equities)