Summary

As the new US tariff rates take effect in August, we believe global central banks are rightly evaluating their impact on economic activity before making policy decisions.

Global central banks are staying in a wait and watch mode as they assess the impact of US tariffs on the economy.

Trump has announced new tariffs and agreements that collectively raised the average US tariffs (vs. last year).

These tariffs will affect US inflation and growth, and investors may explore other regions where inflation is declining.

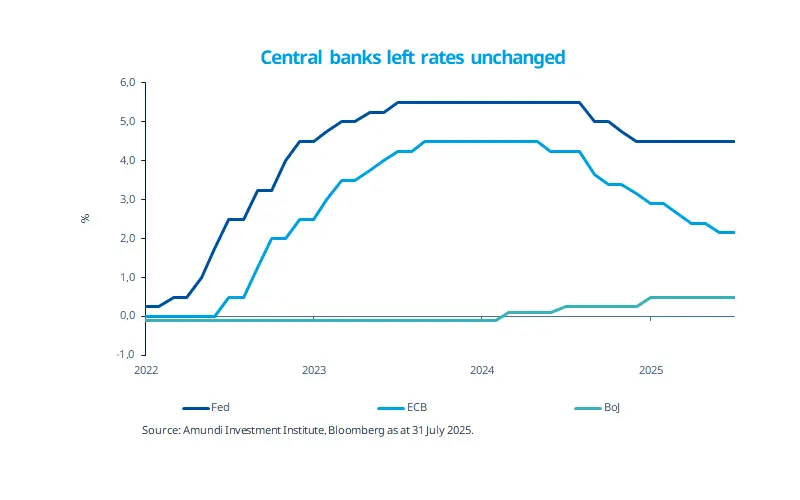

Central banks in the US, Europe and Japan kept interest rates unchanged in their latest policy decisions. In addition to assessing growth and inflation, over the past few months these banks have been forced to deal with the potential economic ramifications of US trade policies. The July decision was the fifth consecutive time when the Fed held rates steady. It also outlined that growth in the first half has moderated but inflation remains elevated. In particular, the second quarter data showed that consumption is weakening, even without the complete effects of tariffs being felt by consumers. Looking ahead, we think the Fed is likely to monitor the effect of US tariffs on consumer spending, inflation and business decisions. The ECB appears more confident on inflation but would monitor tariffs, and the US-EU deal. In Asia, the Bank of Japan also left rates unchanged amid an eye on food prices.

Actionable ideas

European fixed income

Decelerating inflation should be supportive of EU bonds, and corporate credit of quality companies with low debt and stable cash flows.

Gold

Investors could potentially explore safe haven assets such as gold to manage the uncertainty related to economic growth, inflation and policies.

This week at a glance

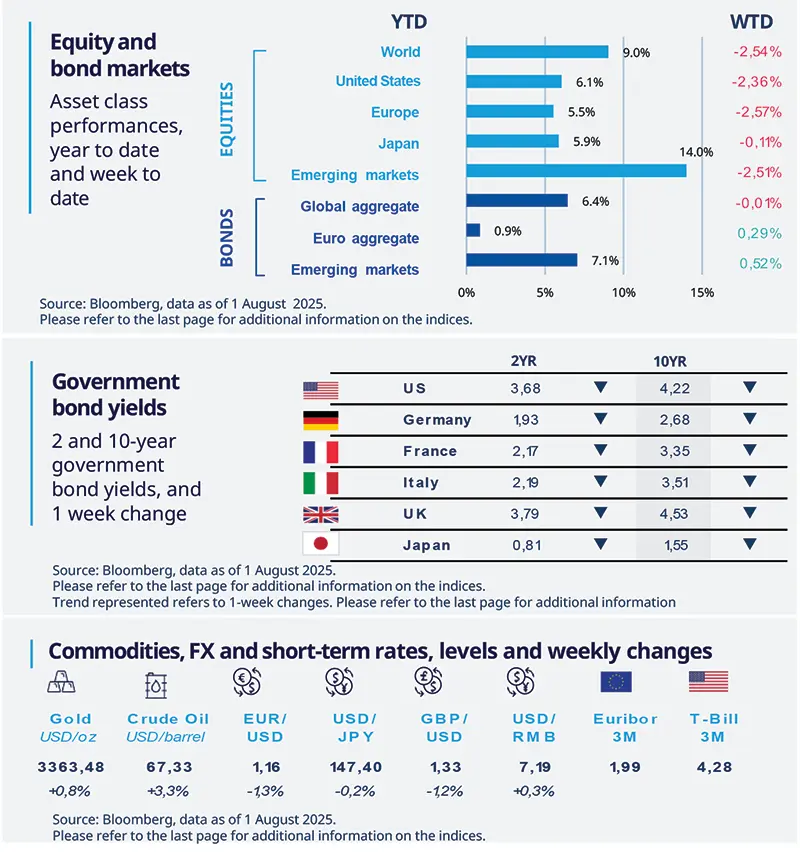

Equity markets were down last week, largely due to the renewed tariff uncertainty and concerns over the economic growth outlook. Government bond yields were down, with long-term yields declining in both the US and Germany. In commodities, oil prices rose due to fears of additional penalties on Russia, which is a major oil supplier.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 1 August 2025. The chart shows the US Dollar Index.

1Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Tariffs distort broader picture of US growth

US real GDP growth came in at 3.0% in Q2 (QoQ), following a mild contraction in Q1, driven largely by a sharp improvement in the trade deficit as imports

collapsed during the quarter. Although tariffs have significantly distorted the data, the key metric in our view is real final sales to private domestic purchasers, which came in weak, consistent with expectations of a decelerating economy.

Europe

Eurozone Q2 growth arrives above consensus

The Eurozone economy grew by 0.1% QoQ in real terms in the Q2. The estimate came in above consensus, which had expected a flat reading. Growth slowed notably from 0.6% in Q1, partly due to the unwinding of the tariff-related frontloading surge in exports seen earlier in the year. Among the major Eurozone economies, Q2 GDP results were mixed, with France and Spain surprising to the upside with positive growth.

Asia

India faces trade pressure from Trump

With talks still ongoing (next round after mid- August), Trump imposed 25% tariffs on India as of the 1st of August, with unspecified additional penalties linked to India’s energy purchases from Russia. The 25% rate is close to the Liberation Day level and far above the ‘new Universal tariffs rate’ of 15%. Given the fluid situation, we continue to monitor the discussions and assess the impact of tariffs on the country’s economic activity.

Key dates

04 Aug US Durable Goods and Factory Orders | 07 Aug US Initial Jobless Claims, Bank of England Bank Rate, China Exports YoY |

08 Aug Canada Unemployment Rate |