Summary

Strong economic growth led by consumption demand, exports and attractive divergences mean the role of EM in the global economy will only increase. This could present long-term opportunities.

-

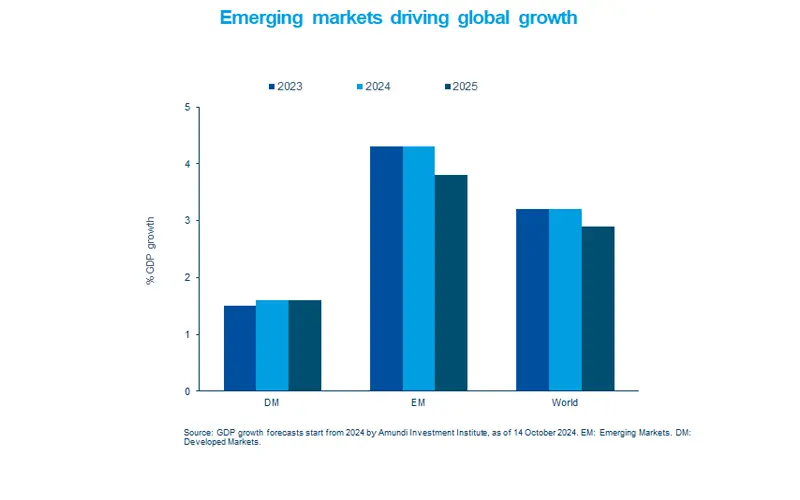

Emerging markets are likely to drive global growth in the long term, led by favourable demographics and demand.

- Regions such as Asia are characterised by divergences - this requires a good understanding of country dynamics.

- Monetary easing by the Fed and subsiding inflation in EM should be further supportive of the asset class.

Emerging markets could drive global economic growth, well ahead of the developed world. With a growing middle class, improving standards of living, strong consumption and potential for exports, Asia stands out. But there are many divergences across EM and countries such as India and Indonesia are attractive from a structural long-term perspective. In addition, China has indicated more recently a clear intention to provide policy support. But we await more specific details on fiscal policy. On monetary policy, inflation in most EM is under control and many prudent central banks have started easing policy depending on their country-specific needs. We could see some near term volatility stemming from US elections and geopolitics, but overall the EM world will continue to provide attractive ideas for long-term returns.

Actionable ideas

- Equity opportunities in Asia

Countries such as Indonesia, India and South Korea display strong demographics and robust economic growth, and hence offer numerous investment ideas.

- Multi Asset

A multi asset approach provides investors access to a range of asset classes that provide stability and also enable search for yield in areas such as EM debt which could benefit from Fed’s rate cuts.

This week at a glance

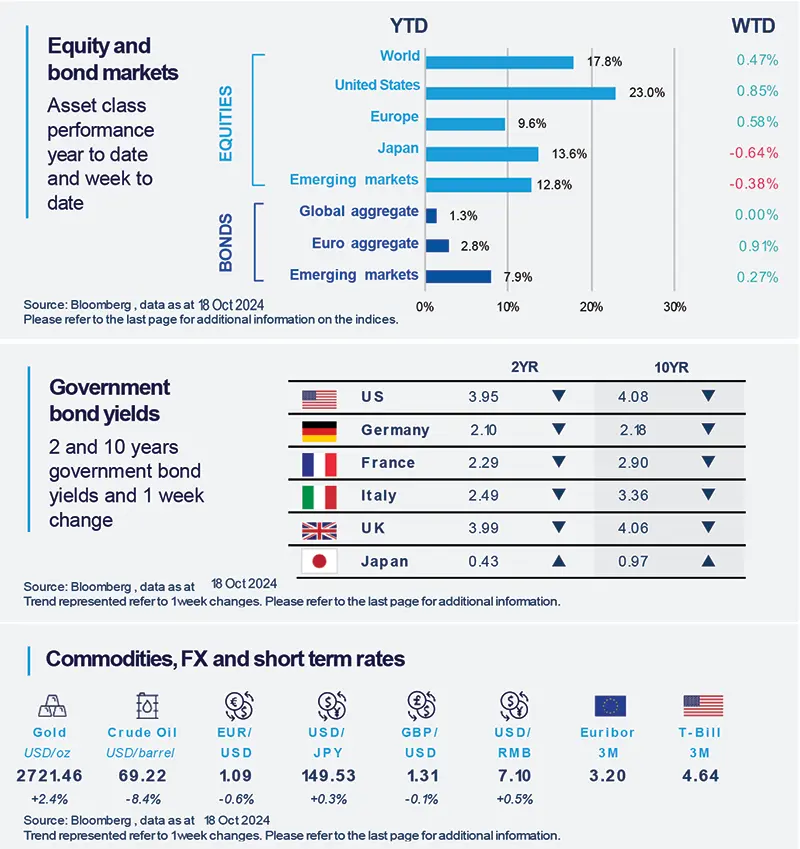

Stocks were mixed as corporate earnings season got a tepid reception so far. Markets also questioned the efficacy of Chinese measures to boost consumption. In commodities, oil prices fell after supply concerns, once Israel assured no attacks on oil infrastructure.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 18 October 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US retail sales show resilient consumer spending

Retail sales growth accelerated in September to 0.4% (month-on-month) compared with August. In addition, growth in core retail sales (sales excluding auto and gasoline stations) climbed up. This indicates robust consumer spending that likely was a powerful engine of growth in the third quarter.

Europe

ECB cuts rates as expected, amid subsiding inflation

The European Central Bank continued on its monetary easing path and reduced rates by 25 bps in its latest policy meeting in October. The bank reiterated its data dependent approach on inflation. We think falling inflation is allowing the ECB to implement rate cuts. The latest eurozone inflation for September came in slightly below initial estimates.

Asia

Latest China data confirms slowing growth

China's GDP growth for Q3 decelerated to 4.6%, YoY, confirming a slowing economic trajectory. In September, although domestic demand recovered as evident in improved retail sales, export growth was weak. The government has announced policy support but the final impact of the measures on economic growth would depend on specific details and the timeline of implementation. We remain vigilant.

Key Dates

|

23 Oct Bank of Canada policy, Fed beige book |

24 Oct EZ and Japan PMIs, South Korea GDP |

25 Oct ECB CPI expectations, US durable goods |