Summary

US consumer confidence increased due to a temporary easing of trade tensions with China, but the global competition between these two will persist. Hence, investors should consider additional sources of portfolio stability and returns.

Confidence rose in May, but it is still below the levels seen at the beginning of the year.

Despite this short-term rapprochement between the US and China, tariffs on Chinese exports are still high.

- We think more clarity is needed on tariffs and US relations with trading partners. The recent US court ruling only raises uncertainty in this regard.

US consumer confidence index rose sharply, and above expectations, in May to 98.0, mainly due to a temporary trade truce between the US and China on tariffs. Expectations about the near future also improved. However, the easing of trade tensions is temporary, and President Trump is still threatening other regions and countries with high tariffs. Obviously, any attempt to impose higher duties will affect consumers’ purchasing power and spending patterns that could undermine confidence later on. Given that consumption and labour markets are crucial for overall economic growth, any weakness here will impact the economy. Hence, more clarity is needed on US trade policies (beyond the 90-day truce period) to estimate the effect on consumption over the long term.

Actionable ideas

- Gold

The uncertainty emerging from global geopolitics and rising government debt underscores the importance of gold as a diversifier* and stability tool.

- US equities excluding large caps

A temporary easing of trade tensions is positive but it may be better to play this through the less expensive and high quality segments.

This week at a glance

Equity markets were generally positive, thanks to potential tariff relief after the US Court of International Trade ruling. Bonds yields moved lower, supported by lower inflation expectations. The dollar was little changed after a long negative streak, while crude oil prices posted a weekly drop.

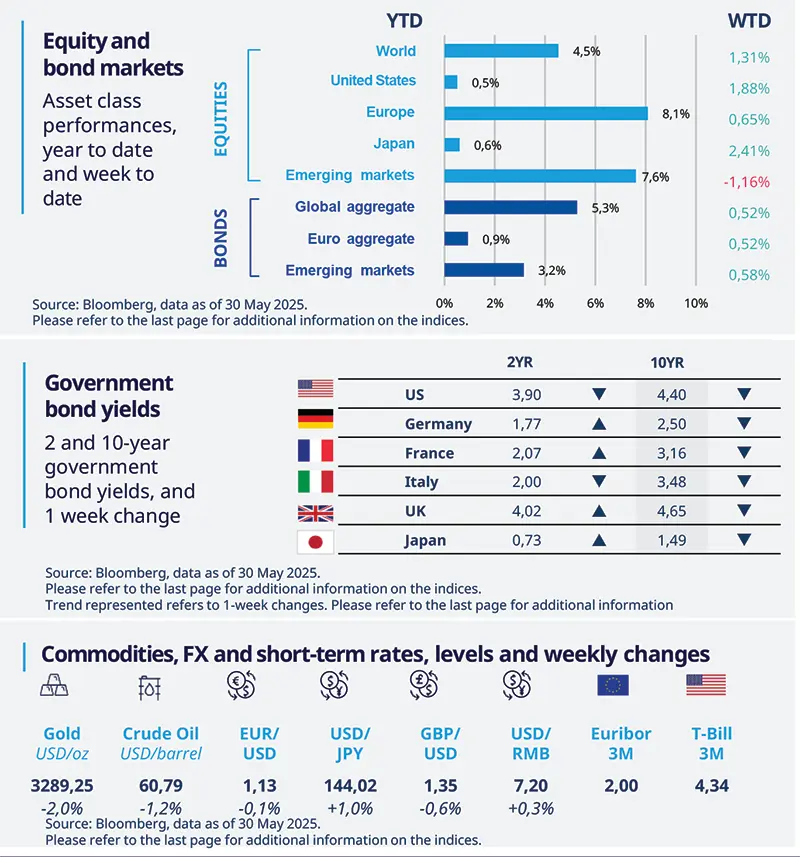

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 30 May 2025. The chart shows US Conference Board consumer confidence.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

No imminent rate cuts, Fed minutes show

Minutes from the May FOMC meeting showed no signs of imminent policy easing. They highlighted how the committee is well positioned to wait for more clarity on the growth and inflation outlook. They saw rising risks of inflation expectations going up. On the other hand, the possibility of the US economy entering a recession was seen almost as likely as their baseline forecast. To such respect, it should be noted that the meeting was held on 6-7 May, before the US-China agreement on a trade truce.

Europe

Economic sentiment on the rise in May

The EZ ESI – a measure of confidence in the economy – improved in May by 1.0 point to 94.8, but remains below its long-term average. The rise was driven by a rebound of confidence in the retail sector and among consumers. Consumer confidence improved thanks to receding pessimism about the general economic situation and to a better assessment on the personal financial situation. This supports our view that private consumption growth – even tough modest – should be a growth driver this year.

Asia

Bank of Korea cut policy rates and growth forecast

The BoK cut policy rate by 25bp to 2.5% on 29 May. The communication confirmed our forecast of a 2.0% terminal rate this year and forecasts of two more cuts of 25bp each in August and November. The BoK has downgraded its 2025 growth forecast to around 0.8%, reflecting concerns over economic stability. Despite the downgrade, the BoK is cautious about further rate cuts, emphasising the need for financial stability amid rising housing prices.

*Diversification does not guarantee a profit or protect against a loss

Key dates

3 June China manufacturing PMI, EZ inflation rate, US factory orders | 5 June ECB interest rate decision, China services PMI, US trade balance | 6 June US non-farm payrolls and unemployment rate, EZ retail sales |