Summary

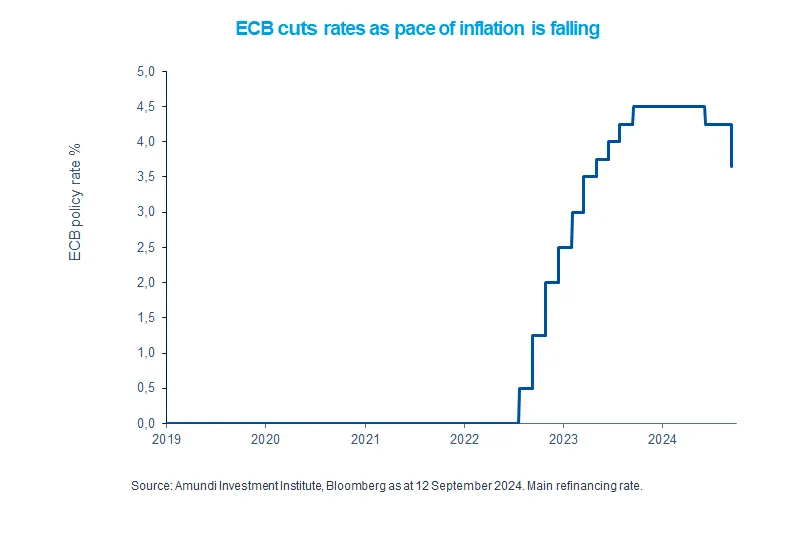

Declining price pressures are leading central banks such as the ECB to reduce policy rates. This, coupled with uncertainty over economic growth, could potentially be supportive for European bonds.

- The ECB cut its benchmark interest rates in the context of falling inflation and weak economic growth.

- We expect the bank to continue on this rate cut path, but it would actively monitor actual incoming data.

- This backdrop calls for a strategically positive stance on government bonds for instance in Europe.

The European Central Bank (ECB) reduced interest rates by 25 bps in its latest policy meeting in September. This is the second time the bank eased rates this year, in an affirmation of falling price pressures. We believe easing wage growth and progress on inflation are allowing the central bank to continue on this path. While we expect two more rate cuts this year, we think the bank is likely to remain data dependent and vigilant on components such as services. Falling oil prices and a strengthening euro (that makes imports from outside the region cheaper) should further help the ECB in dealing with inflation. Looking ahead, the central bank could consider any deceleration in economic activity along with inflation data, before taking policy decisions.

Actionable ideas

- European bonds

In an environment of a mild slowdown in growth and ECB cutting rates, government bonds in Europe appear attractive. - European credit

High quality EU corporate credit is showing attractive valuations and robust fundamentals. Investors could potentially explore this asset class for that extra income, but should tilt towards quality.

This week at a glance

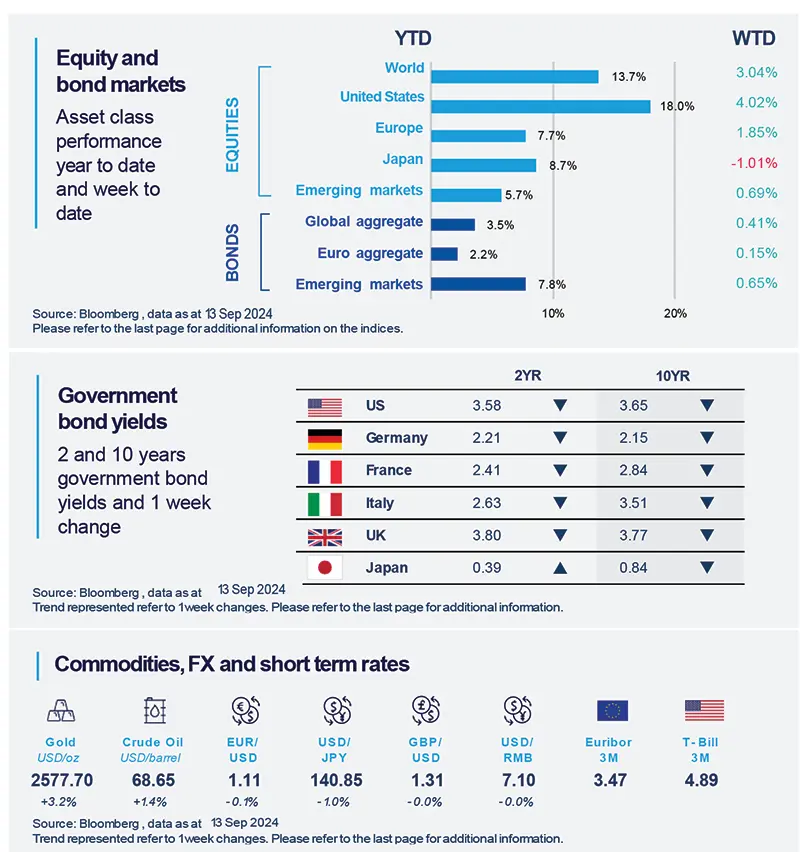

US and European stocks rebounded as markets looked past the slightly stronger-than-expected US inflation print. Expectations of continued rate cuts and a boost from the US technology sector pulled the markets higher. Bond yields declined but gold prices rose.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 13 september 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US inflation continues to moderate

Headline CPI inflation for August came in at 0.2% (month-on-month), in line with expectations. However, core inflation (inflation excluding food and energy) was slightly above expectations. We think although a slower pace of core inflation would have been preferred by the Fed, the overall disinflation trend should still continue. We confirm the outlook for inflation to progressively moderate.

Europe

Eurozone (EZ) investor confidence deteriorates

The Sentix investor confidence indicator for September declined for a third consecutive month, reaching its lowest level since January. The weak sentiment among investors reflects a series of recently released subdued economic data. We believe this is an acknowledgement of the vulnerabilities in the EZ economic recovery. The recovery is likely to be characterised by divergences across countries and the weakness in Germany is a major concern.

Asia

Asian tech exports stay resilient

Taiwan and South Korea exports rebounded strongly in August, driven by semiconductors and demand from the US. Meanwhile, exports from China stabilized at a high level, whereas its imports of tech hardware continued to increase at a fast pace. Overall this indicates that trade data in Asia shows no softening of chip demand yet.

Key Dates

|

18 Sep Fed Policy, Brazil Selic rate |

19 Sep Bank of England |

20 Sep Bank of Japan, PBoC, EZ consumer confidence |