Summary

The US Fed is carefully treading the policy path forward, given the mixed macro data. As signalled at the recently concluded Jackson Hole symposium, the central bank is likely to start cutting rates in September, in line with our expectations.

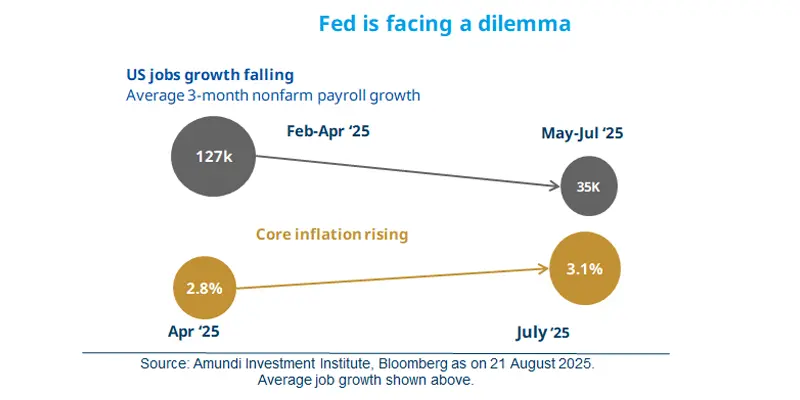

The US has seen some mixed macro data around inflation and labour markets, opening a debate on Fed’s future policy actions.

Weak US employment data and Chair Powell’s recent comments have led the markets to believe that a September rate cut is a done deal.

We think the Fed would not want to be seen as succumbing to political pressure and will prefer to maintain its data-dependent approach.

Macro data over the summer has heightened the debate between whether the Federal Reserve should reduce its monetary policy rates or wait for more clarity on inflation and labour markets. The US has witnessed a deceleration in average monthly job creation to around 35,000 for the past three months. On the other hand, core inflation (inflation excluding food and energy prices) has picked up and higher tariffs have been announced. Latest views from the Fed outline that many Fed governors acknowledge both these risks. However, most see inflation (partly due to import tariffs) as a bigger threat to consumption. In addition, at his recent Jackson Hole speech, Fed Chair Powell indicated the Central Bank is open to cutting rates. While the direction of policy seems clear in the near term, the market will continue to assess incoming data and its impact Fed’s actions.

Actionable ideas

Multi asset

In an environment of weakening growth, a multi asset balanced approach, using different levers of return, may be beneficial in times of high uncertainty.

Global diversified* fixed income

Uncertainty around inflation and monetary policies underscore the need to keep a global approach in fixed income to explore potential opportunities in regions such as Europe and the UK.

This week at a glance

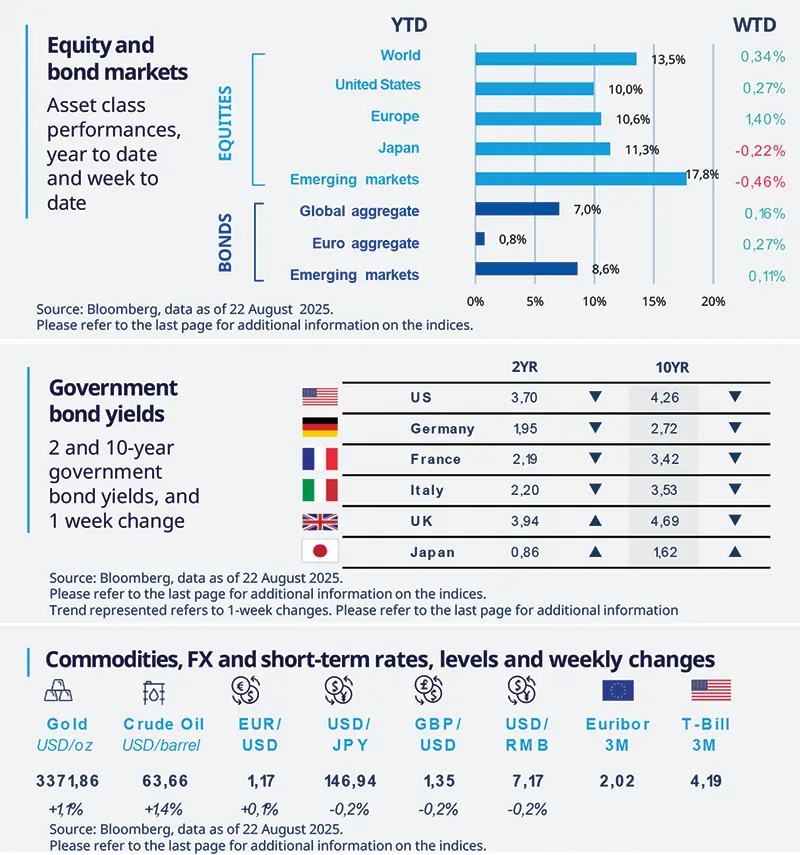

While US labour data came in weak, Fed Chair’s speech at the Jackson Hole summit boosted sentiment leading to gains in US and European equities. European stocks reached closed to their March highs. Bond yields were mostly lower on the back of expectations of policy rate cut by the Fed. In commodities, oil and gold prices rose.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 22 August 2025. The chart shows the US Dollar Index.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US labour markets showing signs of cooling down

Initial claims for unemployment insurance rose by 11,000 to 235,000 for the week ended 16 August. This number was above market expectations. Continuing claims also came in above expectations for the week ended 9 August. Continuing claims over recent months appear to have stabilised to a much higher average than previous years, highlighting a cooling labour market.

Europe

Eurozone PMI came in strong in August

The flash composite PMI rose to 51.1 in August from 50.9 in July. This marked a third consecutive monthly improvement as the index reached its highest reading in more than a year. In particular, manufacturing activity was strong, with the sub-index rising to 50.5 from 49.8. Services activity also expanded but at a reduced pace than before.

Asia

Indonesian central bank cuts policy rates

Bank Indonesia (BI) surprised the markets by cutting its policy rate by 25 basis points to 5%. With economic growth running below potential and inflation remaining benign, the central bank has both the willingness and the capacity to reduce rates further. BI's accommodative stance gains even more importance as the Ministry of Finance prioritizes fiscal discipline. We expect additional 75bps cuts this year.

Key dates

27 Aug China industrial profits, | 28 Aug Bank of Korea policy, |

29 Aug US core PCE July, ECB inflation expectations, India GDP |