Summary

In light of the uncertainty on inflation and on policies of the new US administration, we think investors should maintain a flexible stance on US Treasuries and explore bonds in regions such as Europe.

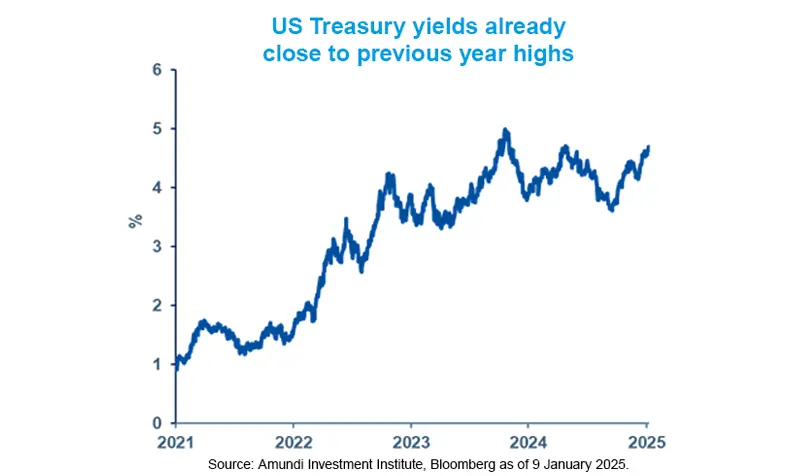

- A change in market expectations on US inflation and economic activity has driven the recent surge in bond yields.

- We believe the Fed will ease policy, but will get vigilant on incoming data that could affect its decisions.

- Bond yields are attractive from a historical perspective, but flexibility is key as uncertainty is high.

Bond yields started the year with strong upward moves, and reached close to the highs seen in April last year. This latest upward trend, which has been evident from September amid Trump’s election campaign and his eventual victory, has been partly driven by resilience in the US economy. More recently, data around labour markets and the services sector and potential policies of the new administration have flamed concerns that disinflation in the US will be affected. This, along with worries of excess Treasuries supply, pushed bond yields higher. The trend was also evident in UK bond yields. Looking ahead, any strength in US labour markets and upside surprise to inflation could cause the Fed to alter its course on policy and cut rates by less than previously expected. We think the overall inflation path will likely remain downwards, but there are some risks.

Actionable ideas

- Global bonds and credit

With rising uncertainty on economic policies, bond investors could benefit from broadening the opportunity set across global regions both in the sovereign and credit spaces.

- Emerging market fixed income

Emerging market debt offers ample opportunities that are less linked with the US and provide attractive yields for long term investors.

This week at a glance

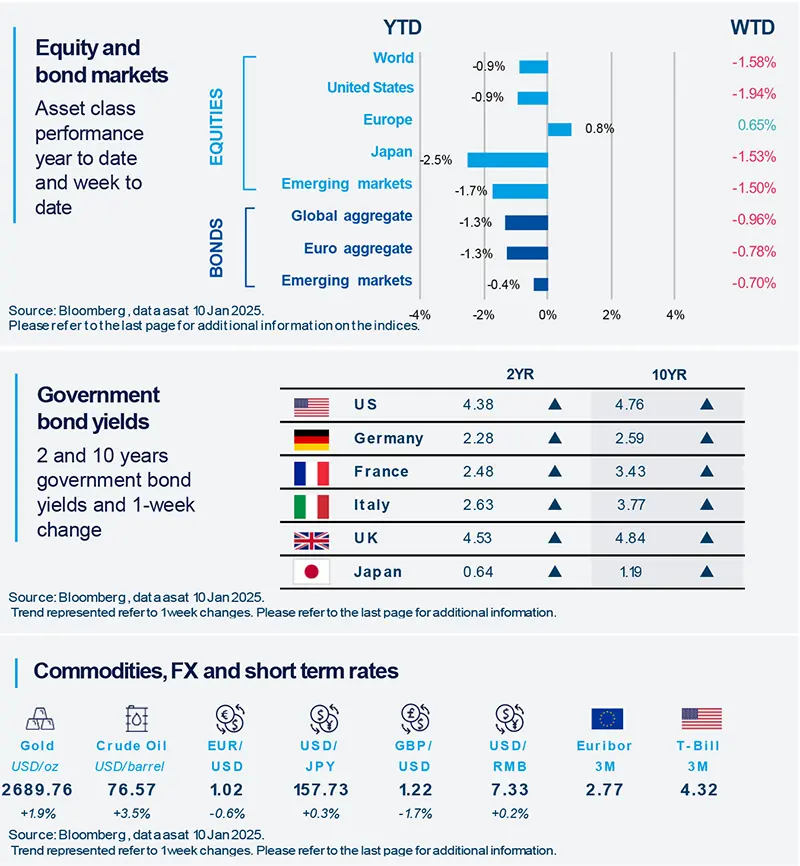

European equities started the year on a positive note, but bond yields rose, notably in the US and UK. Concerns over inflation and government finances pushed UK yields higher. In commodities, gold rose amid uncertainty around US inflation and policies of the new administration.

Amundi Investment Institute Macro Focus

Americas

Mixed labour data point to a moderating US job market

US job openings rose in November but other indicators in the same report point to a softening of labour markets. For instance, job hiring dropped in November. In addition, we believe workers are feeling less comfortable to leave their current jobs in search of better ones (perhaps because it is taking longer to find a new job). This is a good indicator of a possible moderation in wage growth ahead. Overall, our view of a softening, but not sharply deteriorating, labour market remains in place.

Europe

Eurozone inflation accelerated but the trend is lower

Preliminary estimates for CPI were in line with consensus. Headline inflation accelerated slightly to 2.4% in December (from 2.2% in November). One of the main drivers was energy and fuel prices. Although the services component remained quite elevated, the trend over the last few months has been lower. Therefore, overall inflation is likely to maintain its downward path. Energy prices will play a crucial role in this.

Asia

India released advance estimate of GDP

The government released its first estimate for GDP growth for the fiscal year 2025 (1 April 2024 to 31 March 2025) at 6.4%, year-on-year. This is below the growth figure of the previous fiscal year 2024. The recent estimate implies a decent pick up in the economy in the second half of the current fiscal year. However, due to a stalling economic momentum visible for October/November, we expect some further downside revision in the second estimate later.

Key dates

15 Jan US and UK CPI, EZ | 16 Jan US retail sales, UK | 17 Jan EZ CPI, China GDP |